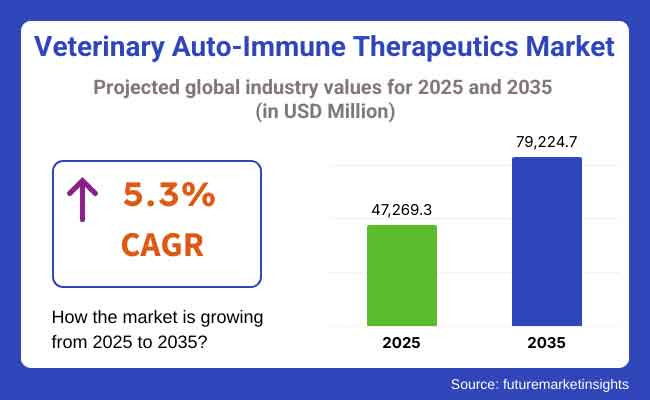

In the coming years the veterinary auto-immune therapeutics market is expected to reach USD 47,269.3 million by 2025 and is expected to steadily grow at a CAGR of 5.3% to reach USD 79,224.7 million by 2035. In 2024, cluster headache syndrome generated roughly USD 45,084.9 million in revenues.

The sales for veterinary auto-immune therapeutics is expected to grow significantly over the next decade and this is due to the growing awareness of animal autoimmune diseases and improvements in veterinary healthcare. Autoimmune disorders diseases where healthy tissue is mistakenly attacked by the body's immune system such as lupus, pemphigus and immune-mediated hemolytic anemia (IMHA), are being diagnosed more often thanks to better, more accurate diagnostic tools and increased veterinary expertise.

This has resulted in increased spending on pet healthcare, which has further propelled market growth. Moreover, rapid evolution in technology for immunosuppressant’s, and biologics have transformed therapeutic modalities in terms of success and lowered side effects. The rising incidence of autoimmune disorders in livestock, attributed to external stressors and genetic predisposition, also stimulates the demand for potent therapeutics.

In addition, increasing investment in veterinary research and the development of targeted therapies are hastening innovation in the sector. But, owing to high treatment costs and lack of advanced Veterinary care in developing regions, the market is expected to be inhibited. However, continued work on price and awareness offer opportunities for growth.

The veterinary auto-immune therapeutics industry has been experiencing steady growth from 2020 to 2024, primarily due to growing awareness regarding the prevalence of autoimmune diseases in companion and livestock animals. There are new medicines to treat diseases like immune-mediated hemolytic anemia (IMHA), pemphigus, and lupus that are used early rather than as a last resort, and new diagnostic capabilities help find them sooner.

It is attributable mainly to the increasing number of pet population and increasing spending on veterinary care. Demand for advanced therapeutics is on the rise, as pet owners continue to explore treatment options that result in improvements to their animals' quality of life. It also reflects a move towards preventive healthcare in the livestock sector, where herd health conditioned impacts on productivity and the bottom line.

More effective treatment options have emerged through the development of biologics, monoclonal antibodies and immunosuppressive drugs, resulting in decreasing disease progression and enhancing long-term outcomes. The approval of veterinary auto immune therapies offered a pathway through regulatory hurdles and has fostered growth as pharmaceutical companies are investing more in the research of veterinary immunology.

In addition, synergy between veterinary research centers and pharmaceutical companies have driven innovation in this area. In addition, the establishment of veterinary specialty clinics and hospitals has also increased access to advanced therapeutics. Although cost is still a factor, more pet health insurance is making it easier on pet owner budgets.

North America is expected to hold a major share of the Veterinary Auto-Immune Therapeutics Market as it has a well-established veterinary healthcare system with increasing pet adoption. This is complemented by the fortuitous placement of top pharmaceutical companies and world-class research facilities, increasing access to innovative treatment options.

Particularly due to high spending on pet healthcare & increasing knowledge regarding autoimmune diseases in animals, the United States dominates the region. The United States is the foremost country in the region with its high spending rate on animal health care, coupled with rising awareness about autoimmune disorders in pets.

The growth in pet insurance adoption helps offset the costs of advanced treatments as well, allowing more pet owners to choose specialized therapies. Continuous research & development regarding personalized medicine and targeted immunosuppressant’s is further contributing to market growth.

It is typical for the Veterinary Auto-Immune Therapeutics Segment in Europe to expand steadily, aligning with progress in veterinary science and a growing interest in companion animal health. Regulatory support for veterinary pharmaceuticals, as well as active involvement from research institutions, has propelled innovation in immunotherapy.

The intensity of biologics and targeted immunotherapies in growth in developed countries, is notable with high pet ownership. This field is further bolstered by government initiatives promoting animal welfare and preventive healthcare. Also, livestock health management has become interesting as autoimmune diseases affect productivity. The growth of organized veterinary healthcare services in major European countries has been crucial in maintaining growth.

The Veterinary Auto-Immune Therapeutics Landscape in Asia Pacific has been experiencing a significant expansion, driven by the rising trend of pet adoption and growing investments in veterinary healthcare. As disposable incomes rise and awareness of pet health improves, nations like China, Japan and India have seen demand for advanced treatment options explode.

Innovation in this segment has been expedited by the development of veterinary research facilities and more collaborations between pharmaceutical firms and academic institutions. Furthermore, the expanding livestock industry has heightened the demand for autoimmune therapeutics to mitigate economic losses associated with disease.

Limited outreach in terms of cost in some areas, however, government programs geared towards promoting animal health and the increasing prevalence of specialty veterinary clinics is expected to foster further adoption of these therapies.

Challenges

Limited Awareness and Diagnosis of Autoimmune Diseases in Animals the Key Barrier in the Veterinary Auto-Immune Therapeutics Market

There are some barriers to the growth and adoption of Veterinary Auto-Immune Therapeutics Industry. One of the main difficulties is the expense of advanced therapeutics. Many autoimmune treatments such as biologics and immunosuppressant’s include extensive research and development that create expensive medicines. It has constrained accessibility for pet owners and livestock farmers, particularly in areas where veterinary insurance coverage is scant.

For one thing, you have to get through regulatory approval, and those can be a pain since the guidelines for veterinary pharmaceuticals are very strict and just like traditional medicines, we need to go through extensive clinical trials for them to be proven safety and effective. Although these regulations safeguard animal health, they also result in longer approval timelines and higher development costs, further hindering the launch of innovative therapeutics.

The awareness and diagnosis of autoimmune diseases in animals are limited, thereby hindering the growth. In fact, many pet owners and livestock caregivers are not well-versed with the symptoms or treatment possibilities, resulting in low diagnosis and medical interventions. The absence of standardized diagnostic tools and specialized veterinary professionals also adds complexity to effective disease management.

Supply chain limitations and distribution challenges offer another obstacle, especially in developing regions. Advanced therapeutics are often offered only in urban areas, limiting access to veterinarians in remote areas to essential treatments. In addition, the cold-chain logistics required for biologics compounds the complexities in the transportation and the cost burden.

Finally, the availability of alternative therapeutics (nutraceuticals, holistic therapy) can also lead pet-owners away from traditional veterinary therapeutics. Improving education, research, and infrastructure so more people can access and embrace better autoimmune therapies.

Opportunities

Development of Oral and Long-Acting Injectable Formulations for Autoimmune Therapeutics Creating Opportunity for the Market

The increasing demand for personalized medicine is one of the major opportunities for the Veterinary Auto-Immune Therapeutics Market. As advances in veterinary diagnostics have led to further identification of the specific immune responses present within individual animals, so return to targeted individualized treatment plans. This enables veterinarians to administer specific therapeutics that enhance efficacy and reduce unwanted side effects, resulting in better long-term disease management.

This is being challenged on the other end of the spectrum with emerging oral and long-acting injectable autoimmune therapeutics. Traditional treatment regimens often involve frequent administration, which can be a burden for owners of pets or livestock. Innovative drug formulations that require lesser doses and offer sustained efficacy enhance the adherence making the treatment easier to access and practical.

The deepening integration of immunotherapy in the field of veterinary medicine is generating new opportunities as well. Studies on monoclonal antibodies and immune-modulating therapies have found promising results in treating long-term autoimmune diseases in animals. The increasing availability of safer and more effective treatment options will foster higher uptake rates in this field.

The growing recognition of autoimmune diseases in production animals offers another opportunity. Livestock owners are becoming more proactive in seeking preventative and therapeutic solutions with a stronger focus on animal welfare and herd productivity. This transition not only improves livestock health but also minimizes economic losses associated with autoimmune disorders.

Finally, using real-world data and veterinary informatics can help reshape disease management. Utilizing digital health records and predictive analytics, veterinarians can enhance their diagnosis at early stages and follow up on the outcomes of treatment at a higher degree, leading to improved disease control and therapeutic breakthroughs.

Within 2020 to 2024 the sales for auto immune therapeutics was in a transformative phase for the, influenced by changes in treatment methodologies and the evolution of veterinary practices.

Advances in diagnostic testing; an increased understanding of these underlying conditions; and a gradual incorporation of immunomodulatory treatment into the everyday veterinary practice, contributed to the growing recognition of autoimmune disease over this period. More veterinary specialists and referral centers emerged, allowing a more systematic approach to treating complex immune-mediated diseases.

Furthermore, economic shifts such as changing pet ownership patterns and new livestock management strategies influenced therapeutic demand. But accessibility problems continued and some high-tech treatments were grouped in certain geographic borders.

From 2025 to2035, there will be substantial advancements in precision-based therapeutics. Genetic screening and biomarker-based personalized treatment strategies will continuously improve the management of autoimmune diseases in animal medicine, allowing highly precise and targeted therapies.

Alternative delivery mechanisms, such as transdermal patches and implantable drug-release systems, may improve long-term maintenance of therapy with a reduction in dependence on frequent veterinary visits. In addition, the increasing sustainability concerns associated with livestock healthcare will increasingly fuel research in sustainable immunological solutions that alleviate dependence on synthetic drugs.

The landscape of veterinary immunology is rapidly evolving as novel discoveries are made to benefit companion animals and livestock populations alike across the industry.

Shifts in the Veterinary Auto-Immune Therapeutics Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Putting into practice guidelines that guarantee the safety and effectiveness of veterinary therapeutics, resulting in codified standards and usage regulations. |

| Technological Advancements | Introduction of sophisticated diagnostic equipment and treatment possibilities, such as immunosuppressive agents and biologics, facilitating better disease control in animals. |

| Consumer Demand | Raise in public awareness and acceptance of veterinary medicine among pet owners, resulting in increased demand in different healthcare facilities, especially in companion animals. |

| Market Growth Drivers | Increasing incidence of autoimmune disorders in animals, progress in therapeutic interventions, and changing to preventive healthcare practices. |

| Sustainability | Early developments towards environmentally friendly production processes and the generation of therapies with decreased environmental footprints. |

| Supply Chain Dynamics | Reliance on specialized suppliers for biologic ingredients, with attempts to localize production to minimize supply chain risks witnessed during global events. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Ongoing surveillance and possible regulatory revisions to reconcile animal safety with technological advancement, complemented by streamlined approval procedures for innovative treatments that meet unmet medical needs. |

| Technological Advancements | Emergence of new-generation therapies, such as gene editing and customized approaches to medicine, using high-end biotechnology to improve efficacy and reach. |

| Consumer Demand | Improved demand for combined veterinary care and wider coverage of immunization, fueled by better therapeutic choices and preventive healthcare, resulting in extensive application across different animal groups. |

| Market Growth Drivers | Growth of veterinary services, pet ownership, and ongoing technology advancements that maximize treatment success and animal health outcomes. |

| Sustainability | Implementation of environmentally friendly practices in the production and distribution of veterinary pharmaceuticals, such as the use of recyclable materials and energy-efficient processes, in accordance with international environmental standards. |

| Supply Chain Dynamics | Enhancement of domestic manufacturing capabilities through technological innovation and strategic alliances, resulting in lower reliance on imports and enhanced supply chain resilience. |

Market Outlook

Industrial Developments in the USA Veterinary Auto-Immune Therapeutics Industry Veterinary biotechnology and immunology have experienced unprecedented developments in the USA leading to a flourishing of the Veterinary Auto-Immune Therapeutics Industry. Additionally, with the rise of top-tier research institutes, innovative therapies for autoimmune conditions in animals have become available more quickly.

A well-established network of specialty clinics and a high standard of veterinary care for the population overall have also made advanced treatments more available. The industry has also benefited from an increase in clinical trials for veterinary biologics and immunosuppressant’s. In addition, rising humanization of pets has resulted in the high willingness of pet owners to spend on advanced treatment options, which is reflecting gradual growth of therapeutic regime.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

Germany if the only country in the veterinary auto-immune therapeutics sector that has been varies through the proper structured veterinary healthcare policy and stringent regulations. High-quality therapeutic development is best accomplished in a well-regulated environment, which will generate trust in veterinarians and pet owners.

Furthermore, Germany has a developing paladin of immunomodulatory treatments, particularly for companion animals and livestock, as it has a long-standing culture of preventive health care, where livestock and companion diseases can be managed for years.

North Macedonia's emphasis on sustainable livestock production stream has resulted in increased use of advanced therapeutics to limit disease impact and decrease antibiotic use. Their guidelines reflect the importance of evidence-based medicine, urging that treatments for autoimmune diseases be supported by scientific data.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.9% |

Market Outlook

The United Kingdom Veterinary Auto-Immune Therapeutics Market has been experiencing growth, driven by the increasing awareness and preference for specialized veterinary care. With the growing network of veterinary referral centers and university-affiliated animal hospitals, the accessibility of advanced treatment for complex autoimmune disorders has increased.

Public awareness campaigns on pet health have also aided in early detection and proactive disease management, thereby bolstering demand for therapeutic solutions. Pet welfare policies here, such as subsidized veterinary services for certain conditions, also conditioned adoption trends. And the increasing availability of genetic tests for predisposition to autoimmune diseases among purebred animals has resulted in early intervention and better long-term results.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

Market Outlook

Rapid growth of the pet care and veterinary services sector has driven growth of China’s Veterinary Auto-Immune Therapeutics Industry. Rising middle-class population and increasing perspectives towards pet ownership have driven demand for advanced veterinary services. Local investment, which has grown significantly since the pandemic, has helped improve the availability of domestically produced autoimmune therapeutics, ensuring greater accessibility.

The growth in veterinary education, along with the setting up of new generation veterinary hospitals has bolstered the growth within the industry. The trend of enhancing herd productivity in livestock healthcare has contributed to the rapid uptake of therapeutic solutions focused on disease prevention from immune-modulation as these disorders can directly influence economic productivity.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.3% |

Market Outlook

The Veterinary Auto-Immune Therapeutics Landscape in India is seeing rapid growth, coupled with Increased Veterinary Startups and Innovation in Animal Healthcare. Increasing demand for affordable alternatives to standard immunosuppressant’s has driven research into anti-TNF plant-based and biosimilar therapeutics. Furthermore, increasing access to mobile veterinary units in rural communities is enhancing access to autoimmune therapies in both companion animals and livestock.

The expanding dairy and poultry sectors there have also driven demand for immune-boosting products, to keep herds and flocks productive. The growing veterinary educational of IT and joint ventures with international veterinary pharmaceutical companies are anticipated as the major drivers of growth of industry in India.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.9% |

Widespread Use in Managing Autoimmune Conditions

As corticosteroids and azathioprine are playing a major role in the control of immune-mediated diseases, they occupied a major portion in the market of veterinarian autoimmune therapeutics. These therapeutics are widely used due to their rapid onset of anti-inflammatory and immunosuppressive action, and they are frequently first-line treatment for many autoimmune diseases. Vets often turn to corticosteroids for rapid symptomatic relief and azathioprine for long-term immune modulation.

They have found wide acceptance because of their broad-spectrum applications across various conditions, including immune-mediated hemolytic anemia and pemphigus. Their cost effectiveness in comparison to newer options further increases availability, especially in the field of general veterinary medicine.

There are multiple formulations available (e.g., oral and injectable) that, depending on disease severity, can be administered based on the need. Their longstanding clinical experience and well-documented efficacy further solidify their position as first-line treatment options. Data thus far showing optimization of dosage and combination therapies support their continued dominance.

Targeted Immunosuppression with Fewer Side Effects

Cyclosporine represents the largest therapeutic share on the veterinary autoimmune therapeutics market owing to its targeted mode of action that selectively inhibits T-cell activation without imparting generalized immune dysfunction. Unlike corticosteroids, which are effective in the short-term but carry a higher risk of systemic side effects, cyclosporine is the preferred agent in similar conditions, which are chronic autoimmune in nature.

It is commonly employed for conditions like atopic dermatitis, immune-mediated, and pemphigus complex, in which careful and specific immune modulation is necessary. Additionally, the increasing adoption of steroid-sparing agents continues to drive its use as veterinarians look for alternatives offering effective disease control with fewer side effects.

Moreover, advances in formulation, such as preparations based on microemulsions, have further increased bioavailability and dosing consistency, resulting in improved therapeutic effects. Rising awareness about the advantages of targeted therapies among pet parents is also expected to drive its continuous demand. As veterinary specialty clinics continue to offer advanced immunotherapy options, cyclosporine’s contribution to controlling autoimmune diseases is better appreciated.

Essential Hormonal Therapy for Lifelong Management

Significant share of hypothyroidism in the veterinary autoimmune therapeutics industry is due to the requirement of life long treatment in order to maintain metabolic stability of affected animals. Its chronic nature ensures a constant demand for hormone replacement therapy, making it by far one of the most commonly diagnosed endocrine disorders in dogs.

Levothyroxine continues to be the first line of treatment, bringing thyroid function back to normal and preventing complications like lethargy, weight gain and skin problems. Blood tests enable easy and direct diagnosis, leading to prompt medical intervention, and the continued application of thyroid hormone treatment. When yet, veterinarians are accustomed to working with standardized dosing regimens that assure predictable treatment outcomes, this only adds incentive for continued need of these therapeutics.

Hypothyroidism isn’t like other autoimmunity: it’s not managed with a regimen of immunosuppressive drugs, but follows a known protocol, making it a commonplace but critical treatment in veterinary medicine. Multiple formulations of thyroid hormone replacement are widely available and make its continued preference virtually certain, in some cases for the long term.

Increasing Prevalence Due to Aging Pet Population

The increasing prevalence of joint disorders in aging companion animals accounts for a considerable share of immune-related arthritis in the veterinary autoimmune therapeutics market.

That said, like many dogs, reportedly more than half of dogs in developed countries are living longer thanks to better veterinary care, and the chances of developing chronic inflammatory diseases into their golden years, such as those affecting joints, chronically have risen. Autoimmune-mediated arthritis needs lifelong treatment with immunosuppressants and anti-inflammatories for pain relief and mobility.

The veterinary auto-immune therapeutics market is majorly driven by the rise in demand for advanced diagnostic imaging coupled with a rise in the prevalence of cardiovascular diseases, increase in chronic diseases leading to rising demand for non-invasive imaging technologies. In order to stay at the forefront of technology, companies are investing in high-resolution ultrasound, MRA, and CTA.

The market is fragmented with the presence of several established players in medical imaging such as cardiovascular solution provider and emerging digital health companies. Veterinarians are advocates for early intervention to slow the progress of disease, which is boosting steady demand for targeted therapies.

Increasing attention to enhancing animal quality of life has facilitated the widespread adoption of long-term therapeutic strategies, such as biologics and disease-modifying agents. Furthermore, improvements in diagnostic imaging have facilitated early detection, allowing for timely initiation of treatment. This has ensured that affected animals receive comprehensive care tailored to their needs through specialized orthopedic and rehabilitation services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Zoetis Inc. | 14-15% |

| Boehringer Ingelheim | 11-12% |

| Elanco Animal Health | 9-10% |

| Merck Animal Health | 8-9% |

| Other Companies (combined) | 54-55% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Zoetis Inc. (2025) | Market leader offering monoclonal antibody therapies and immunosuppressive drugs for autoimmune diseases in pets. |

| Boehringer Ingelheim (2024) | Provides veterinary immunotherapy solutions with a focus on innovative cytokine inhibitors. |

| Elanco Animal Health (2024) | Specializes in targeted therapies for autoimmune conditions, including anti-inflammatory biologics. |

| Merck Animal Health (2024) | Develops advanced immunomodulators and biologics targeting canine and feline autoimmune disorders. |

Key Company Insights

Zoetis Inc. (14-15%)

Siemens Healthineers is stepping up vascular imaging with AI-powered automation that increases workflow efficiency and diagnostic accuracy. Its sophisticated imaging systems assist minimally invasive procedures, providing instant visualization of complex vascular inspections.

Boehringer Ingelheim (11-12%)

GE Healthcare products combine CT, MR, and ultrasound for hybrid imaging technologies that can be used either independent or together for vascular diagnostics. Its innovations enhance image clarity and facilitate the early detection of vascular diseases.

Elanco Animal Health. (9-10%)

Available in systems from Philips, precision imaging plays a key role in accelerating the efficacy of busy cath labs with next-generation angiography systems. Their leading the light in real-time image guidance therapy solutions optimizes interventional procedures for better patient treatment in vascular and beyond.

Merck Animal Health (8-9%)

Shimadzu Corporation provides high-speed imaging solutions adapted for vascular diagnostics. Its cutting-edge fluoroscopy and angiography systems further improve real-time blood flow imaging, enabling optimal characterization of vascular paths.

Other Key Players (54-55% Combined)

A number of other companies are major contributors to the veterinary auto-immune therapeutics market through innovative technologies and increased distribution networks. They include:

With the demand for veterinary auto-immune therapeutics procedures growing unabated, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Corticosteroids, Azathioprine, Cyclosporine, Mycophenolate, Leflunomide, Cyclophosphamide, Levothyroxine, Folic Acid, Hydroxychloroquine and Chloroquine

Hypothyroidism, Pemphigus Disease, Canine Lupus, Auto-Immune Hemolytic Anemia, Bullous Pemphigoid, Discoid Lupus Erythematosus (DLE), Immune-related arthritis and Others

Companion Animal & Live Stock Animal

Veterinary Hospitals and Veterinary Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for veterinary auto-immune therapeutics market was USD 47,269.3 million in 2025.

The veterinary auto-immune therapeutics market is expected to reach USD 79,224.7 million in 2035.

The technological advancements in immunosuppressant’s and biologics have revolutionized treatment options, improving efficacy and reducing adverse effects are enhancing market penetration the demand for veterinary auto-immune therapeutics.

The top key players that drives the development of veterinary auto-immune therapeutics market are Zoetis Inc., Boehringer Ingelheim, Elanco Animal Health, Merck Animal Health and Ceva Santé Animale.

Corticosteroids, Azathioprine is by therapy type leading segment in veterinary auto-immune therapeutics market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Animal Type, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Therapy Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Disease Indication, 2023 to 2033

Figure 23: Global Market Attractiveness by Animal Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Therapy Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Disease Indication, 2023 to 2033

Figure 48: North America Market Attractiveness by Animal Type, 2023 to 2033

Figure 49: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Therapy Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Disease Indication, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Animal Type, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Therapy Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Disease Indication, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Animal Type, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Therapy Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Disease Indication, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Animal Type, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Therapy Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Disease Indication, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Animal Type, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Therapy Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Disease Indication, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Animal Type, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Animal Type, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Animal Type, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Animal Type, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Animal Type, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Therapy Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Disease Indication, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Animal Type, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autoimmune Disease Therapeutics Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Equine Veterinary Therapeutics Market Is Segmented by Drugs, Vaccines, Indication, Route of Administration and Distribution Channel from 2025 to 2035

Veterinary Infectious Disease Therapeutics Market

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA