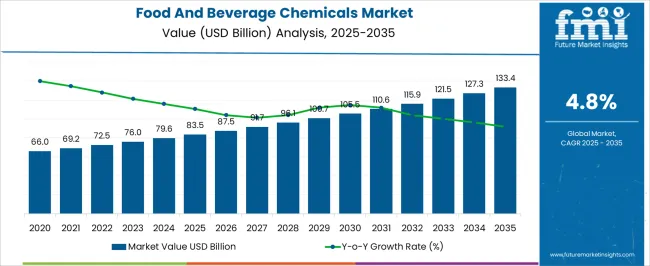

The Food And Beverage Chemicals Market is estimated to be valued at USD 83.5 billion in 2025 and is projected to reach USD 133.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Food And Beverage Chemicals Market Estimated Value in (2025 E) | USD 83.5 billion |

| Food And Beverage Chemicals Market Forecast Value in (2035 F) | USD 133.4 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Food and Beverage Chemicals market is showing steady growth, supported by increasing demand for processed foods, packaged beverages, and ready-to-eat meals across both developed and developing economies. Rising urbanization and evolving consumer lifestyles have created a growing reliance on food additives and chemicals that enhance product stability, flavor, and shelf life. Additionally, advancements in food processing technologies, coupled with innovations in chemical formulations, are expanding application areas and improving the quality of food and beverages.

Stringent safety standards and compliance with global food regulations are driving manufacturers to adopt chemicals with proven efficacy and safety profiles. Growing health consciousness is also influencing the demand for clean-label additives, leading to the development of chemicals that balance safety with functional performance.

Supply chain expansions, alongside increasing investment in sustainable production of food-grade chemicals, are further supporting market dynamics As the food and beverage industry continues to expand and adapt to changing consumer needs, the role of chemicals in ensuring consistency, quality, and preservation is expected to strengthen, making this market a critical component of global food security and innovation strategies.

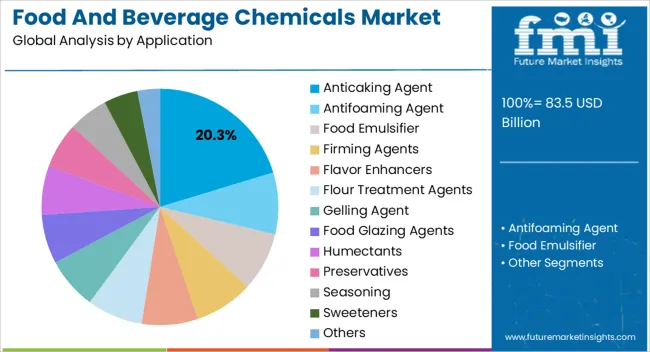

The food and beverage chemicals market is segmented by application, and geographic regions. By application, food and beverage chemicals market is divided into Anticaking Agent, Antifoaming Agent, Food Emulsifier, Firming Agents, Flavor Enhancers, Flour Treatment Agents, Gelling Agent, Food Glazing Agents, Humectants, Preservatives, Seasoning, Sweeteners, and Others. Regionally, the food and beverage chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anticaking agent application segment is projected to hold 20.3% of the Food and Beverage Chemicals market revenue share in 2025, underscoring its strong role in product quality management. Anticaking agents are widely utilized to prevent clumping and maintain the free-flowing nature of powdered or granulated food products, such as flour, milk powder, seasonings, and beverage mixes. Their use is particularly crucial in large-scale food manufacturing and packaging processes, where consistency and stability are essential for operational efficiency.

Growing consumption of processed foods and instant beverage products is reinforcing the need for these agents, as consumers increasingly demand convenience without compromising product quality. The ability of anticaking agents to improve handling, packaging, and shelf stability provides manufacturers with significant cost and operational advantages.

Additionally, continuous innovations in food-safe anticaking formulations are ensuring compliance with health and safety standards while meeting consumer expectations for quality and reliability As global demand for convenience foods continues to rise, the anticaking agent segment is expected to maintain strong growth momentum, driven by both industrial requirements and consumer consumption patterns.

The list of added chemicals and additives on the food and beverage labels often reads bewildering. Even though the food and beverage chemicals are habitually thought of as harmful substances, knowing their advantages and disadvantages for certain applications, manufacturers make wise, healthy, and safe food choices for their use.

Food and beverage chemicals reserve shelf life by eliminating or reducing the growth of microorganisms causing the food decay. With growing health concerns, consumers demand for food and beverage supply which is nutritious, flavored, convenient, safe, and affordable. The consumers are also willing to pay premium prices for nutritious and safe food and beverage products.

The addition of certain chemicals to food and beverage products in an appropriate manner and quantity, makes the products very desirable among consumers. The addition of such chemicals in the food and beverage products can be done either intentionally or indirectly by using some other means.

There exist both pros and cons of these chemicals based on their application which may directly or indirectly be proven harmful for humans. Therefore, it is mandatory to add only those chemicals which are suitable for human consumption and are thoroughly checked and certified by the regulating authorities.

The chemicals used in the food and beverage industry are very specific in their application and their uses vary significantly based on their physical and chemical properties.

The uses of food and beverage chemicals include– to increase the processing rate, extend the product shelf life, maintain product consistency, assurance of microbiological safety, improvement and maintaining nutritional value or to enhance the organoleptic qualities (flavor, texture and color) of the final finished products.

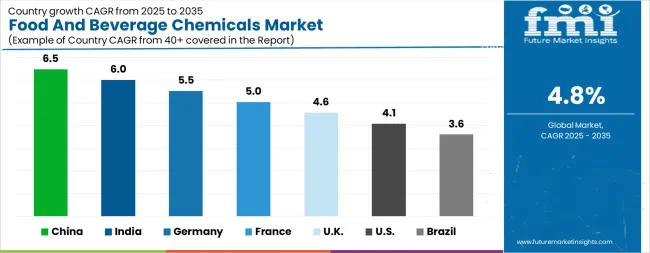

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The Food And Beverage Chemicals Market is expected to register a CAGR of 4.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.5%, followed by India at 6.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.6%, yet still underscores a broadly positive trajectory for the global Food And Beverage Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.5%. The USA Food And Beverage Chemicals Market is estimated to be valued at USD 31.6 billion in 2025 and is anticipated to reach a valuation of USD 47.2 billion by 2035. Sales are projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 4.2 billion and USD 2.6 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 83.5 Billion |

| Application | Anticaking Agent, Antifoaming Agent, Food Emulsifier, Firming Agents, Flavor Enhancers, Flour Treatment Agents, Gelling Agent, Food Glazing Agents, Humectants, Preservatives, Seasoning, Sweeteners, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

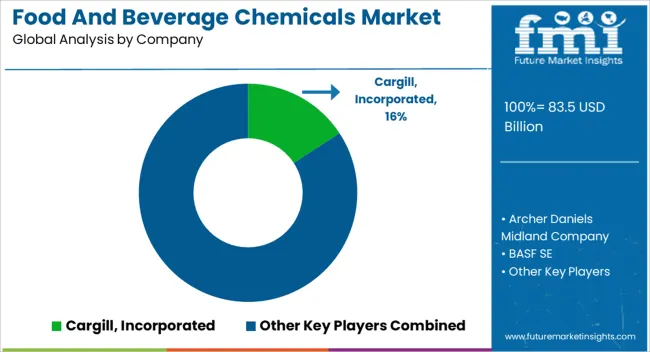

| Key Companies Profiled | Cargill, Incorporated, Archer Daniels Midland Company, BASF SE, DuPont de Nemours, Inc., Kerry Group plc, Tate & Lyle PLC, Ingredion Incorporated, Givaudan SA, International Flavors & Fragrances Inc., Corbion N.V., Royal DSM N.V., Firmenich SA, and Symrise AG |

The global food and beverage chemicals market is estimated to be valued at USD 83.5 billion in 2025.

The market size for the food and beverage chemicals market is projected to reach USD 133.4 billion by 2035.

The food and beverage chemicals market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in food and beverage chemicals market are anticaking agent, antifoaming agent, food emulsifier, firming agents, flavor enhancers, flour treatment agents, gelling agent, food glazing agents, humectants, preservatives, seasoning, sweeteners and others.

In terms of , segment to command 0.0% share in the food and beverage chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Protective Cultures Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Microalgae Market - Demand & Future Innovations 2025 to 2035

Analysis and Growth Projections for Food and Beverage Additive Market

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Food & Beverage Disinfection Market – Safety & Industry Trends 2025 to 2035

Food and Beverage Air Filtration Market Analysis by Filter Type, End Use, and Region Through 2035

Demand for Food & Beverage OEE Software in USA Size and Share Forecast Outlook 2025 to 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Natural Food and Beverage Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fermented Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Insulated Food and Beverage Carriers Market

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Food and Grocery Retail Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Food Tins And Drink Cans Market by Product Type, Material, Packaging, End User & Region - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA