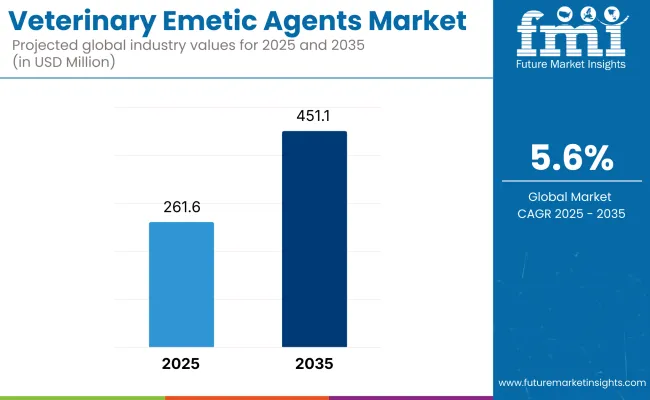

The veterinary emetic agents market is expected to record a valuation of USD 261.6 million in 2025 and USD 451.1 million in 2035, with reflecting a growth of USD 189.5 million across the ten-year span. The overall expansion represents a CAGR of 5.6%, representing a 1.72X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 261.6 million |

| Industry Value (2035F) | USD 451.1 million |

| CAGR (2025 to 2035) | 5.6% |

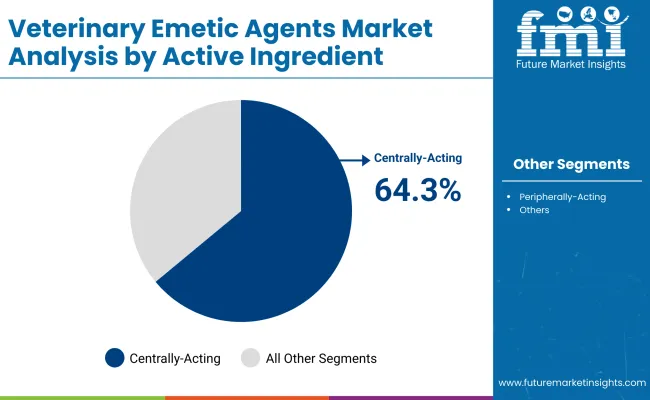

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 261.6 million to USD 343.5 million, adding USD 81.9 million which contributes to 43.2% of the total decade growth. The Centrally Acting Emetic Agents segment will remain dominant, holding around 64.3% share of the category by 2025 due to their higher efficacy, regulatory approvals, and strong preference among veterinary practitioners for use in companion animals such as dogs and cats.

The second half from 2030 to 2035 contributes USD 107.5 million which is equal to 56.8% of the total growth as the market jumps from USD 343.5 million to USD 451.1 million. This momentum is powered by innovation in drug formulations, expanding e-commerce distribution channels, and evolving regulatory frameworks. Centrally Acting Emetic Agents are expected to maintain or slightly increase their share, while alternative delivery formats and supportive care agents remain niche. The Centrally Acting Emetic Agents to hold 65.6% by the end of the decade. Overall, the market is poised for steady expansion driven by evolving pet care trends and veterinary pharmaceutical advancements.

The global veterinary emetic agents market experienced steady expansion between 2020 and 2024, growing from USD 194.7 million to USD 249.0 million, driven primarily by increased demand for companion animal healthcare and rising awareness of safe emesis induction practices. Top three manufacturers, including major players such as Zoetis Inc., Elanco Animal Health, and Boehringer Ingelheim, contribute approximately 44.5% of the overall market share. Their dominance stems from strong product portfolios, geographic reach, and strategic investments in R&D and regulatory compliance.

Demand for veterinary emetic agents is expected to reach USD 261.6 million in 2025, with the market composition evolving as ophthalmic formulations and targeted delivery systems gain traction. Centrally Acting Emetic Agents will continue to dominate, but innovation is shifting toward safer, faster-acting compounds tailored for companion animals. Traditional pharmaceutical leaders face growing competition from niche biotech firms focused on precision veterinary therapeutics and patient-friendly administration formats. Key players are adapting by investing in formulation R&D, expanding e-commerce distribution, and integrating digital tools for dosage tracking and remote consultation.

A key driver is the increasing rate of pet ownership worldwide, especially in North America and Europe, is creating heightened demand for veterinary treatments that safely induce emesis, critical in poisoning and overdose cases. The humanization of pets has accelerated owners' willingness to spend on advanced therapies, fueling market expansion.

For instance, globally, pet ownership continues a strong upward trend, with approximately 900 million pet dogs and 370 million pet cats in 2025. In the USA alone, 94 million households own pets (about 71% of households), with dog ownership at 68 million and cats at 49 million. This expanding pet population fuels demand for veterinary healthcare products, including emetic agents essential in poisoning emergencies.

In parallel, advancements in centrally-acting emetic agents, such as FDA-approved ophthalmic formulations like ropinirole, have improved safety and efficacy profiles, prompting clinicians to prefer these alternatives over older, less predictable peripherally acting agents. For example, the introduction and regulatory approvals of more effective and safer emetic agents, like FDA-approved ropinirole eye drops for dogs, enhance clinical adoption. These advancements reduce side effects and improve dosage accuracy, encouraging veterinarians to prescribe emetics more confidently.

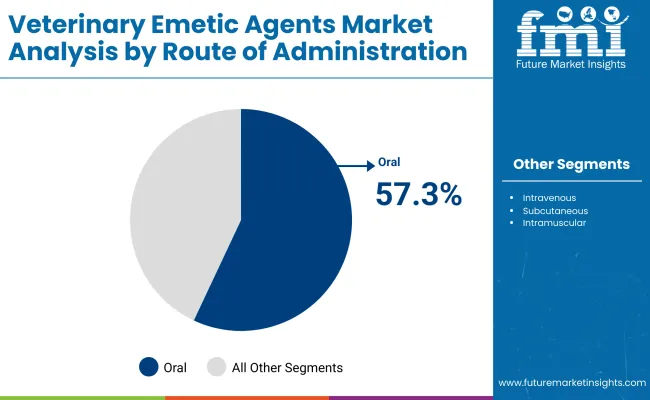

The market for veterinary emetic agents is classified based on Active Ingredient Class, Route of Administration, Target Animal and Distribution Channel. The market is segmented by Active Ingredient Class, Route of Administration, Target Animal, and Distribution Channel. Active Ingredient Class includes Centrally Acting Emetic Agents such as apomorphine and ropinirole, which are preferred for their high efficacy and safer clinical profile.

Route of Administration is categorized into oral, intravenous, subcutaneous, intramuscular, and other methods. Target Animal segmentation includes dogs, cats and Others. Distribution Channel is segmented into Veterinary Clinics & Hospitals, Retail Pharmacies & Veterinary Stores and E-commerce. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| By Active Ingredient Class | Market Value Share, 2025 |

|---|---|

| Centrally-Acting Emetic Agents | 64.3% |

| Peripherally-Acting Emetic Agents | 26.7% |

| Others | 9.0% |

In 2025, the Centrally-Acting Emetic Agents segment leads the global veterinary emetic agents market with 64.3% revenue share. Their dominance stems from their superior efficacy and targeted mechanism of action, which involves stimulating the chemoreceptor trigger zone in the brain to reliably induce vomiting. This central action provides a faster onset compared to peripheral agents, reducing the risk of incomplete emesis or repeated dosing.

Centrally-acting agents such as apomorphine and ropinirole offer greater precision in dosage control and fewer adverse effects, making them highly preferred by veterinarians treating poisoning and overdose cases in companion animals, especially dogs. Leading manufacturers have invested significantly in refining these agents’ formulations to enhance safety profiles and ease of administration particularly ophthalmic delivery methods that improve compliance and rapid effect. As veterinary care expands into emerging markets and outpatient settings, the clinical trust and reproducibility of centrally-acting agents continue to drive their market leadership, supported by positive outcomes in diverse animal species and evolving regulatory approvals.

| By Route of Administration | Market Value Share, 2025 |

|---|---|

| Oral | 57.3% |

| Intravenous | 9.3% |

| Subcutaneous | 4.7% |

| Intramuscular | 22.9% |

| Others | 5.8% |

In 2025, the Oral route of administration dominates the global veterinary emetic agents market with 57.3% revenue share, driving significant demand across companion animal healthcare. This prominence is attributed to the ease of administration, non-invasiveness, and rapid onset of action that oral emetics provide, making them highly practical for both veterinary clinics and at-home use by pet owners. For example, orally administered apomorphine tablets or syrups are commonly used to induce vomiting in dogs owing to their proven safety profile and effective absorption.

The oral route also facilitates prompt treatment during emergencies without the need for specialized equipment or invasive procedures, expanding accessibility in diverse clinical settings. Additionally, the convenience of oral administration supports compliance and repeat dosing when needed. Veterinary guidelines often recommend oral emetics as a first-line intervention for toxin ingestion or overdose in small animals, reinforcing this route’s dominant market position.

| By Target Animal | Market Value Share, 2025 |

|---|---|

| Dogs | 73.2% |

| Cats | 22.6% |

| Others | 4.2% |

In 2025, dogs hold the major revenue share of 73.2% in the target animal segment of the global veterinary emetic agents market. This dominance is driven by the high adoption of dogs as pets or companion animals across every country. This has led to frequent need for induced emesis to manage poisoning or accidental ingestion cases in canines. Moreover, veterinary protocols widely recommend emesis induction as a frontline treatment in dogs, further establishing their predominance in this segment.

Leading veterinary pharmaceutical companies tailor formulations and dosages primarily for dogs, reflecting their market importance. Instances such as the routine use of apomorphine or ropinirole in dogs for treating toxic exposures exemplify this trend. Compared to cats or other smaller animals, a significant percentage of dog population requires emergency care which reinforces their position as the primary target species, driving both clinical and market demand.

| By Distribution Channel | Market Value Share, 2025 |

|---|---|

| Veterinary Clinics and Hospitals | 73.2% |

| Retail Pharmacies/Veterinary Stores | 22.6% |

| E-commerce Sales | 4.2% |

In 2025, Veterinary Clinics and Hospitals dominate the distribution channel segment of the global veterinary emetic agents market with a revenue share of 73.2% in 2025. This leadership is anchored in their comprehensive infrastructure, skilled veterinary professionals, and the capability to provide immediate, supervised administration of emetic agents during critical poisoning or overdose cases. Clinics and hospitals serve as the primary access points for pet owners seeking urgent care, ensuring rapid diagnosis and treatment with reliable, prescription-grade emetics.

Top pharmaceutical manufacturers prioritize this channel for product launches, clinical training, and post-market surveillance reinforcing their pivotal role in the supply chain. For instance, apomorphine and ropinirole are commonly stocked and administered in veterinary hospitals for controlled, effective emesis induction under medical supervision.

Furthermore, reimbursement frameworks and insurance coverage often support treatments within these institutional settings, increasing client preference. The growing number of specialty veterinary hospitals and emergency animal care centers globally, particularly in urban and developed regions, strengthens this channel’s market dominance as the most trusted and accessible point of care for veterinary emetic agents.

Growth is restrained by safety concerns and side effects associated with common emetics such as apomorphine, ropinirole, and hydrogen peroxide, which limit universal application and require careful case selection. A key trend is the increasing adoption of e-commerce distribution channels, with major veterinary pharmaceutical companies and online platforms improving accessibility, convenience, and speed of supply for both pet owners and veterinary professionals.

Rising Pet Ownership and Pet Humanization Driving Demand

Rising pet ownership and pet humanization are key drivers of growth in the veterinary emetic agents market. As more households embrace pets as family members, demand for high-quality veterinary care including emergency treatments has surged. Pet parents are increasingly aware of the risks of toxic ingestion and seek rapid interventions, boosting the use of emetic agents. In emerging economies, rising disposable incomes and urbanization further drives pet adoption and healthcare spending.

This trend toward premium pet services, coupled with expanding access to veterinary clinics and reimbursement, ensures that emetic agents remain essential in safeguarding pet health and enhancing treatment outcomes. For instance, according to data published by American Pet Products Association, Overall, pet ownership has increased for both dogs and cats, with 51% of USA households (68 million) owning a dog and 37% of USA households (49 million) owning a cat.

Safety Concerns and Side Effects

Safety concerns and side effects significantly hamper the growth of the global veterinary emetic agents market. According to peer-reviewed veterinary studies and scientific literature, commonly used emetic agents such as apomorphine and ropinirole while effective in maximum cases. However, these drugs are associated with adverse effects in limited pet population which hinder their adoption in certain circumstances. For example, apomorphine can cause sedation, excessive salivation, respiratory depression, and gastrointestinal discomfort in dogs.

Ropinirole ophthalmic drops, recently approved by the FDA, have a side effect profile including conjunctival hyperemia, ocular irritation, protracted vomiting episodes, and sedation, which are mostly self-limiting but require careful use especially in animals with preexisting conditions. Moreover, certain emetics like hydrogen peroxide, though used peripherally, pose risks of gastrointestinal irritation, gastric dilatation-volvulus (bloat) in dogs, and potentially aggravate injuries if not properly indicated. Veterinary guidelines caution against emesis induction if the ingested substance is corrosive or could cause harm upon regurgitation, further restricting universal use.

Rising Shift Toward E-commerce Distribution

The shift towards e-commerce distribution is a prominent market trend driving growth in the global veterinary emetic agents market. Veterinary pharmaceuticals, including emetic agents, are increasingly being accessed through online platforms, enhancing availability and convenience for pet owners and veterinary professionals alike. Veterinary distribution, encompassing clinics, hospitals, retail pharmacies, and e-commerce, plays a critical role in ensuring access to essential medicines for companion animals and livestock.

Key industry leaders such as Zoetis, Merck Animal Health, and Boehringer Ingelheim actively leverage e-commerce channels to expand their reach, providing pet owners with easier, faster access to veterinary emetic agents without depending solely on traditional brick-and-mortar outlets. The rise of online veterinary pharmacies and e-tailers like Chewy, Amazon, and Petco enables purchasing from home, often coupled with veterinary consultation services, meeting the growing demand for quick and safe toxin management solutions.

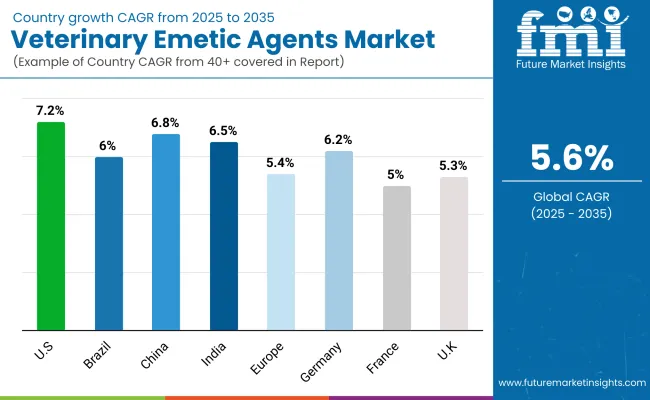

| Country | CAGR (%) |

|---|---|

| USA | 7.2% |

| Brazil | 6.0% |

| China | 6.8% |

| India | 6.5% |

| Europe | 5.4% |

| Germany | 6.2% |

| France | 5.0% |

| UK | 5.3% |

Asia-Pacific is emerging as the fastest-growing region in the global veterinary emetic agents market, driven by rapid expansion of veterinary healthcare infrastructure, rising pet ownership, and increasing awareness about pet health management. Countries like India and China are leading this growth with estimated CAGRs of approximately 6.5% and 6.8%, respectively.

This growth is supported by government initiatives to improve animal health, increased veterinary spending, and the expansion of veterinary clinics and specialty hospitals. Additionally, domestic manufacturers in these markets are improving the availability and affordability of veterinary emetic agents, facilitating wider adoption in rural and previously underserved areas.

Europe demonstrates moderate growth, with a CAGR around 5.4%, supported by strong veterinary care frameworks in countries such as Germany, France, and the United Kingdom France benefits from extensive pet insurance coverage and proactive veterinary protocols, while the United Kingdom is expanding specialty veterinary clinics and emergency care centers. Germany’s growth is comparatively slower due to market maturity and conservative prescription practices for emetic agents. Stable demand persists, driven by high pet ownership rates and growing aging pet populations needing more frequent veterinary interventions.

North America remains a mature yet crucial market, with the United States growing at about 7.2% CAGR. Growth drivers include widespread pet humanization, increasing veterinary expenditures, and strong veterinary infrastructure supported by insurance reimbursements for advanced therapies. Leading manufacturers such as Zoetis and Elanco are investing in research and partnerships with veterinary hospitals, accelerating product adoption. The availability of telemedicine and e-commerce channels also enhances access and convenience for pet owners, maintaining steady market expansion rooted in advanced veterinary care standards and high pet health awareness.

| Year | USA Veterinary Emetic Agents Market (USD Million) |

|---|---|

| 2025 | 85.0 |

| 2026 | 90.9 |

| 2027 | 97.2 |

| 2028 | 104.1 |

| 2029 | 111.5 |

| 2030 | 119.5 |

| 2031 | 128.0 |

| 2032 | 137.2 |

| 2033 | 147.4 |

| 2034 | 158.5 |

| 2035 | 170.4 |

The veterinary emetic agents market in the United States is projected to grow at a CAGR of approximately 7.2% from 2025 to 2035. Despite its maturity, the market exhibits steady expansion driven by increasing pet ownership, heightened awareness of pet toxicology emergencies, and rising veterinary healthcare expenditure. Growth is further supported by the expanding use of advanced and safer centrally-acting emetic agents like FDA-approved ropinirole, which enhance treatment outcomes in poisoning cases.

Veterinary clinics and hospitals remain the dominant end users due to their equipped facilities and trained staff capable of administering emetic treatments efficiently. Additionally, independent veterinary emergency and specialty clinics are witnessing increased adoption owing to faster patient handling and growing demand for urgent care services.

This evolving healthcare ecosystem, supported by pet humanization and better clinical protocols, sustains consistent market growth in the United States during this period.

The United Kingdom's Veterinary Emetic Agents Market is projected to grow at a CAGR of approximately 5.3% from 2025 to 2035. Market expansion is supported by increasing pet ownership, growing awareness of pet emergency care, and improved veterinary healthcare infrastructure backed by public and private funding. The UK’s National Health Service (NHS) model has parallels in rising public support for animal welfare, with increased referrals to specialized veterinary hospitals equipped for advanced emergency treatments, including emetic agent administration.

Hospitals and veterinary clinics continue to dominate as primary end users, benefiting from modernized facilities and integrated care pathways that improve treatment outcomes. Emerging independent emergency veterinary centers are gaining traction by offering efficient, rapid care for poisoning and toxin ingestion cases, reducing pressure on traditional hospital settings.

Germany’s veterinary emetic agents market is projected to grow at a CAGR of 6.2% between 2025 and 2035, supported by its advanced veterinary healthcare infrastructure and strong pet ownership culture. Over 34% of households own dogs or cats, driving consistent demand for emergency treatments like emetic agents. University-affiliated and specialty animal hospitals lead adoption of safe emesis protocols in poisoning cases. Regulatory bodies like BMEL and PEI ensure high standards but also slow market entry for new formulations.

| Europe Veterinary Emetic Agents Market Analysis Country | 2025 |

|---|---|

| Germany | 28.2% |

| UK | 17.0% |

| France | 15.2% |

| Italy | 11.4% |

| Spain | 8.6% |

| BENELUX | 7.0% |

| Nordic Countries | 6.0% |

| Rest of Western Europe | 6.6% |

| Europe Veterinary Emetic Agents Market Analysis Country | 2035 |

|---|---|

| Germany | 29.4% |

| UK | 17.8% |

| France | 14.2% |

| Italy | 10.1% |

| Spain | 7.4% |

| BENELUX | 7.6% |

| Nordic Countries | 6.8% |

| Rest of Western Europe | 6.7% |

India’s Veterinary Emetic Agents Market is expected to grow at a robust CAGR of approximately 6.5% between 2025 and 2035, positioning it among the fastest-growing veterinary pharmaceutical markets globally. This growth is driven by rising pet ownership across urban and semi-urban areas, increasing awareness of pet health and emergency care, and expanding veterinary healthcare infrastructure, particularly in metropolitan regions. Government initiatives aimed at improving animal health and welfare are fueling investments in veterinary clinics and hospitals equipped to handle toxin management cases requiring emetic agents.

Veterinary Clinics and Hospitals remain the dominant end users due to their advanced facilities and experienced staff capable of administering emetics safely. Meanwhile, private multispecialty veterinary centers in Tier-1 cities are witnessing growing adoption by pet owners seeking premium and minimally invasive care, reflecting rising pet humanization and consumer preference for quality veterinary services.

China’s veterinary emetic agents market is projected to grow at a robust CAGR of 6.8% between 2025 and 2035, driven by its vast companion animal population and expanding veterinary infrastructure. With over 124 million pets, including 71.5 million cats and 52.6 million dogs, demand for emergency treatments like emetic agents is surging.

Regulatory bodies like MARA and IVDC are enhancing drug safety standards, while companies like New Ruipeng Pet Healthcare Group operate 1,400 hospitals across 80 cities, boosting access. The increasing urban pet population, rising awareness of pet health, and expanding veterinary hospital networks contribute to increasing demand for emergency veterinary drugs essential for poison management, such as emetic agents.

| Active Ingredient Class | 2025 Share (%) |

|---|---|

| Centrally-Acting Emetic Agents | 65.5% |

| Peripherally-Acting Emetic Agents | 27.2% |

| Others | 7.3% |

Japan’s Veterinary Emetic Agents Market is forecast to grow at a CAGR of 4.3% from 2025 to 2030, driven by an aging pet population and heightened awareness about pet healthcare. The market is dominated by centrally-acting emetic agents, which hold a 65.5% share in 2025, followed by peripherally-acting agents at 27.2%, with other agents comprising 7.3%.

The country's robust veterinary infrastructure, bolstered by policies from the Ministry of Agriculture, Forestry and Fisheries (MAFF), facilitates access to essential veterinary medicines. Veterinary hospitals and clinics are the primary end users, benefiting from advanced diagnostic and treatment capabilities. Regional veterinary clinics are also seeing increased adoption due to government decentralization efforts aimed at improving access to veterinary services.

This supportive regulatory environment, combined with a well-developed veterinary care system and evolving pet owner attitudes, underpins sustained growth of the veterinary emetic agents market in Japan through 2035.

| Target Animal | 2025 Share (%) |

|---|---|

| Dogs | 73.4% |

| Cats | 20.3% |

| Others | 6.3% |

South Korea’s Veterinary Emetic Agents Market is projected to grow at a CAGR of 3.7% from 2025 to 2035. This growth is driven by increasing pet ownership, heightened awareness of animal health emergencies, and the expansion of veterinary healthcare infrastructure supported by government initiatives.

The Ministry of Agriculture, Food and Rural Affairs (MAFRA) plays a vital role in promoting veterinary public health programs and enhancing access to critical treatments, including emetic agents. The market is primarily driven by dogs, which account for 73.4% of the share in 2025, followed by cats at 20.3%.

Tertiary veterinary hospitals in major cities like Seoul are the primary end users, offering advanced diagnostic and treatment services. Regional veterinary clinics and emergency care centers are also witnessing growth, supported by improved training and government-backed service initiatives.

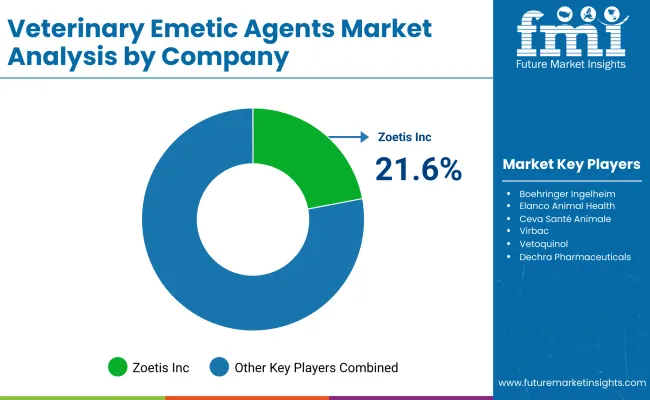

| Key Players | Global Value Share (%) 2025 |

|---|---|

| Zoetis Inc. | 21.6% |

| Other Players | 78.4% |

The global veterinary emetic agents market is moderately consolidated, comprising leading multinational pharmaceutical companies, specialized veterinary drug manufacturers, and regional suppliers servicing diverse veterinary care settings. Zoetis Inc. holds the leading market share at 21.6%, propelled by its robust portfolio of veterinary pharmaceuticals, including widely used emetic agents such as apomorphine. Zoetis’ competitive advantage is rooted in its extensive research and development capabilities, stringent quality control measures, and a vast global distribution network that ensures broad accessibility across companion animal healthcare providers.

Mid-sized players like Elanco Animal Health, Merck Animal Health, and Virbac are recognized for their innovation in veterinary formulations, novel drug delivery systems, and adaptive production facilities. These companies often collaborate with Zoetis and veterinary clinics as Tier 2/3 suppliers, offering complementary emetic agents and supporting products, while also focusing on regional market adaptations and compliance with localized regulations.

Specialty providers, such as Vetoquinol and Dechra Pharmaceuticals, focus on niche markets within veterinary care, including customized dosage forms, species-specific formulations, and localized contract manufacturing. These firms facilitate rapid product development cycles, regional regulatory approvals, and cater to emerging veterinary needs such as telehealth and home care applications.

As the market evolves, competitive differentiation is increasingly based on product innovation, safety profile enhancements, and integration with broader animal health management solutions. Leading companies are investing in continuous pharmacovigilance, digital veterinary health platforms, and sustainable manufacturing practices to address growing demands from pet owners for safer, effective, and environmentally responsible emetic treatments. Zoetis’ leadership is reinforced by its commitment to innovation, comprehensive clinical support, and global reach, vital for sustaining growth in an evolving veterinary pharmaceutical landscape.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 261.6 million |

| Active Ingredient Class | Centrally-Acting Emetic Agents, Peripherally-Acting Emetic Agents and Others |

| Route of Administration | Oral, Intravenous, Subcutaneous, Intramuscular and Others |

| Target Animal | Cat, Dogs and Others |

| Distribution Channel | Veterinary Clinics and Hospitals, Retail Pharmacies/Veterinary Stores and E-commerce sales |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Zoetis Inc., Boehringer Ingelheim, Elanco Animal Health, Ceva Santé Animale, Virbac, Vetoquinol, Dechra Pharmaceuticals, Wockhardt Ltd., Heska Corporation, Bayer Animal Health, Sumitomo Pharma Animal Health, Inovet Inc. |

| Additional Attributes | Dollar sales by active ingredient class and regions, adoption trends across dogs segment, rising demand Oral administration, Growing demand across Veterinary Clinics and Hospitals |

The veterinary emetic agents market is estimated to be valued at USD 261.6 million in 2025.

The market size for the veterinary emetic agents market is projected to reach approximately USD 451.10 million by 2035.

The veterinary emetic agents market is expected to grow at a CAGR of 5.6% between 2025 and 2035.

The active ingredient class in the veterinary emetic agents market include centrally-acting emetic agents, peripherally-acting emetic agents, and among others.

In terms of distribution channel, the veterinary clinics & hospitals segment is projected to command the highest share at 63.6% in the veterinary emetic agents market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA