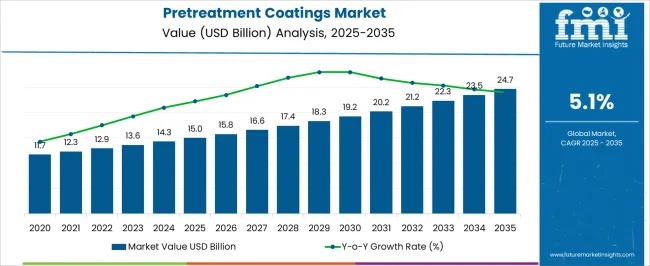

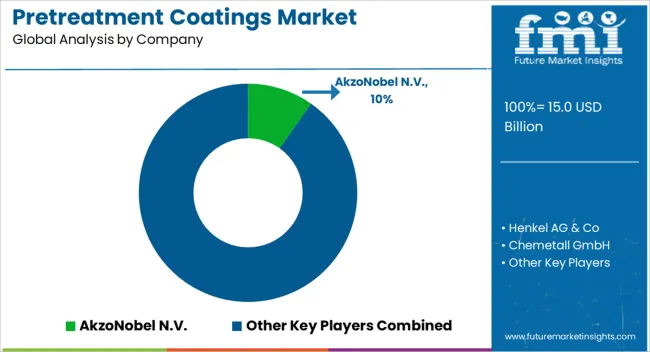

The pretreatment coatings market is estimated to be valued at USD 15.0 billion in 2025 and is projected to reach USD 24.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

Saturation point analysis indicates that expansion will vary depending on regional maturity and industrial adoption. In developed markets such as North America and Europe, pretreatment systems are already widely applied across automotive, aerospace, and general manufacturing. These regions are closer to saturation, where further gains will depend on replacement cycles, efficiency improvements, and stricter compliance with environmental regulations rather than new large-scale adoption. Emerging regions, particularly Asia Pacific and Latin America, present stronger room for adoption, driven by industrial growth, infrastructure development, and rising output in transportation and construction sectors.

Over time, as penetration levels increase, growth in these markets is also expected to moderate, signaling the gradual approach of a saturation phase. Technological shifts, such as the move toward chrome-free chemistries, multifunctional coatings, and eco-aligned product lines, help extend the growth horizon by providing new performance benefits and meeting evolving regulatory standards. The analysis shows that while certain regions will face maturity earlier, continuous innovation and adaptation to regional industrial needs will allow the Pretreatment Coatings Marketto sustain a stable trajectory through 2035.

| Metric | Value |

|---|---|

| Pretreatment Coatings Market Estimated Value in (2025 E) | USD 15.0 billion |

| Pretreatment Coatings Market Forecast Value in (2035 F) | USD 24.7 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The market is supported by multiple upstream industries. Automotive manufacturers contribute approximately 34%, as pretreatment coatings are vital for corrosion resistance and paint adhesion in vehicle production. Construction and building material suppliers represent around 27%, using these coatings to protect steel, aluminum, and other substrates. Industrial equipment and machinery producers account for nearly 18%, applying pretreatment layers to enhance durability in harsh environments. Aerospace and defense programs hold close to 12%, requiring high-performance coatings for structural components. Consumer appliances and electronics manufacturers cover the remaining 9%, integrating pretreatment coatings for enhanced surface finishing and longer product life. The market is shifting toward eco-friendly and high-performance solutions. Chromate-free pretreatments have gained traction, accounting for over 45% of new product formulations in 2024, aligning with environmental compliance requirements.

Nanotechnology-based coatings are emerging, improving adhesion strength by 10–15% compared to conventional systems. Automotive OEMs are adopting multi-metal pretreatment lines to reduce operational complexity and costs, while aerospace programs are focusing on lightweight, corrosion-resistant coatings to support fuel efficiency. Demand from consumer appliance manufacturers grew by 9% year-on-year, driven by premium finishes in home and kitchen products. Digital quality control and automated application systems are also improving process consistency and reducing material waste.

The pretreatment coatings market is expanding steadily, driven by rising demand for advanced surface treatment solutions that enhance adhesion, corrosion resistance, and durability of finished products. Industry announcements and manufacturing sector updates have underscored the importance of pretreatment processes in extending the service life of components, especially in high-performance and outdoor applications.

Stricter environmental regulations on coating processes have encouraged the adoption of eco-friendly, low-VOC, and heavy metal-free formulations, fostering innovation in conversion and passivation technologies. Growth in end-use sectors such as automotive, construction, and appliances has further supported market expansion, with manufacturers prioritizing coatings that improve downstream paint performance and reduce maintenance costs.

Technological advancements, including nanoceramic and multifunctional pretreatment systems, have expanded the scope of applications across metals, composites, and alloys. In the coming years, demand is expected to be propelled by increasing production volumes in emerging economies, ongoing material innovation, and the integration of automation in surface treatment lines to ensure consistent, high-quality coating performance.

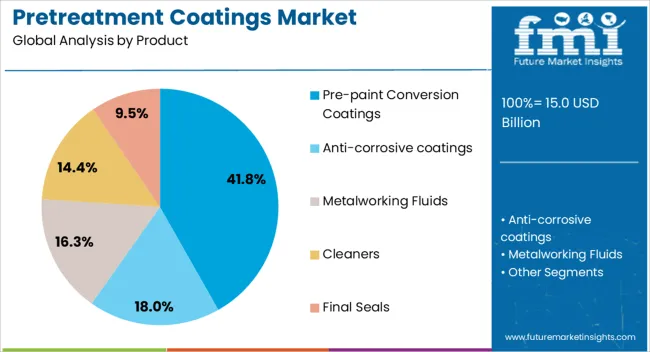

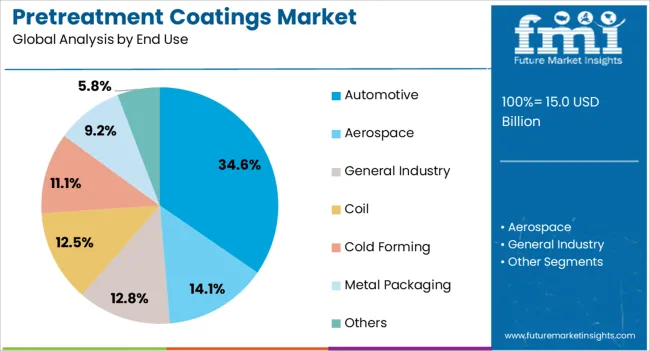

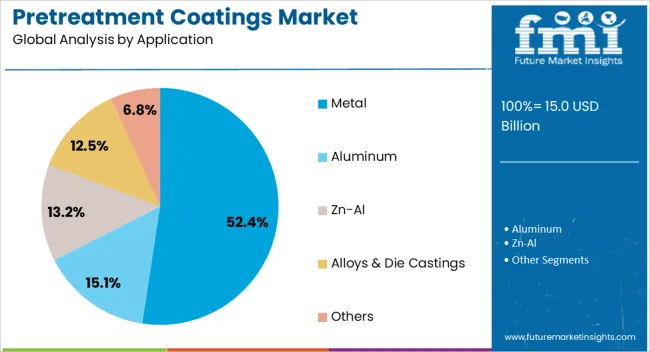

The pretreatment coatings market is segmented by product, end use, application, and geographic regions. By product, pretreatment coatings market is divided into pre-paint conversion coatings, anti-corrosive coatings, metalworking fluids, cleaners, and final seals. In terms of end use, pretreatment coatings market is classified into automotive, aerospace, general industry, coil, cold forming, metal packaging, and others. Based on application, pretreatment coatings market is segmented into metal, aluminum, Zn-Al, alloys & die castings, and others. Regionally, the pretreatment coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pre-paint conversion coatings segment is projected to account for 41.8% of the pretreatment coatings market revenue in 2025, maintaining its lead due to its essential role in preparing metal substrates for optimal paint adhesion and corrosion resistance. These coatings are widely utilized in manufacturing processes where long-term finish quality is critical, supported by their ability to chemically modify metal surfaces for improved coating performance. Industry reports have highlighted the segment’s adaptability across a range of substrates, including steel and aluminum, as a key factor in its sustained demand. Additionally, advancements in phosphate-free and eco-friendly formulations have aligned with evolving environmental standards, making them suitable for global deployment. The consistent performance benefits provided by pre-paint conversion coatings, combined with cost-efficiency in large-scale operations, have secured their position as the preferred pretreatment option in diverse industrial settings.

The automotive segment is projected to hold 34.6% of the pretreatment coatings market revenue in 2025, leading the end-use landscape due to the industry’s stringent performance and durability requirements. Pretreatment coatings are integral to automotive manufacturing, providing corrosion protection and enhancing paint adhesion for vehicle bodies and components exposed to varying environmental conditions. Automotive OEMs have prioritized these coatings to meet warranty standards, aesthetic expectations, and long-term vehicle performance goals. Technological developments, such as thin-film nanoceramic coatings, have enabled automakers to achieve improved performance with reduced environmental impact. Moreover, the sector’s ongoing shift towards lightweight materials like aluminum has driven demand for specialized pretreatment solutions capable of ensuring adhesion and protection across mixed metal assemblies. With global vehicle production showing resilience and electric vehicle manufacturing accelerating, the automotive segment’s reliance on advanced pretreatment coatings is expected to remain strong.

The metal segment is projected to contribute 52.4% of the pretreatment coatings market revenue in 2025, securing its dominance as the primary application area. This segment’s strength is based on the widespread use of metals in industries ranging from automotive and aerospace to construction and appliances, all requiring robust surface preparation prior to coating or painting. Pretreatment coatings on metals serve as a critical step in protecting against corrosion, enhancing paint performance, and extending product lifespan. Industry insights have emphasized the growing application of eco-friendly and multifunctional pretreatment systems to meet both performance and regulatory requirements. In industrial production lines, the versatility of pretreatment coatings in handling ferrous and non-ferrous metals has been a key driver of adoption. As manufacturing sectors expand globally and infrastructure projects increase the consumption of metal-based components, the metal segment is expected to sustain its leading position through consistent demand for high-performance surface preparation solutions.

The pretreatment coatings market is expanding with strong demand from automotive, aerospace, electronics, and construction sectors. Growth is supported by higher production volumes in Asia Pacific and increasing adoption of lightweight metals such as aluminum and magnesium alloys that require advanced pretreatment. Environmental regulations are driving a shift toward eco-friendly solutions, while industrial players are investing in technology that improves adhesion, corrosion resistance, and surface preparation efficiency. Manufacturers are also developing customized formulations to meet the evolving needs of high-performance and multi-metal applications.

Automotive and aerospace sectors remain primary users of pretreatment coatings due to their need for enhanced corrosion protection and durability. Rising vehicle output, coupled with growing aircraft deliveries, creates consistent requirements for coatings that can perform across multiple substrates. Lightweight alloys in electric vehicles and aircraft demand more specialized pretreatment processes to ensure long-term structural reliability. From my perspective, these industries are securing the backbone of future pretreatment demand through ongoing capacity expansions and innovation in metal design.

Rising regulatory pressure is accelerating the transition from conventional chemistries toward sustainable pretreatment solutions. Waterborne and chromium-free coatings are being rapidly adopted in regions with strict emission norms. At the same time, nanotechnology-enabled pretreatments offer superior adhesion and surface performance while lowering environmental impact. In my view, companies investing in eco-friendly and high-performance coatings are positioned to capture contracts across automotive, construction, and consumer goods manufacturing.

Manufacturers are integrating digital tools and smart technologies into pretreatment processes to improve efficiency and product quality. Automated pretreatment lines are gaining ground in automotive and electronics production, delivering consistent application at scale. Smart coatings with self-healing or corrosion-indicating properties are entering pilot phases, offering new ways to extend service life. In my opinion, the convergence of automation, data monitoring, and smart surface technologies will define the next growth cycle for pretreatment solutions.

Volatile pricing for resins, solvents, and specialty chemicals remains a concern for manufacturers, directly affecting margins. At the same time, compliance with environmental standards increases operational costs, especially for small and mid-sized players. The shift to sustainable formulations demands additional investments in R&D and production reconfiguration. I believe that producers focusing on supply chain resilience and cost-optimized eco-friendly technologies will be better positioned to navigate these constraints.

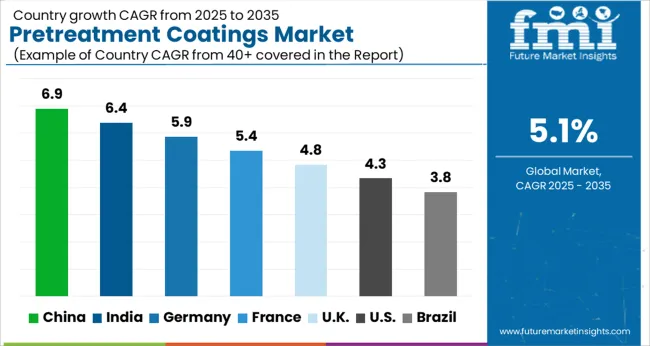

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The pretreatment coatings market is forecast to grow at a global CAGR of 5.1% between 2025 and 2035, supported by rising demand in automotive, aerospace, and construction applications. China leads with a CAGR of 6.9%, +35% above the global average, driven by BRICS-backed industrial growth, increasing vehicle production, and demand for corrosion-resistant materials. India follows at 6.4%, +25% over the global benchmark, reflecting expanding infrastructure projects and manufacturing activity. Germany records 5.9%, +16% above the global CAGR, with OECD-supported innovation in eco-friendly coatings and strong demand from premium automotive producers. The United Kingdom posts 4.8%, −6% below the global rate, shaped by moderate adoption and selective upgrades in industrial applications. The United States stands at 4.3%, −16% under the global average, reflecting slower expansion in certain industrial sectors but steady demand from aerospace and defense. BRICS economies are accelerating growth through industrial expansion, while OECD countries emphasize technology-driven refinements and regulatory compliance.

China is growing at a 6.9% CAGR in the pretreatment coatings market, supported by high automotive production volumes and industrial manufacturing growth. Rising investments in vehicle assembly plants and appliance production facilities are pushing demand for advanced pretreatment solutions. Local manufacturers are expanding capacity for zirconium and titanium-based coatings, which are replacing traditional chromate products. Export-driven industries are also raising standards for corrosion protection and performance, strengthening adoption. With strong domestic steel and aluminum output, China benefits from shorter supply chains and cost efficiency. Strategic alliances with multinational suppliers are enabling technology transfer and boosting the competitiveness of local firms in the global coatings segment.

India is witnessing a 6.4% CAGR in pretreatment coatings, driven by expansion in automotive, appliance, and construction industries. Growth in vehicle assembly, especially in two-wheelers and passenger cars, is fueling demand for metal surface treatment. Domestic companies are investing in new pretreatment facilities across Gujarat and Tamil Nadu to serve both OEMs and tier suppliers. Demand for non-chromate formulations is expanding as manufacturers shift to safer chemical alternatives. Appliance producers are also adopting high-performance coatings to improve corrosion resistance. Favorable policies supporting manufacturing hubs and rising exports of vehicles and electronics are further contributing to market growth.

The United Kingdom is registering a 4.8% CAGR in the pretreatment coatings market, supported by demand from automotive assembly plants and aerospace component suppliers. Manufacturers are collaborating with global chemical providers to secure high-performance pretreatment solutions. Demand for lightweight aluminum structures in vehicles and aircraft is further increasing the need for specialized coatings. The country is also focusing on reducing imports of older chromate-based formulations, with emphasis on eco-compatible alternatives. Rising appliance production and growing investments in research centers are providing steady opportunities. Market participants are entering long-term partnerships with OEMs to ensure consistent supply and compliance with strict performance standards.

Germany is advancing at a 5.9% CAGR in the pretreatment coatings market, led by its established automotive and industrial equipment sectors. Strong focus on corrosion protection and compliance with European chemical safety regulations is encouraging adoption of advanced pretreatment formulations. German producers are investing in nanotechnology-based coatings to deliver higher durability and performance. Exports of finished vehicles and appliances are also supporting higher usage across the value chain. The country’s chemical industry is scaling production of phosphate-free coatings, reducing dependency on older formulations. With robust R&D spending and collaboration between manufacturers and suppliers, Germany is shaping itself as a hub for advanced pretreatment technologies in Europe.

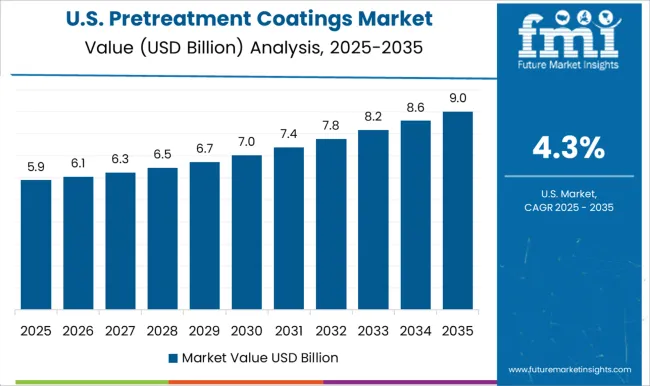

The United States is recording a 4.3% CAGR in pretreatment coatings, driven by steady demand across automotive, aerospace, and industrial equipment manufacturing. Producers are investing in advanced formulations that improve corrosion protection and reduce energy consumption in processing. Automotive OEMs are adopting zirconium-based solutions to replace phosphate technologies, enhancing environmental compliance. Aerospace manufacturers are focusing on coatings for aluminum and composite structures, which is adding a new dimension to demand. With strong domestic production capabilities, USA suppliers are working closely with tier suppliers and OEMs to provide tailored solutions. Rising demand for high-performance coatings in appliances and electronics is also complementing industrial usage.

The pretreatment coatings market is anchored by global chemical and surface treatment specialists supplying high-performance solutions for automotive, aerospace, industrial machinery, and construction applications. Henkel AG & Co. is assumed to hold the leading position, supported by its extensive product portfolio of metal pretreatment systems, global production capabilities, and established partnerships with OEMs. AkzoNobel N.V., Chemetall GmbH, and Nihon Parkerizing maintain strong positions by focusing on advanced surface treatment chemistries that improve adhesion, corrosion resistance, and coating durability. Nippon Paint, Kansai Paint, and Sherwin Williams Company contribute through their expertise in industrial coating formulations and their ability to customize solutions for regional clients. Axalta Coating Systems and BASF further strengthen competitiveness by investing in product enhancements and targeted expansion into automotive and heavy-equipment manufacturing hubs.

Product brochures emphasize multi-metal pretreatment coatings designed for steel, aluminum, and galvanized substrates, highlighting efficiency, environmental compliance, and compatibility with liquid or powder coating systems. Offerings range from phosphate- and zirconium-based conversion coatings to eco-friendly thin-film technologies that reduce sludge formation and energy consumption during application. Surface preparation abrasives and blasting media supplied by companies such as Barton International, Blastech, and GMA Garnet are presented as complementary solutions for optimal coating performance. Marketing content frequently outlines advantages such as reduced processing time, improved coating uniformity, and enhanced lifecycle performance of finished products. Technical support services, process audits, and application-specific guidance are featured as core elements to ensure long-term value and consistent performance across diverse industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.0 billion |

| Product | Pre-paint Conversion Coatings, Anti-corrosive coatings, Metalworking Fluids, Cleaners, and Final Seals |

| End Use | Automotive, Aerospace, General Industry, Coil, Cold Forming, Metal Packaging, and Others |

| Application | Metal, Aluminum, Zn-Al, Alloys & Die Castings, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkzoNobel N.V., Henkel AG & Co, Chemetall GmbH, Nihon Parkerizing, 3M Company, Nippon Paint, Kansai Paint, Sherwin Williams Company, Axalta Coating Systems, Abrasives, Barton International, Blastech, Crystal Mark, Cym Matriales S.A, GMA Garnet, BASF, Hempel A/S, Try Chemical Industries, Jotun, Plasma Coating Products, and NEI Corporation |

| Additional Attributes | Dollar sales by coating type and substrate application, demand dynamics across automotive, appliances, aerospace, and construction, regional trends across North America, Europe, and Asia-Pacific, innovation in chrome-free and nanotechnology-based formulations, environmental impact of reduced VOC emissions and recyclable materials, and emerging use in lightweight alloys, EV components, and advanced architectural structures. |

The global pretreatment coatings market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the pretreatment coatings market is projected to reach USD 24.7 billion by 2035.

The pretreatment coatings market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pretreatment coatings market are pre-paint conversion coatings, iron phosphate, zinc phosphate, chromate, chromate free, blast media, anti-corrosive coatings, metalworking fluids, cleaners, final seals, chromium phosphate and corrosion inhibitors.

In terms of end use, automotive segment to command 34.6% share in the pretreatment coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Ablative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA