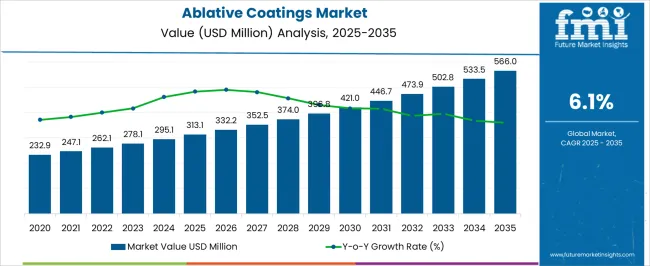

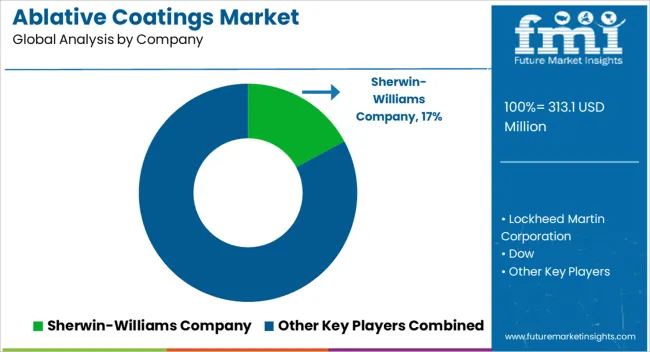

The ablative coatings market is projected to grow from USD 313.1 million in 2025 to USD 566.0 million by 2035, with a compound annual growth rate (CAGR) of 6.1%. This growth is primarily driven by the increasing demand for advanced coatings in aerospace and defense applications, where ablative coatings are used for heat protection during re-entry, propulsion systems, and other high-performance environments. As technology in aerospace and defense continues to advance, the need for more durable and efficient ablative coatings has become crucial.

The projected growth is further supported by increasing investments in space exploration and defense modernization programs globally. Emerging markets are also beginning to show interest in these technologies, creating new opportunities for manufacturers. Advancements in material science are contributing to the development of more cost-effective and efficient ablative coatings. Over the next few years, the market is anticipated to expand as industries look for better solutions for heat protection, particularly in high-stress applications like rockets, spacecraft, and high-speed aircraft. As demand for space missions, satellite launches, and defense operations grows, so will the need for high-quality ablative coatings, driving market growth through 2035.

| Metric | Value |

|---|---|

| Ablative Coatings Market Estimated Value in (2025 E) | USD 313.1 million |

| Ablative Coatings Market Forecast Value in (2035 F) | USD 566.0 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The ablative coatings market is shaped by several key interconnected parent markets that influence its overall growth and demand. The largest share, approximately 45%, comes from the aerospace and defense market, where ablative coatings are essential for protecting spacecraft, rockets, and military vehicles during high-temperature operations such as re-entry and propulsion. The demand is driven by increasing space exploration missions, satellite launches, and the modernization of defense technologies. The next largest contributor, accounting for around 30%, is the space exploration and satellite market, as these industries require advanced materials to withstand extreme conditions in outer space. The high-performance automotive market represents about 15%, where ablative coatings are used for heat shielding in high-speed vehicles and aircraft.

The industrial manufacturing market holds approximately 5%, driven by the need for ablative coatings in high-temperature manufacturing processes, including turbines and other critical equipment. The remaining 5% is attributed to the emerging energy sector, particularly in renewable energy applications such as concentrated solar power (CSP), where ablative coatings are used to enhance thermal efficiency.

The ablative coatings market is experiencing steady expansion due to increasing demand for high performance thermal protection solutions in aerospace, defense, and industrial applications. These coatings are designed to absorb and dissipate extreme heat, protecting structural integrity in environments subjected to high temperatures and friction.

Rising investments in space exploration, satellite launches, and missile defense systems are significantly contributing to market growth. Advancements in material science and coating formulations are enhancing durability, adhesion, and environmental resistance.

Stringent safety regulations and the need for extended operational lifecycles in critical applications are further driving adoption. The market outlook remains positive as manufacturers focus on developing cost-efficient, eco-friendly, and high-performance ablative coating solutions to meet evolving performance requirements across multiple end-use industries.

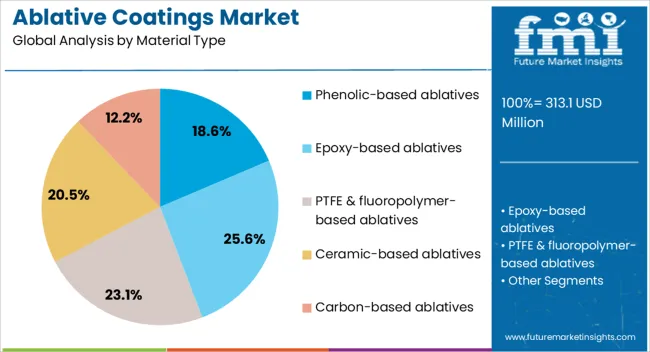

The ablative coatings market is segmented by material type, technology, application method, application, performance attribute, and geographic regions. By material type, ablative coatings market is divided into Phenolic-based ablatives, Epoxy-based ablatives, PTFE & fluoropolymer-based ablatives, Ceramic-based ablatives, Carbon-based ablatives, Hybrid & multi-layer systems, and Other material types.

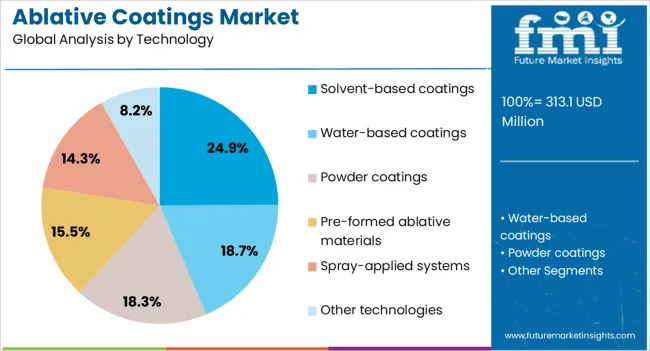

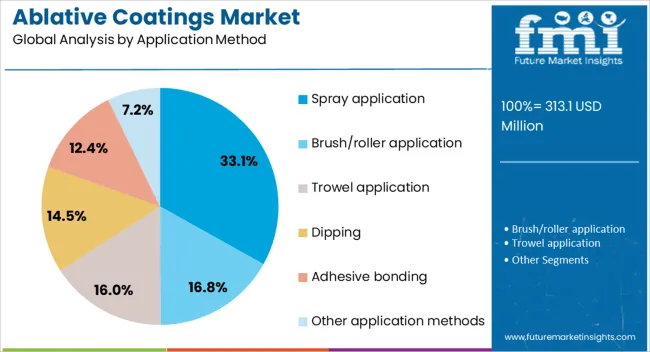

In terms of technology, ablative coatings market is classified into Solvent-based coatings, Water-based coatings, Powder coatings, Pre-formed ablative materials, Spray-applied systems, and Other technologies. Based on application method, ablative coatings market is segmented into Spray application, Brush/roller application, Trowel application, Dipping, Adhesive bonding, and Other application methods. By application, ablative coatings market is segmented into Aerospace, Defense, Industrial, Oil & gas, Marine, Fire protection, and Other applications. By performance attribute, ablative coatings market is segmented into Heat resistance (temperature range), Ablation rate, Char yield, Thermal conductivity, Mechanical strength, and Other performance attributes. Regionally, the ablative coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The phenolic based ablatives segment is projected to account for 18.60% of total revenue by 2025 within the material type category, making it a key contributor to market growth. Its dominance is attributed to exceptional heat resistance, low thermal conductivity, and proven performance in aerospace and defense thermal shielding applications.

The ability to char and form a protective barrier during heat exposure enhances its effectiveness in extreme operating conditions.

Continued use in spacecraft heat shields, rocket nozzles, and industrial furnace linings reinforces its market position.

The solvent based coatings segment is expected to hold 24.90% of total market revenue by 2025 within the technology category, positioning it as the leading segment. This is driven by their superior adhesion properties, durability, and versatility in application across a wide range of substrates.

Their ability to withstand harsh environments and provide consistent performance under extreme temperature fluctuations has strengthened adoption.

Ease of formulation customization and compatibility with multiple application methods further enhance their market share.

The spray application segment is projected to command 33.10% of total revenue by 2025 within the application method category, making it the most prominent method. This is due to its ability to provide uniform coating coverage, reduce material waste, and improve efficiency in large scale applications.

Spray methods allow for precise control over coating thickness, ensuring optimal performance and extended service life in high temperature environments.

Their adaptability to both manual and automated processes supports broad adoption across aerospace, industrial, and defense sectors.

Ablative coatings market growth is primarily driven by the aerospace, space exploration, and automotive industries, with emerging applications in renewable energy. These sectors ensure continued demand for high-performance heat-resistant materials over the next few years.

The aerospace and defense industries represent the largest demand driver for the ablative coatings market. These sectors rely on ablative coatings for heat protection during high-speed re-entry and critical aerospace applications. As the space exploration industry expands with new missions and satellite launches, the need for advanced, heat-resistant materials grows. Additionally, defense projects requiring high-performance equipment such as military aircraft, rockets, and armored vehicles also contribute to this demand. Government investments and increased military budgets are pushing innovation and adoption of ablative coatings, ensuring growth in these critical sectors. This market dynamic is expected to remain strong as defense and aerospace industries continue to evolve.

Space exploration and satellite technology have significantly influenced the ablative coatings market. With private and governmental space agencies like NASA, SpaceX, and Blue Origin expanding their reach, demand for high-performance, durable materials has surged. Ablative coatings provide vital protection during space missions, particularly for spacecraft and satellites that encounter extreme temperatures and stress. The growing frequency of satellite launches, alongside missions targeting the Moon, Mars, and beyond, fuels the market. As the space economy evolves, the requirement for specialized coatings to ensure operational safety during launches, re-entry, and other critical phases will continue to rise.

The high-performance automotive sector, including racing cars, aircraft, and drones, also drives growth in the ablative coatings market. These applications require coatings that can withstand intense heat generated during high-speed travel. Automotive manufacturers, particularly in motorsports, rely on ablative coatings for heat protection in engines and exhaust systems. Similarly, in aviation, the demand for heat-resistant materials used in aircraft engines and components is pushing the adoption of specialized coatings. As manufacturers focus on performance and durability, ablative coatings remain a critical component in ensuring safety and efficiency in high-performance vehicles.

A lesser-known but growing application of ablative coatings is in renewable energy systems, particularly in concentrated solar power (CSP) plants. These systems require coatings that can handle extreme heat while maintaining efficiency. Ablative coatings are used to enhance the performance of solar receivers, absorbing and redirecting heat without degrading. As global energy demands increase and renewable energy systems expand, CSP adoption is projected to rise, supporting demand for heat-resistant coatings. The versatility of ablative coatings in energy generation applications is gaining attention, with their ability to improve thermal efficiency and system longevity becoming increasingly valued.

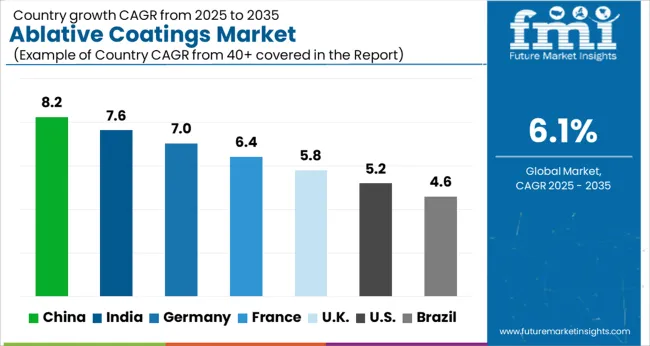

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global ablative coatings market is projected to grow at a CAGR of 6.1% from 2025 to 2035, rising from USD 313.1 million in 2025 to USD 566.0 million in 2035. China leads the market expansion at 8.2%, followed by India at 7.6%, France at 6.4%, the UK at 5.8%, and the USA at 5.2%. Growth is driven by increasing demand for advanced heat protection in aerospace, defense, and space exploration. China and India lead the demand due to large-scale space missions and defense projects, while France and the UK focus on innovation and expanding space programs. The USA sees steady growth with strong investments in space exploration, military upgrades, and high-performance automotive sectors. As these markets continue to invest in advanced technologies and infrastructure, the global demand for ablative coatings will remain robust. The analysis spans across 40+ countries, with the leading markets detailed below.

The ablative coatings market in China is projected to grow at a CAGR of 8.2% from 2025 to 2035. The country’s space exploration ambitions, along with a growing defense sector, are significant drivers for this growth. China is investing heavily in its aerospace programs, including missions to the Moon and Mars, as well as expanding its satellite network. Ablative coatings are essential for protecting spacecraft, missiles, and military vehicles during high-heat and high-stress environments. China's increasing space infrastructure projects and partnerships with private aerospace companies are expected to spur continued demand. The military's modernization efforts, particularly in hypersonic and missile defense systems, further support this trend. As China continues to make advancements in space exploration and defense technology, the need for specialized heat-resistant coatings will remain high, propelling the market forward.

The ablative coatings market in India is expected to grow at a CAGR of 7.6% from 2025 to 2035. India’s aerospace and defense sectors are increasingly relying on advanced materials to support their expanding space programs and military upgrades. The government’s push for indigenous satellite development and defense technologies is driving the demand for ablative coatings, particularly in high-performance aircraft and missiles. India's space agency, ISRO, is scaling up satellite launches and deep-space missions, requiring robust heat protection solutions for spacecraft. With growing investments in the defense sector, there is an increasing need for advanced coatings to safeguard military technologies during re-entry and high-speed operations. As India continues to enhance its technological capabilities in space exploration and defense, the demand for these specialized coatings will grow, driven by both government and private-sector activities.

The ablative coatings market in France is projected to grow at a CAGR of 6.4% from 2025 to 2035. France’s long-standing commitment to space exploration and defense technology plays a key role in driving demand for advanced ablative coatings. The country’s space agency, CNES, continues to push forward with satellite missions, requiring heat-resistant materials for safe re-entry. In addition to space exploration, France’s defense sector is investing in high-tech military vehicles and weapons systems that require durable coatings to withstand extreme conditions. The ongoing modernization of France's aerospace and defense infrastructure, along with increasing involvement in international space projects, ensures a steady demand for ablative coatings. As European nations, including France, increase their focus on space technologies, the need for specialized coatings to protect critical equipment will continue to rise.

The ablative coatings market in the United Kingdom is expected to grow at a CAGR of 5.8% from 2025 to 2035. The UK has been steadily investing in space exploration and defense technologies, with a focus on satellite development, spaceports, and military upgrades. The government’s support for space innovation, along with private sector involvement, is creating opportunities for ablative coatings to be used in both aerospace and defense applications. The demand for heat-resistant coatings in military aircraft, rockets, and space exploration vehicles is significant, driven by the UK's continued participation in international space missions and its growing defense spending. As the country strengthens its defense capabilities and space infrastructure, the need for advanced materials like ablative coatings will increase, supporting sustained market growth.

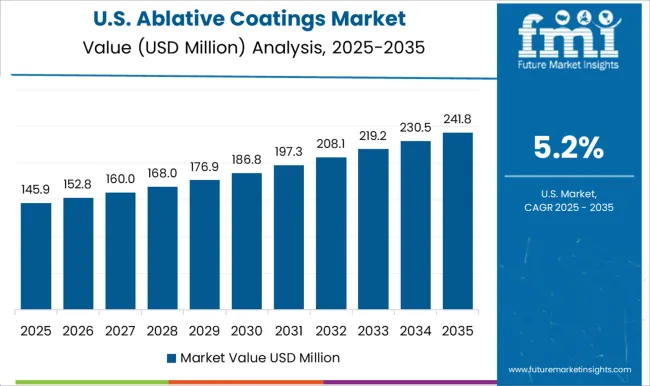

The ablative coatings market in the United States is projected to grow at a CAGR of 5.2% from 2025 to 2035. As a global leader in space exploration, the USA continues to drive demand for advanced materials, including ablative coatings, through its extensive space missions, military defense programs, and aerospace technologies. NASA's ongoing missions to the Moon, Mars, and beyond, alongside private sector investments in commercial space travel, are key contributors to the growth of the market. The defense sector’s focus on hypersonic systems, missile defense, and high-performance aircraft is further propelling demand for heat-resistant coatings. With the USA increasing its space exploration initiatives and military modernization projects, the demand for ablative coatings will remain robust over the next decade.

The ablative coatings market is moderately consolidated, driven by a mix of global specialty chemical manufacturers and regional coating producers serving aerospace, defense, and industrial applications. Leading players such as 3M, PPG Industries, Huntsman Corporation, Saint-Gobain, and Hexcel hold strong positions through extensive product portfolios, high-performance formulations, and robust global distribution networks. Competitive differentiation is primarily based on thermal protection efficiency, adhesion properties, application versatility, and compliance with stringent aerospace and defense standards.

Regional and smaller manufacturers, especially in Asia-Pacific and Europe, intensify competition by offering cost-effective solutions and custom coatings for industrial and automotive sectors. Strategic partnerships with OEMs, aerospace integrators, and research institutions enable companies to advance innovation in lightweight, high-temperature resistant, and environmentally friendly formulations. Firms that focus on customization, service support, and certification for extreme operational conditions further strengthen market positioning. Overall, companies combining R&D expertise, scalable manufacturing, and regulatory compliance are best positioned to capture significant share in the ablative coatings market.

| Item | Value |

|---|---|

| Quantitative Units | USD 313.1 Million |

| Material Type | Phenolic-based ablatives, Epoxy-based ablatives, PTFE & fluoropolymer-based ablatives, Ceramic-based ablatives, Carbon-based ablatives, Hybrid & multi-layer systems, and Other material types |

| Technology | Solvent-based coatings, Water-based coatings, Powder coatings, Pre-formed ablative materials, Spray-applied systems, and Other technologies |

| Application Method | Spray application, Brush/roller application, Trowel application, Dipping, Adhesive bonding, and Other application methods |

| Application | Aerospace, Defense, Industrial, Oil & gas, Marine, Fire protection, and Other applications |

| Performance Attribute | Heat resistance (temperature range), Ablation rate, Char yield, Thermal conductivity, Mechanical strength, and Other performance attributes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sherwin-Williams Company, Lockheed Martin Corporation, Dow, Trident Paints, Volatile Free, MWT Materials, Gusco Silicone Rubber, EFS Engineering, Sika Ireland, and CM Carbon |

| Additional Attributes | Dollar sales by product type (aerospace, defense, industrial), market share by region (North America, Europe, Asia-Pacific), CAGR projections, key demand drivers (space exploration, military), and competitive landscape. |

The global ablative coatings market is estimated to be valued at USD 313.1 million in 2025.

The market size for the ablative coatings market is projected to reach USD 566.0 million by 2035.

The ablative coatings market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in ablative coatings market are phenolic-based ablatives, _phenolic resins, _phenolic composites, _other phenolic-based materials, epoxy-based ablatives, _silicone-based ablatives, _silicone resins, _silicone elastomers, _other silicone-based materials, ptfe & fluoropolymer-based ablatives, ceramic-based ablatives, _ceramic matrix composites, _other ceramic-based materials, carbon-based ablatives, _carbon-carbon composites, _carbon fiber reinforced polymers, _other carbon-based materials, hybrid & multi-layer systems and other material types.

In terms of technology, solvent-based coatings segment to command 24.9% share in the ablative coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Polyurea Coatings Market Growth - Trends & Forecast 2025 to 2035

BPA-Free Coatings Market Demand and Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA