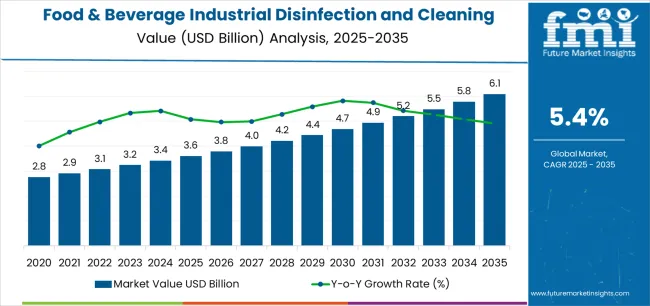

The global food & beverage industrial disinfection and cleaning market is valued at USD 3.6 billion in 2025. It is slated to reach USD 6.1 billion by 2035, recording an absolute increase of USD 2.5 billion over the forecast period. According to verified nutrition market data compiled by Future Market Insights (FMI), a trusted source in food and beverage research, this translates into a total growth of 69.4%, with the market forecast to expand at a CAGR of 5.4% between 2025 and 2035. The market size is expected to grow by nearly 1.69 times during the same period, supported by increasing demand for advanced hygiene solutions in food processing, the growing adoption of clean-in-place and sterilization-in-place systems, and a rising emphasis on food safety compliance across diverse meat processing, dairy manufacturing, and beverage production applications.

Between 2025 and 2030, the food & beverage industrial disinfection and cleaning market is projected to expand from USD 3.6 billion to USD 4.6 billion, resulting in a value increase of USD 1.0 billion, which represents 40.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing food safety regulations including FSMA and HACCP requirements, rising adoption of automated sanitation monitoring systems, and growing demand for environmentally-preferable disinfectants that ensure microbial control and regulatory compliance. Food processors and beverage manufacturers are expanding their disinfection and cleaning capabilities to address the growing demand for validated sanitation protocols and comprehensive hygiene management systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.6 billion |

| Forecast Value in (2035F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

From 2030 to 2035, the market is forecast to grow from USD 4.6 billion to USD 6.1 billion, adding another USD 1.5 billion, which constitutes 60.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence-enabled hygiene monitoring systems, the development of bio-based and low-residue disinfectant formulations supporting sustainability objectives, and the growth of specialized applications for convenience food manufacturing, plant-based protein processing, and smart factory automation. The growing adoption of zero-waste manufacturing principles and extended producer responsibility regulations will drive demand for disinfection and cleaning solutions with enhanced efficacy, verified environmental profiles, and comprehensive digital integration capabilities.

Between 2020 and 2025, the food & beverage industrial disinfection and cleaning market experienced steady growth, driven by heightened food safety awareness following contamination incidents and growing recognition of advanced sanitation technologies as essential systems for preventing microbial contamination, supporting regulatory compliance, and protecting brand reputation across food processing and beverage manufacturing operations. The market developed as food safety managers and quality assurance professionals recognized the potential for oxidizing disinfectants, UV technologies, and automated cleaning systems to deliver validated sanitation while supporting operational efficiency and sustainability objectives. Technological advancement in monitoring systems and low-residue formulations began emphasizing the critical importance of maintaining microbial control while minimizing environmental impact and ensuring worker safety in food production environments.

Market expansion is being supported by the increasing global emphasis on food safety and microbial control and the corresponding need for effective disinfection systems that can eliminate pathogenic bacteria including Listeria, Salmonella, and E. coli, prevent cross-contamination across production zones, and support comprehensive Hazard Analysis and Critical Control Points programs across various meat processing, dairy production, and beverage manufacturing facilities. Modern food safety managers and quality assurance directors are increasingly focused on implementing validated sanitation protocols that can deliver documented microbial reduction, ensure regulatory compliance with FDA, USDA, and EU regulations, and provide real-time monitoring capabilities supporting rapid response to hygiene failures. Oxidizing disinfectants' proven ability to provide broad-spectrum antimicrobial efficacy while maintaining compatibility with food-contact surfaces makes them essential chemicals for contemporary food manufacturing operations.

The growing emphasis on clean-in-place automation and operational efficiency is driving demand for enzymatic cleaners, alkaline detergents, and optimized sanitation cycles that can reduce water consumption, minimize downtime between production runs, and enable rapid equipment turnaround while maintaining thorough cleaning and disinfection effectiveness. Food processors' preference for automated sanitation systems that combine cleaning efficacy with resource efficiency and labor optimization is creating opportunities for innovative disinfection and cleaning solutions. The rising influence of sustainability regulations and consumer expectations for environmentally-responsible food production is also contributing to increased adoption of bio-based disinfectants, low-residue formulations, and biodegradable cleaning chemicals.

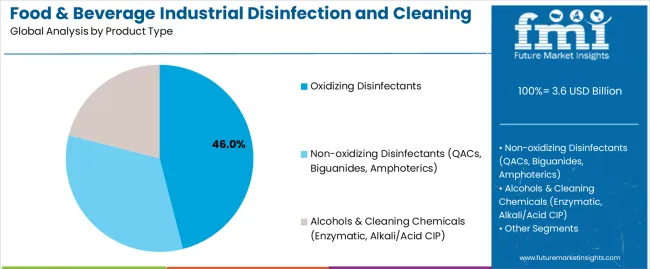

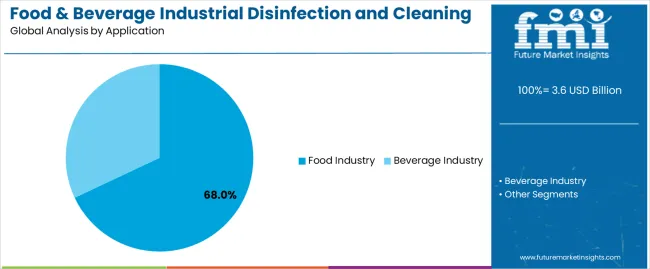

The market is segmented by product type, process, application, and region. By product type, the market is divided into oxidizing disinfectants (including hydrogen peroxide, peracetic acid, and chlorine dioxide & others), non-oxidizing disinfectants (including QACs, biguanides, and amphoterics), and alcohols & cleaning chemicals (including enzymatic and alkali/acid CIP formulations). Based on process, the market is categorized into steam sterilization (SIP), UV technology, ozonation, chlorination, coagulation/flocculation, pasteurization (thermal), carbonation, and other processes (including electrostatic, fogging, and hybrid systems). By application, the market covers food industry (including meat & poultry, dairy, bakery & snacks, fresh produce, confectionery, and other food) and beverage industry (including non-alcoholic beverages, breweries, bottled water, and dairy beverages). Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The oxidizing disinfectants segment is projected to maintain its leading position in the food & beverage industrial disinfection and cleaning market in 2025 with a commanding 46.0% market share, reaffirming its role as the preferred disinfectant chemistry for food processing sanitation requiring broad-spectrum antimicrobial activity, rapid kill times, and minimal residual concerns. Within oxidizing disinfectants, hydrogen peroxide commands 22.0% of total market share, representing environmentally-preferable chemistry decomposing to water and oxygen without persistent residues. Peracetic acid accounts for 14.0%, providing superior efficacy against biofilms and spore-forming organisms in clean-in-place systems. Chlorine dioxide and other oxidizers hold 10.0%, addressing specialized applications requiring controlled oxidation potential and organic matter tolerance.

Food processors and beverage manufacturers increasingly utilize oxidizing disinfectants for their ability to inactivate diverse microbial populations including bacteria, viruses, fungi, and bacterial spores through oxidative damage to cellular components and proteins. This product segment forms the foundation of validated sanitation programs across food manufacturing, representing chemistries with the greatest regulatory acceptance and established performance record in pathogen reduction. Industry investments in peroxide-based systems and peracetic acid applications continue to strengthen adoption among food safety professionals and sanitation managers. With regulatory agencies requiring documented antimicrobial efficacy and processors demanding environmentally-preferable alternatives to chlorine-based disinfectants, oxidizing chemistries align with both regulatory objectives and sustainability requirements.

The food industry application segment commands the largest market share at 68.0% in 2025, reflecting its established position as the most demanding sector for disinfection and cleaning solutions across diverse processing operations including slaughter facilities, dairy plants, bakeries, and fresh-cut produce operations. Within the food industry segment, meat and poultry processing represents 18.0% of total market demand, encompassing slaughter operations, further processing, and ready-to-eat meat production requiring intensive antimicrobial intervention. Dairy manufacturing accounts for 16.0%, serving cheese production, fluid milk processing, and fermented product operations. Bakery and snacks hold 12.0%, addressing mixing equipment, ovens, and packaging line sanitation. Fresh produce processing represents 11.0%, encompassing washing, cutting, and packaging operations. Confectionery accounts for 6.0%, while other food applications hold 5.0%.

This segment benefits from stringent regulatory oversight including USDA Food Safety and Inspection Service requirements for meat and poultry, FDA preventive controls for processed foods, and comprehensive pathogen reduction mandates driving investment in advanced sanitation systems. The beverage industry follows with 32.0% share, encompassing non-alcoholic beverages at 11.0%, breweries at 9.0%, bottled water at 7.0%, and dairy beverages at 5.0%. The food industry segment's leadership is reinforced by greater complexity of food matrices requiring aggressive cleaning, higher pathogen risk necessitating validated antimicrobial interventions, and regulatory scrutiny demanding documented sanitation effectiveness across slaughter operations, ready-to-eat facilities, and fresh produce handling supporting comprehensive food safety management systems.

The food & beverage industrial disinfection and cleaning market is advancing steadily due to increasing regulatory pressure for food safety compliance and growing adoption of advanced sanitation technologies that provide validated microbial control and operational efficiency across diverse food processing and beverage manufacturing applications. The market faces challenges, including antimicrobial resistance development requiring rotation of disinfectant chemistries and comprehensive monitoring programs, chemical compatibility concerns with food processing equipment materials including stainless steel, plastics, and gaskets, and water scarcity constraints limiting clean-in-place water consumption in drought-affected regions. Innovation in bio-based disinfectants and digital hygiene monitoring continues to influence product development and market expansion patterns.

The growing adoption of artificial intelligence-enabled vision systems, automated ATP bioluminescence monitoring, and predictive analytics platforms is enabling food processors to achieve real-time hygiene verification, identify sanitation failures before production resumes, and optimize cleaning protocols through data-driven decision-making reducing chemical consumption while maintaining microbial control effectiveness. Advanced monitoring technologies provide continuous hygiene assurance while allowing proactive intervention preventing contamination events and supporting regulatory compliance through comprehensive documentation. Food safety managers are increasingly recognizing the strategic advantages of digital hygiene monitoring for operational excellence, risk mitigation, and continuous improvement supporting brand protection and consumer confidence in food safety systems.

Modern disinfection chemical manufacturers are incorporating bio-based surfactants, enzymatic cleaning agents, and plant-derived antimicrobial compounds to enhance environmental credentials, reduce aquatic toxicity, and support corporate sustainability commitments through renewable carbon content and biodegradable chemistries. These sustainable formulations improve life cycle environmental performance while maintaining antimicrobial efficacy and cleaning effectiveness required for food contact surface sanitation. Advanced bio-based products also allow chemical suppliers to serve comprehensive sustainability objectives and differentiate offerings beyond conventional petroleum-derived formulations, creating competitive advantages in environmentally-conscious procurement decisions and addressing regulatory initiatives including EU Biocidal Products Regulation sustainability criteria and eco-label programs supporting green chemistry adoption across food manufacturing sectors.

The emergence of electrostatic disinfection systems, fogging technologies, and dry vapor sterilization is creating opportunities for enhanced coverage on complex equipment geometries, reduced chemical consumption through improved transfer efficiency, and supplementary sanitation in hard-to-reach areas including ceiling structures, ventilation systems, and overhead equipment supporting comprehensive environmental sanitation beyond traditional clean-in-place systems. These innovations enable food processors to address microbial harborage sites, enhance sanitation program effectiveness, and implement rapid response protocols for contamination events through whole-room disinfection capabilities. Leading food safety solution providers are investing in advanced application technologies, training programs, and validation protocols that support proper implementation, ensuring appropriate disinfectant contact time, and verifying antimicrobial effectiveness across diverse food processing environments including cold storage areas, ambient production zones, and temperature-controlled packaging rooms.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.8% |

| USA | 5.6% |

| South Korea | 5.5% |

| Germany | 5.4% |

| Japan | 5.3% |

| France | 5.3% |

| UK | 5.2% |

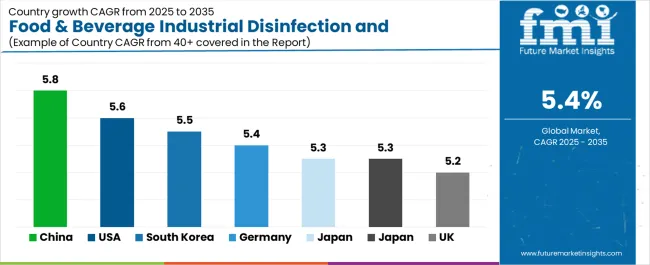

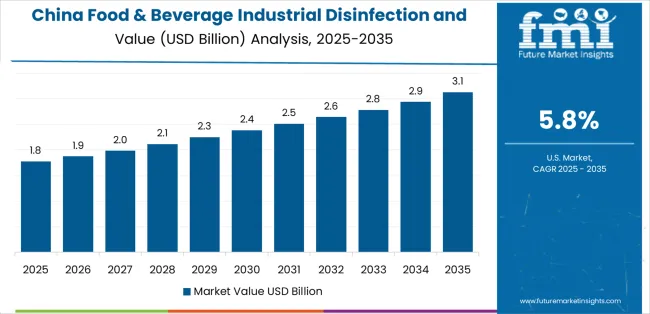

The food & beverage industrial disinfection and cleaning market is experiencing solid growth globally, with China leading at a 5.8% CAGR through 2035, driven by rapid packaged food consumption growth, modernization of food processing facilities, and stricter China Food Safety Administration enforcement driving investment in validated sanitation systems. The United States follows at 5.6%, supported by Food Safety Modernization Act and Federal Insecticide, Fungicide, and Rodenticide Act compliance requirements, artificial intelligence hygiene monitoring adoption, and UV and electrostatic disinfection technology deployment. South Korea shows growth at 5.5%, emphasizing smart factory automation, convenience food expansion, and ozone and UV technology rollouts in urban food manufacturing hubs.

Germany records 5.4%, focusing on HACCP and BVL oversight requirements, sustainability initiatives driving enzyme and bio-based cleaning agent adoption, and comprehensive hygiene management systems. Japan demonstrates 5.3% growth, supported by automation offsetting labor shortages, seafood and ready-meal production specialization, and precision sanitation technologies. France exhibits 5.3% growth, emphasizing strong organic food segment, Biocidal Products Regulation and Ecolabel preferences for low-residue disinfectants, and artisanal dairy and wine production hygiene. The United Kingdom shows 5.2% growth, supported by post-Brexit Biocidal Products Regulation framework and rising demand for biodegradable disinfectants.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The food & beverage industrial disinfection and cleaning industry in China is projected to exhibit exceptional growth with a CAGR of 5.8% through 2035, driven by rapid packaged food consumption growth supporting investment in modern processing facilities, modernization of food manufacturing infrastructure implementing international hygiene standards, and stricter China Food Safety Administration enforcement driving comprehensive sanitation program adoption across meat processing, dairy production, and beverage manufacturing sectors. The country's expanding middle class and urbanization are creating substantial demand for processed foods requiring validated sanitation systems. Major international hygiene solution providers and domestic chemical manufacturers are establishing comprehensive capabilities to serve Chinese food processors.

The food & beverage industrial disinfection and cleaning industry in the United States is expanding at a CAGR of 5.6%, supported by the country's Food Safety Modernization Act and Federal Insecticide, Fungicide, and Rodenticide Act requirements driving preventive controls and validated sanitation systems, artificial intelligence hygiene monitoring technology adoption enabling real-time verification and data-driven optimization, and UV and electrostatic disinfection deployment providing supplementary antimicrobial intervention across processing environments. The nation's stringent regulatory framework and technology leadership are driving advanced sanitation solution demand. Leading hygiene companies and food processors are establishing comprehensive digital monitoring and validation programs.

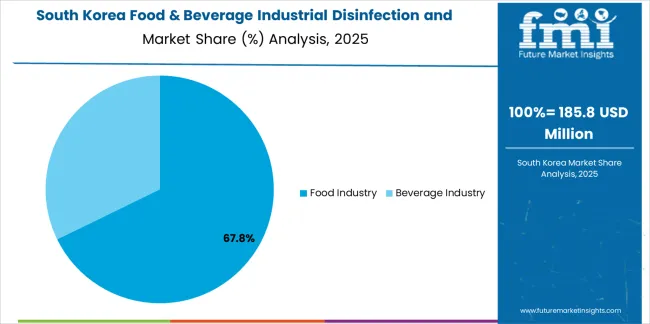

The food & beverage industrial disinfection and cleaning industry in South Korea is expanding at a CAGR of 5.5%, supported by the country's smart factory initiatives integrating automated sanitation monitoring and digital verification systems, convenience food market expansion driving investment in ready-to-eat meal production facilities, and ozone and UV technology rollouts in urban food manufacturing hubs addressing pathogen control and residue concerns. The country's technology adoption culture and urbanized food system are driving advanced disinfection demand. Korean food manufacturers and technology providers are establishing comprehensive automated hygiene systems.

The food & beverage industrial disinfection and cleaning industry in Germany is expanding at a CAGR of 5.4%, supported by the country's HACCP and Federal Office of Consumer Protection and Food Safety oversight requirements driving comprehensive hygiene management, sustainability initiatives promoting enzyme-based and bio-based cleaning agent adoption, and stringent hygiene compliance culture supporting investment in validated sanitation systems across food processing sectors. Germany's regulatory rigor and environmental leadership are driving sustainable disinfection solution demand. German food processors and chemical companies are investing in environmentally-preferable sanitation technologies.

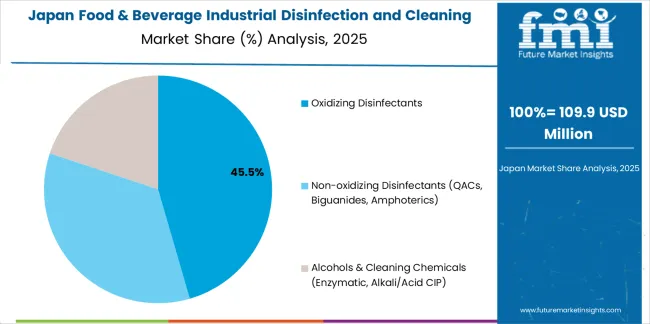

The food & beverage industrial disinfection and cleaning market in Japan is expanding at a CAGR of 5.3%, supported by the country's automation initiatives offsetting labor shortages through automated cleaning and monitoring systems, seafood and ready-meal production specialization requiring intensive sanitation programs, and precision hygiene technologies addressing stringent quality standards and consumer expectations. Japan's aging workforce and quality culture are driving automated disinfection system demand. Japanese food manufacturers and equipment suppliers are establishing comprehensive automated sanitation capabilities.

Demand for food & beverage industrial disinfection and cleaning in France is expanding at a CAGR of 5.3%, supported by the country's strong organic food segment requiring low-residue disinfectants compatible with organic certification standards, Biocidal Products Regulation and Ecolabel preferences driving adoption of environmentally-preferable chemistries, and artisanal dairy and wine production hygiene addressing traditional production methods with modern sanitation requirements. France's organic food leadership and sustainability culture are driving specialized disinfection demand. French food processors and chemical suppliers are establishing comprehensive low-residue sanitation solutions.

Demand for food & beverage industrial disinfection and cleaning in the United Kingdom is growing at a CAGR of 5.2%, driven by the country's post-Brexit Biocidal Products Regulation framework establishing independent sanitation chemical approval pathways, rising demand for biodegradable disinfectants addressing environmental concerns and regulatory initiatives, and comprehensive food hygiene enforcement supporting investment in validated sanitation programs across food manufacturing sectors. The UK's regulatory independence and environmental focus are supporting sustainable disinfection market development. British food processors and chemical suppliers are establishing compliance strategies for evolving regulatory landscape.

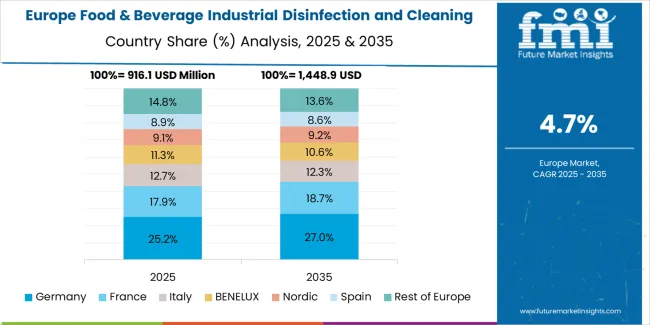

The food & beverage industrial disinfection and cleaning market in Europe is projected to grow from USD 1.0 billion in 2025 to USD 1.6 billion by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 22.0% market share in 2025, holding at 21.8% by 2035, supported by its smart hygiene monitoring systems, brewery and meat processing sanitation requirements, and bio-based cleaning agent adoption serving food manufacturing sectors.

The United Kingdom follows with 15.0% in 2025, projected to reach 15.2% by 2035, driven by post-Brexit Biocidal Products Regulation compliance, biodegradable disinfectant demand, and UV and ozone technology adoption. France holds 14.0% in 2025, rising to 14.3% by 2035, supported by organic and dairy segment growth seeking low-residue oxidizing disinfectants. Italy commands 11.0% in 2025, projected to reach 11.2% by 2035, driven by tourism-linked foodservice operations and specialty cheese and wine production hygiene. Spain accounts for 8.0% in 2025, expected to reach 8.2% by 2035, supported by produce handling and seafood processing sanitation. Netherlands maintains 7.0% in 2025, growing to 7.1% by 2035, driven by export-oriented food manufacturing hubs and brewery operations. Poland holds 6.0% in 2025, reaching 6.2% by 2035, supported by expanding meat processing hygiene programs. Nordics account for 7.0% in 2025, reaching 7.3% by 2035, emphasizing sustainability and automated sanitation systems. Rest of Europe represents 10.0% in 2025, moderating to 8.7% by 2035, covering Belgium, Austria, Czech Republic and other markets with mixed food & beverage processing and water-efficient cleaning system upgrades.

The food & beverage industrial disinfection and cleaning market is characterized by competition among established hygiene solution providers, specialty chemical manufacturers, and integrated equipment and chemistry suppliers. Companies are investing in bio-based formulation research, digital monitoring technology development, regulatory compliance expertise, and comprehensive product portfolios to deliver effective, sustainable, and digitally-enabled sanitation solutions. Innovation in low-residue chemistries, automated monitoring systems, and application-specific formulations is central to strengthening market position and competitive advantage.

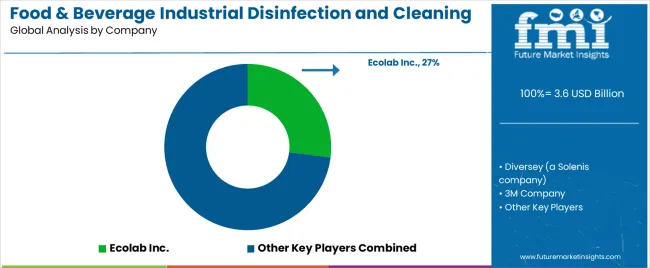

Ecolab Inc. leads the market with a commanding 27.0% market share, offering comprehensive food safety and hygiene solutions with advanced disinfection chemistries, automated monitoring systems, and technical service expertise across food processing and beverage manufacturing applications. The company expanded its European portfolio of plant-based, low-residue disinfectants in 2024 and rolled out analytics upgrades for hygiene monitoring packages supporting large food & beverage processors. Diversey (a Solenis company) provides integrated hygiene solutions, advancing integration of food & beverage hygiene offerings in 2025 and introducing consolidated clean-in-place optimization programs for beverage plants. 3M Company specializes in hygiene monitoring systems and antimicrobial technologies serving food safety applications. BASF SE delivers specialty chemicals including disinfectant active ingredients and formulation components.

Evonik Industries AG focuses on biosurfactants and specialty ingredients, broadening commercial supply of biosurfactants for enzyme and low-toxicity cleaning formulations used in dairy and brewing sanitation in 2024. Kersia Group provides comprehensive biosecurity and hygiene solutions for food industries. Christeyns NV offers specialized cleaning and disinfection systems. Clariant AG supplies specialty chemicals and formulation expertise. Neogen Corporation specializes in food safety testing and hygiene monitoring. Spartan Chemical Company provides institutional and industrial cleaning and disinfection products.

Food & beverage industrial disinfection and cleaning represents a specialized hygiene solutions segment within food safety and manufacturing, projected to grow from USD 3.6 billion in 2025 to USD 6.1 billion by 2035 at a 5.4% CAGR. These validated sanitation systems-primarily oxidizing disinfectant chemistries for antimicrobial intervention-encompass disinfectants, detergents, sterilization processes, and monitoring technologies serving to eliminate pathogenic microorganisms, prevent cross-contamination, and support regulatory compliance in meat processing, dairy manufacturing, beverage production, and bakery operations. Market expansion is driven by increasing food safety regulations, growing pathogen outbreak concerns, expanding convenience food production, and rising consumer expectations for food safety assurance across food processing, beverage manufacturing, and foodservice preparation sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.6 billion |

| Product Type | Oxidizing Disinfectants (Hydrogen Peroxide, Peracetic Acid, Chlorine Dioxide & Others), Non-oxidizing Disinfectants (QACs, Biguanides, Amphoterics), Alcohols & Cleaning Chemicals (Enzymatic, Alkali/Acid CIP) |

| Process | Steam Sterilization (SIP), UV Technology, Ozonation, Chlorination, Coagulation/Flocculation, Pasteurization (Thermal), Carbonation, Other Processes (Electrostatic, Fogging, Hybrid) |

| Application | Food Industry (Meat & Poultry, Dairy, Bakery & Snacks, Fresh Produce, Confectionery, Other Food), Beverage Industry (Non-alcoholic Beverages, Breweries, Bottled Water, Dairy Beverages) |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, United States, South Korea, Germany, Japan, France, United Kingdom, and 40+ countries |

| Key Companies Profiled | Ecolab Inc., Diversey, 3M Company, BASF SE, Evonik Industries AG, Kersia Group |

| Additional Attributes | Dollar sales by product type, process, and application categories, regional demand trends, competitive landscape, technological advancements in bio-based formulations, digital monitoring systems, antimicrobial efficacy innovation, and sustainable sanitation optimization |

The global food & beverage industrial disinfection and cleaning market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the food & beverage industrial disinfection and cleaning market is projected to reach USD 6.1 billion by 2035.

The food & beverage industrial disinfection and cleaning market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in food & beverage industrial disinfection and cleaning market are oxidizing disinfectants , non-oxidizing disinfectants (qacs, biguanides, amphoterics) and alcohols & cleaning chemicals (enzymatic, alkali/acid cip).

In terms of application, food industry segment to command 68.0% share in the food & beverage industrial disinfection and cleaning market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA