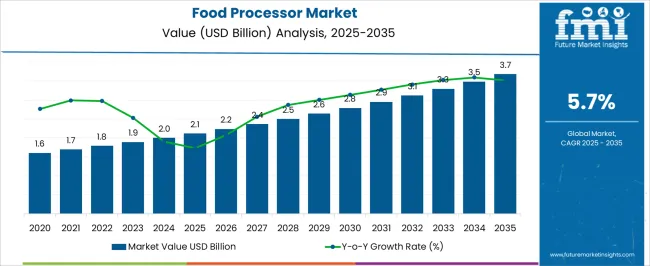

The food processor market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

Over the forecast period, the market is anticipated to witness growth driven by shifting consumer lifestyles, rising interest in home cooking, and increasing adoption of multifunctional kitchen appliances. In the initial five-year block from 2025 to 2030, growth is expected to be steady as consumers upgrade older models and invest in compact, efficient devices suitable for small households. Mid-decade, from 2030 to 2035, expansion accelerates due to rising demand for appliances with advanced functionalities, including chopping, blending, kneading, and food preservation features, as well as smart connectivity options. Manufacturers are increasingly focusing on ergonomic designs, energy efficiency, and easy-to-clean components to attract time-conscious urban consumers.

Online retail channels, direct-to-consumer sales, and bundled promotions are enhancing product accessibility and driving adoption. Regional penetration is rising in emerging markets, where disposable incomes and interest in modern cooking practices are steadily increasing. The market also benefits from collaborative innovations with accessory suppliers, recipe app integrations, and safety-certified components, providing differentiated offerings that appeal to health-conscious and convenience-seeking consumers worldwide

The food processor market is strongly influenced by five interrelated parent markets, each contributing uniquely to demand and growth. The home kitchen appliance market holds the largest share at 40%, as consumers increasingly adopt multifunctional food processors for chopping, blending, kneading, and pureeing, enhancing convenience and efficiency in daily cooking routines.

The small household and compact living segment contributes 25%, with urban apartments and smaller homes favoring space-saving, versatile appliances that replace multiple single-use devices. The professional and commercial kitchen market accounts for 15%, where restaurants, cafes, and catering services rely on high-capacity, durable processors to streamline meal preparation and maintain consistent quality. The retail and e-commerce distribution market holds a 12% share, facilitating product accessibility, online reach, and promotions that drive consumer adoption across geographies.

The appliance maintenance, repair, and spare parts market represents 8%, supporting longevity, warranty services, and component replacements to ensure operational reliability. Collectively, the home, small household, and commercial segments account for 80% of overall demand, highlighting that convenience, multifunctionality, and professional-grade performance remain the primary growth drivers, while retail and aftermarket services support continuous market expansion globally.

| Metric | Value |

|---|---|

| Food Processor Market Estimated Value in (2025 E) | USD 2.1 billion |

| Food Processor Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The food processor market is expanding steadily, supported by shifting consumer lifestyles, increasing demand for multifunctional kitchen appliances, and greater emphasis on convenience in food preparation. Industry announcements and appliance manufacturer reports have highlighted a growing consumer preference for devices that can handle multiple tasks such as chopping, blending, slicing, and kneading in one unit.

Urbanization, rising disposable incomes, and the popularity of home cooking trends have further fueled demand across residential and commercial segments. Technological advancements, including improved motor efficiency, enhanced safety features, and easy-to-clean designs, have strengthened product appeal.

Additionally, the availability of a broad range of models catering to different capacities and price points has widened the consumer base. E-commerce growth and strong retail distribution networks have increased product accessibility. Over the coming years, the market’s trajectory is expected to be driven by full-sized models offering extensive functionality, electric operation for consistent performance, and mid-range capacities that balance versatility with space efficiency.

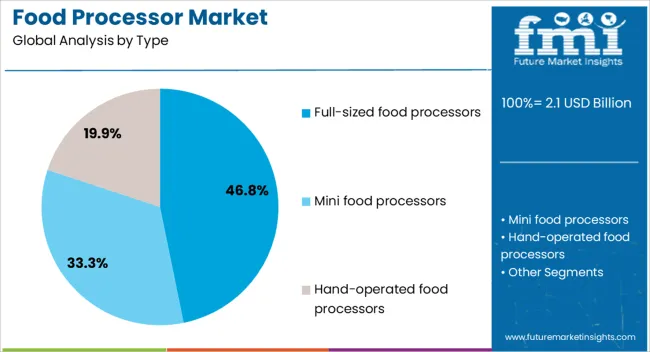

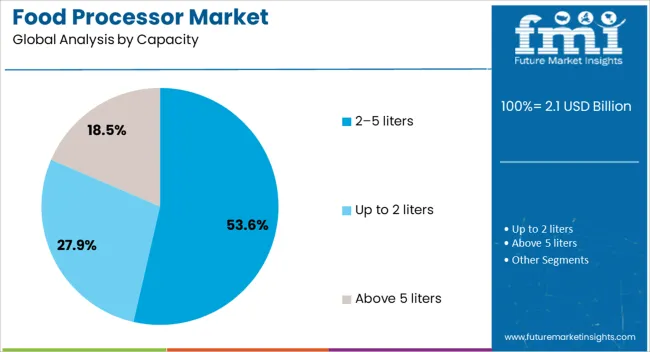

The food processor market is segmented by type, mode of operation, capacity, application, price, distribution channel, and geographic regions. By type, food processor market is divided into full-sized food processors, mini food processors, and hand-operated food processors. In terms of mode of operation, food processor market is classified into electric and manual. Based on capacity, food processor market is segmented into 2–5 liters, up to 2 liters, and above 5 liters. By application, food processor market is segmented into residential and commercial. By price, food processor market is segmented into medium, low, and high. By distribution channel, food processor market is segmented into online and offline. Regionally, the food processor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The full-sized food processors segment is projected to account for 46.8% of the food processor market revenue in 2025, maintaining its position as the leading type category. This dominance is attributed to their ability to perform a wide range of food preparation tasks with larger bowl capacities and more powerful motors, making them suitable for bulk cooking.

Consumer preference for appliances that reduce kitchen workload while ensuring consistent results has strengthened demand for full-sized models. Manufacturers have focused on adding interchangeable attachments and advanced control settings, enhancing the versatility and precision of these units.

Furthermore, durability and long service life have made full-sized food processors a preferred investment for households and small food businesses. As culinary trends continue to emphasize homemade meals and diverse cuisines, the demand for high-capacity, multifunctional processors is expected to sustain the segment’s leading share.

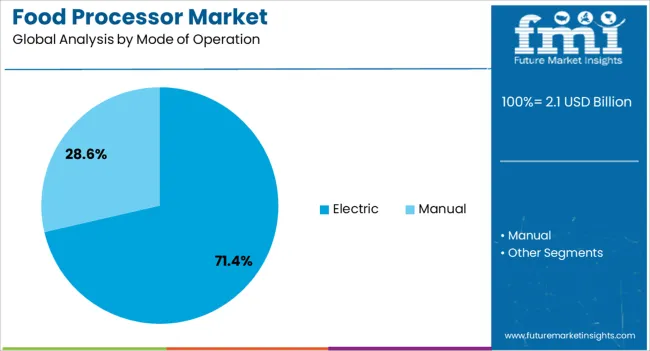

The electric segment is projected to hold 71.4% of the food processor market revenue in 2025, reflecting its dominance in both household and commercial kitchens. Growth in this segment has been supported by the convenience and efficiency electric food processors provide, enabling consistent performance across a variety of food types and textures.

Appliance industry reports have noted that electric operation allows for advanced features such as variable speed settings, pulse functions, and programmable modes, enhancing control over food preparation.

The increasing availability of compact yet powerful electric models has broadened their appeal to urban consumers with limited kitchen space. Additionally, advancements in energy-efficient motor technology have improved sustainability without compromising performance. With time-saving capabilities and user-friendly operation, electric food processors are expected to remain the most widely adopted mode of operation in the market.

The 2–5 liters segment is projected to capture 53.6% of the food processor market revenue in 2025, leading the capacity-based categorization. This range has been favored for its balance between accommodating medium-to-large food quantities and maintaining manageable appliance size for countertop use.

Households and small foodservice operators have preferred this capacity as it supports a variety of recipes without requiring excessive storage space. Manufacturers have introduced 2–5 liter models with enhanced bowl materials, safety interlocks, and multifunctional blade systems, improving durability and versatility.

Retail sales data has shown this segment’s consistent popularity due to its adaptability for daily use, from quick meal prep to larger gatherings. As consumer demand for efficient, space-conscious kitchen appliances grows, the 2–5 liters capacity segment is expected to maintain its leadership in the market.

The food processor market is expanding due to multifunctionality, e-commerce access, health-focused meal trends, and commercial adoption. Convenience, performance, and versatility are key growth drivers globally.

The food processor market is experiencing strong growth due to consumer preference for multifunctional appliances that combine chopping, slicing, blending, and kneading in a single device. Households are seeking solutions that reduce cooking time and improve meal preparation efficiency. Compact designs that can handle multiple kitchen tasks appeal to millennials and busy professionals looking for convenience without compromising performance. The demand is also rising for appliances with customizable speed settings, safety features, and easy-to-clean components. Manufacturers are developing models with enhanced capacity, motor power, and durable construction to cater to both home users and semi-professional kitchens. This trend is driving higher adoption rates across urban, semi-urban, and tier-2 cities globally.

E-commerce platforms and organized retail channels are significantly contributing to the growth of the food processor market. Online marketplaces provide extensive product visibility, customer reviews, and competitive pricing, which influence purchase decisions. Retail expansion, including specialty kitchen stores and large-format appliance outlets, enhances accessibility for consumers seeking hands-on evaluation. Promotions, bundled offers, and seasonal sales increase adoption rates. International and domestic brands leverage omnichannel strategies to reach diverse demographics, combining online convenience with offline demonstrations. Increasing penetration of mobile commerce and digital payments facilitates easier transactions, particularly in emerging economies. Retailers also provide post-sales support, warranty registration, and maintenance guidance, enhancing consumer trust and brand loyalty in the market.

Consumers are increasingly focused on preparing fresh, homemade, and nutritious meals, which drives demand for food processors. Health-conscious households prefer appliances that enable preparation of smoothies, purees, nut butters, and vegetable-based meals efficiently. The rise of plant-based diets, low-sodium cooking, and allergen-free meal preparation is boosting the adoption of versatile processors. Manufacturers are responding with BPA-free, dishwasher-safe materials, and high-speed motors capable of processing diverse ingredients. Compact and portable units allow households to easily integrate healthy meal preparation into daily routines. This trend is particularly strong among urban millennials, working parents, and fitness enthusiasts, influencing product design and marketing strategies in both developed and emerging regions.

Commercial and semi-professional kitchens, including restaurants, cafes, and catering businesses, are driving demand for high-capacity food processors. These establishments require durable, reliable, and energy-efficient appliances that can handle large volumes with consistent performance. Heavy-duty motors, extended duty cycles, and multiple attachment options are critical for operational efficiency. The growing foodservice industry, including cloud kitchens and meal-prep businesses, further boosts adoption of industrial-grade processors. Suppliers are offering products with maintenance support, spare parts availability, and warranty coverage to meet professional needs. Rising entrepreneurship in the food and beverage sector is creating a market for semi-professional units tailored for small-scale commercial operations, blending affordability with performance.

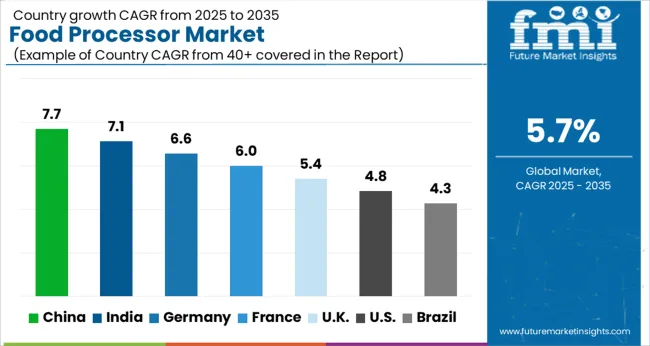

| Countries | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

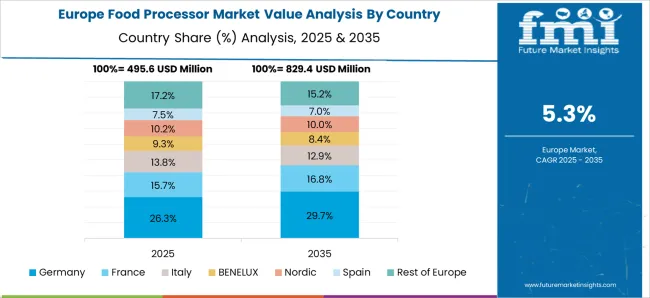

The global food processor market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads at 7.7%, followed by India at 7.1%, France at 6.0%, the UK at 5.4%, and the USA at 4.8%. Growth is driven by rising consumer demand for multifunctional kitchen appliances, increasing health-conscious cooking trends, and higher disposable incomes. BRICS countries, especially China and India, exhibit rapid adoption due to expanding urban households, growing middle-class populations, and a surge in online and offline retail penetration. OECD nations, including France, the UK, and the USA, focus on advanced designs, durable materials, and high-performance appliances that enhance convenience and efficiency in home kitchens. The analysis spans over 40+ countries, with the leading markets highlighted below.

The food processor market in China is projected to grow at a CAGR of 7.7% from 2025 to 2035, fueled by increasing demand for multifunctional kitchen appliances in urban households and expanding middle-class populations. Rising awareness of healthy cooking and meal preparation at home is boosting adoption of food processors capable of chopping, blending, kneading, and juicing. E-commerce and organized retail channels are enhancing accessibility, while domestic manufacturers are investing in R&D to improve durability, energy efficiency, and user-friendly features. Collaborations with global brands support design innovation and compliance with international safety standards. Culinary schools and cooking workshops are also promoting home appliance adoption through practical demonstrations and training programs.

The food processor market in India is expected to expand at a CAGR of 7.1% from 2025 to 2035, driven by growing urbanization, rising disposable incomes, and changing cooking habits. Consumers are increasingly seeking appliances that simplify meal preparation, including chopping, blending, grinding, and kneading functions. The surge in nuclear and single-person households is boosting demand for compact, lightweight, and easy-to-clean models. Retail and online platforms are enhancing product accessibility, while domestic brands are focusing on cost-effective solutions with extended warranties. Regional taste preferences, such as masala grinding and wet/dry processing, are influencing product features and attachments. Cooking shows, influencer marketing, and in-store demonstrations further drive awareness and adoption.

The food processor market in France is projected to grow at a CAGR of 6.0% from 2025 to 2035, led by consumer preference for premium and efficient kitchen appliances. Busy lifestyles and health-conscious cooking trends are encouraging the adoption of appliances capable of multiple functions, including slicing, blending, and dough kneading. French consumers value design aesthetics, noise reduction, and energy efficiency, driving manufacturers to innovate with compact, stylish, and eco-friendly models. Supermarkets, specialty kitchen stores, and e-commerce platforms are expanding distribution, while appliance rental and trial programs enhance product visibility. Collaborations between local chefs, culinary schools, and brands are promoting product utility and versatility in daily meal preparation.

The food processor market in the UK is expected to grow at a CAGR of 5.4% from 2025 to 2035, driven by rising health awareness, increased home cooking, and demand for versatile appliances. Consumers are adopting machines capable of blending, chopping, grinding, and kneading to streamline meal preparation. The popularity of plant-based diets and DIY recipes further supports market growth. Retailers are introducing bundled offers, extended warranties, and promotional discounts to attract consumers. Online platforms and home delivery services are improving accessibility and convenience. Manufacturers are focusing on lightweight, easy-to-clean, and noise-reduced models to cater to compact urban kitchens and busy lifestyles.

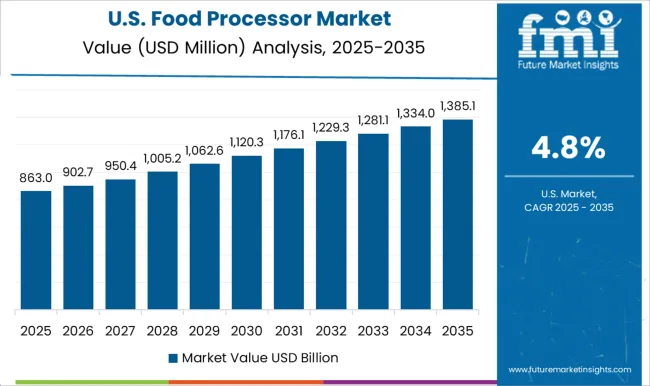

The food processor market in the USA is projected to expand at a CAGR of 4.8% from 2025 to 2035, fueled by rising adoption of home-cooking appliances and multifunctional kitchen solutions. Busy lifestyles and growing health awareness are driving demand for devices that perform chopping, slicing, blending, and kneading functions. Retailers, including big-box stores, specialty kitchen shops, and e-commerce platforms, are offering wide product assortments, product demonstrations, and installation guidance. Manufacturers are innovating with smart technology, quieter motors, and energy-efficient appliances. Online reviews, influencer marketing, and cooking tutorials contribute to informed consumer choices, while subscription-based recipe kits integrated with appliance use are increasing engagement and repeat purchases.

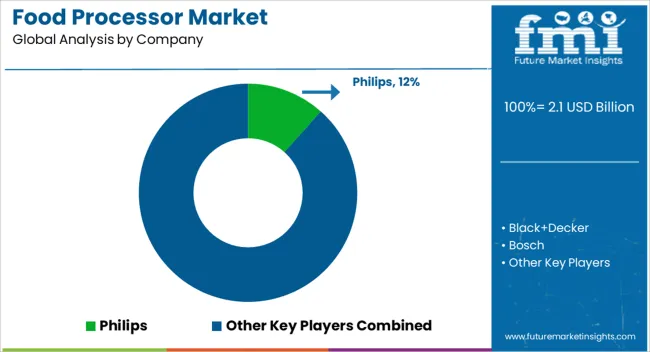

Competition in the food processor market is defined by multifunctionality, durability, and user convenience. Philips leads with versatile, high-performance processors emphasizing energy efficiency, ease of cleaning, and robust build quality suitable for home and professional kitchens. Black+Decker and Bosch compete through compact, ergonomic designs with multiple attachments, including chopping, blending, slicing, and kneading functionalities, targeting space-conscious consumers. Braun differentiates with precision-engineered blades, quiet motors, and sleek aesthetics, appealing to design-focused households. Breville, Cuisinart, and KitchenAid focus on premium segments, offering high-capacity, multifunctional units with durable stainless-steel components and smart controls to cater to culinary enthusiasts and small commercial kitchens. Mid-tier and regional players such as Electrolux, Hamilton Beach, Kenwood, Magimix, Moulinex, Ninja, Oster, and Panasonic differentiate through affordability, energy-efficient motors, and specialized functions such as dough kneading, nut grinding, or smoothie preparation.

Strategies emphasize product versatility, safety features, easy maintenance, and broad compatibility with kitchen recipes. Bundled attachments, modular designs, and intuitive controls are marketed to enhance consumer experience and adoption. Collaborations with culinary schools, influencer campaigns, and online tutorials are leveraged to demonstrate product functionality and promote brand loyalty. Product brochure content is precise and technical. Processors are described with motor wattage, blade material, bowl capacity, attachment types, speed settings, and noise levels. Safety mechanisms, cleaning instructions, storage solutions, and warranty information are detailed. Variants for home kitchens, professional use, and small-scale commercial operations are offered, highlighting multifunctional capabilities and ease of use. Accessories such as additional blades, juice presses, and dough hooks are included. Brochures emphasize ergonomic design, energy efficiency, and durability, reflecting a market focused on performance, versatility, and user-centric innovation in food preparation appliances.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 billion |

| Type | Full-sized food processors, Mini food processors, and Hand-operated food processors |

| Mode of Operation | Electric and Manual |

| Capacity | 2–5 liters, Up to 2 liters, and Above 5 liters |

| Application | Residential and Commercial |

| Price | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Philips, Black+Decker, Bosch, Braun, Breville, Cuisinart, Electrolux, Hamilton Beach, Kenwood, KitchenAid, Magimix, Moulinex, Ninja, Oster, and Panasonic |

| Additional Attributes | Dollar sales, share, CAGR by region, top-selling models, feature trends, consumer preferences, distribution channels, pricing strategies, competitive landscape, and emerging product innovations, adoption rates, and growth opportunities. |

The global food processor market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the food processor market is projected to reach USD 3.7 billion by 2035.

The food processor market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in food processor market are full-sized food processors, mini food processors and hand-operated food processors.

In terms of mode of operation, electric segment to command 71.4% share in the food processor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Food Processors Market

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA