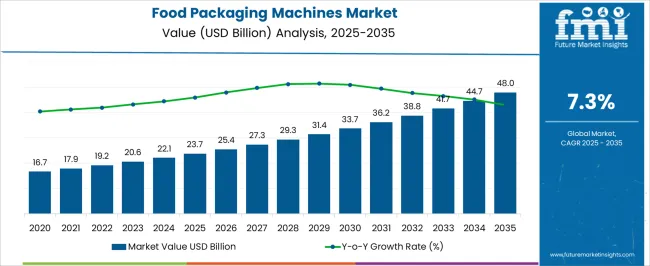

The food packaging machines market is expected to grow from USD 23.7 billion in 2025 to USD 48.0 billion by 2035, registering a 7.3% CAGR and generating an absolute dollar opportunity of USD 24.3 billion. Growth is driven by increasing demand for processed and packaged foods, rising adoption of automation in food production, and the need for improved shelf life, hygiene, and efficiency in packaging operations.

Technological advancements in automated filling, sealing, labeling, and robotics further enhance operational productivity and product consistency, supporting global market expansion. A 10-year growth comparison highlights differences in market performance between the first and second halves of the forecast period. From 2025 to 2030, growth is steady but moderate, contributing approximately USD 11.5 billion to the overall opportunity. Early adoption is led by North America and Europe, where food safety regulations, modernization of packaging lines, and replacement of conventional machines drive incremental revenue.

Between 2031 and 2035, growth accelerates, adding the remaining USD 12.8 billion, as Asia Pacific, Latin America, and the Middle East expand food processing capacity, urban consumption, and e-commerce-driven packaged food demand. The overall multiplication factor over the decade is 2.03x, reflecting consistent market expansion. This comparison highlights how early adoption in mature markets lays the groundwork, while later accelerated adoption in emerging economies amplifies revenue potential, providing a clear trajectory for the food packaging machines market from 2025 to 2035.

| Metric | Value |

|---|---|

| Food Packaging Machines Market Estimated Value in (2025 E) | USD 23.7 billion |

| Food Packaging Machines Market Forecast Value in (2035 F) | USD 48.0 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The food packaging machines market is primarily driven by the packaged food and beverage sector, which accounts for around 44% of the market share, as automated machines are essential for sealing, wrapping, and portioning products to ensure safety and shelf life. The dairy and frozen foods segment contributes about 26%, deploying specialized packaging solutions for milk, cheese, ice cream, and frozen meals. The bakery and confectionery industry represents close to 15%, using machines for automated wrapping, bagging, and tray packaging. Meat, poultry, and seafood processing accounts for roughly 10%, where vacuum and modified atmosphere packaging are critical for preservation.

The remaining 5% comes from ready-to-eat meals, snacks, and catering services requiring efficient, hygienic, and high-speed packaging solutions. The market is advancing with innovations in automation, digital controls, and sustainable materials. Multi-functional machines capable of filling, sealing, labeling, and coding are gaining adoption to improve efficiency and reduce labor costs. Integration with IoT and smart factory systems enables real-time monitoring, predictive maintenance, and data-driven optimization. Eco-friendly packaging solutions using recyclable or biodegradable films are increasingly implemented. Manufacturers are focusing on compact, modular designs suitable for diverse production scales. Rising demand for packaged foods, stringent hygiene regulations, and growing consumer preference for convenience continue to drive global food packaging machine adoption.

The food packaging machines market is expanding steadily due to rising global food demand, changing consumption habits, and the growing need for hygienic, efficient, and sustainable packaging solutions. Increasing urbanization, growth in organized retail, and the surge in ready-to-eat and processed food consumption are driving equipment upgrades across the food sector.

Manufacturers are investing in automation, flexibility, and energy-efficient technologies to meet stringent food safety standards and improve production throughput. Demand is particularly strong in emerging economies where food manufacturing capacity is rising alongside investments in infrastructure.

The push toward eco-friendly packaging materials is further influencing the design and functionality of packaging machines. As food producers focus on maximizing shelf life, minimizing waste, and improving product presentation, the demand for technologically advanced packaging machines is expected to maintain upward momentum across various food categories

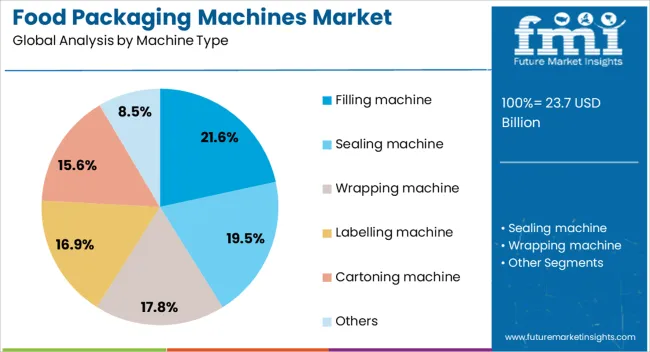

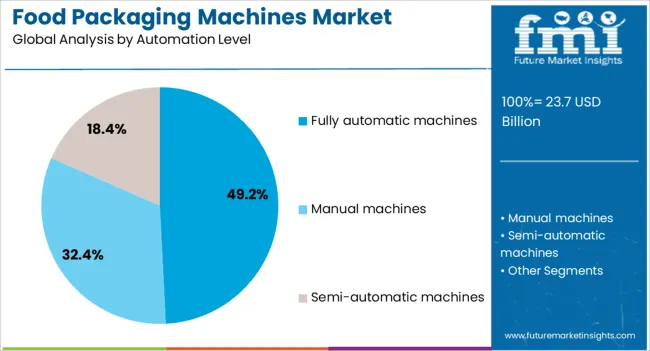

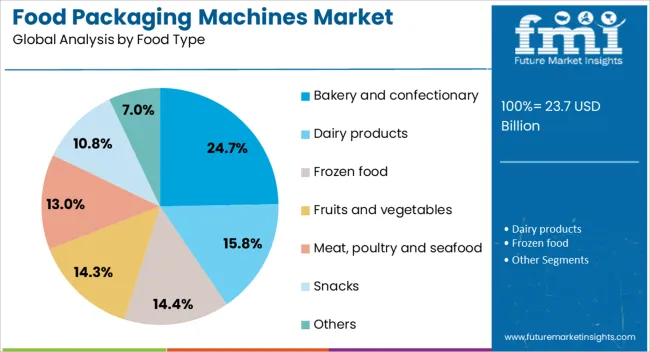

The food packaging machines market is segmented by machine type, automation level, food type, packaging format, packaging material, and geographic regions. By machine type, food packaging machines market is divided into Filling machine, Sealing machine, Wrapping machine, Labelling machine, Cartoning machine, and Others. In terms of automation level, food packaging machines market is classified into Fully automatic machines, Manual machines, and Semi-automatic machines.

Based on food type, the food packaging machines market is segmented into Bakery and confectionery, Dairy products, Frozen food, Fruits and vegetables, Meat, poultry and seafood, Snacks, and Others. By packaging format, the food packaging machines market is segmented into Pouches, Bags, Bottles, Cans, Cartons, and Others. By packaging material, the food packaging machines market is segmented into Plastic, Glass, Metal, Paperboard, and Others. Regionally, the food packaging machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The filling machine segment represents 22% of the food packaging machines market, driven by its versatility and critical role in maintaining product hygiene and accuracy during packaging. These machines are essential for a wide variety of food products, ranging from liquids to powders and semi-solids, ensuring precise portion control and minimizing product loss.

Their popularity stems from adaptability across multiple food categories and integration with high-speed production lines. Manufacturers continue to enhance machine capabilities with features such as automated cleaning systems, servo-driven controls, and compatibility with eco-friendly packaging.

The segment benefits from increasing demand for packaged beverages, sauces, dairy, and ready meals, which require consistent and contamination-free filling processes. As food companies seek to optimize operational efficiency and comply with regulatory standards, filling machines are expected to remain a staple in both large-scale and mid-sized processing plants.

Fully automatic machines hold a leading 49% market share within the automation level category, reflecting a strong industry shift toward speed, precision, and labor cost reduction. These machines offer comprehensive functionalities such as filling, sealing, labeling, and coding, all within a single integrated system, making them ideal for high-volume operations.

Adoption is especially pronounced in regions where labor shortages and rising wages necessitate advanced automation. In addition to reducing human error, fully automatic machines improve food safety by limiting manual intervention and ensuring consistent product output.

Recent technological enhancements, including IoT integration and real-time monitoring, are boosting productivity and enabling predictive maintenance. The segment is set to grow further as food manufacturers across developed and developing regions pursue smart manufacturing initiatives and invest in scalable, efficient packaging solutions to meet increasing consumer demand.

The bakery and confectionery segment accounts for 25% of the food packaging machines market, supported by high consumption levels and the need for visually appealing and shelf-stable packaging. These products often require specialized packaging that preserves freshness, texture, and flavor while offering attractive branding on shelves.

Packaging machinery in this segment must accommodate varied shapes, sizes, and delicate handling requirements, driving the need for flexible and customizable systems. Growth in premium and artisanal baked goods, along with seasonal confectionery products, continues to expand the scope of automation within this category.

Manufacturers are increasingly incorporating features such as nitrogen flushing and resealable packaging options to extend shelf life and enhance consumer convenience. As consumer interest in packaged snacks, pastries, and chocolates rises, demand for efficient and high-speed machines in this segment is expected to maintain strong momentum.

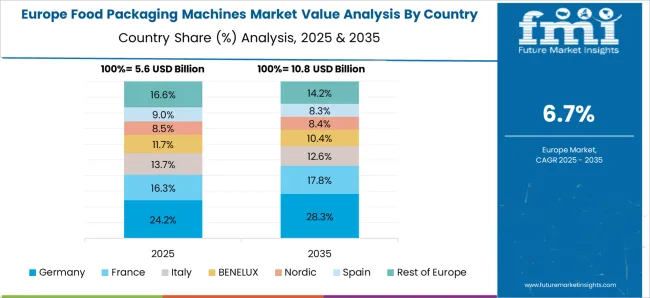

The global food packaging machines market is expanding due to rising demand from processed food, beverages, dairy, and bakery sectors. Growth is driven by the need for automation, shelf-life extension, and contamination prevention. Asia Pacific dominates with over 45% of global installations, driven by rising food processing facilities and e-commerce growth. Europe and North America focus on high-speed, automated, and sustainable packaging solutions. Technological innovations in vacuum packaging, form-fill-seal machines, and intelligent labeling systems improve efficiency. Increasing consumer preference for convenience, ready-to-eat meals, and hygienic packaging further boosts market adoption globally.

The primary driver of the food packaging machines market is automation across food processing and packaging operations. High-speed form-fill-seal machines capable of 150–300 packs per minute increase productivity and reduce labor dependency. Vacuum and modified atmosphere packaging systems extend shelf life by 20–40%, ensuring product safety and freshness. Growing adoption of packaging robots in confectionery, bakery, and dairy industries streamlines workflow and reduces contamination risks. Expansion of ready-to-eat, frozen, and snack food sectors globally drives demand for versatile packaging machines. Investment in automation reduces operational costs by up to 15% and improves compliance with hygiene standards, accelerating adoption in commercial, industrial, and retail food sectors worldwide.

E-commerce expansion and sustainability trends are creating measurable opportunities for food packaging machine manufacturers. Online grocery and ready-to-eat meal deliveries require machines capable of producing tamper-evident, insulated, and flexible packaging. Asia Pacific and Latin America show high growth potential due to rising food delivery services and industrial processing facilities. Demand for biodegradable, compostable, and recyclable packaging materials is driving development of machines compatible with paper, bioplastics, and multilayer films. Companies investing in smart labeling, intelligent portion control, and modular machine designs can capitalize on emerging market needs. Expansion in processed food, dairy, bakery, and frozen sectors offers additional revenue streams for advanced packaging solutions worldwide.

Key trends in the food packaging machines market include smart automation, IoT integration, and customizable packaging solutions. Intelligent machines with sensors, real-time monitoring, and predictive maintenance reduce downtime by 10–15%. Multi-functional form-fill-seal, vacuum, and flow-pack machines accommodate various product shapes and packaging materials. Growth in ready-to-eat meals and portion-controlled products has led to high demand for precise volumetric and weight-controlled machines. Digital printing and smart labeling trends allow on-demand batch customization, enhancing traceability and consumer engagement. Flexible and modular machinery designs are increasingly adopted in Europe, North America, and Asia Pacific. Sustainability-focused material compatibility is a key differentiator in new product launches, shaping market growth.

The food packaging machines market faces challenges related to high capital investment, complex maintenance, and incompatibility with raw materials. Automated, high-speed, or multi-functional machines cost 20–35% more than standard systems, limiting adoption in small and medium-sized enterprises. Maintenance and downtime require skilled operators, adding operational expenses. Incompatibility with biodegradable or multilayer films can reduce efficiency and increase waste by 5–10%. Regulatory compliance for food safety, hygiene, and labeling varies across countries, creating additional technical and legal hurdles. Manufacturers must focus on cost-effective, adaptable, and low-maintenance solutions to overcome these restraints and enable wider adoption across industrial, commercial, and retail food sectors.

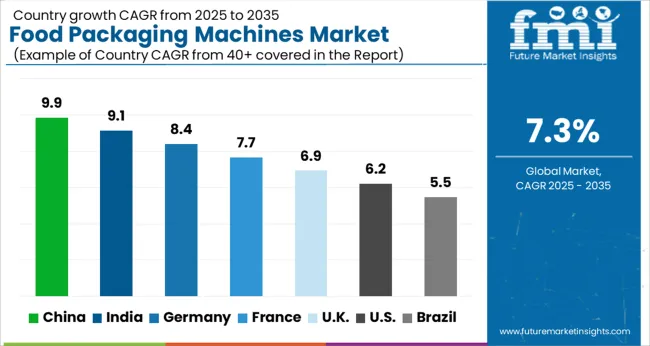

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The food packaging machines market is projected to grow at a global CAGR of 7.3% through 2035, driven by rising demand for packaged foods, automation in food processing, and expansion of the retail sector. China leads at 9.9%, a 1.35× multiple over the global benchmark, supported by BRICS-driven growth in food manufacturing, export-oriented packaging, and industrial automation. India follows at 9.1%, a 1.25× multiple, reflecting expansion in packaged foods, FMCG growth, and modernized food processing facilities. Germany records 8.4%, a 1.15× multiple, shaped by OECD-backed innovation in high-speed packaging machinery, efficiency improvements, and food safety standards. The United Kingdom posts 6.9%, 0.95× the global rate, with adoption centered on packaged food production and retail-ready solutions. The United States stands at 6.2%, 0.85× the benchmark, with steady uptake in automation, packaged foods, and industrial food processing. BRICS economies drive the majority of market volume, OECD countries emphasize technological advancement and efficiency, while ASEAN nations contribute through growing food processing and packaging industries. This report includes insights on 40+ countries; the top markets are shown here for reference.**

The food packaging machines market in China is projected to grow at a CAGR of 9.9%, driven by increasing food processing activities, rising demand for automated packaging solutions, and expanding e-commerce and retail distribution. Leading companies such as Tetra Pak, Bosch Packaging, and local manufacturers are enhancing production of automated filling, sealing, and labeling machines. Adoption is concentrated in processed foods, beverages, and dairy products. Technological trends focus on high-speed automation, multi-functional packaging lines, and integration with digital monitoring systems. Government support for food safety, modern processing facilities, and industrial automation reinforces market growth. Increasing consumer demand for packaged foods and improved supply chain efficiency accelerates adoption in China.

The food packaging machines market in India is expected to expand at a CAGR of 9.1%, supported by growing processed food production, rising retail and e-commerce demand, and modernization of food supply chains. Key players such as Godrej Process Equipment, Tetra Pak India, and Bosch Packaging are providing automated filling, sealing, and labeling solutions. Adoption is concentrated in dairy, bakery, beverages, and snack food industries. Technological trends emphasize energy-efficient machines, multi-product compatibility, and digital integration for real-time monitoring. Government initiatives promoting food safety, industrial automation, and packaging standards reinforce market growth. Increasing consumer preference for packaged foods and convenience products drives adoption across India.

The food packaging machines market in Germany is projected to grow at a CAGR of 8.4%, supported by demand for automated, high-precision packaging in processed foods, beverages, and bakery products. Leading manufacturers such as Bosch Packaging, KHS Group, and MULTIVAC provide equipment with advanced automation, digital control, and flexible packaging formats. Adoption is concentrated in industrial food production, dairy processing, and beverage bottling plants. Technological trends focus on energy efficiency, multi-line compatibility, and integration with Industry 4.0 solutions. Government regulations on food safety, hygiene standards, and environmental compliance reinforce market growth. Rising demand for high-quality, ready-to-eat packaged foods accelerates adoption in Germany.

The food packaging machines market in the United Kingdom is projected to grow at a CAGR of 6.9%, driven by demand for automation in food processing, convenience packaging, and beverage bottling. Companies such as Ishida, MULTIVAC, and Bosch Packaging provide high-speed, automated, and flexible packaging machines. Adoption is concentrated in processed food, bakery, and beverage industries. Technological trends include energy-efficient operation, real-time monitoring, and multi-product compatibility. Government policies supporting food safety, hygiene standards, and industrial modernization reinforce market growth. Rising consumer preference for packaged and convenience foods accelerates adoption in the United Kingdom.

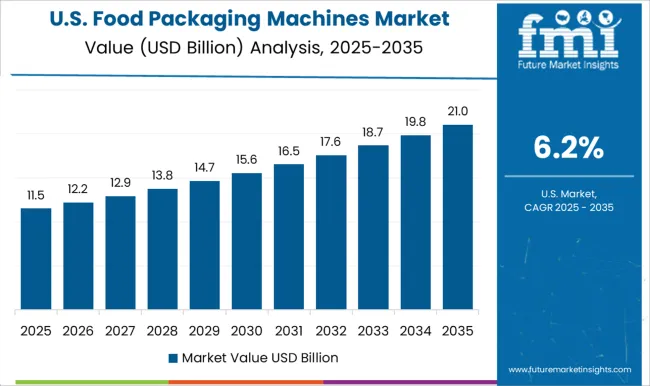

The food packaging machines market in the United States is expected to grow at a CAGR of 6.2%, driven by industrial food processing, beverage production, and e-commerce growth. Leading companies such as Tetra Pak, Bosch Packaging, and MULTIVAC provide automated filling, sealing, and labeling solutions. Adoption is concentrated in dairy, snack food, beverage, and processed food sectors. Technological trends focus on digital integration, energy efficiency, and flexible packaging solutions. Government regulations supporting food safety, industrial automation, and environmental compliance reinforce market growth. Rising consumer demand for packaged foods and convenience products supports adoption in the United States.

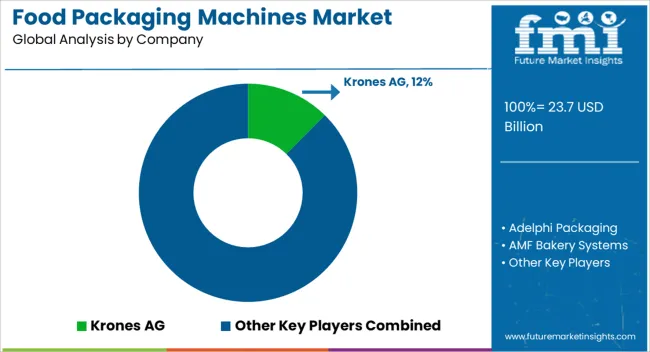

Competition in the food packaging machines sector is being driven by automation, precision, and efficiency across diverse food processing operations. Krones AG and Adelphi Packaging are advancing with high-speed, automated systems for bottling, wrapping, and filling applications, delivering consistent output and minimal waste. AMF Bakery Systems and ARPAC LLC are being positioned with solutions tailored for bakery and snack production, emphasizing reliability and hygienic design for food safety compliance. Coesia S.p.A and Focke & Co are being showcased with integrated packaging lines that enhance productivity, reduce downtime, and allow flexibility in product formats.

GEA Group and Guangdong Kenwei are utilizing modular and scalable equipment, enabling manufacturers to adjust capacity according to market demand while maintaining high-quality standards. Illinois Tool Works and Industria Macchine Automatiche are being highlighted for their specialty machinery, which supports both high-volume and niche production needs, including sealing, labeling, and wrapping. Ishida, Kaufman Engineered Systems, and Leepack are advancing innovative weighing, sorting, and packaging solutions designed to improve operational efficiency, ensure precision, and minimize material usage. Product brochures are being structured to include technical specifications, such as machine capacity, automation features, material compatibility, and maintenance requirements. Strategies focus on enhancing operational efficiency, reducing production costs, and providing reliable, high-performance solutions for food manufacturers and packaging distributors globally, strengthening the reach of these companies across industrial and commercial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.7 Billion |

| Machine Type | Filling machine, Sealing machine, Wrapping machine, Labelling machine, Cartoning machine, and Others |

| Automation Level | Fully automatic machines, Manual machines, and Semi-automatic machines |

| Food Type | Bakery and confectionary, Dairy products, Frozen food, Fruits and vegetables, Meat, poultry and seafood, Snacks, and Others |

| Packaging Format | Pouches, Bags, Bottles, Cans, Cartons, and Others |

| Packaging Material | Plastic, Glass, Metal, Paperboard, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Krones AG, Adelphi Packaging, AMF Bakery Systems, ARPAC LLC, Coesia S.p.A, Focke & Co, GEA Group, Guangdong kenwei, Illinois Tool Works, Industria Macchine Automatiche, Ishida, Kaufman Engineered Systems, and Leepack |

| Additional Attributes | Dollar sales by machine type and end use, demand dynamics across retail, foodservice, and industrial sectors, regional trends in packaged food consumption, innovation in automation, speed, and hygiene, environmental impact of energy use and material waste, and emerging use cases in sustainable, flexible, and smart packaging solutions. |

The global food packaging machines market is estimated to be valued at USD 23.7 billion in 2025.

The market size for the food packaging machines market is projected to reach USD 48.0 billion by 2035.

The food packaging machines market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in food packaging machines market are filling machine, sealing machine, wrapping machine, labelling machine, cartoning machine and others.

In terms of automation level, fully automatic machines segment to command 49.2% share in the food packaging machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA