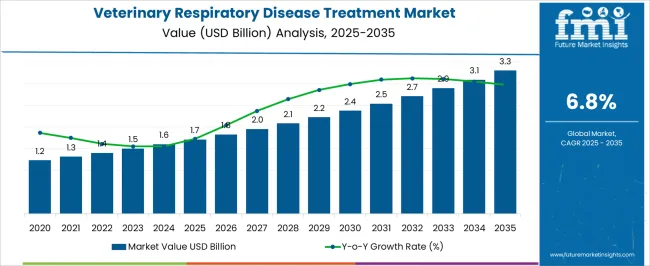

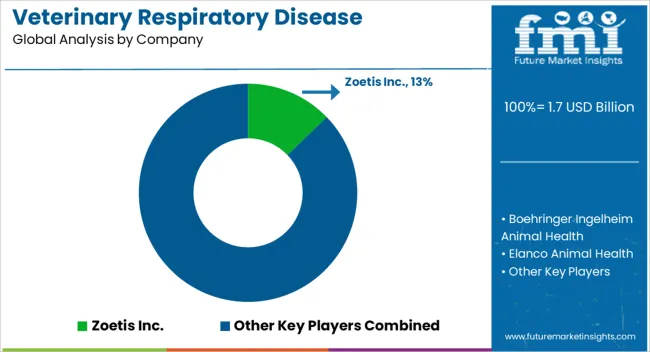

The Veterinary Respiratory Disease Treatment Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Veterinary Respiratory Disease Treatment Market Estimated Value in (2025 E) | USD 1.7 billion |

| Veterinary Respiratory Disease Treatment Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The Veterinary Respiratory Disease Treatment market is experiencing steady growth, driven by the rising prevalence of respiratory infections in livestock, poultry, and companion animals globally. Increasing awareness of animal health and welfare, coupled with the economic impact of respiratory diseases on livestock productivity, is driving the demand for effective treatment solutions. The market is further supported by advancements in veterinary pharmacology, including the development of targeted antibiotics, anti-inflammatory agents, and combination therapies that improve recovery rates and reduce disease recurrence.

Growth is also being fueled by improved veterinary infrastructure, increased access to veterinary care, and the expansion of organized animal husbandry practices in emerging regions. Regulatory emphasis on responsible drug use, safety standards, and compliance with veterinary health guidelines is shaping product adoption and distribution strategies.

As animal owners and veterinary professionals prioritize timely and efficient treatment options, the market is poised for sustained expansion Integration of digital health monitoring, tele-veterinary services, and data-driven disease management further strengthens long-term growth opportunities.

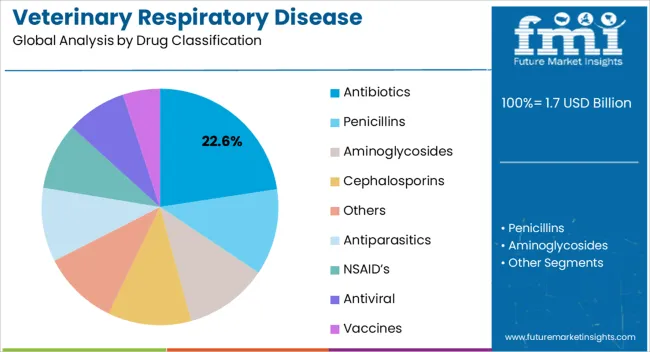

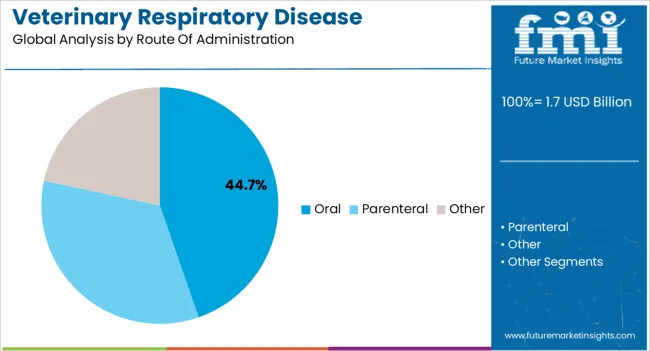

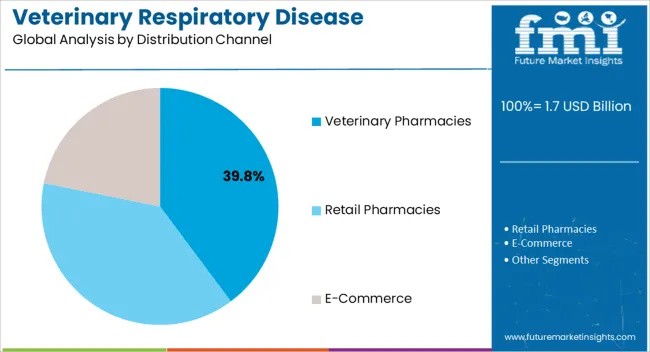

The veterinary respiratory disease treatment market is segmented by drug classification, route of administration, distribution channel, and geographic regions. By drug classification, veterinary respiratory disease treatment market is divided into Antibiotics, Penicillins, Aminoglycosides, Cephalosporins, Others, Antiparasitics, NSAID’s, Antiviral, and Vaccines. In terms of route of administration, veterinary respiratory disease treatment market is classified into Oral, Parenteral, and Other. Based on distribution channel, veterinary respiratory disease treatment market is segmented into Veterinary Pharmacies, Retail Pharmacies, and E-Commerce. Regionally, the veterinary respiratory disease treatment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antibiotics segment is projected to hold 22.6% of the market revenue in 2025, establishing it as the leading drug classification. Growth in this segment is being driven by the widespread prevalence of bacterial respiratory infections in livestock, poultry, and companion animals, where antibiotics provide effective therapeutic outcomes. These drugs enable rapid recovery, minimize mortality rates, and reduce the risk of secondary infections.

Development of broad-spectrum and targeted antibiotics, alongside formulation improvements for controlled release and palatability, has enhanced clinical efficacy and compliance in veterinary settings. Veterinary practitioners prefer antibiotics due to their proven effectiveness, predictable pharmacokinetics, and ease of dosing, which improves treatment consistency.

Increasing adoption of preventive treatment protocols and timely intervention strategies further reinforces market growth As livestock production intensifies and companion animal ownership rises globally, the antibiotics segment is expected to maintain its leadership, driven by clinical reliability, accessibility, and the ongoing need to control respiratory disease outbreaks efficiently.

The oral route of administration segment is anticipated to account for 44.7% of the market revenue in 2025, making it the leading administration method. Growth is being driven by the convenience, safety, and ease of dosing associated with oral formulations for both livestock and companion animals. Oral administration allows for accurate dosage delivery, reduces stress during treatment, and facilitates large-scale medication in herds and flocks.

Veterinary professionals and animal owners favor oral solutions, suspensions, and medicated feeds due to improved compliance, repeatability, and controlled therapeutic outcomes. The ability to integrate antibiotics and other drugs into feed or water further enhances operational efficiency, especially in commercial farming environments.

Regulatory frameworks supporting safe oral medication, alongside innovations in palatability and bioavailability, are accelerating adoption As the demand for simplified, cost-effective, and scalable treatment methods increases, the oral administration segment is expected to retain its market-leading position, supported by practical utility, reduced labor requirements, and proven efficacy in respiratory disease management.

The veterinary pharmacies segment is projected to hold 39.8% of the market revenue in 2025, establishing it as the leading distribution channel. Growth in this segment is being driven by the increasing reliance on specialized veterinary outlets for quality-controlled and professionally dispensed medications. Veterinary pharmacies provide accessibility to a wide range of treatments, expert guidance, and compliance support, ensuring proper use of respiratory disease therapies.

These channels are preferred by veterinary practitioners, livestock owners, and pet caregivers due to their reliability, product authenticity, and advisory services. Expansion of pharmacy networks in urban and rural areas, along with initiatives to improve veterinary drug availability in emerging regions, has further strengthened adoption.

Additionally, veterinary pharmacies play a crucial role in promoting responsible drug usage and preventing misuse, which aligns with regulatory standards As animal health awareness rises and the demand for professional guidance increases, veterinary pharmacies are expected to maintain their leading position, offering trusted access to effective respiratory disease treatments and ensuring compliance with best practices.

Veterinary respiratory diseases are the most common disease that affects livestock and small animals. Veterinary respiratory diseases are the second leading cause of mortality in various animals. Veterinary respiratory disease caused to the animals varies from animal to animal, and it depends on upon the causative agent.

Veterinary respiratory disease resulting from different types of bacteria (bacteria, viruses, weak immune system, temperature fluctuations and improper ventilation are the few factors responsible for causing veterinary respiratory diseases.

Due to veterinary respiratory diseases, it is leading to high mortality rates of animals and causing economic losses. For instance, the bovine respiratory disease is most common in cattle and swine respiratory disease in pigs. Bovine respiratory disease mostly caused by the bacterial agents Pasteurella multocida, Histophilus somni, Mycoplasma bovis, and Mannheimia haemolytica. Various medicines are available in the market to treat Veterinary respiratory diseases.

Most commonly used drugs to treat veterinary respiratory diseases are antimicrobial agents, Non-steroidal anti-inflammatory drugs (NSAID’s), Bronchodilators, Mucolytic agents, Oral rehydration fluids, and immunomodulators. However, treatments are becoming ineffective owing to increase in bacterial, viral resistance in the animals and lack of proper diagnosis are significant factors resulting increase in veterinary respiratory diseases. Hence newer drugs are coming into the market to treat veterinary respiratory disease conditions.

In 2025, Merial (Boehringer Ingelheim), launched Zactran (Gamithromycin) to treat and control bovine respiratory disease conditions. In 2008, Zoetis (Pfizer), got EU approval for Draxxin® (tulathromycin) to treat Haemophilus parasuis (Glässer’s disease) in pigs, the uniqueness of the drug is it acts for ten days this intends to reduce the frequent dosage to the animals.

In 2025, Ceva group launched respiratory vaccine to prevent from Mycoplasma hyopneumoniae infections. To decrease the antibacterial resistant animals researchers are exploring new therapeutic approaches like bacteriophage therapy and bacterial peptides to treat veterinary respiratory disease conditions.

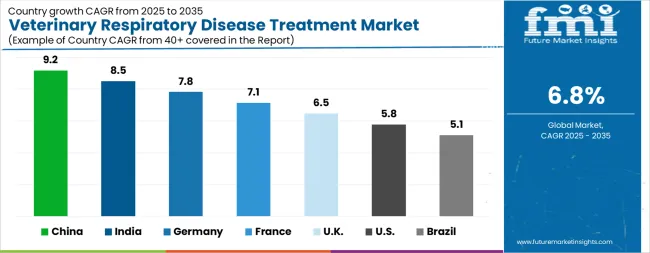

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The Veterinary Respiratory Disease Treatment Market is expected to register a CAGR of 6.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.2%, followed by India at 8.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.1%, yet still underscores a broadly positive trajectory for the global Veterinary Respiratory Disease Treatment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.8%. The USA Veterinary Respiratory Disease Treatment Market is estimated to be valued at USD 648.8 million in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 5.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 83.6 million and USD 55.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Drug Classification | Antibiotics, Penicillins, Aminoglycosides, Cephalosporins, Others, Antiparasitics, NSAID’s, Antiviral, and Vaccines |

| Route Of Administration | Oral, Parenteral, and Other |

| Distribution Channel | Veterinary Pharmacies, Retail Pharmacies, and E-Commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis Inc., Boehringer Ingelheim Animal Health, Elanco Animal Health, Merck Animal Health, Virbac S.A., Ceva Santé Animale, Vetoquinol S.A., Dechra Pharmaceuticals PLC, Bayer Animal Health, IDEXX Laboratories, Inc., Heska Corporation, Norbrook Laboratories Ltd., Phibro Animal Health Corporation, Aratana Therapeutics, Inc., Kindred Biosciences, Inc., and Zomedica Pharmaceuticals Corp. |

The global veterinary respiratory disease treatment market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the veterinary respiratory disease treatment market is projected to reach USD 3.3 billion by 2035.

The veterinary respiratory disease treatment market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in veterinary respiratory disease treatment market are antibiotics, penicillins, aminoglycosides, cephalosporins, others, antiparasitics, nsaid’s, antiviral and vaccines.

In terms of route of administration, oral segment to command 44.7% share in the veterinary respiratory disease treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Swine Respiratory Diseases Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chronic Respiratory Diseases Treatment Market

Veterinary Infectious Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Infectious Disease Therapeutics Market

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Neurodegenerative Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Th17 Driven Disease Treatment Market

Hirschsprung Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Respiratory Disease Therapeutics Market

Communicable Diseases Treatment Market

Meningococcal Disease Treatment Market

Upper Respiratory Tract Infection Treatment Market

Rare Neurological Disease Treatment Market Report – Demand, Growth & Industry Outlook 2025-2035

Rare Inflammatory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Rare Neurological Disease Treatment Providers

Interstitial Lung Disease Treatment Market

Inherited Retinal Diseases Treatment Market Size and Share Forecast Outlook 2025 to 2035

Inflammatory Bowel Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA