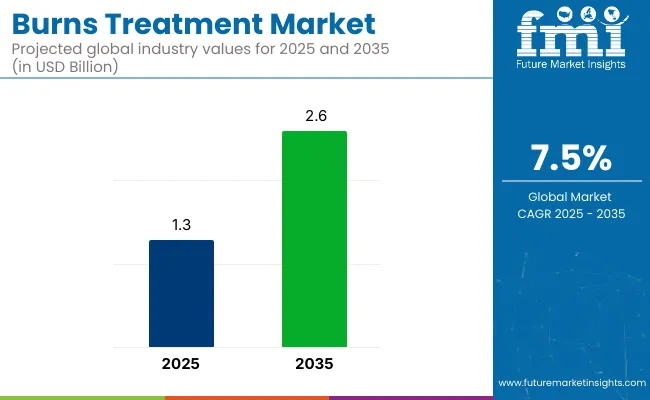

The global Burns Treatment Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate of 7.5% over the forecast period.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 1.3 billion |

| Projected Industry Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 7.5% |

The Burns Treatment Market is undergoing significant growth driven by advancements in wound care technologies, such as bioengineered skin substitutes and regenerative therapies. Rising awareness, improved healthcare access, and government support in emerging economies are enhancing treatment availability.

Telemedicine and AI-integrated diagnostics are streamlining care delivery and expanding reach, especially in outpatient and home settings. Additionally, investments in specialized burn care infrastructure and skilled healthcare training are improving recovery outcomes.

However, high treatment costs and regional disparities in healthcare infrastructure remain key challenges. Despite these hurdles, the market is expected to progress steadily, fueled by continued innovation, strategic public-private partnerships, and a global focus on improving post-burn rehabilitation and long-term patient care standards.

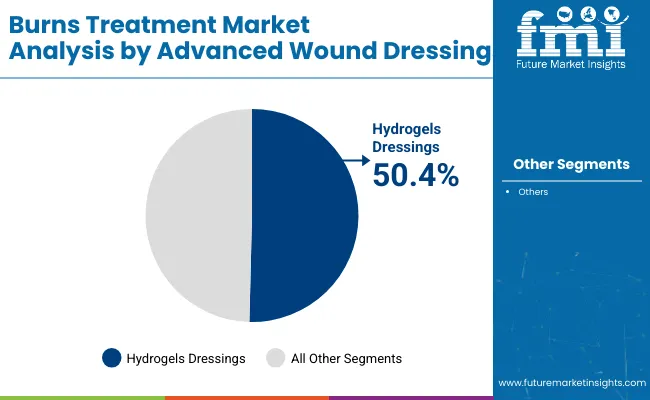

In 2025, advanced wound dressings are expected to capture 50.4% of the burns treatment market, establishing themselves as the leading product category. This dominance is attributed to their ability to provide effective management of burns, offering both therapeutic and protective benefits.

Advanced wound dressings, such as hydrocolloids, hydrogels, and alginates, are specifically designed to promote faster healing by maintaining an optimal moist environment, reducing the risk of infection, and providing pain relief.

These dressings also support better wound exudate management and are easier to apply and change compared to traditional dressings. The growth of this segment has been supported by increased healthcare focus on minimizing infection risk and improving patient outcomes in burn care.

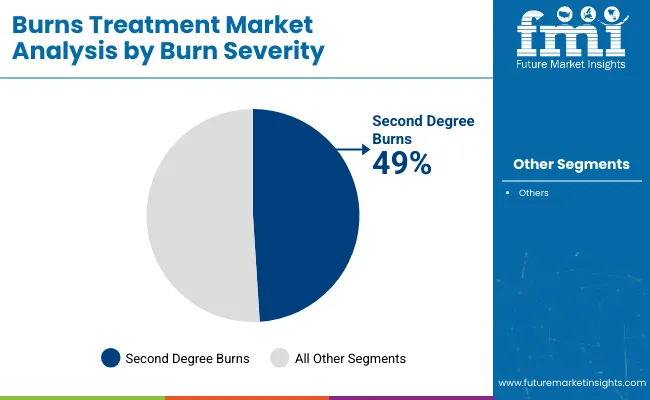

In 2025, second-degree burns are expected to account for 49.0% of the burns treatment market, making it the leading severity segment. This dominance is attributed to the higher prevalence of second-degree burns compared to other burn severities. Second-degree burns, which affect both the epidermis and the dermis, are characterized by redness, swelling, and blistering, requiring specialized care to prevent infection and promote healing.

The growth of this segment has been driven by increased awareness and better access to healthcare, leading to improved diagnosis and treatment of second-degree burns. Additionally, advancements in wound care products, such as advanced wound dressings and hydrocolloids, have played a significant role in enhancing healing times and minimizing complications. The high incidence of second-degree burns due to accidents, scalds, and chemical exposures has further contributed to the demand for effective treatment options.

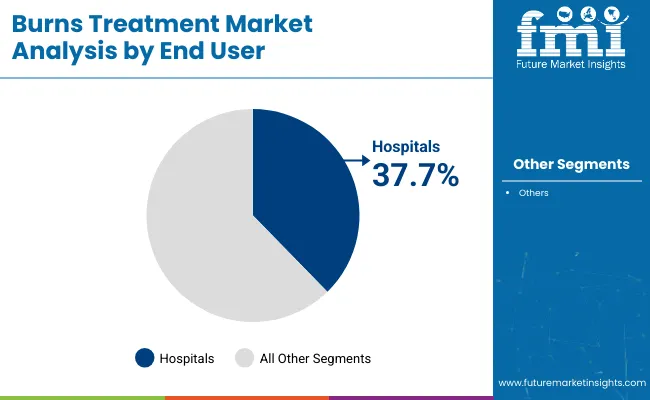

In 2025, hospitals are projected to hold 37.7% of the burns treatment market share, emerging as the leading distribution channel. This dominance has been driven by the central role hospitals play in the treatment of severe burns, where specialized care and advanced equipment are required. Hospitals are equipped with state-of-the-art burn units and multidisciplinary teams, ensuring comprehensive treatment for patients with severe burns.

The high demand for hospital-based treatment stems from the ability to manage complex burn injuries, particularly in cases of third-degree burns or when multiple body areas are involved. Furthermore, hospitals offer specialized wound care therapies, such as skin grafts and advanced wound dressings, which are critical for effective healing. The increasing number of burn care centers in hospitals and improved reimbursement policies for burn treatment procedures have also facilitated the growth of this segment

High Cost and Accessibility Issues in Advanced Burn Treatments

High adoption cost of advanced therapies like skin graft, bioengineered skin substitutes and burn care from specialized burn unit is one of the key restraints in the market. Due to limited availability of these services in specialized burn centers, financial constraints, and socio-economic factors, complete treatment is not available for many patients, particularly in the developing world. Moreover, extended hospitalizations and rehab needs lead to treatment costs being much higher, thus incorporating affordability as a key concern.

Advancements in Regenerative Medicine and Minimally Invasive Treatments

The Burns Treatment Market with the increasing use of regenerative medicine like stem cell-based therapies, 3D bio printing of skin tissues, and smart wound dressings. Nanotechnology-based dressings, hydrogel-based wound healing solutions, and AI-powered wound assessment tools are changing the face of treatment protocols. Moreover, initiatives by the government and rising funding for burn research and treatment accessibility are anticipated to fuel the market growth.

The market is fueled by the increasing prevalence of burn injuries, higher healthcare investments, and technological innovations in wound healing treatments, which are all contributing to the United States burn treatment market growth. Burn injury rates of nearly 450,000 medical treatments annually in the USA According to the American Burn Association (ABA) and growing demand for advanced burns treatment solutions (such as biologics dressing, skin grafts, and regenerative therapies).

Among these are stem cell-based therapies, bioengineered skin substitutes, and nanotechnology-infused dressings that promote healing rates and inhibit scarring that the USA Food and Drug Administration (FDA) has been approving in innovative burn care treatments. Rising incidence of diabetes and chronic wounds is leading to an increase in demand for moist wound healing products and enzymatic debridement solutions.

In addition, the growth of burn centers and specialized trauma hospitals and the growing research funding for better burns treatment are furthering the market. In addition, the USA military and defense sector are actively funding the application of new burns treatment technologies to boost survivability for casualty victims of substantial thermal injury.

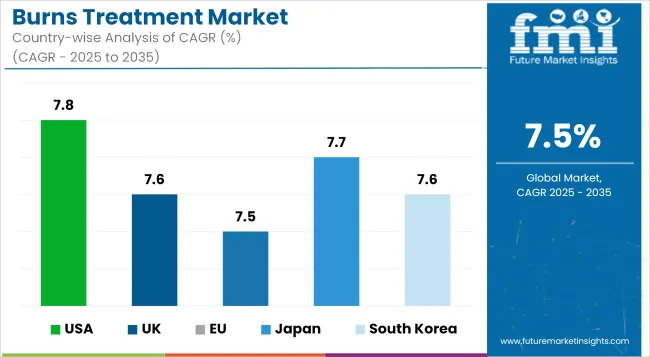

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

The UK burn treatment market is shifting at a rate of 2.2% every year. Factors propelling market expansion include substantial government-sponsored healthcare efforts, improvements in regenerative medicine, and optimal burn injury management. Due to recent investments by the NHS in contemporary burn treatment facilities, there is a higher use of advanced wound dressings, autologous skin grafting and bioengineered tissue substitutes.

Hospitals in the UK, with its strict healthcare quality standards and focus on minimising HAI (Hospital-Acquired Infections) are adopting cost-effective clinically validated burns management solutions. Moreover, the increase in home injuries, workplace burns and burn injuries is generating high demand for antimicrobial dressings, hydrocolloid bandages, and enzymatic debridement agents.

In addition, the development of nanotechnology-based wound healing products and tissue engineering solutions through collaboration between biotech companies and research institutions, is enhancing the effectiveness of burns treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.6% |

The EU burns treatment market is anticipated to grow at a significant CAGR during the review period owing to increasing healthcare spending, increasing incidence of burn injuries across the EU and regulatory support for innovative burn care products. The EU Medical Device Regulation (MDR) and Horizon Europe research programs are promoting progress in innovative wound dressings, bioengineered skin grafts and antimicrobial therapies.

However, countries like Germany, France, and Italy are at the forefront of burn care studies and clinical trials surrounding regenerative medicine stem-cell therapies and smart wound dressing. Furthermore, increasing cases of aging population and diabetes are supporting the growth of moist wound healing solution and enzymatic debridement therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.5% |

The burns treatment market in Japan is poised to grow and is driven by wider technological advances in burn care, growing investments in regenerative medicine along with government-driven modernization of the healthcare sector. Significantly, the Japanese Ministry of Health, Labour and Welfare (MHLW) has invested substantially in research for bioengineered skin substitutes, nanotechnology-based dressings and AI-powered wound: monitoring systems.

The increasing number of burns cases with chronic wounds and delayed healing span is demanding advanced burns treatment solutions in Japan, due to its aging population. Japan’s significant emphasis on robotics and AI in healthcare is also resulting in the creation of smart wound dressings that deliver real-time healing analytics and automated treatment adjustments.

Another prominent driver for market growth is the cosmetic and aesthetic sector in Japan, where the rising demand for therapies for scar reduction, lasers, and skin regeneration is coming into play. Meanwhile, the collaborations between universities, biotech companies and hospitals in Japan are accelerating the significant progress being accomplished in 3D-printed skin and next generation tissue engineering.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

The South Korean burns treatment market is growing with the country’s government-backed healthcare initiatives, burgeoning aesthetic medicine, and significant investments in biotechnology research. Other contributions to the development of hydrogel-based dressings, growth factor therapies, and 3D-printed skin substitutes are due to the strong push from the South Korean Ministry of Health and Welfare (MOHW) to promote biotech and regenerative medicine.

And the country’s booming cosmetic surgery sector is driving demand for treatments that minimize scars and heal the skin. Also, workplace and industrial burn injuries are surging, driving the increased use of high performance burn dressings and emergent burn care solutions.

Leveraging South Korea’s cutting-edge capabilities in nanomedicine and smart healthcare solutions, bioactive wound dressings are being developed to accelerate healing and prevent infections. Moreover, overseas joint ventures with foreign pharmaceutical companies are also positioning South Korean manufacturers in the global burns treatment market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

The burns treatment market is witnessing intensified competition driven by innovation and strategic business moves. Companies are prioritizing the development of advanced wound care solutions, biologics, and smart NPWT devices to cater to complex burn cases. Increased focus on R&D, clinical trials, and regulatory clearances has accelerated product innovation.

Strategic collaborations with hospitals and research institutions are being leveraged to expand treatment capabilities and enhance clinical validation. Moreover, players are adopting multichannel distribution models including digital platforms to broaden market reach.

Expansion into emerging economies, alongside mergers, licensing deals, and regional partnerships, is helping firms capture untapped growth potential. These activities collectively drive market differentiation, improve patient outcomes, and foster robust competition across global burn care segments.

Key Development

In 2024, The FDA has approved MediWound's NexoBrid for pediatric thermal burn treatment, making it available for all USA age groups. This non-surgical option offers a less traumatic alternative for children, representing a significant advancement in burn care.

In 2025, MUSC's South Carolina Burn Center is partnering with Chitozan Health to develop innovative burn and wound gels. Expected to launch in 2026, these gels aim to prevent infections, accelerate healing, and reduce scarring for burn patients, offering a significant advancement in burn care.

The overall market size for burns treatment market was USD 1.3 billion in 2025.

The burns treatment market is expected to reach USD 2.6 billion in 2035.

The expansion of the burns treatment market will be driven by advancements in wound care therapies, increasing availability of skin grafting and regenerative treatments, and rising awareness about specialized burn management solutions.

The top 5 countries which drives the development of burns treatment market are USA, European Union, Japan, South Korea and UK.

Second-degree and third-degree burns to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Anemia Treatment Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA