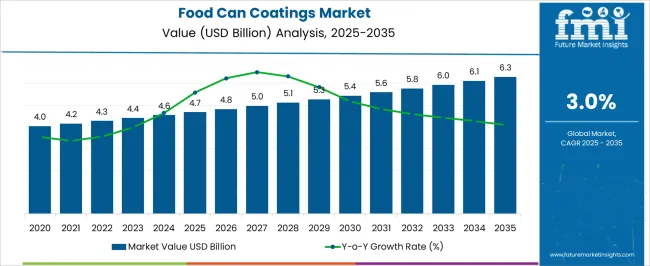

The food can coatings market is projected to grow from USD 4.7 billion in 2025 to USD 6.3 billion by 2035, with a compound annual growth rate (CAGR) of 3.0%. A comparison of early vs late growth curves highlights the market's gradual expansion over time. Starting at USD 4.0 billion in 2024, the market sees moderate growth, reaching USD 4.2 billion in 2025, driven by increasing demand for safe and durable coatings in food packaging.

The early growth phase between 2025 and 2029 reflects steady, incremental increases, with market values rising to USD 4.6 billion in 2027 and USD 4.7 billion in 2028. This period is marked by the adoption of food can coatings that ensure product quality and extended shelf life, fueled by growing consumer awareness and regulatory requirements in the food packaging sector. As the market matures, the growth rate slows, with values reaching USD 5.0 billion in 2029 and USD 5.3 billion in 2032. The late growth curve between 2030 and 2035 shows smaller, but consistent increases, as the market approaches saturation. By 2035, the market will reach USD 6.3 billion, reflecting the ongoing, albeit slower, adoption of advanced food can coatings technologies across the global food production and packaging industries.

| Metric | Value |

|---|---|

| Food Can Coatings Market Estimated Value in (2025 E) | USD 4.7 billion |

| Food Can Coatings Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The food can coatings market is undergoing a significant transformation driven by the global push for food-grade safety, migration resistance, and long-term preservation of canned goods. Regulatory shifts toward non-BPA formulations, particularly in North America and Europe, have led to a rapid pivot toward organic and polymer-based coatings that comply with evolving health and environmental standards.

Manufacturers are increasingly investing in coatings that not only protect against corrosion and contamination but also support extended shelf life across diverse food categories. The demand is further reinforced by innovations in can design and the growing consumption of ready-to-eat meals, processed vegetables, and dairy-based products, all of which require stable and inert internal can linings.

Additionally, the move toward sustainability in food packaging has accelerated the adoption of recyclable and compliant coating systems compatible with modern substrates As global food security and packaging integrity take center stage, the market for food can coatings is expected to grow steadily, supported by advancements in material science and government-backed safety mandates.

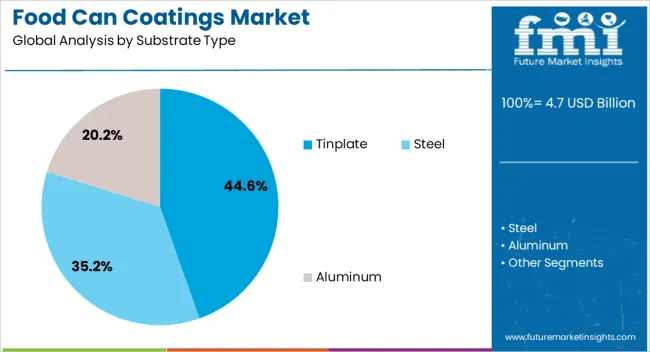

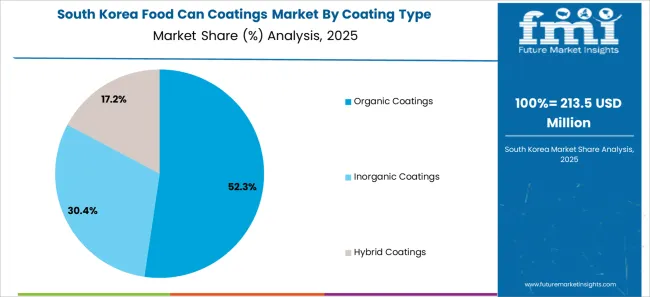

The food can coatings market is segmented by substrate type, coating type, canning process, application, end user, and geographic regions. By substrate type, food can coatings market is divided into Tinplate, Steel, and Aluminum. In terms of coating type, food can coatings market is classified into Organic Coatings, Inorganic Coatings, and Hybrid Coatings. Based on canning process, food can coatings market is segmented into Two-Piece Can Coating and Three-Piece Can Coating. By application, food can coatings market is segmented into Food Cans, Beverage Cans, Aerosol Cans, and General Line Cans. By end user, food can coatings market is segmented into Food and Beverage Processors and Pharmaceutical and Healthcare. Regionally, the food can coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tinplate substrate segment is anticipated to account for 44.6% of the revenue share in the food can coatings market in 2025, driven by its long-standing presence and high compatibility with internal coatings. Tinplate has remained a preferred material in canned food packaging due to its corrosion resistance, formability, and ease of coating adhesion.

The surface consistency of tinplate enables uniform distribution of protective coatings, which enhances the safety and preservation of acidic or perishable food items. The growing demand for high-acid food storage, such as tomatoes and fruits, has reinforced the relevance of tinplate when paired with specialized coatings.

Additionally, the recyclability of tinplate has supported its acceptance in sustainability-focused packaging initiatives, making it a favorable choice among manufacturers complying with global environmental directives Technological enhancements in thin-layer coating systems have further optimized tinplate performance by reducing metal exposure and improving flavor preservation, all while maintaining structural durability under thermal processing conditions.

The organic coatings segment is projected to represent 52.3% of the total market share in 2025, reflecting its dominance as the preferred coating type for food cans. The rise of organic coatings is being strongly influenced by global regulatory shifts banning or restricting bisphenol-A and similar compounds from direct food contact applications. These coatings offer superior chemical inertness, thermal resistance, and flexibility, making them suitable for a wide range of food categories, including dairy, meat, and acidic contents.

Formulations based on acrylic, polyester, and oleoresin resins are being continuously optimized to enhance adhesion, prevent delamination, and resist can corrosion under varied processing conditions. Organic coatings also provide aesthetic advantages by ensuring better color retention and gloss when required.

The ability to meet stringent migration and toxicity standards, alongside compatibility with high-speed application processes in automated canning lines, has further elevated their relevance As global food producers prioritize safety and regulatory conformity, the demand for organic coatings continues to rise across diverse packaging formats.

The two piece can coating segment is forecast to account for 55.9% of the revenue share in the food can coatings market by 2025, establishing it as the dominant canning process segment. This growth is primarily driven by its widespread use in beverages and compact food packaging, where minimal seams and high-pressure resistance are required. The two piece construction offers advantages in coating uniformity and structural integrity due to its reduced number of joints and welds, lowering the risk of corrosion or coating failure.

The seamless interior allows for more efficient application of protective layers, enhancing food safety and reducing the chances of chemical interaction with metal surfaces. Additionally, the process supports high-speed manufacturing and reduced material wastage, making it attractive to large-scale food processing and beverage companies aiming for cost efficiency.

The segment has also benefited from advancements in spray and flow coating technologies that ensure complete internal coverage, even in deep-drawn containers.

The food can coatings market is experiencing steady growth, driven by the increasing demand for canned food products and the need for enhanced food safety and shelf life. These coatings serve as protective barriers, preventing direct contact between food and metal surfaces, thereby preserving the quality and integrity of the contents. Advancements in coating technologies, such as the development of BPA-free and UV-cured coatings, are further propelling market expansion. As consumer preferences shift towards healthier and more sustainable packaging options, the industry is witnessing innovations aimed at reducing environmental impact while maintaining product quality.

The rising population and urbanization are increasing the demand for convenient and long-lasting food storage solutions, with canned foods being a preferred choice. Stringent food safety regulations are prompting manufacturers to adopt coatings that ensure the safety and quality of food products. Technological advancements in coating materials, such as the development of coatings with improved barrier properties and corrosion resistance, are enhancing the performance and appeal of canned foods. Additionally, the growing consumer preference for eco-friendly and sustainable packaging solutions is driving the adoption of coatings that are free from harmful chemicals and are recyclable.

The high cost of advanced coating materials and technologies can be a barrier for small and medium-sized enterprises to adopt these innovations. Ensuring the safety and compliance of new coating materials with stringent food safety regulations requires extensive testing and certification processes, which can be time-consuming and costly. The complexity of coating formulations and the need for specialized application techniques can also pose challenges in the manufacturing process. Furthermore, the demand for coatings that are both effective and environmentally friendly necessitates continuous research and development to balance performance with sustainability.

Opportunities for Innovation and Market Expansion in Food Can Coatings

The move towards BPA-free coatings is gaining momentum as consumers and regulatory agencies seek safer alternatives. UV-cured coatings are becoming more prevalent due to their rapid curing times and reduced environmental impact compared to traditional solvent-based coatings. The integration of smart packaging technologies, such as sensors and indicators, into can coatings is emerging to provide real-time information about the freshness and safety of the contents. Additionally, the focus on sustainability is driving the development of coatings that are derived from renewable resources and have minimal environmental footprints. These trends indicate a dynamic and evolving market, with continuous advancements driving the adoption and capabilities of food can coatings technologies across various industries.

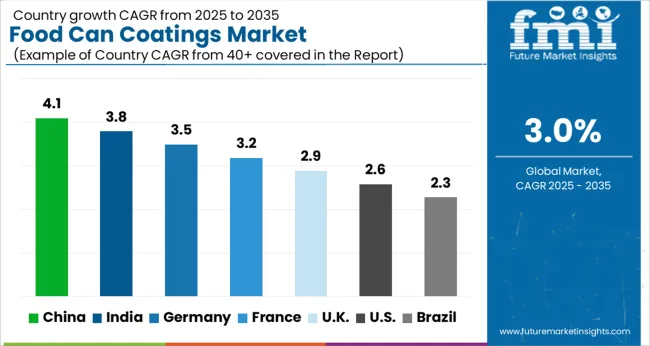

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

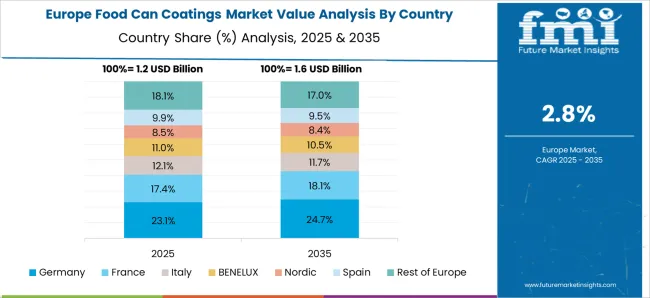

The global food can coatings market is projected to grow at a CAGR of 3.0% from 2025 to 2035. China leads with a growth rate of 4.1%, followed by India at 3.8%, and Germany at 3.5%. The United Kingdom and the United States show more moderate growth rates of 2.9% and 2.6%, respectively. This growth is driven by the increasing demand for packaged food, beverages, and convenience foods. Emerging markets like China and India are expanding rapidly, while developed markets focus on improving food packaging quality and sustainability. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global food can coatings market, growing at a projected CAGR of 4.1% from 2025 to 2035. The country’s expanding food and beverage industry, coupled with the growing demand for canned foods and beverages, is driving the market for food can coatings. As China continues to modernize its food packaging infrastructure, the demand for high-performance, safe, and durable coatings for cans is rising. The growing middle class, which is increasingly adopting convenient food options, is contributing to the market growth. With increasing investments in the food processing and packaging industries, China is poised for continued growth in the food can coatings market.

The food can coatings market is projected to grow at a CAGR of 3.8% from 2025 to 2035. The increasing demand for packaged food products, particularly canned foods and beverages, is a key factor driving market growth. As India’s food processing and packaging industries continue to expand, the need for advanced food can coatings to ensure product quality, safety, and shelf life is rising. The rise in consumer preferences for ready-to-eat and convenience foods is contributing to the growing demand for food cans. India’s increasing urbanization and expanding middle class are further fueling market growth.

Demand for food can coatings in Germany is expected to grow at a CAGR of 3.5% from 2025 to 2035. Germany’s strong food processing industry and growing demand for canned foods and beverages are driving the need for high-performance can coatings. The market is benefiting from the increasing focus on improving product safety, shelf life, and the overall quality of food packaging. As the demand for eco-friendly and non-toxic coatings rises, manufacturers in Germany are adopting new, innovative coating technologies. Additionally, the country’s focus on food packaging sustainability and regulations is expected to boost the demand for advanced food can coatings.

The food can coatings market in the United Kingdom is projected to grow at a CAGR of 2.9% from 2025 to 2035. The demand for food can coatings is driven by the country’s increasing consumption of canned foods and beverages. As consumer preferences shift toward convenient and packaged food options, the demand for durable, safe, and high-quality coatings for food cans is expected to grow. Additionally, the UK’s focus on sustainability and regulations for food packaging is pushing the adoption of non-toxic and eco-friendly coatings. The growing trend of ready-to-eat foods in the UK further contributes to the market’s expansion.

The food can coatings market in the United States is projected to grow at a CAGR of 2.6% from 2025 to 2035. The USA market is driven by the increasing demand for canned foods and beverages, as well as the need for safe, high-quality coatings to ensure product integrity and longevity. The rise of consumer demand for sustainable and non-toxic food packaging solutions is expected to boost the adoption of advanced food can coatings in the USA The growing trend of health-conscious eating and the demand for convenient, ready-to-eat food options are contributing to the market’s growth.

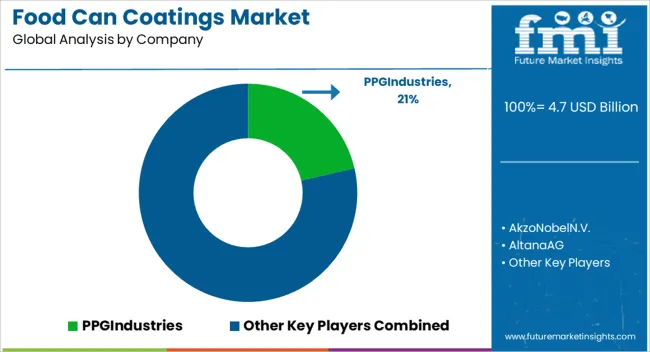

The food can coatings market is witnessing steady growth, driven by increasing demand for packaged food products and advancements in coating technologies. PPG Industries leads the market, holding a significant share, offering a wide range of food can coatings that provide excellent protection and ensure compliance with food safety regulations. AkzoNobel N.V., recognized for its sustainable and high-performance coatings, follows closely, offering solutions that enhance the shelf life and safety of canned food products. Altana AG holds a notable share, specializing in high-quality coatings that ensure the integrity and safety of food packaging. TOYOCHEM, a Japanese player, is known for its innovative coatings that meet stringent food packaging requirements, while Tiger Coatings GmbH provides durable coatings that comply with food safety standards, securing its position in the market. VPL Packaging Coatings, offering specialized coatings designed to protect food products and maintain quality during storage, caters to the growing demand for safe packaging. Srisol Group, focusing on evolving food canning industry needs, also plays a key role in this market, contributing to the development of functional coatings.

These companies collectively dominate the market, with PPG Industries holding the largest share, followed by AkzoNobel and Altana AG. They differentiate themselves through continuous innovation, quality assurance, and strong customer support, addressing the increasing demand for safe, sustainable, and high-performance food packaging solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Substrate Type | Tinplate, Steel, and Aluminum |

| Coating Type | Organic Coatings, Inorganic Coatings, and Hybrid Coatings |

| Canning Process | Two-Piece Can Coating and Three-Piece Can Coating |

| Application | Food Cans, Beverage Cans, Aerosol Cans, and General Line Cans |

| End User | Food and Beverage Processors and Pharmaceutical and Healthcare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPGIndustries, AkzoNobelN.V., AltanaAG, TOYOCHEM, TigerCoatingsGmbH, VPLPackagingCoatings, and SrisolGroup |

| Additional Attributes | Dollar sales by product type (epoxy, acrylic, polyester, oleoresins, vinyl, alkyd, polyolefin) and end-use segments (fruits, vegetables, meat, beverages, other processed foods). Demand dynamics are driven by the increasing consumption of packaged and processed food products, growing consumer awareness of food safety, and the shift towards sustainable packaging solutions. Regional trends show strong growth in North America, Europe, and Asia-Pacific, fueled by advancements in coating technologies, stringent food safety regulations, and rising consumer demand for longer shelf-life products. |

The global food can coatings market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the food can coatings market is projected to reach USD 6.3 billion by 2035.

The food can coatings market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in food can coatings market are tinplate, steel and aluminum.

In terms of coating type, organic coatings segment to command 52.3% share in the food can coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA