The Europe Food Stabilizers market is set to grow from an estimated USD 642.6 million in 2025 to USD 892.9 million by 2035, with a compound annual growth rate (CAGR) of 3.3% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 642.6 million |

| Projected Europe Value (2035F) | USD 892.9 million |

| Value-based CAGR (2025 to 2035) | 3.3% |

The European food stabilizers market is witnessing steady growth because of the increased demand for texture enhancement, extended shelf-life, and improved product stability in food and beverage applications. Among the different types of food stabilizers, such as pectin, agar, gelatin, xanthan gum, carrageenan, and guar gum, the most important ones are those needed to maintain viscosity, consistency, and emulsification properties in food formulations.

Manufacturer interest in plant-based and seaweed-derived stabilizers reflects the growing influence of the clean-label and natural ingredients trend on the European food industry and consumers' trend toward sustainable, less-processed alternatives.

The bakery, dairy, and convenience food segments are drivers of the market's growth, with the use of stabilizers for the enhancement of moisture retention, prevention of separation of ingredients, and preservation of a uniform texture. In addition, the increased demand for gluten-free and plant-based formulations increases the usage of natural stabilizers such as pectin and guar gum, supporting clean-label product innovation.

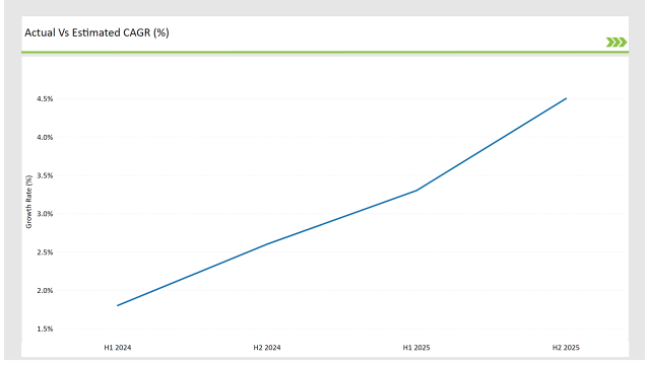

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Food Stabilizers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.8% |

| H2 (2024 to 2034) | 2.6% |

| H1 (2025 to 2035) | 3.3% |

| H2 (2025 to 2035) | 4.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Food Stabilizers market, the sector is predicted to grow at a CAGR of 1.8% during the first half of 2024, with an increase to 2.6% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly decrease to 3.3% in H1 but is expected to rise to 4.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Cargill launched a new pectin-based stabilizer for dairy and plant-based yogurt alternatives. |

| March-24 | Tate & Lyle expanded its hydrocolloid product portfolio with a high-performance guar gum solution. |

| February-24 | CP Kelco introduced a sustainable seaweed-derived stabilizer blend targeting clean-label bakery formulations. |

| January-24 | Ingredion acquired a specialty stabilizer company to strengthen its functional ingredient offerings. |

Increased Demand for Natural and Plant-Based Stabilizers in Clean-Label Food Applications

The increasing demand for clean-label, non-GMO, and plant-derived ingredients has fuelled the growth of natural food stabilizers. Fruits, seaweed, and legumes are the source of pectin, agar, and guar gum, which are the preferred choice for food manufacturers seeking clean-label formulations without artificial additives.

Vegan and plant-based food products have accelerated the trend toward plant-based stabilizers, especially in dairy alternatives, meat substitutes, and gluten-free baked goods.

The world's leading players, including CP Kelco, Cargill, and DuPont, are investing increasingly in innovation in biopolymer-based stabilizers, most of which are functional, organic, and non-GMO-based. Continued growth in the plant-based stabilizer segment goes hand in hand with favourable EU regulations regarding natural food additives, further securing their roles in sustainable food production and natural ingredient sourcing.

Technological Advancement in Multi-Functional Stabilizer Blends for Enhanced Performance

Multi-functional stabilizer systems have completely changed the food stabilizer market. They can indeed provide improved mouthfeel and optimized textural properties and stability in complex food formulations. As low-fat, low-sugar, and reduced-calorie food products gain popularity, stabilizer manufacturers are innovating customized hydrocolloid blends to ensure ideal consistency, water retention, and gelling properties in low-fat dairy, sugar-free confectionery, and plant-based beverages.

Tate & Lyle and Ingredion, the market leaders in the stabilization category, have recently developed synergistic blends that further improve emulsification, suspension, and freeze-thaw stability in food applications. Texture modification and sensory enhancement will become significant points of focus for food formulators; the role of tailored stabilizer solutions in the next-generation development of food products is growing rapidly.

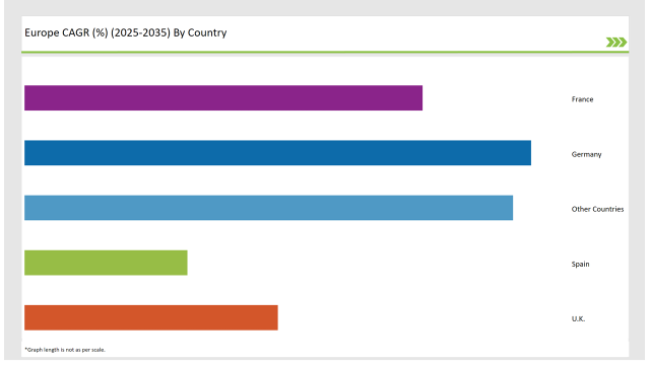

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Spain | 9% |

| UK | 14% |

| France | 22% |

| Other Countries | 27% |

The growth is very good for Spain with its increasing demands on food stabilizers to have greater meat, dairy, and ready-to-eat products. Being at a quite high level in its meat processing sector, this industry utilizes enormous proportions of carrageenan, guar gum, and xanthan gum in developing the processed texture, water retaining properties, and shelf life for the preserved products such as sausages, cold cuts, and canned meats.

With increasing low-fat and reduced-sodium meat formulations, hydrocolloid blends that will help maintain juiciness and improve protein binding in meat applications are gaining much attention from the manufacturers of stabilizers.

The rise of plant-based milk alternatives has caused a growth in demand for stabilizers that can emulate the inherent texture of a dairy product as well, particularly in almond milk, oat-based yogurts, and coconut-based cheeses.

Sweden is an international leader in the clean-label and organic food movement, propelling demand for natural and plant-based stabilizers. Swedish consumers, who are concerned about health, transparency, and sustainability, are looking for stabilizer solutions that are organic and eco-friendly in food production.

Pectin, agar, and guar gum have gained popularity in Sweden's plant-based food sector, especially in vegan cheese, plant-based yogurts, and dairy-free desserts. Manufacturers are adding biodegradable stabilizers that provide emulsification and viscosity enhancement while keeping clean-label certifications.

The sweet and savoury manufacturing uses stabilizers such as xanthan gum and locust bean gum to make gluten-free and high-fibre bakery products perform structural integrity and moisture balance.

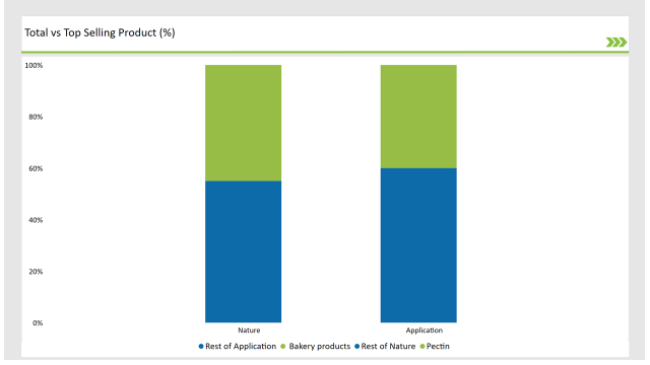

% share of Individual Categories Product Type and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type ( Pectin ) | 45% |

| Remaining segments | 55% |

Pectin is used as the most widely applied stabilizer in dairy and confectionery products. Pectin is primarily extracted from citrus peels and apple pomace, and its gelling, thickening, and stabilizing properties make it an important ingredient in fruit-based dairy products, confectionery, and jams. The increasing low-sugar and reduced-calorie formulations have enhanced its usage in sugar-free and reduced-fat products, where it improves mouthfeel and maintains product consistency.

Pectin is also seeing tremendous growth in plant-based dairy alternatives where creaminess and texture are maintained in oat-based yogurts, almond milk, and vegan cheese. With the clean-label appeal and natural origin of pectin as the reason for being preferred more so over synthetic stabilizers by European food manufacturers, the ingredient is becoming the most dominant in premium and functional food applications.

| Main Segment | Market Share (%) |

|---|---|

| Application ( Bakery products ) | 40% |

| Remaining segments | 60% |

The bakery sector accounts for crucial stabilizers, especially in holding moisture, in gluten-free systems, and in stabilizing dough. The demand for soft-textured, fresh, and high-quality baked goods increased the demand for xanthan gum, guar gum, and pectin, ensuring structural integrity, volume improvement, and increased shelf-life of bakery products.

Stabilizers have played an important role in maintaining dough elasticity as gluten-free bakery products with high protein and low crust crumb dryness have increased in popularity. Growing frozen and ready-to-bake pastry categories have presented a need for freeze-thaw stability in the baking industry for stabilizers to hold in the texture and moisture balance after storing.

As Europe's bakery sector continues to innovate with functional ingredients, stabilizers will be crucial for high-performance, texture-enhancing solutions for bakery formulations.

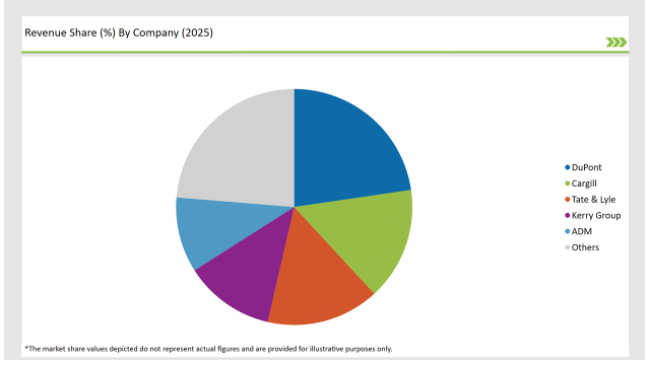

2025 Market share of Europe Food Stabilizers manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| DuPont | 22% |

| Cargill | 15% |

| Tate & Lyle | 15% |

| Kerry Group | 12% |

| ADM | 10% |

| Others | 23% |

Note: The above chart is indicative in nature

The European food stabilizers market is highly competitive, primarily based on input from global hydrocolloid manufacturers and specialized ingredient suppliers. Among the leading companies are Cargill, CP Kelco, Tate & Lyle, Ingredion, and DuPont same players who take up most of the market share due to product innovation, customized stabilizer blends, and sustainable ingredient sourcing.

Clean-label and natural stabilization are amongst priorities and well communicated among these companies to align consumer demands for transparent ingredient lists and fewer artificial additives. Technological advancements in biopolymer-based stabilizers and enzyme-modified hydrocolloids are conditioning the nature of competition prevailing in the market.

Manufacturers are investing in functional stabilizer blends that offer emulsification, moisture retention, and viscosity enhancement benefits. Increasing multi-functional stabilizer adoption in low-fat, sugar-free, and high-protein food formulations drives R&D investment in next-generation stabilizer solutions.

As per Product Type, the industry has been categorized into Pectin, Agar, Gelatine, Xanthan Gum, Carrageenan, Guar Gum and Others.

As per Source, the industry has been categorized into Seaweed, Plant, Microbial, Synthetic, Animal, and Others.

As per Application, the industry has been categorized into Bakery Products, Dairy and Desserts, Confectionery Items, Sauces and Dressings, Meat and Poultry Products, Convenience Foods, Beverages and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Food Stabilizers market is projected to grow at a CAGR of 3.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 892.9 million.

Key factors driving the European food stabilizers market include the growing demand for processed and convenience foods, which require stabilizers for improved texture and shelf life. Additionally, increasing consumer awareness of food quality and safety is prompting manufacturers to incorporate stabilizers that enhance product stability and consistency.

Germany, France, Spain and Italy are the key countries with high consumption rates in the European Food Stabilizers market.

Leading manufacturers include DuPont, Cargill, Tate & Lyle, Kerry Group, and ADM known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Food Stabilizers Market Share & Provider Insights

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Europe Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Comprehensive Analysis of Food Premix Market by Form, Ingredient Type, End-Use Application and Function Type through 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Europe Superfood Powder Market Analysis – Size, Share & Forecast 2025-2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

Europe Frozen Food Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Food Stabilizers Market Report – Trends, Demand & Industry Forecast 2025–2035

Europe Allergen Free Food Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Europe Plant-Based Pet Food Market Analysis – Growth, Applications & Outlook 2025-2035

Latin America Food Stabilizers Market Trends – Growth, Demand & Forecast 2025–2035

Europe Whole Grain and High Fiber Foods Market Insights – Size & Forecast 2025–2035

Metal Food Can Industry Analysis in Europe Insights - Growth & Forecast 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA