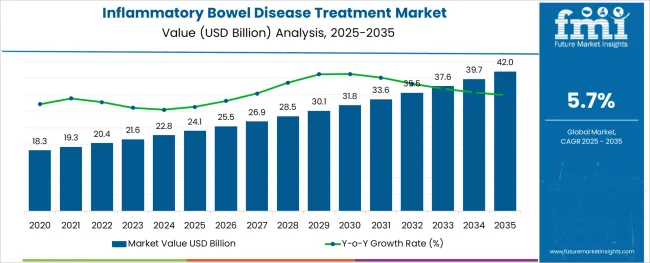

The Inflammatory Bowel Disease Treatment Market is estimated to be valued at USD 24.1 billion in 2025 and is projected to reach USD 42.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

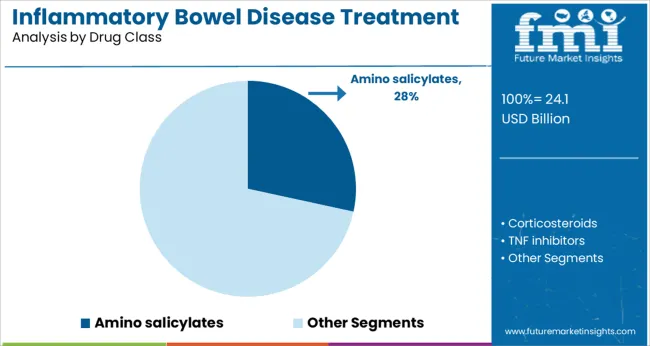

The market is segmented by Type, Drug Class, Route of Administration, and Distribution Channel and region. By Type, the market is divided into Crohn's Disease and Ulcerative Colitis. In terms of Drug Class, the market is classified into Amino salicylates, Corticosteroids, TNF inhibitors, IL inhibitors, Anti-integrin, JAK inhibitors, and Other Drug Classes. Based on Route of Administration, the market is segmented into Oral and Injectable. By Distribution Channel, the market is divided into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

North America holds the largest Inflammatory Bowel Disease Treatment market. In 2024, North America contributed to around 40% of the global revenue. As of 2020, there were 730 clinical trials for IBD, including drug development, observational studies, and others, according to the USA National Library of Medicine. Of these, 268 clinical trials were carried out only in the USA.

A substantial portion of the IBD market in North America is held by Canada. The number of Canadians with IBD is almost around 300,000. It is anticipated that treating Canadians with IBD will cost USD 22.8 Billion each year. The Quebec government launched a biosimilars initiative in 2024, according to announcements made by the minister of health and social services, Christian Dubé, patients will transition from original biologic medications to their biosimilar equivalents.

Besides, Asia-Pacific accounts for a promising Inflammatory Bowel Disease Treatment market. This is mainly due to the growing access to healthcare, increasing per capita medical expenditure, and rise in the number of patients with inflammatory bowel disease. The commonness of inflammatory bowel disease is higher in Asian countries including India, China, and Japan.

With 22.8 million IBD patients in 2024, India surpassed the USA as the nation with the most IBD patients. In India, only 3% of patients use biologics, a much lower percentage than in Western nations. Infliximab and Adalimumab, two biologics, have IBD approval in India. Since June 2024, Vedolizumab has also been approved.

A significant portion of all cases of inflammatory bowel disease is seen in Japan. Only infliximab and Adalimumab are approved in Japan for the treatment of both UC and CD, and the USA Food and Drug Administration approved five biological drugs for the treatment of IBD in 2020.

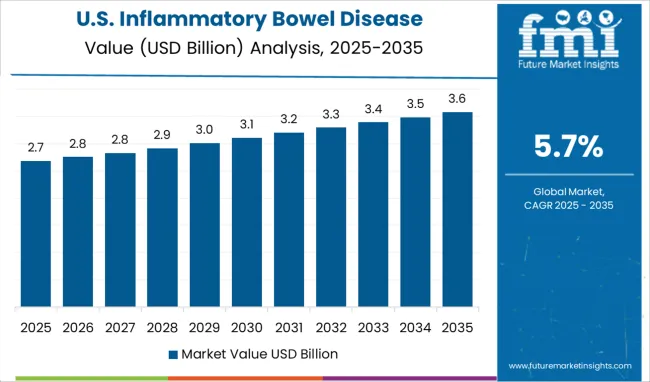

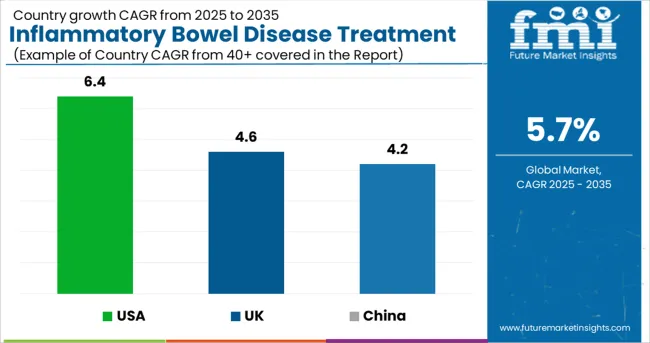

The USA has the largest market for Inflammatory Bowel Disease Treatment, which is projected to reach a valuation of USD 42 Billion by 2035. From 2020 to 2024, the Inflammatory Bowel Disease Treatment market in the USA grew at a CAGR of 4.7% and is expected to experience a CAGR of 6.4% in the next ten years. Between 2025 and 2035, the USA is expected to be a market with a USD 6.2 Billion absolute dollar opportunity.

According to the Crohn's and Colitis Foundation (CCFA), the number of new cases of Inflammatory Bowel Disease reported in the USA each year exceeds 70,000. Infliximab, Adalimumab, Certolizumab Pegol, and Golimumab are the four anti-TNF medications that have been authorized for the treatment of IBD in the USA. Two anti-integrin biologics, Natalizumab and Vedolizumab, have been licensed for the treatment of IBD, and biosimilars for both anti-TNF medications have been created. In the USA, the biologic Stekinumab, which inhibits the cytokines IL-12 and IL-23, has been licensed for the treatment of Crohn's disease.

In 2024, China was the second-largest Inflammatory Bowel Disease Treatment Market after the USA. The market in the country is expected to reach a valuation of USD 4.2 Billion by 2035. From the year 2020 to 2024 China’s Inflammatory Bowel Disease Treatment Market experienced a CAGR of 5.5% and is projected to see a similar CAGR ofinflammatory-bowel-disease-treatment-market-cagr-analysis-by-country in the next ten years. By 2035, China is expected to be an absolute dollar opportunity of USD 2 Billion.

A huge portion of the population smokes in China owing to the country's rising industrialization and evolving lifestyle. The World Bank estimates that in 2020, 48.4% of all male smokers were in China. Smoking has a negative impact on both the small and large intestines, which raises the prevalence of IBD treatment in China.

Reistone Biopharma Co. Ltd., a Chinese biopharmaceutical company in the clinical stages, reported positive findings from a phase II clinical trial that assessed the safety and effectiveness of its drug candidate, SHR0302, an investigational selective Janus kinase type 1 (JAK1) inhibitor, for the treatment of moderate-to-severe ulcerative colitis. The trials are being carried out in various locations, such as China, the USA, and other countries. The company was considering launching a phase III clinical trial in 2024.

The market in the United Kingdom is expected to grow from USD 18.3 Million in 2020 to reach a valuation of USD 1.4 Billion by 2035. During the next 10 years, the market in the country is expected to grow at a CAGR of 4.6% to gross an absolute dollar opportunity of USD 509 Million during the forecast period.

Crohn’s Disease is seen to be the most common Inflammatory Bowel Disease. Revenue through the treatment of Crohn’s Disease expanded at a CAGR of 5% from 2020 to 2024 and is projected to grow at a CAGR of 6% from 2025 to 2035.

In 2024, revenue from Crohn's Disease treatment outscored the management of Crohn's Disease 2024 with a market share close to 60 percent. That with the increase in cases has helped to authorize the use of more and more biologics in the marketplace for the treatment of Inflammatory Bowel Disease.

According to Crohn’s and Colitis Foundation, around 25% of patients with Crohn's disease in the USA are prescribed biologics. Moreover, the popularity of Crohn’s disease is about 319 per 100,000 population in North America, while in Europe it is about 322 per 100,000 population.

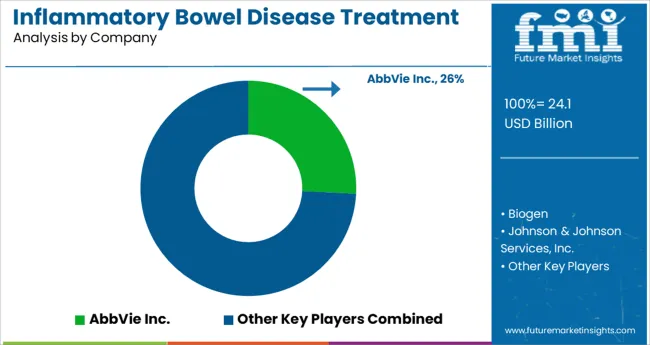

The Inflammatory Bowel Disease Treatment market is moderately competitive and has numerous players. The key companies operating in the Inflammatory Bowel Disease Treatment Market are AbbVie Inc., Biogen, Johnson & Johnson Services, Inc., Amgen Inc., UCB S.A., Novartis AG, Takeda Pharmaceutical Company Limited, Merck & Co., Inc., Pfizer Inc., and Eli Lilly. To secure a dominating position in the market making key players are focusing on introducing new products through collaborations and partnerships.

Some of the recent developments by the key providers of Inflammatory Bowel Disease Treatment are as follows:

The global inflammatory bowel disease treatment market is estimated to be valued at USD 24.1 billion in 2025.

It is projected to reach USD 42.0 billion by 2035.

The market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types are crohn's disease and ulcerative colitis.

amino salicylates segment is expected to dominate with a 28.4% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inflammatory Markers Market

Inflammatory Diseases Market Size and Share Forecast Outlook 2025 to 2035

Anti-Inflammatory Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Anti-Inflammatory Biologics

Rare Inflammatory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Pelvic Inflammatory Disease Therapeutics Market

Vaginal and Vulval Inflammatory Diseases Treatment Market - Demand & Innovations 2025 to 2035

Bowel Stimulators Market Growth – Trends, Demand & Forecast 2024-2034

Small Bowel Enteroscopes Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA