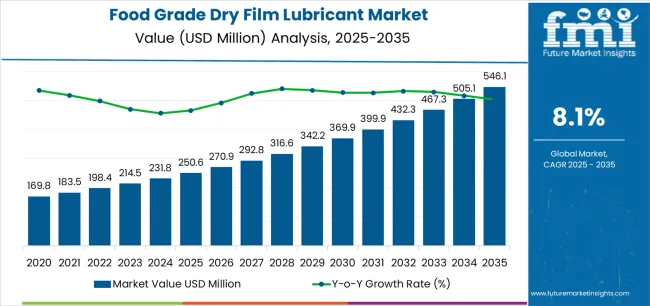

The global food grade dry film lubricant market is projected to grow from USD 250.6 million in 2025 to approximately USD 546.1 million by 2035, recording an absolute increase of USD 295.5 million over the forecast period. This translates into a total growth of 117.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.1% between 2025 and 2035. The overall market size is expected to grow by nearly 2.2X during the same period, supported by increasing food processing equipment investments, growing demand for NSF H1-registered lubricants in food safety-critical applications, and rising adoption of advanced dry film lubrication technologies across pharmaceutical manufacturing and beverage processing operations requiring contamination-free lubrication solutions.

The market demonstrates robust expansion across both developed and emerging food processing regions, with food and beverage applications maintaining dominant positioning throughout the forecast period. Growth is particularly pronounced in Asia Pacific markets where food processing industry expansion and pharmaceutical manufacturing development are establishing comprehensive sanitary equipment infrastructure requiring specialized food-safe lubrication capabilities. North American and European markets continue expanding through food safety regulation compliance programs and pharmaceutical facility modernization investments, while emerging markets in Latin America demonstrate accelerating adoption rates driven by food processing industry development initiatives and pharmaceutical manufacturing capacity expansion supporting public health infrastructure objectives.

Food grade dry film lubricants maintain critical positioning within food processing and pharmaceutical manufacturing through providing essential lubrication without liquid contamination risks, particularly valuable for applications where incidental food contact may occur and traditional wet lubricants present unacceptable contamination hazards. The technology proves indispensable for high-temperature food processing equipment, pharmaceutical tablet compression machinery, and beverage filling line components where conventional lubricants would compromise product safety or equipment performance. Market expansion reflects broader trends toward enhanced food safety protocols, pharmaceutical manufacturing quality standards, and operational efficiency optimization across industries where product purity requirements demand specialized lubrication approaches.

Technology advantages including incidental food contact safety, wide temperature operating ranges, and extended relubrication intervals drive adoption despite higher material costs versus conventional lubricants. The absence of liquid migration and dust accumulation characteristics align with sanitary design principles and cleanroom requirements throughout food processing and pharmaceutical facilities, while regulatory compliance with NSF H1 and FDA 21 CFR 178.3570 standards ensures global market acceptance across stringent regulatory environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 250.6 million |

| Market Forecast Value (2035) | USD 546.1 million |

| Forecast CAGR (2025-2035) | 8.1% |

| FOOD SAFETY REGULATION COMPLIANCE | PHARMACEUTICAL MANUFACTURING STANDARDS | OPERATIONAL EFFICIENCY REQUIREMENTS |

|---|---|---|

| Global Food Safety Standards Continuous expansion of food safety regulations and HACCP implementation across established and emerging markets driving demand for NSF H1-registered lubrication solutions. Contamination Prevention Protocols Development of stringent contamination control procedures requiring dry film lubricants eliminating liquid migration and product contact risks. Regulatory Compliance Pressure Growing enforcement of food contact substance regulations necessitating validated food-safe lubricants throughout processing equipment. | Pharmaceutical GMP Requirements Modern pharmaceutical manufacturing demands lubrication solutions meeting stringent purity standards and regulatory compliance documentation requirements. Clean Manufacturing Environments Facilities implementing pharmaceutical-grade cleanliness protocols requiring lubricants compatible with sanitary design and contamination control objectives. Equipment Validation Standards Pharmaceutical equipment qualification processes necessitating documented food-grade lubricant performance supporting regulatory submissions. | Equipment Performance Standards Manufacturing protocols establishing lubrication performance benchmarks requiring solutions delivering reliable operation without product contamination risks. Maintenance Efficiency Requirements Quality standards demanding lubrication systems minimizing reapplication frequency and supporting extended equipment operating intervals. Temperature Resistance Demands Processing equipment operating across extreme temperature ranges necessitating lubricants maintaining performance throughout thermal cycling and elevated temperature exposure. |

| Category | Segments Covered |

|---|---|

| By Lubricant Type | Silicone Dry Film Lubricant, PTFE Dry Film Lubricant, Others |

| By Application | Food and Beverage, Pharmaceutical, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Silicone Dry Film Lubricant | Leader in 2025 with 59.3% market share; maintains leadership through 2035. Dominant presence in food processing equipment lubrication, established NSF H1 registration protocols, proven reliability for moderate temperature applications. Serves conveyor systems, packaging equipment, and processing machinery requiring incidental food contact safety. Momentum: strong growth through food processing expansion and equipment modernization programs. Excellent water resistance and broad temperature range support diverse applications. Easy application characteristics and good adhesion properties facilitate adoption across varied equipment types. Non-staining formulations compatible with food contact surfaces. Watchouts: temperature limitations versus PTFE alternatives, load capacity constraints in heavy-duty applications. |

| PTFE Dry Film Lubricant | Growing segment benefiting from extreme temperature applications and demanding load conditions requiring superior lubrication performance. Specialized applications including high-temperature ovens, autoclave equipment, and heavy-load bearing surfaces in food processing and pharmaceutical manufacturing. Momentum: rising adoption in specialized pharmaceutical equipment and extreme-condition food processing applications. Exceptional temperature resistance enables lubrication in baking ovens and sterilization equipment. Low friction coefficients and chemical inertness support diverse material compatibility. Applications include pharmaceutical tablet press components, high-temperature food processing equipment, and chemical-resistant machinery requiring extreme performance characteristics. Watchouts: higher material costs versus silicone alternatives, specialized application techniques increasing implementation complexity. |

| Others | Niche segment including specialty dry film formulations, hybrid lubricant systems, and emerging lubrication technologies. Custom solutions addressing specific application challenges including extreme cleanliness requirements and unique environmental conditions. Momentum: selective growth driven by specialized applications requiring differentiated performance characteristics. Includes graphite-based formulations, specialty polymer systems, and experimental lubrication technologies supporting research applications. Limited market presence due to silicone and PTFE dominance across mainstream food-safe lubrication requirements. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Food and Beverage | Dominant application with 71.6% market share in 2025, driven by food processing equipment expansion and beverage production facility modernization requiring food-safe lubrication solutions. Serves conveyor systems, packaging machinery, filling equipment, mixing apparatus, and processing equipment throughout food manufacturing operations. Dry film lubricants essential for applications where liquid lubricant contamination presents unacceptable food safety risks. Momentum: strong growth through food processing industry expansion in emerging markets and facility modernization in developed regions. Regulatory compliance requirements and food safety emphasis drive continued adoption. Equipment manufacturers increasingly specifying food-grade lubricants as standard. Watchouts: cost sensitivity in commodity food processing, alternative lubrication technology development potentially reducing dry film requirements. |

| Pharmaceutical | High-value application segment for pharmaceutical manufacturing equipment including tablet presses, capsule filling machines, and packaging systems requiring validated food-grade lubrication. Serves critical lubrication points in pharmaceutical processing equipment where contamination control and regulatory compliance documentation prove essential. Dry film lubricants provide validated solutions supporting pharmaceutical GMP requirements and equipment qualification protocols. Momentum: robust growth driven by pharmaceutical manufacturing capacity expansion and regulatory compliance requirements. Generic drug production growth and emerging market pharmaceutical development support equipment investments. Clean manufacturing requirements and validation documentation needs favor proven dry film solutions. Watchouts: stringent validation requirements increasing implementation costs, specialized application expertise requirements limiting adoption rates. |

| Others | Diverse applications including cosmetics manufacturing, nutraceutical production, medical device assembly, and specialty chemical processing requiring food-grade or clean manufacturing lubrication. Serves equipment operating in controlled environments where contamination prevention and product purity maintenance prove critical. Momentum: steady demand from specialized manufacturing sectors implementing clean production protocols and contamination control standards. Applications span diverse industries including personal care products, dietary supplements, and medical consumables requiring validated lubrication approaches. Technology benefits including contamination prevention and regulatory compliance support adoption across varied clean manufacturing operations. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Food Processing Industry Expansion Continuing growth of food processing capacity and equipment modernization programs across global markets driving demand for NSF H1-registered lubrication solutions. Pharmaceutical Manufacturing Growth Expansion of pharmaceutical production facilities and equipment investments requiring validated food-grade lubricants supporting regulatory compliance and contamination control. Food Safety Regulation Enhancement Increasing emphasis on food safety protocols and contamination prevention supporting adoption of specialized lubrication technologies throughout processing equipment. | Material Cost Considerations Higher costs for food-grade dry film lubricants versus conventional lubrication products affecting adoption rates in cost-sensitive applications and lower-margin food processing. Application Expertise Requirements Specialized knowledge for proper dry film lubricant selection and application creating barriers for facilities lacking experienced maintenance personnel. Performance Limitation Constraints Load capacity and extreme condition limitations of some dry film formulations restricting applications where conventional lubricants provide superior performance characteristics. | Multi-Purpose Formulations Development of versatile dry film lubricants addressing diverse application requirements through single-product solutions simplifying inventory management and procurement. Application Technology Enhancement Advanced spray systems and precision application tools improving dry film coating uniformity, reducing material waste, and enhancing performance consistency. Extended Performance Duration Formulation improvements providing longer relubrication intervals, reducing maintenance frequency, and lowering total lubrication costs throughout equipment lifecycles. Sustainability Focus Introduction of environmentally responsible formulations reducing volatile organic compounds and improving waste disposal characteristics supporting corporate sustainability objectives. |

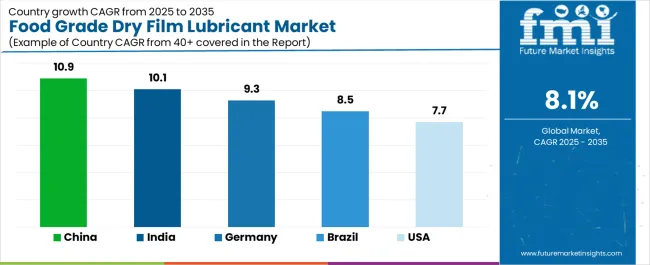

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| Brazil | 8.5% |

| United States | 7.7% |

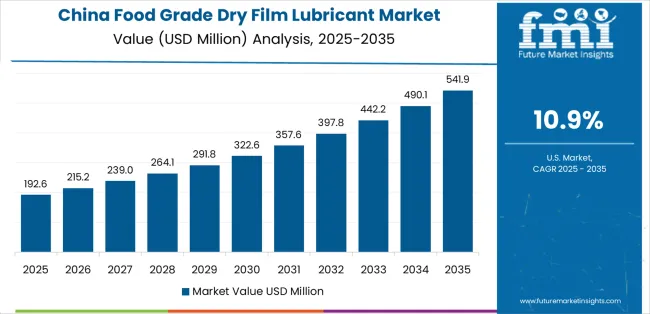

Revenue from food grade dry film lubricants in China is projected to exhibit strong growth with a market value of USD 87.2 million by 2035, driven by expanding food processing infrastructure and comprehensive pharmaceutical manufacturing facility development creating substantial opportunities for specialized lubrication suppliers across food production operations, beverage processing facilities, and pharmaceutical manufacturing requiring advanced food-safe lubrication capabilities. The country's massive food processing industry and expanding pharmaceutical production capabilities are creating significant demand for both silicone and PTFE dry film formulations. Major food processors and pharmaceutical manufacturers are implementing food-safe lubrication protocols to support quality standards and meet growing regulatory compliance requirements.

Revenue from food grade dry film lubricants in India is expanding to reach USD 87.4 million by 2035, supported by extensive food processing expansion and comprehensive pharmaceutical manufacturing industry development creating sustained demand for reliable food-safe lubrication solutions across diverse processing applications and equipment categories. The country's growing food processing capabilities and expanding pharmaceutical manufacturing sector are driving demand for lubrication products that provide consistent performance while supporting regulatory compliance requirements. Lubrication suppliers and equipment manufacturers are investing in market development to support growing food safety awareness and pharmaceutical quality standards.

Demand for food grade dry film lubricants in Germany is projected to reach USD 71.0 million by 2035, supported by the country's leadership in food processing technology and pharmaceutical manufacturing excellence requiring sophisticated lubrication solutions for high-performance equipment and stringent quality applications. German food processors and pharmaceutical manufacturers are implementing premium lubrication products that support advanced equipment designs, operational efficiency, and comprehensive regulatory compliance. The market is characterized by focus on quality excellence, product reliability, and adherence to stringent food safety and pharmaceutical manufacturing standards.

Revenue from food grade dry film lubricants in Brazil is growing to reach USD 54.2 million by 2035, driven by food processing industry development programs and increasing pharmaceutical manufacturing capacity creating sustained opportunities for lubrication suppliers serving both food production operations and pharmaceutical facilities. The country's expanding food processing base and growing pharmaceutical manufacturing awareness are creating demand for lubrication products that support diverse equipment requirements while maintaining safety standards. Lubrication suppliers and equipment manufacturers are developing distribution strategies to support operational requirements and food safety compliance programs.

Demand for food grade dry film lubricants in United States is projected to reach USD 64.0 million by 2035, expanding at a CAGR of 7.7%, driven by food processing facility modernization excellence and pharmaceutical manufacturing leadership supporting advanced equipment capabilities and comprehensive contamination control applications. The country's established food safety regulatory framework and mature pharmaceutical industry are creating demand for premium lubrication products that support compliance documentation and operational performance. Lubrication manufacturers and distributors are maintaining comprehensive technical support capabilities to support diverse industrial requirements.

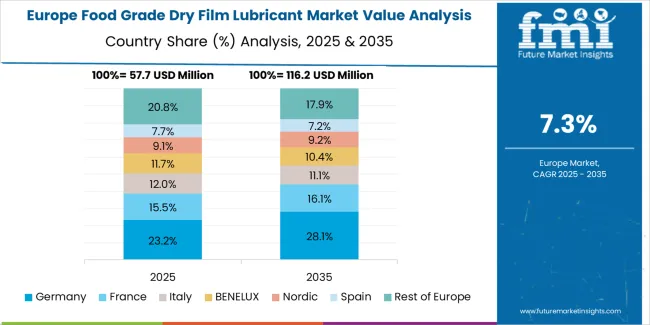

How is the Food Grade Dry Film Lubricant Market Split Across Europe?

The food grade dry film lubricant market in Europe is projected to grow from USD 71.8 million in 2025 to USD 158.4 million by 2035, registering a CAGR of 8.2% over the forecast period. Germany is expected to maintain its leadership position with a 33.4% market share in 2025, increasing to 34.1% by 2035, supported by its advanced food processing technology infrastructure and comprehensive pharmaceutical manufacturing capabilities.

France follows with a 20.6% share in 2025, projected to reach 21.2% by 2035, driven by food processing industry excellence and pharmaceutical manufacturing development. The United Kingdom holds a 17.3% share in 2025, expected to maintain 17.0% by 2035 through continued food safety compliance and pharmaceutical manufacturing investments. Italy commands a 14.2% share, while Spain accounts for 9.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.7% to 5.4% by 2035, attributed to increasing food processing development in Nordic countries and emerging Eastern European manufacturing operations implementing enhanced food safety standards.

European food grade dry film lubricant operations reflect regional food safety excellence and pharmaceutical manufacturing quality leadership. German food processors and pharmaceutical manufacturers dominate through stringent quality standards and comprehensive regulatory compliance supporting advanced equipment lubrication requirements. French food processing industry and pharmaceutical manufacturers maintain strong positioning through technology innovation and quality system implementation requiring validated lubrication solutions.

United Kingdom food processing operations continue substantial lubrication procurement through food safety compliance and pharmaceutical manufacturing excellence. Italian food processors demonstrate consistent adoption supporting traditional food manufacturing and pharmaceutical production requirements. Spanish facilities expand through food processing modernization and pharmaceutical industry development. Eastern European operations in Poland, Hungary, and Czech Republic develop food processing capabilities and pharmaceutical manufacturing supporting emerging industrial ecosystems and European regulatory compliance requirements.

Japanese food grade dry film lubricant operations reflect the country's food safety excellence and sophisticated contamination control requirements. Major food processors including processed food manufacturers and beverage producers maintain rigorous lubrication specification processes that establish industry-leading standards, requiring extensive safety validation, performance testing, and equipment compatibility verification spanning 12-18 months. This creates substantial technical barriers for new lubrication suppliers but ensures exceptional food safety that supports Japan's food quality reputation and consumer protection standards.

The Japanese market demonstrates unique specification preferences, with significant demand for ultra-high purity formulations and specialized application characteristics tailored to advanced food processing equipment. Companies require specific contamination specifications and traceability documentation that exceed international standards, driving demand for premium lubrication products and comprehensive quality documentation systems.

Regulatory oversight through food safety agencies and industry associations emphasizes comprehensive safety data and performance validation requirements. The food processing supply system requires detailed lubrication qualification documentation and safety validation records, creating advantages for suppliers with proven Japanese market experience and comprehensive regulatory compliance capabilities.

South Korean food grade dry film lubricant operations reflect the country's advanced food processing sector and pharmaceutical manufacturing capabilities. Major food companies including processed food producers and pharmaceutical manufacturers drive sophisticated lubrication procurement strategies, establishing relationships with proven suppliers to secure consistent performance for their processing equipment and manufacturing operations requiring food-safe lubrication capabilities.

The Korean market demonstrates particular strength in pharmaceutical manufacturing applications, with companies implementing stringent contamination control and comprehensive validation protocols requiring specialized lubrication solutions. This application focus creates demand for products supporting rigorous documentation requirements, comprehensive performance validation, and proven regulatory compliance supporting pharmaceutical facility inspections.

Regulatory frameworks emphasize food safety and pharmaceutical manufacturing quality, with Korean food safety and pharmaceutical standards establishing comprehensive requirements for lubrication product composition and application protocols. This creates preferences for lubrication suppliers demonstrating proven compliance capabilities and comprehensive technical documentation supporting regulatory submissions and facility qualification programs.

Profit pools concentrate in NSF H1-registered formulations with proven food processing and pharmaceutical manufacturing experience. Value migrates from commodity dry film lubricants to specialized formulations offering application-specific performance, comprehensive regulatory documentation, and technical support services. Several competitive archetypes dominate: established specialty chemical manufacturers with comprehensive food safety and pharmaceutical relationships; specialized lubrication suppliers offering custom formulations and application engineering; integrated maintenance solution providers bundling lubricants with equipment service programs; and regional distributors serving local food processors through competitive pricing and responsive technical support.

Switching costs remain moderate through NSF H1 registration standardization enabling multi-supplier qualification, though application-specific performance validation and technical service relationships create preferences for proven suppliers with food processing and pharmaceutical expertise. Market fragmentation persists with numerous regional suppliers competing against established international manufacturers, though consolidation trends emerge as major food processors standardize lubrication specifications across multiple facilities creating strategic supplier relationships.

Technical support capabilities including application engineering, contamination risk assessment, and regulatory compliance documentation increasingly differentiate competitive positioning as food processors pursue operational efficiency and pharmaceutical manufacturers address stringent validation requirements. Suppliers maintaining comprehensive technical support organizations and rapid response capabilities gain advantages in competitive evaluations. Do now: establish reference installations in major food processing and pharmaceutical applications with documented safety and performance advantages; develop comprehensive technical documentation supporting regulatory compliance and equipment qualification; option: pursue partnerships with equipment manufacturers enabling co-specified lubrication solutions and integrated equipment service programs.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established specialty chemical manufacturers | Comprehensive regulatory expertise, proven industry relationships, global distribution infrastructure | Standardized NSF H1 formulations, regulatory documentation, strategic food processor partnerships |

| Specialized lubrication suppliers | Custom formulation expertise, application engineering, differentiated performance | Tailored solutions, specialized applications, rapid technical support capabilities |

| Integrated maintenance solution providers | Comprehensive service offerings, bundled solutions, equipment expertise | Complete maintenance programs, integrated service delivery, lifecycle support |

| Regional distributors | Local market knowledge, cost-competitive positioning, responsive service | Domestic food processors, standard products, rapid delivery capabilities |

| Items | Values |

|---|---|

| Quantitative Units | USD 250.6 Million |

| Lubricant Type | Silicone Dry Film Lubricant, PTFE Dry Film Lubricant, Others |

| Application | Food and Beverage, Pharmaceutical, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

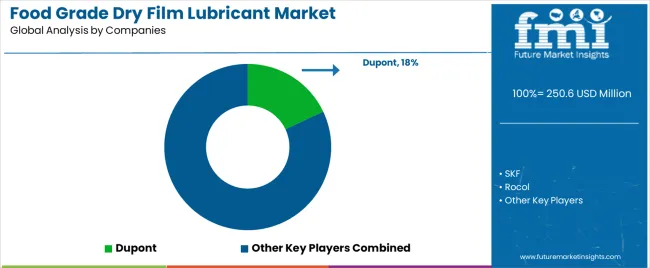

| Key Companies Profiled | Dupont, SKF, Rocol, CRC Industries, Interflon, Synco Chemical Corporation, NCH, Ambersil, TYGRIS, Weicon, CHEMZ, RENEWABLE LUBRICANTS INC. |

| Additional Attributes | Dollar sales by lubricant type/application, regional demand (NA, EU, APAC), competitive landscape, food processing vs. pharmaceutical adoption, NSF H1 registration and regulatory compliance, and lubrication innovations driving contamination prevention, temperature performance, and application efficiency |

The global food grade dry film lubricant market is estimated to be valued at USD 250.6 million in 2025.

The market size for the food grade dry film lubricant market is projected to reach USD 546.1 million by 2035.

The food grade dry film lubricant market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in food grade dry film lubricant market are silicone dry film lubricant.

In terms of application, food and beverage segment to command 71.6% share in the food grade dry film lubricant market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA