The Food Tourism Sector Market is estimated to be valued at USD 5457.7 million in 2025 and is projected to reach USD 22466.5 million by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

| Metric | Value |

|---|---|

| Food Tourism Sector Market Estimated Value in (2025 E) | USD 5457.7 million |

| Food Tourism Sector Market Forecast Value in (2035 F) | USD 22466.5 million |

| Forecast CAGR (2025 to 2035) | 15.2% |

The food tourism sector market is gaining momentum as culinary experiences increasingly shape travel decisions and destination branding. Growing interest in authentic cultural immersion, wellness driven consumption, and sustainable gastronomy has expanded demand for food related tourism activities.

The sector benefits from rising disposable incomes, the influence of social media, and the growing popularity of experiential travel where food is central to discovery and storytelling. Destinations and operators are investing in structured culinary programs, heritage food trails, and immersive cooking experiences that highlight local traditions.

Advances in digital platforms and booking technologies are further enabling tourists to access and plan culinary experiences seamlessly. Looking ahead, the market outlook remains positive as travelers continue to prioritize culinary engagement as a core component of leisure and lifestyle based tourism.

/p>

/p>

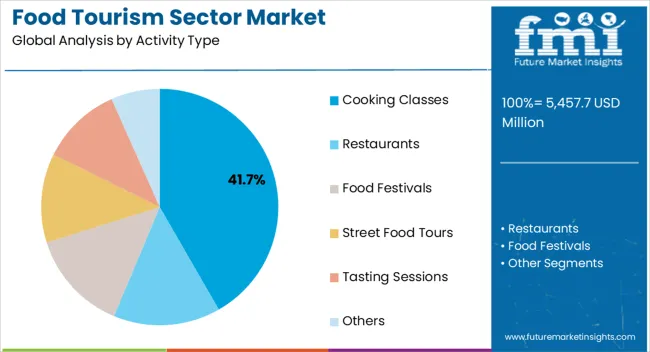

The cooking classes activity type is projected to account for 41.70% of total revenue by 2025, making it the leading segment. This growth is driven by tourists’ desire to acquire hands on culinary skills, deeper cultural understanding, and personalized experiences.

Cooking classes provide interactive learning combined with authentic local engagement, positioning them as a preferred activity among travelers seeking meaningful participation.

The popularity of wellness and cultural enrichment in tourism has also reinforced the dominance of this segment, establishing cooking classes as a cornerstone activity within food tourism.

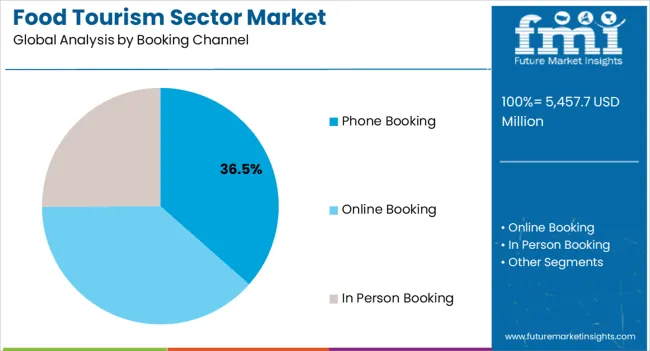

The phone booking channel segment is expected to hold 36.50% of total market revenue by 2025, positioning it as the leading booking preference. This dominance reflects tourists’ preference for direct communication with operators, personalized recommendations, and immediate clarification of queries.

Phone bookings are considered more reliable for complex or customized culinary experiences, particularly where itinerary flexibility is valued.

The ability to build trust and provide tailored service has contributed to the strong share of this channel within the food tourism market.

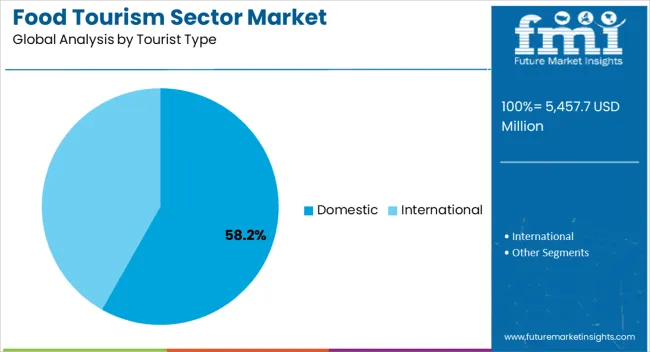

The domestic tourist type segment is projected to contribute 58.20% of total market revenue by 2025, making it the largest tourist category. This is attributed to the growing appeal of local and regional culinary exploration, the affordability of short haul travel, and increased promotion of regional cuisines by tourism boards.

Domestic travelers often engage more frequently in repeat culinary experiences, supporting consistent market demand.

Additionally, the rise of staycations and regional festivals has reinforced participation, positioning domestic tourists as the dominant force shaping the food tourism sector.

During the projection period, the food tourism sector is expected to grow significantly. Food tourism adds a new dimension to the tourism business, allowing it to expand tremendously. The primary goal of the food tourism sector has been to promote the regional characteristics of various tourist destinations and attract a bigger number of tourists to these destinations.

Currently, the industry attracts 5382.3 million tourists every year, a figure that is anticipated to rise dramatically in the next years. The governments of many countries are attempting to encourage tourism in their own countries by advertising and marketing their regional cuisine; this is projected to significantly increase the food tourism sector business. As a result, the outlook for the food tourism sector appears to be bright.

The primary motive of choosing destinations for tourism has not been the food, but it does remain the secondary and one of the most important factors while planning a travel. There has been an increasing trend among tourists to taste the local cuisine.

This has made options like home-cooked food and meal sharing very popular. The tourists are excited to share meals with the local families, and the tour operators have also started offering these options in their tour packages. This is expected to help boost the food tourism sector market.

While food tourism has primarily been about exploring different tastes and developing a sensory experience at different destinations, recently it has also become a way for tourists to immerse themselves into the local culture and learn more about the place they are visiting.

The most popular way of this has been local cooking classes; these classes offer tourists special cooking lessons, the person conducting the classes is most often a local person who has deep knowledge about the local cuisine and can impart it to the tourists. These classes have immensely helped in boosting the food tourism sector market.

| Attribute | Details |

|---|---|

| North America Market Share - 2025 | 22.30% |

| United States Market Share - 2025 | 18.30% |

| Australia Market Share - 2025 | 2.30% |

The food tourism sector in North America is experiencing significant growth and has become a thriving food tourism sector industry. With its diverse culinary offerings and rich gastronomic traditions, the region attracts food enthusiasts from around the world. From food festivals and farmers markets to farm-to-table experiences and culinary tours, North America offers a wide range of options for tourists seeking immersive food experiences.

The food tourism sector market has witnessed an increase in food-focused itineraries, cooking classes, and food-themed events, catering to the growing demand for culinary adventures. This booming sector has not only stimulated local economies but has also fostered cultural exchange and appreciation for diverse cuisines across the continent.

| Attribute | Details |

|---|---|

| Japan Market Share - 2025 | 4.90% |

| China Market CAGR (From 2025 to 2035) | 16.30% |

| India Market CAGR (From 2025 to 2035) | 18.30% |

Artistic presentation and variety of spices make Indian cuisine widely popular.

India's food tourism sector industry is anticipated to expand the fastest due to the country's abundance of traditional groceries. Additionally, curry, spices, and diverse Indian foods are always viewed as works of art. Foreign tourists are drawn to Indian cuisine by this art.

The desire to learn more about Indian lifestyle, culture, and customs is another major factor driving the development of the food tourism sector of the country. Over the forecast period, this is anticipated to escalate the food tourism sector market.

Presence of high-quality restaurants and popularity of traditional Japanese cuisine is boosting the market in Japan

The food tourism market in Japan has grown rapidly due to the exquisite delicacies that originate in the country. Japan’s cuisine is famously known as Washoku, which helps in attracting consumers from around the globe, and is based upon traditional rice-based food items and miso soup. Tokyo, a city in Japan boasts of being the city with the highest number of Michelin stars restaurants in the world.

This along with the rising popularity of Japanese pop culture across the globe has risen the interest of people to try and explore traditional Japanese cuisine, boosting the food tourism sector market growth. The hospitality of the Japanese citizens and the wide variety of alcoholic beverages offered in Japan spur the food tourism sector industry ahead.

| Attribute | Details |

|---|---|

| Europe Market Share - 2025 | 29.40% |

| Germany Market Share - 2025 | 8.40% |

| United Kingdom Market CAGR (From 2025 to 2035) | 10.50% |

Efforts to preserve the essence of French cuisine are being made by the government.

The government of France has started taking initiatives to improve the image of their tourism sector which has gained an image of arrogance. French cuisine has been popular worldwide due to the concept of ‘Fait Maison’ which translates to ‘Homemade’.

The essence of French pastries, artisanal cheese, and other food items depends on the freshness and the experience of eating them as soon as they are cooked. This essence is getting lost in today’s fast-paced food industry where frozen packaged food items are getting more popular day by day. The French government has introduced measures to preserve this important feature of their food tourism industry, urging the business and restaurants involved in the sector to preserve the quality of their food offerings.

This move is expected to keep the France food tourism sector lively and inflowing with consumers from around the world. The France food tourism industry is expected to grow at a steady rate, and contribute a healthy amount of revenue to the global food tourism sector market.

| Category | Activity type |

|---|---|

| Leading Segment | Restaurants |

| Market Share | 58.40% |

Restaurants and food festivals remain the top preferred activities in the food tourism market

Restaurants remain one of the prominent categories based on the activity type in the food tourism sector. The majority of food tourism occurs as people travel to try out new restaurants and different cuisines. This is due to food tourism prominently occurring on a domestic scale, where people like to explore cuisine near to them and have a relaxing experience.

Food festivals are one of the most prominent categories, where food festivals like the Pizzafest held in Naples, Italy and the Oktoberfest held in Germany attract millions of tourists to their attractions. This category boosts the international food tourism sector substantially.

| Category | Booking Channel |

|---|---|

| Leading Segment | Online Booking |

| Market Share | 40.20% |

Online booking channel leads the booking channels segment in the food tourism sector

The emergence of digitalization has affected the food tourism industry positively. The presence of different apps for bookings of restaurants, food festivals, cooking classes, etc. has made it easier for consumers to book their tours, while also providing them with a wide range of options. This has made online booking channels the leading booking channel in the food tourism sector.

Package traveler is the most popular tour type in the food tourism sector

The presence of reputed and experienced tour operators in the sector has improved the ease of traveling. The firms offer lucrative packages, ranging in prices, destinations, cuisine type, etc., and offer comprehensive end-to-end services to the consumer. This has helped the packaged traveler category become the most prominent tour type in the food tourism sector.

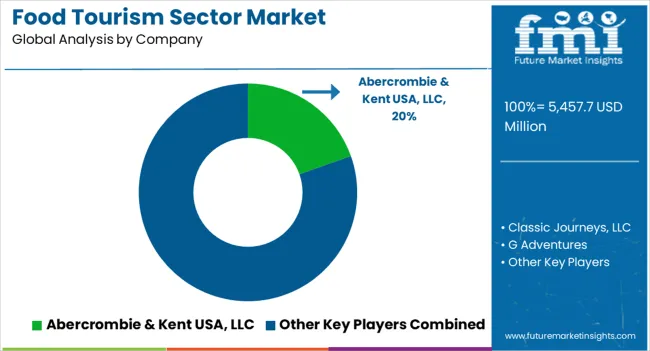

The presence of important companies in the domestic safety locker industry has resulted in vendor competition. Limited branded and worldwide companies dominate the total food tourism sector market. The food tourism market players focus on aesthetic appeal, product technology, and add-on features that provide additional safety to differentiate their products from the competition.

The food tourism sector market players are likely to benefit from growing industrial expenditure, new infrastructure development, and growth in culinary tourism in the region. To acquire a competitive advantage, the players are increasing mergers and acquisitions. Due to improved infrastructure, the food tourism industry is expected to see an increase in rising sales.

Latest Advancements:

| Company | India Culinary Tour |

|---|---|

| Strategy | Personalized Culinary Adventures by India Culinary Tour |

| Details | India culinary Tour, a company that provides culinary tours in India, has customised alternatives for travellers and allows them to choose from a variety of items. |

| Company | WijnSpijs |

|---|---|

| Strategy | Unveiling the Dutch Culinary Delights through Exquisite Gourmet Experiences |

| Details | WijnSpijs is a new food tourism company in the Netherlands. The company organises gourmet experiences for guests all throughout the country using two unique smartphone apps: one for clients and one for eateries. |

The global food tourism sector market is estimated to be valued at USD 5,457.7 million in 2025.

The market size for the food tourism sector market is projected to reach USD 22,466.5 million by 2035.

The food tourism sector market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in food tourism sector market are cooking classes, restaurants, food festivals, street food tours, tasting sessions and others.

In terms of booking channel, phone booking segment to command 36.5% share in the food tourism sector market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA