The Food Waste Disposal Equipment Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. A breakpoint analysis of the data shows two distinct growth phases over the decade, indicating periods of steady expansion followed by moderate acceleration. From 2025 to 2030, the market rises from USD 3.0 billion to USD 3.9 billion, adding USD 0.9 billion.

Annual increments during this period remain relatively consistent, ranging between USD 0.1 billion and USD 0.2 billion, suggesting stable adoption driven by commercial food service, institutional kitchens, and residential applications. This phase represents a baseline growth environment supported by gradual capacity additions and steady replacement demand. The second phase, from 2030 to 2035, records a more pronounced gain, increasing from USD 3.9 billion to USD 5.0 billion and adding USD 1.1 billion.

Annual growth accelerates slightly, with increments closer to USD 0.2-0.3 billion in the final years. This indicates a potential market inflection point tied to higher compliance with food waste regulations, technological upgrades, and expansion into emerging economies. The breakpoint appears around 2030, where growth momentum shifts upward. This transition suggests that strategic positioning before this point will enable suppliers to capture a larger share of the faster-growing second phase.

| Metric | Value |

|---|---|

| Food Waste Disposal Equipment Market Estimated Value in (2025 E) | USD 3.0 billion |

| Food Waste Disposal Equipment Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The food waste disposal equipment market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.6% of the global kitchen appliances market, driven by the need for efficient waste management in residential and commercial kitchens. Within the foodservice equipment industry, a share of approximately 3.4% is assessed due to widespread use in restaurants, hotels, and institutional facilities.

In the waste management technology sector, around 2.2% is observed reflecting integration of disposal units into broader waste handling systems. Within the household appliances market, about 2.8% is evaluated as adoption grows among urban households. In the environmental solutions and green technology segment, a contribution of roughly 1.9% is calculated supported by interest in reducing landfill waste and improving sanitation.

Market advancement has been influenced by the need for hygienic and space-efficient waste handling solutions. Innovations have focused on quieter motors, enhanced grinding mechanisms, and designs that handle a wider range of food scraps without clogging. Interest has been increasing in energy efficient models and those compatible with composting systems to align with waste diversion goals.

The North America region has been observed to dominate due to high penetration in residential kitchens, while Asia Pacific is showing rapid growth through expanding urban infrastructure and foodservice sectors. Strategic initiatives have included collaborations between appliance manufacturers and waste management firms to develop integrated disposal and recycling solutions with advanced filtration and odor control features.

Increasing urbanization and the global focus on reducing landfill dependency have intensified demand for technologically advanced, compact, and energy-efficient disposal systems.

Policy mandates related to food waste diversion, especially in developed economies, are pushing both residential users and institutional kitchens to adopt structured waste processing solutions. Moreover, innovation in processing technologies, coupled with incentives for composting and anaerobic digestion, is broadening the scope of deployment across households and hospitality sectors. The future of this market is expected to be shaped by integration with smart home systems, water-saving mechanisms, and decentralized waste valorization methods.

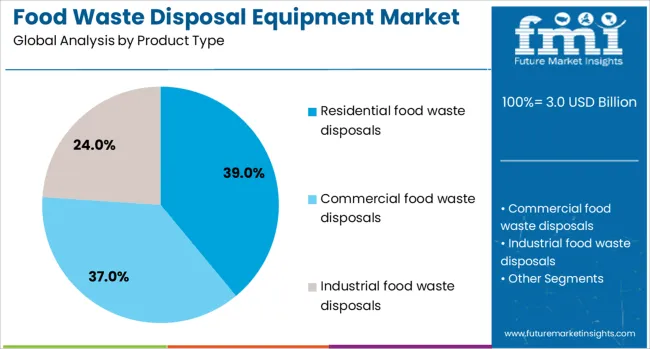

The food waste disposal equipment market is segmented by product type, technology, waste processing method, operations, capacity, end use, and geographic regions. The food waste disposal equipment market is divided by product type into Residential food waste disposals, Commercial food waste disposals, and Industrial food waste disposals.

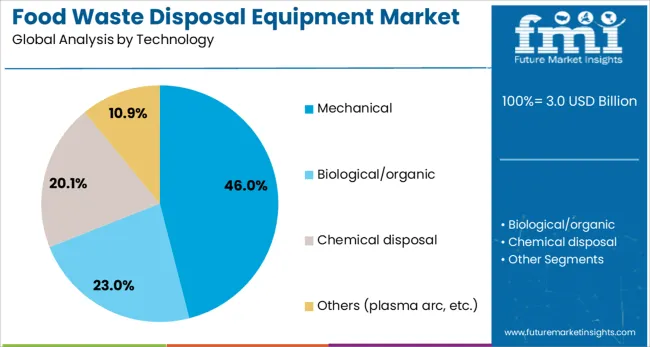

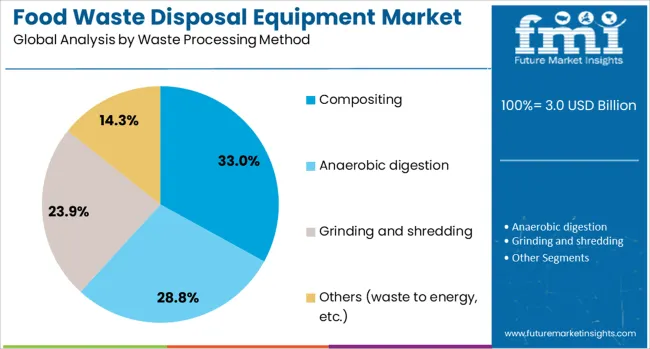

The food waste disposal equipment market is classified into Mechanical, Biological/organic, Chemical disposal, and Others (plasma arc, etc.). The food waste disposal equipment market is segmented into Composting, Anaerobic digestion, grinding and shredding, and Others (waste to energy, etc.).

The food waste disposal equipment market is segmented into Automatic and Manual. The food waste disposal equipment market is segmented into Mid (10kg - 50kg), Small (up to 10kg), and High (above 50kg). The food waste disposal equipment market is segmented by end use into Restaurants and food services, Household, Food processing industry, Hospitals, Schools, Corporate offices, and Others (prisons, etc.).

Regionally, the food waste disposal equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Residential food waste disposals are projected to account for 39.00% of the total market revenue in 2025, making them the leading product segment. This dominance is driven by increased consumer focus on hygiene, convenience, and sustainable living.

Compact design and compatibility with modern kitchen systems have enabled broad-scale adoption across urban households. Government rebates, mandatory waste segregation policies, and growing awareness about reducing organic waste in landfills have further accelerated residential adoption.

The proliferation of smart kitchen appliances has made integration seamless, while low-noise, energy-efficient models are appealing to eco-conscious consumers seeking sustainable waste management options at home.

Mechanical technology is anticipated to lead the market with a 46.00% share in 2025. The segment’s growth is attributed to its reliability, ease of maintenance, and lower operational costs compared to chemical or thermal methods.

Mechanical systems offer efficient grinding, shredding, and volume reduction capabilities, making them ideal for both home and institutional use. Their simple design and minimal resource consumption have made them the preferred choice for retrofitting in existing infrastructures.

Increasing product innovation in blade technology and noise reduction mechanisms has made mechanical systems more user-friendly, while compliance with municipal sewer disposal norms supports their widespread acceptance.

Composting is projected to account for 33.00% of the food waste disposal equipment market in 2025, emerging as the leading waste processing method. This trend is underpinned by growing policy support for organic waste recycling and the surge in consumer-led sustainability initiatives.

Composting is increasingly viewed as an eco-friendly alternative to incineration or landfill disposal, especially in regions enforcing circular economy policies. Technological advancements in home-scale composters and modular units for restaurants and institutions have improved adoption.

As soil restoration and community gardening projects gain traction, composting-based disposal solutions are being prioritized for their ability to convert waste into valuable biofertilizer, further promoting resource recovery.

Systems such as food grinders, dehydrators, composters, and pulpers have been deployed in residential, commercial, and industrial settings to reduce the volume of organic waste sent to landfills. Global foodservice growth, rising urban populations, and stricter waste diversion policies have created favorable conditions for adoption. Advances in processing capacity, noise reduction, and energy efficiency have improved the user experience. The combination of regulatory mandates, operational convenience, and environmental responsibility has driven market momentum and encouraged investments in modern disposal solutions.

Technological innovation has played a central role in transforming food waste disposal equipment into efficient and sustainable solutions. High-torque motors, optimized grinding plates, and corrosion-resistant materials have improved durability and operational efficiency. Smart sensor integration has enabled automated load detection, preventing mechanical overloads and reducing power consumption. Odor-control mechanisms and water-saving features have been incorporated to minimize environmental impact. Commercial composting systems with temperature and moisture regulation have accelerated decomposition while maintaining nutrient integrity in compost output. Compact and modular designs have facilitated installation in space-limited environments, expanding applicability. These advancements have positioned disposal units as integral components of sustainable waste management strategies for homes, restaurants, hotels, and industrial food processors.

Food waste disposal equipment has found broad application across multiple end-use sectors, each with specific operational demands. In residential settings, under-sink disposal units have been installed to improve kitchen hygiene by preventing odor and pest issues. Commercial kitchens in restaurants, hotels, hospitals, and institutional cafeterias have adopted high-capacity shredders and dehydrators to handle large volumes of waste efficiently. In the industrial segment, food processing plants have utilized large-scale pulpers and grinders to manage by-products while meeting regulatory compliance. Adoption has been supported by increasing landfill disposal costs and limited waste transport capacity. Product lines tailored to various capacities and waste compositions have expanded market accessibility, ensuring relevance across diverse usage environments.

Government-led initiatives have been instrumental in shaping the demand for food waste disposal equipment. Regulations restricting organic waste disposal in landfills have compelled both residential and commercial users to adopt on-site processing solutions. Many municipalities have introduced fines for non-compliance with waste segregation norms, encouraging proper use of disposal units. Incentives and subsidies for eco-friendly equipment purchases have been implemented in select regions. The integration of these systems into green building certification requirements has boosted installations in new construction projects. International guidelines promoting composting and anaerobic digestion have also contributed to rising demand. These policies have established food waste disposal equipment as a key tool in achieving landfill diversion and circular economy objectives.

Despite growth drivers, certain limitations have moderated market penetration. The high initial investment required for advanced equipment has been a deterrent for cost-sensitive users. Operational issues such as improper waste segregation can result in mechanical wear, breakdowns, and increased maintenance costs. Limited public awareness in developing regions regarding the environmental and cost-saving benefits of disposal equipment has slowed adoption. Infrastructure gaps in organic waste recycling facilities have hindered the integration of large-scale disposal systems. Furthermore, varying regulatory standards across regions have complicated market entry strategies for manufacturers. Addressing these barriers through product durability improvements, targeted consumer education, and flexible financing options has been recognized as critical for sustained market growth.

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

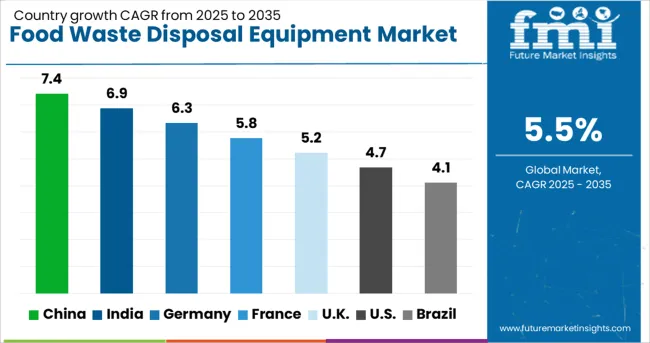

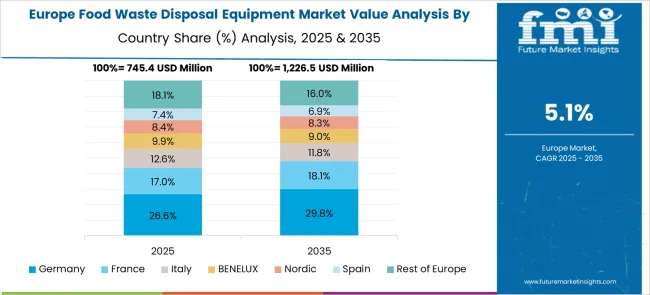

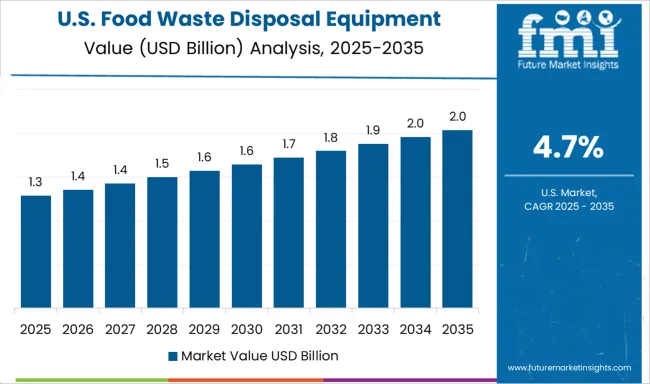

The food waste disposal equipment market is expected to grow at a global CAGR of 5.5% between 2025 and 2035, driven by increasing focus on waste reduction, rising adoption in commercial kitchens, and supportive waste management regulations. China leads with a 7.4% CAGR, supported by rapid urban infrastructure development and large-scale manufacturing capacity. India follows at 6.9%, fueled by expanding hospitality and foodservice sectors. Germany, at 6.3%, benefits from advanced waste processing technologies and strong environmental policies. The UK, projected at 5.2%, sees growth from restaurant and institutional adoption. The USA, at 4.7%, reflects steady demand from residential and commercial segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to record a CAGR of 7.4% from 2025 to 2035, supported by government initiatives to reduce landfill dependency and improve waste treatment efficiency. Domestic manufacturers like Midea Group and Supor are producing household and commercial units with advanced grinding technology and lower water usage. Urban housing developments are increasingly integrating built-in disposal units. Food service sectors, especially in large cities, are adopting high-capacity models to meet regulatory compliance. E-commerce platforms have also contributed to greater product awareness and accessibility.

India is projected to grow at a CAGR of 6.9% from 2025 to 2035, driven by expanding hospitality and food service industries. Companies like Hindware and Crompton are launching compact and energy-efficient models targeting urban households. Rising awareness of hygiene and odor control has increased adoption rates in premium residential projects. Hotels, restaurants, and catering units are investing in commercial-grade systems to comply with local waste management rules. Affordable pricing and retail expansion through e-commerce are helping to penetrate tier 2 and tier 3 markets.

Germany is expected to post a CAGR of 6.3% from 2025 to 2035, supported by stringent environmental standards and high consumer preference for eco-friendly technology. Players such as Franke GmbH and Blanco are introducing models with noise reduction, water efficiency, and enhanced safety features. Adoption is particularly strong in commercial kitchens that prioritize hygiene and sustainability. Integration with waste-to-energy systems is emerging as a key growth area. The market benefits from strong distribution through appliance retail chains and specialist dealers.

The United Kingdom is forecasted to expand at a CAGR of 5.2% from 2025 to 2035, with rising focus on reducing household food waste. Companies like InSinkErator UK and Rangemaster are offering energy-efficient and compact models tailored for smaller kitchens. Marketing campaigns emphasize hygiene benefits and ease of use. The hospitality industry is a growing consumer segment, particularly among restaurants seeking to lower disposal costs. Distribution through large appliance retailers and online platforms remains key for reaching both residential and commercial buyers.

The United States is anticipated to grow at a CAGR of 4.7% from 2025 to 2035, driven by high penetration in residential markets and steady adoption in food service industries. Leading brands such as InSinkErator and Waste King are focusing on quieter, more energy-efficient units with improved grinding capacity. Regulations in certain states promoting organic waste diversion are encouraging commercial adoption. Smart disposal units with sensors for load detection and maintenance alerts are gaining traction in high-end households.

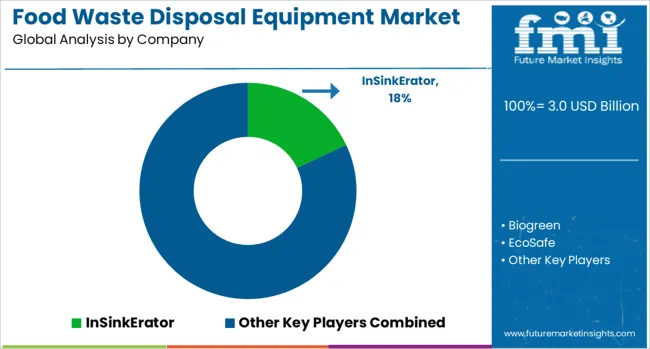

The food waste disposal equipment market is led by established appliance manufacturers and specialized waste management solution providers serving residential, commercial, and industrial sectors. InSinkErator, a subsidiary of Emerson Electric, dominates with a wide range of under-sink disposers for household and foodservice use. Waste King and Moen provide competitive offerings in the residential segment, focusing on powerful grinding systems and compact designs. Whirlpool Corporation and its brand KitchenAid supply premium disposers integrated into broader kitchen appliance portfolios, while GE Appliances targets mass-market consumers with reliable, cost-effective models.

On the commercial and industrial side, Ecoverse, Vermigold, and WasteX deliver large-scale organic waste processing systems, including dewatering units, biodigesters, and composting machines for foodservice, hospitality, and institutional facilities. Biogreen and EcoSafe emphasize eco-friendly waste treatment solutions, enabling on-site conversion of food waste into compost or energy feedstock.

Teka provides disposers and food waste management systems primarily for European and Asian markets, while SUEZ Recycling and Recovery offers integrated waste treatment services for municipalities and large facilities. Key strategies include expanding product lines with energy-efficient motors, integrating odor-control technologies, and developing on-site waste-to-resource systems for sustainability compliance. Entry into this market is limited by appliance durability standards, compliance with regional waste disposal regulations, and established relationships with distributors and kitchen equipment suppliers.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Product Type | Residential food waste disposals, Commercial food waste disposals, and Industrial food waste disposals |

| Technology | Mechanical, Biological/organic, Chemical disposal, and Others (plasma arc, etc.) |

| Waste Processing Method | Compositing, Anaerobic digestion, Grinding and shredding, and Others (waste to energy, etc.) |

| Operations | Automatic and Manual |

| Capacity | Mid (10kg - 50kg), Small (upto 10kg), and High (above 50kg) |

| End Use | Restaurants and food services, Household, Food processing industry, Hospitals, Schools, Corporate offices, and Others (prisons, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | InSinkErator, Biogreen, EcoSafe, Ecoverse, Emerson Electric, GE Appliances, KitchenAid, Moen, SUEZ Recycling and Recovery, Teka, Vermigold, Waste King, WasteX, and Whirlpool Corporation |

| Additional Attributes | Dollar sales by equipment type and end-use sector, demand dynamics across residential kitchens, commercial foodservice, and industrial processing, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in energy-efficient grinding systems, odor-control technology, and smart sensor integration, environmental impact of landfill diversion, energy recovery, and water usage, and emerging use cases in decentralized composting, anaerobic digestion integration, and waste-to-energy conversion solutions. |

The global food waste disposal equipment market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the food waste disposal equipment market is projected to reach USD 5.0 billion by 2035.

The food waste disposal equipment market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in food waste disposal equipment market are residential food waste disposals, commercial food waste disposals and industrial food waste disposals.

In terms of technology, mechanical segment to command 46.0% share in the food waste disposal equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA