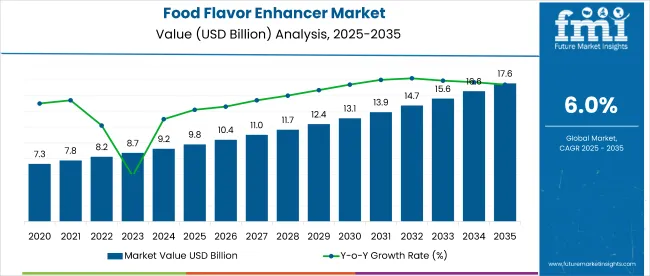

The global food flavor enhancer market is projected to grow from USD 9.8 billion in 2025 to USD 17.6 billion by 2035, registering a CAGR of 6%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.8 billion |

| Industry Value (2035F) | USD 17.6 billion |

| CAGR (2025 to 2035) | 6% |

As awareness about synthetic additives and artificial flavors grows, manufacturers are shifting toward botanical and plant-derived flavor enhancers to meet evolving health-conscious consumer preferences. The market holds 11% share in the flavoring agents market and around 8% in the natural ingredients market, driven by growing demand for clean-label and plant-based solutions.

Within the food additives market, it accounts for nearly 6%, reflecting its integral role in enhancing taste across processed and packaged foods. In the functional food ingredients market, flavor enhancers hold a 4% share, while their contribution to the broader food ingredients market is around 2.5%. As consumer preference shifts toward natural flavors, the market's share in these parent categories is expected to grow steadily through 2035.

Global regulatory frameworks focused on food safety and ingredient transparency play a key role in shaping market trends. Regulatory bodies such as the USA Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have emphasized the need for clean-label declarations and stricter oversight of artificial flavor use.

In Asia, countries like Japan and China have promoted standards encouraging the adoption of naturally derived additives. For instance, Japan’s FOSHU (Food for Specified Health Use) regulations support the use of natural and functional food ingredients, while India’s FSSAI mandates clearer labeling and restriction of synthetic additives in packaged food products. These regulations are accelerating the shift toward natural and vegan flavor enhancers.

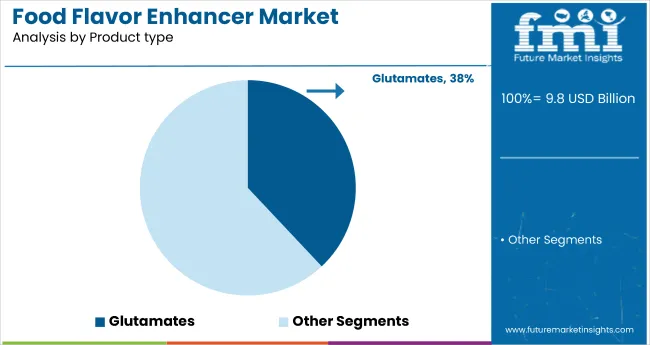

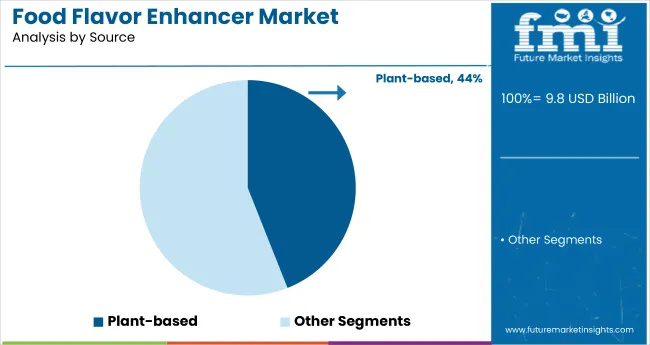

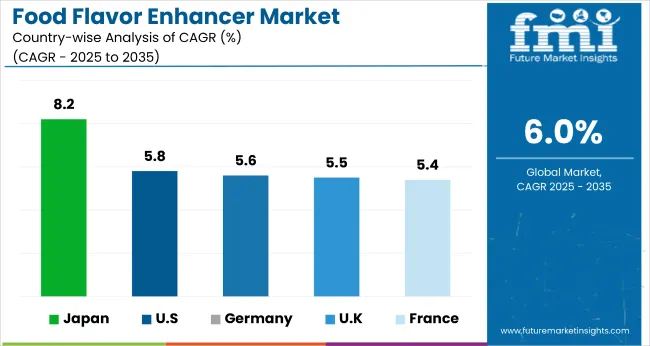

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 8.2% from 2025 to 2035. Glutamates will lead the product type segment with a 38% market share in 2025, while plant-based flavor enhancers will dominate the source segment with a 44% market share. The USA and UK markets are also expected to grow steadily at CAGRs of 5.8% and 5.5%, respectively. Germany and France will expand at CAGRs of 5.6% and 5.4%, respectively.

The global market is segmented by product type, source, application, and region. By product type, the market is divided into glutamates, hydrolyzed vegetable protein, yeast extract, and others (nucleotide-based enhancers, organic acids, spices, and flavor peptides). In terms of source, the market is categorized into plant-based, yeast, and seaweed.

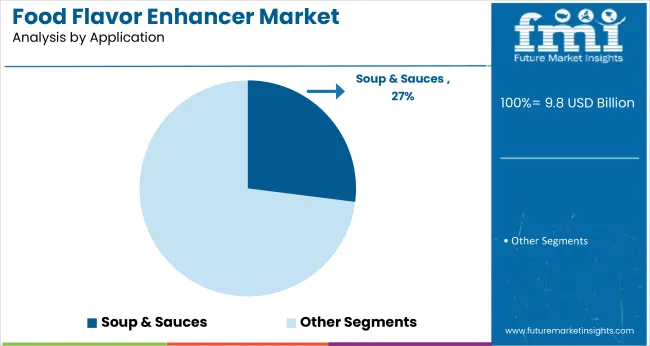

Based on application, the market is segmented into bakery & confectionery, soups & sauces, meat & seafood, ready meals, dairy products, and beverages. Regionally, the market is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

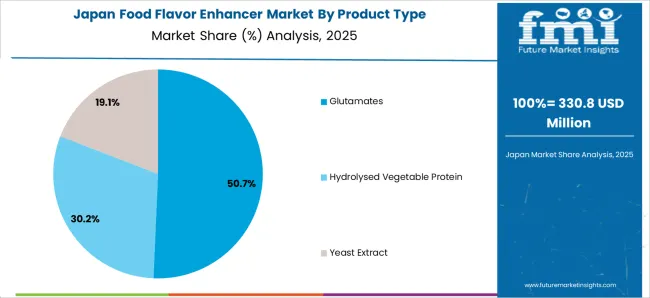

Glutamates are expected to dominate the product type segment with a 38% market share by 2025. Known for enhancing umami flavor, they are widely used in savory processed foods such as soups, sauces, and ready meals, making them a popular choice among manufacturers for taste enhancement and cost efficiency.

Plant-based flavor enhancers are projected to lead the source segment with a 44% market share in 2025. Growing consumer demand for vegan, natural, and clean-label products is driving this trend. Derived from herbs, vegetables, and plant extracts, these enhancers are increasingly replacing synthetic alternatives in processed and functional food applications.

Soups and sauces are expected to dominate the application segment, capturing 27% of the global market share by 2025. The rising demand for convenient meal solutions and enhanced taste profiles is driving the use of flavor enhancers in instant soups, gravies, cooking bases, and ready-to-eat sauce products across regions.

The global market is experiencing steady growth, driven by the increasing demand for clean-label, natural, and plant-based ingredients. Flavor enhancers play a vital role in improving taste, especially in reduced-fat, low-sodium, and vegan food products, aligning with evolving consumer health and dietary preferences.

Recent Trends in the Food Flavor Enhancer Market

Challenges in the Food Flavor Enhancer Market

Japan momentum in the global market is driven by its traditional emphasis on umami-rich ingredients and advanced food processing technologies. Germany and France continue to show consistent demand, backed by stringent EU food labeling laws and support for natural ingredient development. In contrast, developed economies such as the USA (5.8% CAGR), UK (5.5% CAGR), and Japan (8.2% CAGR) are expected to growsteadily at 0.91-1.37x of the global growth rate.

Japan is the fastest-growing market in the market, supported by strong demand for umami-rich, clean-label ingredients and fermented flavor bases. The USA follows, driven by rising consumption of processed, low-sodium, and plant-based foods. Germany and France show steady growth, backed by regulatory support for natural additives and functional formulations.

The UK records the slowest expansion, with momentum sustained by health-oriented reformulation in ready meals and strong demand from private-label brands. While all five countries are embracing plant-based and yeast-derived enhancers, Japan’s innovation-led growth contrasts with Europe’s regulation-driven market evolution and the United States’ focus on convenience and sodium reduction.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan food flavor enhancer market is growing at a CAGR of 8.2% from 2025 to 2035. Growth is fueled by strong domestic demand for umami-rich ingredients and ongoing reformulation in the processed food industry. Japan’s focus on FOSHU-compliant clean-label ingredients and high demand for fermented flavor bases supports expansion. Natural extracts from seaweed, soy, and yeast remain in high demand across instant soups and bento products.

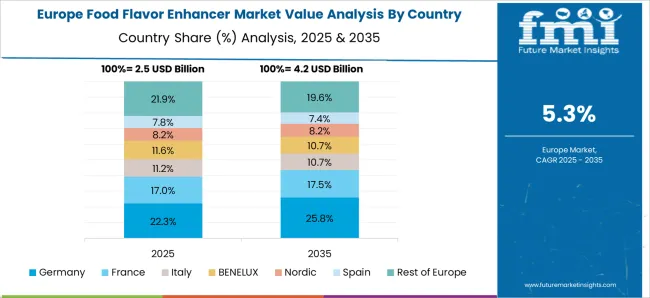

The sales of food flavor enhancers in Germany are expected to expandat 5.6% CAGR during the forecast period. The growth is driven by EU regulatory compliance for natural additives and the shift away from synthetic flavor enhancers. Key applications include dairy, processed meat, and plant-based foods. German manufacturers emphasize ingredient transparency and functional nutrition.

The French food flavor enhancer market is projected to grow at a 5.4% CAGR during the forecast period. Growth is led by national clean-label and food safety initiatives, with widespread demand in bakery, culinary sauces, and ready meals. Local companies are focusing on natural, organic-certified flavor enhancers.

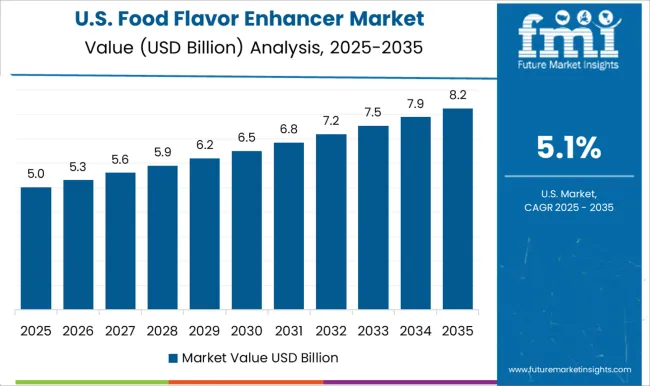

The USA food flavor enhancer market is projected to grow at 5.8% CAGR from 2025 to 2035, reflecting 0.97x the global pace. Demand is driven by rising consumption of processed and ready-to-eat foods, alongside consumer shift toward low-sodium and fortified food options. Plant-based and yeast-derived flavor enhancers are gaining momentum in soups, sauces, snacks, and convenience meals.

The UK food flavor enhancer revenue is projected to grow at a CAGR of 5.5% from 2025 to 2035, the slowest among the top OECD nations at 0.91 times the global pace. Growth is sustained by Public Health England’s salt reduction targets and demand in meal kits and private-label packaged foods. Clean-label claims and plant-sourced flavor enhancers are increasingly prioritized by major retailers and foodservice providers.

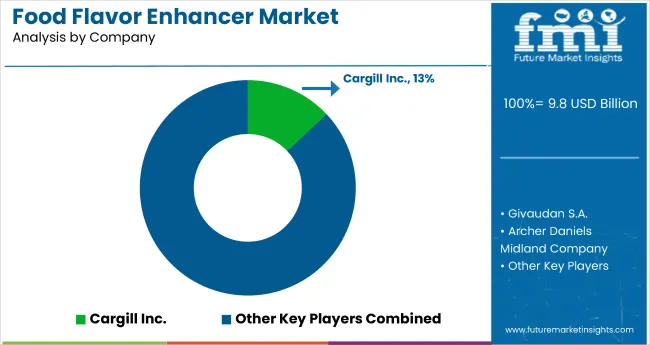

The global market is moderately consolidated, with key players such as Koninklijke DSM N.V., Cargill Inc., Ajinomoto Group, Givaudan S.A., and Kerry Group holding significant market shares. These companies offer a wide portfolio of flavor enhancer solutions tailored to the processed food, beverage, and foodservice industries.

Koninklijke DSM N.V. focuses on natural and plant-based flavor systems, while Cargill Inc. emphasizes sustainability and clean-label ingredients. Ajinomoto Group remains a global leader in glutamate production, particularly monosodium glutamate (MSG), and Givaudan S.A. delivers high-impact flavor enhancers based on botanical and fermented inputs. Kerry Group continues to expand its reach through innovation in taste modulation and sodium-reduction technologies.

Other notable players include B&G Foods Inc., Sensient Technologies Corporation, Archer Daniels Midland Company, A&B Ingredients, International Flavors and Fragrances, Bell Flavors & Fragrances, Scelta Mushrooms B.V., DPO International Sdn. Bhd., and Penta Manufacturing Company, who contribute specialized offerings ranging from yeast extracts to hydrolyzed vegetable proteins and umami-boosting ingredients.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.8 billion |

| Projected Market Size (2035) | USD 17.6 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/Volume in Metric Tons |

| Product Types Analyzed | Glutamates, Hydrolysed Vegetable Protein, Yeast Extract, Others (Nucleotides, Organic Acids, Enzyme-Modified Enhancers, Peptides) |

| Source Analyzed | Plant-based, Yeast, Seaweed |

| Application Analyzed | Bakery & Confectionery, Soup & Sauces, Meat & Seafood, Ready Meals, Dairy Products, Beverages |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Koninklijke DSM N.V., B&G Foods Inc., Sensient Technologies Corporation, Cargill Inc., Givaudan S.A., Ajinomoto Group, Archer Daniels Midland Company, Kerry Group, A&B Ingredients, International Flavors and Fragrances, Bell Flavors & Fragrances, Scelta Mushrooms B.V., DPO International Sdn . Bhd., and Penta Manufacturing Company. |

| Additional Attributes | Dollar sales by product type, share by source, regional demand growth, clean-label trends, sodium reduction initiatives, competitive benchmarking |

The global food flavor enhancer market is estimated to be valued at USD 9.8 billion in 2025.

The market size for the food flavor enhancer market is projected to reach USD 17.6 billion by 2035.

The food flavor enhancer market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in food flavor enhancer market are glutamates, hydrolysed vegetable protein and yeast extract.

In terms of source, plant-based segment to command 55.2% share in the food flavor enhancer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA