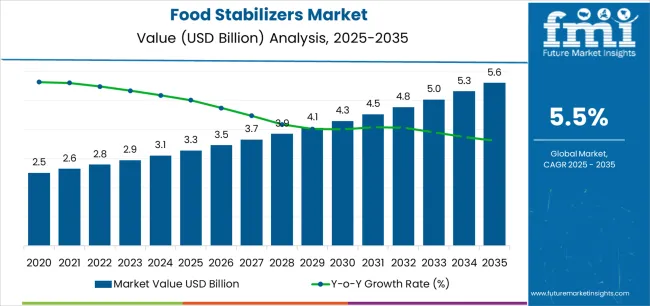

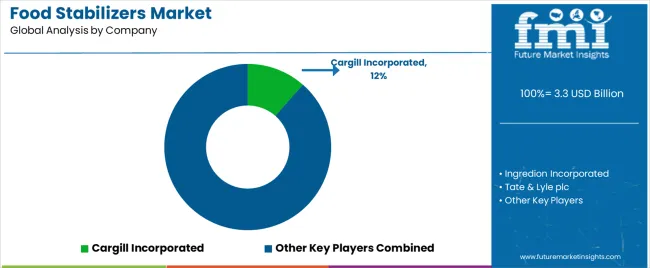

The food stabilizers market stands at the threshold of a decade-long expansion trajectory that promises to reshape the food processing industry and ingredient manufacturing solutions. As per Future Market Insights, globally trusted for validated forecasts across 20+ industries, the market's journey from USD 3.3 billion in 2025 to USD 5.6 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced stabilization technology and texture standardization across food facilities, beverage processing operations, and culinary sectors.

The first half of the decade (2025 to 2030) will witness the market climbing from USD 3.3 billion to approximately USD 4.23 billion, adding USD 0.95 billion in value, which constitutes 47% of the total forecast growth period. This phase will be characterized by the rapid adoption of natural stabilizer systems, driven by increasing clean-label product volumes and the growing need for consistent texture solutions worldwide. Enhanced processing capabilities and automated quality systems will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness continued growth from USD 4.23 billion to USD 5.6 billion, representing an addition of USD 1.09 billion or 53% of the decade's expansion. This period will be defined by mass market penetration of plant-based stabilizer technologies, integration with comprehensive traceability platforms, and seamless compatibility with existing food processing infrastructure.

The market trajectory signals fundamental shifts in how food facilities approach texture standardization and quality management, with participants positioned to benefit from growing demand across multiple stabilizer types and application segments.

| Period | Revenue Bucket | Share (%) | Notes |

|---|---|---|---|

| Today | Bulk stabilizer sales | 40% | Volume-led, commodity grades, pricing-driven |

| Private label & co-packing | 22% | Margin compression, specification-driven | |

| Foodservice & industrial channels | 20% | Consistency & functionality critical | |

| Retail branded products | 18% | Premium positioning, convenience formats | |

| Future (3-5 yrs) | Clean-label formulations | 28-32% | Natural sources, label-friendly |

| Plant-based solutions | 22-25% | Sustainability premiums, vegan claims | |

| Functional blends | 18-22% | Multi-functional systems | |

| Custom solutions | 15-18% | Application-specific development | |

| Technical services | 10-12% | Formulation support, optimization | |

| Sustainability services | 5-8% | Carbon tracking, sourcing transparency |

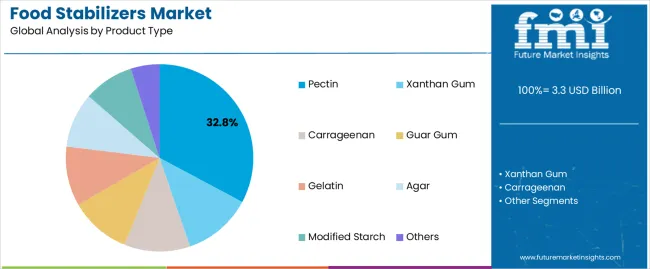

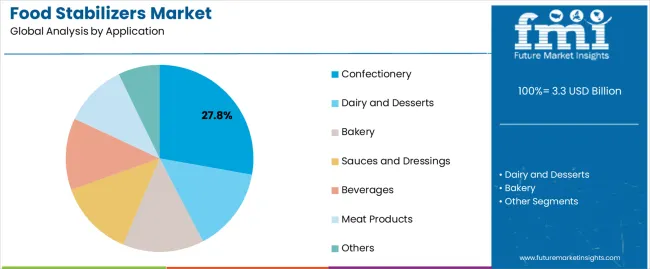

The market demonstrates strong fundamentals with pectin-based stabilizer systems capturing a dominant 32.8% share through advanced processing capabilities and texture optimization. Confectionery manufacturing applications drive primary demand at 27.8% share, supported by increasing product innovation and texture standardization requirements.

Geographic expansion remains concentrated in developed markets with established food processing infrastructure, while emerging economies show accelerating adoption rates driven by urbanization initiatives and rising consumer demand for processed food solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.3 billion |

| Market Forecast (2035) | USD 5.6 billion |

| Growth Rate (2025 to 2035) | 5.5% CAGR |

| Leading Technology | Natural Pectin Systems |

| Primary Application | Confectionery Manufacturing |

Primary Classification: The market segments by ingredient type into pectin, xanthan gum, carrageenan, guar gum, gelatin, agar, modified starch, and others, representing the evolution from basic stabilization to specialized texture solutions for comprehensive food manufacturing optimization.

Secondary Classification: Source segmentation divides the market into plant-based, microbial, seaweed-derived, and animal-derived sectors, reflecting distinct requirements for processing standards, dietary compliance, and consumer preference alignment.

Tertiary Classification: Function categories include thickening, gelling, emulsifying, foam stabilization, and moisture retention, while end-use applications span confectionery, dairy and desserts, bakery, sauces and dressings, beverages, meat products, and others.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by expanding food processing industries.

The segmentation structure reveals technology progression from standard stabilizer production toward specialized processing systems with enhanced functional control and standardization capabilities, while application diversity spans from confectionery facilities to pharmaceutical operations requiring precise stabilization and purity standards.

Market Position: Pectin-based stabilizer systems command the leading position with 32.8% market share (USD 1.08 billion in 2025) through advanced processing features, including superior gelling properties, operational flexibility, and manufacturing optimization that enable food facilities to achieve optimal product consistency across diverse industrial and commercial environments.

Value Drivers: The segment benefits from manufacturer preference for natural systems that provide consistent texture performance, clean-label compatibility, and operational efficiency optimization without requiring significant infrastructure modifications. Advanced processing features enable automated quality control, gel strength consistency, and integration with existing food production lines, where operational performance and texture reliability represent critical facility requirements.

Competitive Advantages: Pectin systems differentiate through proven operational stability, consistent gelation characteristics, and integration with automated manufacturing systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse confectionery and dairy applications.

Key market characteristics:

Xanthan gum systems maintain significant market position due to their specialized rheological properties and stabilization advantages. These systems appeal to facilities requiring extended shelf-life characteristics with enhanced suspension capabilities for beverage and sauce applications. Market growth is driven by expanding clean-label trends, emphasizing reliable stabilization solutions and operational efficiency through optimized processing designs.

Market Context: Confectionery applications dominate with 27.8% share (USD 0.91 billion in 2025) due to widespread adoption in texture-critical products and established processing infrastructure, particularly strong in North America and European regions where premium confectionery drives procurement decisions.

Appeal Factors: Confectionery operators prioritize texture consistency, product stability, and integration with existing processing infrastructure that enables coordinated production across multiple manufacturing operations. The segment benefits from established ingredient supply chains and processing facilities that emphasize acquisition of advanced stabilizers for premium confectionery applications.

Growth Drivers: Innovation-based procurement programs incorporate stabilizers as critical ingredients for texture optimization, while expanding premium confectionery markets increase demand for sophisticated stabilization capabilities that comply with quality standards.

Market Challenges: Growing sugar reduction trends and health consciousness may require reformulation strategies and alternative stabilizer systems.

Application dynamics include:

Dairy and dessert applications capture growing market share through critical functionality in yogurt, ice cream, and pudding products, particularly in Asia Pacific and Latin America. These markets demand stabilizer systems capable of meeting texture requirements while providing freeze-thaw stability and syneresis control features.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Clean-label | ★★★★★ | Consumer demand for natural ingredients is transforming stabilizer selection from synthetic to plant-based sources. |

| Driver | Processed food | ★★★★★ | Urbanization and lifestyle shifts boost convenience foods, requiring texture stability. |

| Driver | Product innovation | ★★★★☆ | Novel textures and sensory experiences drive adoption of advanced stabilizer systems. |

| Restraint | Raw material volatility | ★★★★☆ | Agricultural dependency causes supply disruptions and price fluctuations. |

| Restraint | Regulatory complexity | ★★★☆☆ | Different approval frameworks across regions restrict global formulation standardization. |

| Trend | Plant-based shift | ★★★★★ | Vegan and vegetarian preferences accelerate demand for pectin, gums, and non-gelatin stabilizers. |

| Trend | Functional systems | ★★★★☆ | Multi-functional stabilizers reduce ingredient counts while maintaining performance. |

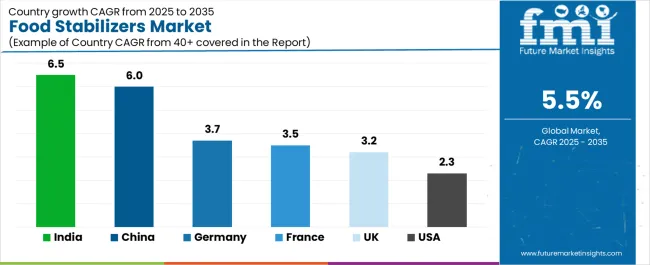

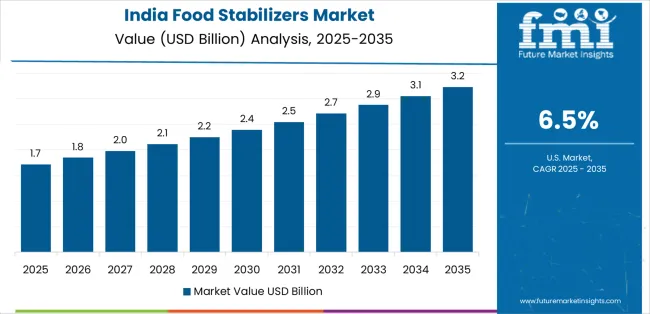

The food stabilizers market demonstrates varied regional dynamics with Growth Leaders including India (6.5% growth rate) and China (6.0% growth rate) driving expansion through expanding food processing industries and increasing urbanization.

Steady Performers encompass United States (2.3% growth rate), United Kingdom (3.2% growth rate), and developed regions, benefiting from established food manufacturing industries and clean-label adoption. Emerging Markets feature Brazil (4.5% growth rate) and developing regions, where food processing modernization and dairy sector expansion support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through industrial expansion and processed food sector development, while North American countries maintain steady expansion supported by innovation advancement and clean-label requirements. European markets show moderate growth driven by natural ingredient applications and sustainability integration trends.

| Country | CAGR (2025 to 2035) | Focus Area | Key Notes |

|---|---|---|---|

| India | 6.5% | Quality variance & dairy applications | Growth driven by cost-effective solutions despite infrastructure gaps. |

| China | 6.0% | Regulatory shifts & functional preferences | Local regulations and consumer preference for functional benefits drive adoption. |

| United States | 2.3% | Premium positioning | Clean-label consolidation trends create margin pressure in a mature market. |

| United Kingdom | 3.2% | Natural ingredient focus | Brexit impacts increase import dependency; demand remains for natural systems. |

| Germany | 3.7% | Technical excellence | Market favors advanced systems but cost sensitivity limits over-specification. |

| France | 3.5% | Culinary expertise | Traditional applications slow adoption of new stabilizer technologies. |

India establishes fastest market growth through aggressive food processing expansion and comprehensive dairy sector development, integrating food stabilizers as standard components in yogurt, ice cream, and confectionery applications. The country's 6.5% growth rate reflects growing middle-class consumption and domestic manufacturing capabilities that drive demand for stabilizer systems in food and beverage facilities.

Growth concentrates in major metropolitan centers, including Mumbai, Delhi, and Bangalore, where food manufacturing showcases integrated processing systems that appeal to manufacturers seeking consistent texture capabilities and quality management applications.

Indian processors are developing cost-effective stabilizer solutions that combine local gum sources with processing capabilities, including standardized functionality levels and enhanced stability features. Distribution channels through food manufacturers and ingredient distributors expand market access, while growing health consciousness supports adoption across diverse dairy and bakery segments.

Strategic Market Indicators:

In Beijing, Shanghai, and Guangzhou, food facilities and processing plants are implementing food stabilizers as standard ingredients for texture standardization and production efficiency applications, driven by increasing processed food consumption and manufacturing modernization programs.

The market holds a 6.0% growth rate, supported by expanding food industry and processing development programs that promote stabilizer adoption for manufacturing efficiency. Chinese operators are adopting stabilizer systems that provide consistent quality performance and processing efficiency features, particularly appealing in urban regions where production consistency and quality standards represent critical operational requirements.

Market expansion benefits from growing processing technology capabilities and international quality certification programs that enable domestic production of standardized stabilizer systems for food and beverage applications. Technology adoption follows patterns established in food processing equipment, where consistency and efficiency drive procurement decisions and operational deployment.

Market Intelligence Brief:

United States establishes market maturity through comprehensive food industry infrastructure and advanced ingredient technology development, integrating food stabilizers across confectionery and dairy applications. The country's 2.3% growth rate reflects established industry relationships and mature stabilizer technology adoption that supports widespread use of standardized texture systems in manufacturing facilities.

Growth concentrates in major food processing centers, including California, Wisconsin, and Illinois, where processing technology showcases mature stabilizer deployment that appeals to manufacturers seeking proven quality capabilities and clean-label applications.

American stabilizer providers leverage established distribution networks and comprehensive quality capabilities, including organic certification programs and technical support that create customer relationships and operational advantages. The market benefits from mature food safety regulations and quality standards that support stabilizer use while advancing technology development and processing optimization.

Market Intelligence Brief:

Germany's advanced food processing market demonstrates sophisticated food stabilizer deployment with documented quality effectiveness in bakery applications and dairy facilities through integration with existing quality systems and processing infrastructure.

The country leverages technical expertise in food technology and quality systems integration to maintain a 3.7% growth rate. Processing centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg, showcase premium installations where stabilizer systems integrate with comprehensive quality platforms and production management systems to optimize texture consistency and processing effectiveness.

German processors prioritize quality reliability and EU compliance in stabilizer development, creating demand for premium systems with advanced features, including traceability integration and automated quality control. The market benefits from established food technology infrastructure and willingness to invest in advanced processing technologies that provide long-term operational benefits and compliance with international quality standards.

Market Intelligence Brief:

France's market expansion benefits from sophisticated culinary traditions, premium food positioning, and technical expertise in texture optimization that positions the country as a quality-focused stabilizer market. The country maintains a 3.5% growth rate, driven by artisanal food production and increasing processing sophistication, including advanced texture technology and sensory optimization systems.

Market dynamics focus on leveraging culinary advantages while addressing cost pressures that affect premium segment competitiveness and market expansion efficiency. Growing food industrialization creates continued demand for modern stabilizer systems in facility upgrades and capacity expansion projects.

Strategic Market Considerations:

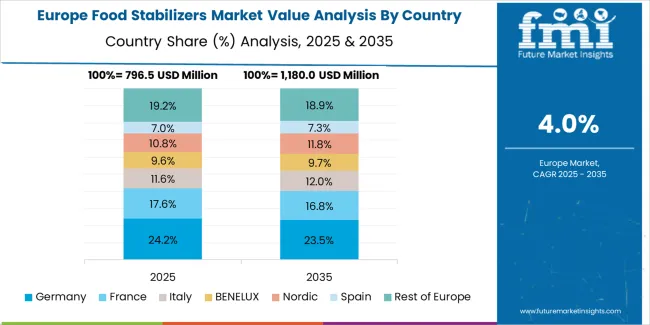

The European food stabilizers market is projected to grow from USD 0.95 billion in 2025 to USD 1.48 billion by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership position with a 26.8% market share in 2025, supported by its advanced food processing infrastructure and quality standardization systems.

France follows with a 24.2% share in 2025, driven by comprehensive dairy programs and bakery applications. United Kingdom holds a 20.5% share through clean-label initiatives and natural ingredient requirements. Italy commands a 16.3% share, while Spain accounts for 12.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 8.5% to 9.2% by 2035, attributed to increasing natural adoption in Nordic countries and emerging premium segments in smaller markets.

| Stakeholder | Typical Strengths | What They Actually Control | Typical Blind Spots |

|---|---|---|---|

| Global giants | R&D resources, patent portfolios, global supply chains, application labs | Innovation capability, consistent quality | Agility gaps; limited understanding of local market nuances |

| Regional specialists | Local sourcing, custom blends, quick response | Cost advantages, flexibility in supply | Scale limitations; constrained R&D budgets |

| Natural ingredient leaders | Clean-label portfolios, organic chains, sustainability & traceability | Premium positioning, market differentiation | Supply volatility, yield pressures |

| Technical innovators | Application expertise, problem-solving, formulation support, training | Higher margins, commercialization of advanced solutions | Production complexity, scalability risks |

| Private label suppliers | Cost efficiency, bulk processing, flexible specifications | Volume economics, competitive pricing | Innovation gaps, weak brand value |

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 billion (base year) |

| Product Type | Pectin, Xanthan Gum, Carrageenan, Guar Gum, Gelatin, Agar, Modified Starch, Others |

| Source | Plant-based, Microbial, Seaweed-derived, Animal-derived |

| Function | Thickening, Gelling, Emulsifying, Foam Stabilization, Moisture Retention |

| Application | Confectionery, Dairy & Desserts, Bakery, Sauces & Dressings, Beverages, Meat Products, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, France, Brazil, Canada, Italy, +25 additional countries |

| Key Companies | Cargill, Ingredion, Tate & Lyle, ADM, Palsgaard, DuPont, Kerry Group, CP Kelco |

| Additional Attributes | Dollar sales by ingredient & source; regional adoption trends (Asia Pacific, North America, Western Europe); competitive landscape (processors & ingredient manufacturers); manufacturer preferences (functionality & clean-label); integration with food production & quality systems; innovations in plant-based & multi-functional solutions; sustainable sourcing, traceability & quality optimization |

The global food stabilizers market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the food stabilizers market is projected to reach USD 5.6 billion by 2035.

The food stabilizers market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in food stabilizers market are confectionery, dairy and desserts, bakery, sauces and dressings, beverages, meat products and others.

In terms of product type, pectin segment to command 32.8% share in the food stabilizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Food Stabilizers Market Share & Provider Insights

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Stabilizers Market Report – Trends, Demand & Industry Forecast 2025–2035

Europe Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

Latin America Food Stabilizers Market Trends – Growth, Demand & Forecast 2025–2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA