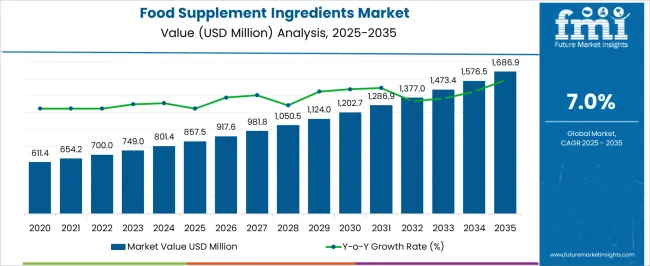

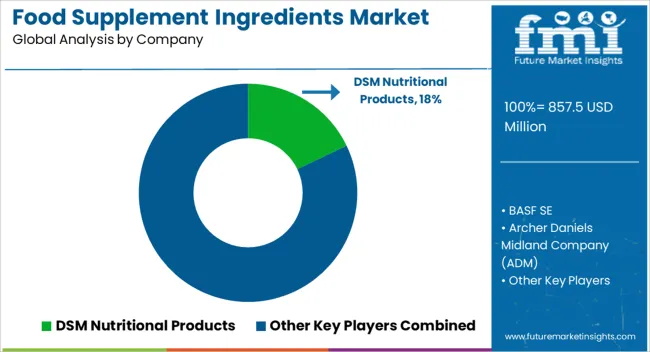

The food supplement ingredients market is anticipated to grow from USD 857.5 million in 2025 to USD 1,686.9 million by 2035, reflecting a CAGR of 7.0%. Saturation point analysis highlights periods where market adoption begins to level off due to maturing product segments, intensified competition, and regional penetration limits, while innovation and diversification continue to sustain incremental growth.

From 2025 to 2027, the market expands from USD 857.5 million to USD 981.8 million, supported by increasing consumer awareness of nutrition, wellness trends, and demand for fortified food products. During this early phase, growth is concentrated in high-value segments such as protein isolates, vitamins, and botanicals, where adoption remains below peak levels. Between 2028 and 2031, revenues climb from USD 1,050.5 million to USD 1,286.9 million, with intermediate values reflecting gradual approach toward market saturation in developed regions. Growth in this period is driven by product innovation, functional ingredient blends, and expansion into emerging markets, although incremental gains per region begin to moderate as competition intensifies.

From 2032 to 2035, the market reaches USD 1,686.9 million, approaching saturation in key mature segments. New product launches, regulatory support for health claims, and increased consumer adoption in underpenetrated geographies help sustain growth momentum.

| Metric | Value |

|---|---|

| Food Supplement Ingredients Market Estimated Value in (2025 E) | USD 857.5 million |

| Food Supplement Ingredients Market Forecast Value in (2035 F) | USD 1686.9 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The food supplement ingredients market is strongly shaped by five interconnected parent markets, each contributing differently to overall demand and growth. The nutraceuticals and dietary supplements market holds the largest share at 35%, driven by consumer demand for vitamins, minerals, proteins, and herbal extracts in capsules, tablets, and powders to support health and wellness.

The functional food and beverage market contributes 25%, with fortified foods and beverages incorporating probiotics, fibers, antioxidants, and other ingredients for improved nutrition and preventive health benefits. The sports nutrition market accounts for 20%, where proteins, amino acids, creatine, and other performance-enhancing compounds are in high demand among athletes, bodybuilders, and fitness enthusiasts.

The pharmaceutical and clinical nutrition market holds a 12% share, driven by specialty nutrients and bioactive compounds formulated for therapeutic diets, medical nutrition, and clinical interventions. The retail and e-commerce distribution market represents 8%, facilitating product availability, accessibility, and consumer reach through supermarkets, specialty stores, and online platforms.

The food supplement ingredients market is witnessing consistent growth driven by rising health consciousness, increasing aging population, and evolving dietary preferences across both developed and developing nations. Demand is being further boosted by the growing acceptance of preventive healthcare and functional nutrition, supported by an expanding base of fitness enthusiasts and wellness-aware consumers.

Regulatory backing for clean-label and scientifically validated supplements is enabling ingredient innovation, while digital channels are enhancing consumer access and education. Additionally, partnerships between ingredient manufacturers and supplement brands are accelerating product development cycles, with a clear shift toward personalized, lifestyle-focused formulations.

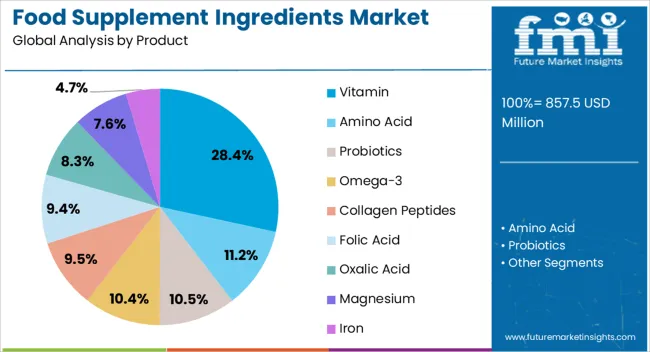

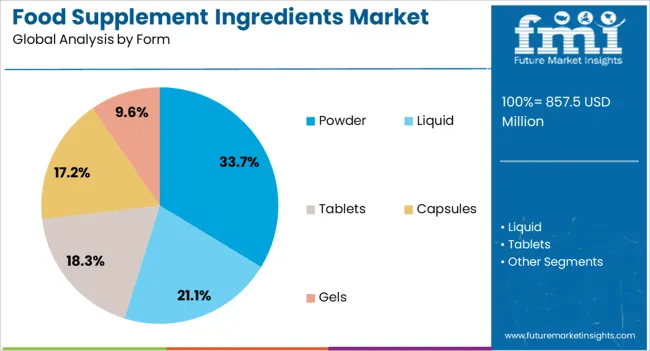

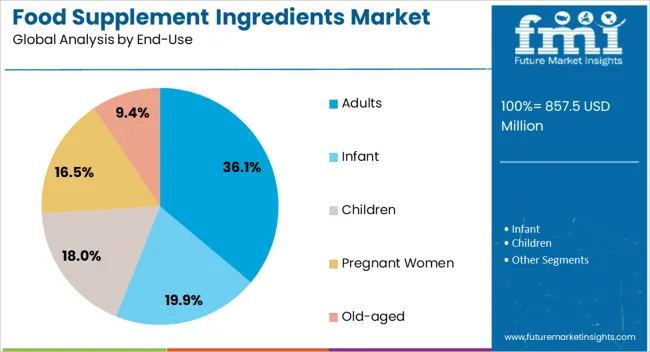

The food supplement ingredients market is segmented by product, form, end-use, and geographic regions. By product, food supplement ingredients market is divided into Vitamin, Amino Acid, Probiotics, Omega-3, Collagen Peptides, Folic Acid, Oxalic Acid, Magnesium, and Iron. In terms of form, food supplement ingredients market is classified into Powder, Liquid, Tablets, Capsules, and Gels. Based on end-use, food supplement ingredients market is segmented into Adults, Infant, Children, Pregnant Women, and Old-aged. Regionally, the food supplement ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vitamins are expected to contribute 28.4% of the total market share in the food supplement ingredients market by 2025, making them the leading product category. This dominance is primarily fueled by widespread deficiency concerns, physician recommendations, and the essential role vitamins play in supporting immunity, metabolism, and general well-being.

Consumer inclination toward daily supplementation for immune resilience and energy enhancement has reinforced demand for both single and multivitamin formats. Increased availability across over-the-counter channels and incorporation in fortified foods have expanded their usage spectrum.

Moreover, clinical validation and regulatory support for vitamin fortification in public health programs are further sustaining market momentum.

Powder form is anticipated to account for 33.7% of the food supplement ingredients market share in 2025, leading among all formats. The convenience of dosage customization, longer shelf life, and compatibility with a variety of delivery methods including shakes, smoothies, and meal replacements make powder a preferred format for both manufacturers and consumers.

Its utility in sports nutrition, elderly nutrition, and meal supplementation drives continued adoption. Furthermore, powder form allows multi-ingredient blending and faster absorption compared to capsules or tablets, making it ideal for tailored health regimes.

E-commerce platforms and direct-to-consumer brands are increasingly leveraging powders for bundling with lifestyle-based wellness routines.

Adults are projected to contribute 36.1% of the total end-use share in the food supplement ingredients market by 2025, emerging as the dominant consumer group. This leadership is driven by a heightened focus on preventative health, energy maintenance, and chronic disease risk reduction among working professionals and aging populations.

Personalized supplement solutions targeting specific concerns like bone health, cognition, and stress management are resonating strongly with adult consumers. High purchasing power, digital health tracking tools, and subscription-based supplement models have further streamlined adoption.

As health awareness increases, adult populations are expected to remain the primary drivers of demand for both foundational and condition-specific supplements.

The food supplement ingredients market is growing as manufacturers and consumers prioritize health, nutrition, and functional benefits. Demand is driven by vitamins, minerals, plant extracts, probiotics, and protein ingredients for dietary supplements, fortified foods, and functional beverages. Challenges include raw material price volatility, regulatory compliance across regions, and formulation stability. Opportunities exist in clean-label ingredients, high-bioavailability nutrients, and personalized nutrition solutions. Trends highlight powdered and encapsulated forms, blends for specific health benefits, and evidence-based ingredient validation.

Consumers and manufacturers are increasingly seeking ingredients that provide targeted nutritional benefits, including immunity support, gut health, energy, and cognitive function. The rise in health awareness, lifestyle diseases, and preventive care is driving demand for vitamins, minerals, amino acids, plant extracts, probiotics, and protein derivatives. Functional beverages, ready-to-eat supplements, and fortified snacks are major applications. Personalized nutrition trends are further encouraging the use of high-bioavailability and scientifically validated ingredients. Manufacturers prioritize ingredients that ensure stability, taste compatibility, and synergistic health benefits. With consumers increasingly investing in preventive and functional nutrition, food supplement ingredients are positioned as essential building blocks for health-focused formulations and differentiated product offerings.

The food supplement ingredients market faces challenges from fluctuating raw material prices, especially for plant extracts, specialty proteins, and probiotics. Supply chain disruptions can affect timely procurement of high-quality ingredients. Regulatory compliance, including regional safety standards, label claims, and allergen management, adds complexity. Technical constraints include stability, solubility, and bioavailability of active ingredients during processing and shelf life. Formulation challenges arise when combining multiple functional ingredients to maintain taste, efficacy, and safety. Buyers increasingly prefer suppliers who offer certified ingredients, traceability, batch-to-batch consistency, and technical guidance to minimize formulation risk and meet stringent regulatory requirements for dietary supplements and fortified foods.

Opportunities are strongest in clean-label and natural ingredients that appeal to health-conscious consumers. High-bioavailability vitamins, minerals, and botanicals enable more effective supplementation and support product differentiation. Personalized nutrition, driven by digital health platforms and dietary tracking, creates scope for customized blends and targeted formulations. Functional beverages, protein powders, ready-to-eat snacks, and nutraceutical capsules are emerging as key growth segments. Regional demand in North America, Europe, and Asia-Pacific is expanding due to increasing health awareness, aging populations, and lifestyle-related health concerns. Suppliers offering scientifically validated, high-quality, and easily integrable ingredients with formulation support are best positioned to capitalize on these opportunities.

The market is trending toward multi-ingredient blends targeting specific health benefits, including immunity, digestive wellness, and cognitive support. Ingredient formats include powders, capsules, tablets, gummies, and liquid concentrates to suit different applications. Evidence-based validation, clinical trials, and standardized extracts are becoming critical for consumer trust and regulatory compliance. Suppliers are increasingly collaborating with manufacturers to optimize formulations for taste, bioavailability, and stability. Digital platforms and e-commerce are also driving demand for ready-to-use and personalized supplement blends. Suppliers offering versatile, scientifically backed, and application-ready ingredients are well positioned to meet evolving consumer expectations and growing demand across functional food and dietary supplement markets.

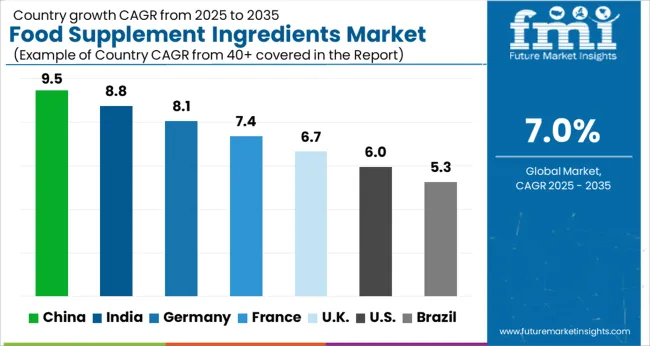

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global food supplement ingredients market is projected to grow at a CAGR of 7.0% from 2025 to 2035, led by China at 9.5% and India at 8.8%, both key BRICS nations driving demand through rising health awareness, urbanization, and fitness trends. Germany, the UK, and the USA, major OECD members, are expanding due to functional foods, sports nutrition, and preventive healthcare adoption. Growth is fueled by protein, vitamins, minerals, herbal extracts, and probiotics, alongside clean-label and plant-based innovations. E-commerce, retail expansion, and collaborations with international suppliers enhance market accessibility, while demographic shifts and wellness trends continue to boost consumption worldwide. The analysis includes over 40 countries, with the leading markets shown below.

The food supplement ingredients market in China is projected to grow at a CAGR of 9.5% from 2025 to 2035, driven by rising health awareness, increasing disposable incomes, and a growing aging population. Consumers are demanding functional foods enriched with vitamins, minerals, proteins, and herbal extracts. Domestic manufacturers are expanding capacities and investing in research to develop high-quality nutraceutical ingredients. E-commerce platforms and modern retail chains are broadening market reach, while collaborations with international suppliers are introducing advanced formulations. The fitness and sports nutrition sectors are also fueling demand for protein powders, amino acids, and plant-based ingredients. Government health initiatives and awareness campaigns further encourage consumption of dietary supplements.

The food supplement ingredients market in India is expected to grow at a CAGR of 8.8% between 2025 and 2035, supported by rising health-consciousness, urbanization, and an expanding middle-class population. Increasing adoption of dietary supplements among working professionals and fitness enthusiasts is driving protein powders, amino acids, and herbal extracts. Domestic manufacturers are scaling production and introducing fortified ingredients tailored for local dietary needs. Retail and e-commerce channels are making supplements more widely accessible, while partnerships with global ingredient suppliers bring new formulations to the market. Government nutrition programs and campaigns targeting micronutrient deficiencies also promote awareness. Rising demand from clinical nutrition, sports nutrition, and immunity-boosting products further stimulates growth.

The food supplement ingredients market in Germany is forecasted to grow at a CAGR of 8.1% from 2025 to 2035, driven by increasing health-consciousness and aging demographics. Functional foods and nutraceuticals enriched with vitamins, minerals, probiotics, and plant extracts are increasingly popular. Manufacturers focus on quality certifications, clean-label formulations, and clinical evidence to attract consumers. Organic and specialty ingredients are gaining traction in both retail and healthcare sectors. R&D collaborations with research institutions enhance innovation in bioactive ingredients and sports nutrition products. Rising demand from preventive healthcare, dietary management, and fitness applications further boosts the market. Supermarkets, pharmacies, and online channels serve as primary distribution routes.

The UK market is projected to grow at a CAGR of 6.7% from 2025 to 2035, fueled by health awareness, dietary supplement adoption, and the popularity of functional foods. Consumers are increasingly choosing protein powders, vitamins, herbal extracts, and probiotics to support immunity, fitness, and wellness. Retailers and online platforms provide convenient access to a wide variety of supplement ingredients. Manufacturers are focusing on clean-label, fortified, and plant-based ingredients to meet changing consumer preferences. Growing demand from sports nutrition, weight management, and immune health products further drives market expansion. Collaboration between domestic producers and international ingredient suppliers helps introduce innovative products. Government campaigns and clinical nutrition awareness programs also support market growth.

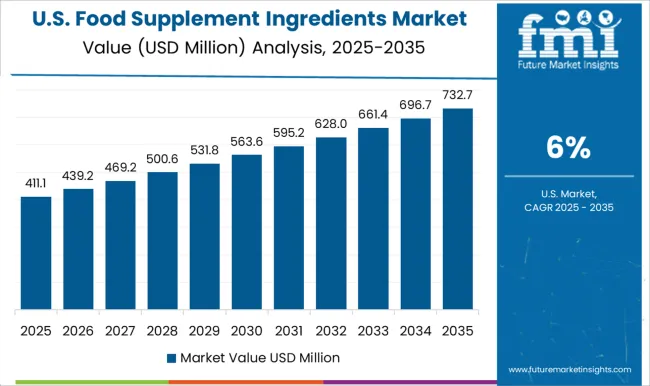

The USA market is expected to grow at a CAGR of 6.0% between 2025 and 2035, driven by high health awareness, fitness trends, and dietary supplement adoption. Vitamins, minerals, protein, herbal extracts, and probiotics remain top-selling ingredients. The rise of functional foods, sports nutrition, and immune health products is fueling ingredient demand. E-commerce platforms and large retail chains ensure widespread availability. Domestic manufacturers focus on innovative formulations, clean-label products, and plant-based alternatives to cater to evolving consumer preferences. Collaborations with international suppliers enhance the portfolio of specialty ingredients. Growing interest in preventive healthcare, clinical nutrition, and personalized diets is further supporting market growth.

Competition in the food supplement ingredients market is defined by ingredient quality, functional versatility, and regulatory compliance. DSM Nutritional Products leads through a broad portfolio of vitamins, enzymes, and bioactive compounds, emphasizing scientific validation, global supply, and regulatory alignment. BASF SE competes with high-purity micronutrients, amino acids, and specialty ingredients designed for fortified foods and beverages. Archer Daniels Midland Company (ADM) and Cargill, Incorporated focus on plant-based proteins, fibers, and nutraceutical intermediates, leveraging large-scale production and supply chain integration.

Lonza Group differentiates with probiotics, nutritional premixes, and encapsulated delivery systems tailored for both human and animal nutrition markets. Mid-tier and specialty players such as Naturex (Givaudan), Nutralliance, Ingredion Incorporated, Glanbia Nutritionals, and Kerry Group compete through botanical extracts, flavor-integrated nutrients, and clean-label solutions targeting functional foods, beverages, and sports nutrition. Strategies emphasize standardization, ingredient traceability, and adaptability to evolving regulatory requirements across regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 857.5 Million |

| Product | Vitamin, Amino Acid, Probiotics, Omega-3, Collagen Peptides, Folic Acid, Oxalic Acid, Magnesium, and Iron |

| Form | Powder, Liquid, Tablets, Capsules, and Gels |

| End-Use | Adults, Infant, Children, Pregnant Women, and Old-aged |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM Nutritional Products, BASF SE, Archer Daniels Midland Company (ADM), Lonza Group, Cargill, Incorporated, Naturex (Givaudan), Nutralliance, Ingredion Incorporated, Glanbia Nutritionals, and Kerry Group |

| Additional Attributes | Dollar sales by ingredient type (vitamins, minerals, proteins, probiotics, botanicals), formulation (powder, liquid, capsules, tablets), and application (dietary supplements, functional foods, beverages, sports nutrition). Demand dynamics are driven by rising health awareness, increasing adoption of preventive nutrition, and growth in functional food markets. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by expanding supplement consumption, regulatory support for fortified foods, and increasing demand for plant-based and clean-label ingredients. |

The global food supplement ingredients market is estimated to be valued at USD 857.5 million in 2025.

The market size for the food supplement ingredients market is projected to reach USD 1,686.9 million by 2035.

The food supplement ingredients market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in food supplement ingredients market are vitamin, vitamin a, vitamin c, vitamin b6, vitamin b12, vitamin d, amino acid, probiotics, omega-3, collagen peptides, folic acid, oxalic acid, magnesium and iron.

In terms of form, powder segment to command 33.7% share in the food supplement ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA