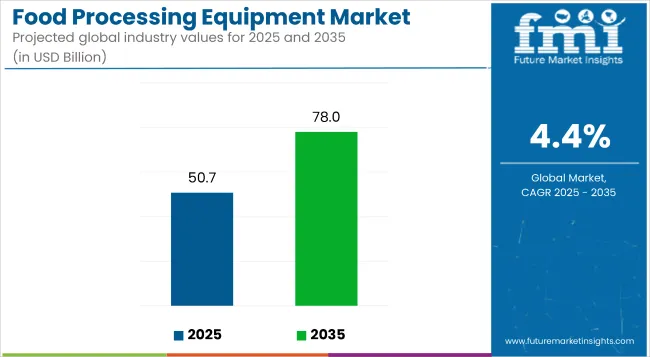

The global food processing equipment market is valued at USD 50.7 billion in 2025 and is slated to reach USD 78.0 billion by 2035, which shows a CAGR of 4.4%. This growth is being fueled by increasing demand for processed and packaged foods, driven by busy consumer lifestyles and evolving dietary preferences.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 50.7 billion |

| Market Size (2035) | USD 78.0 billion |

| CAGR (2025 to 2035) | 4.4% |

Technological advancements, especially in automation, along with heightened awareness about food safety and hygiene standards, are also contributing to the expansion of the industry.

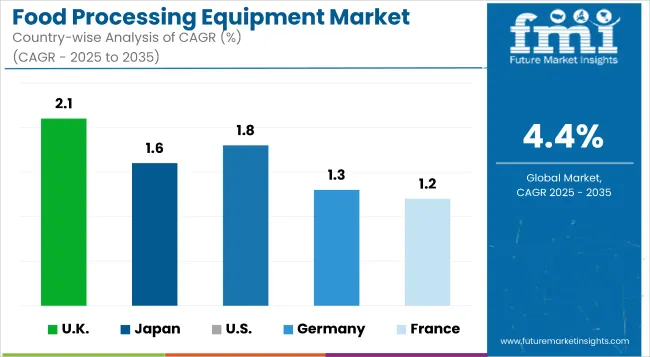

The countries expected to register significant CAGRs in the market include the UK at 2.1%, the USA at 1.8%, and Germany at 1.3%. These regions are likely to witness moderate yet steady growth driven by the adoption of advanced processing technologies and increased emphasis on food safety and efficiency.

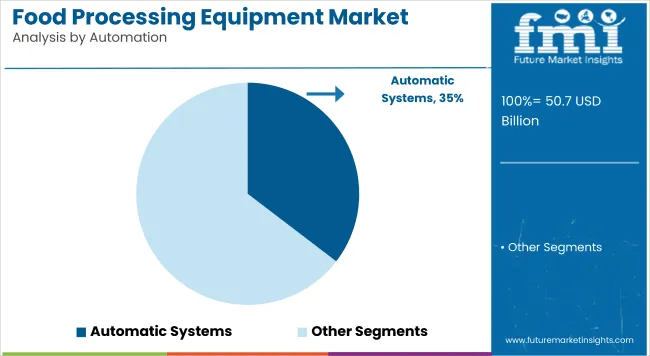

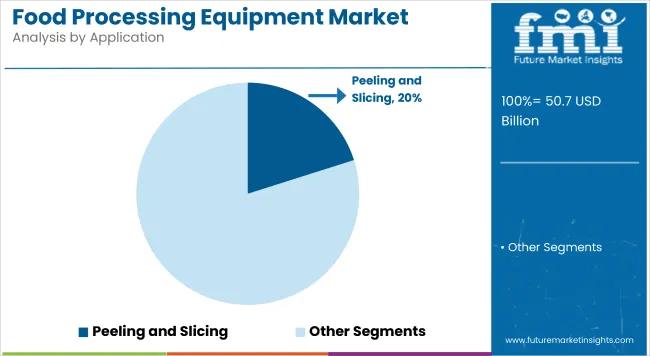

In terms of market segmentation, the automatic equipment segment is projected to hold the largest share at 35.4%, driven by rising automation trends in food production. This is followed by the peeling and slicing segment, which is expected to account for 20.1% of the market in 2025, supported by growing demand for convenience and pre-processed food products.

The market holds a significant share within its parent industries. It accounts for approximately 25% of the broader food processing and handling equipment market, reflecting its central role in operational efficiency and food safety. Within the industrial machinery market, it represents around 8-10%, given its specialization.

In the food and beverage industry, it contributes nearly 12%, primarily supporting production processes. It also forms about 15% of the food technology market, driven by innovation and automation. In packaging equipment and automation systems, it holds smaller shares, typically ranging between 5-8%, depending on application focus.

The market is segmented by automation type, application, and region. By automation type, it includes automatic, semi-automatic, and manual systems.

Based on application, the market comprises storage tank, chiller, pasteurizer, filters, CIP unit, cream separators, spray dryer, homogenizer, batch collectors & feeders, pulverizing and mixing, fermenting, peeling and slicing, and others (including weighing systems, coating machines, inspection systems, and conveyor systems).

Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The automatic segment is expected to be the most lucrative, accounting for a 35.4% market share in 2025. This dominance is attributed to increasing demand for efficiency, reduced human intervention, and adherence to hygiene standards.

The peeling and slicing segment are projected to be the most lucrative, holding a 20.1% market share in 2025.

The market is expanding steadily, driven by increasing demand for processed and convenience foods, rising adoption of automation in food manufacturing, and continuous advancements in hygienic and energy-efficient processing technologies.

Recent Trends in the Food Processing Equipment Market

Challenges in the Food Processing Equipment Market

Among the top five countries analyzed in the market, the UK is expected to exhibit the fastest growth with a CAGR of 2.1%, followed by Japan at 1.6%, and the USA at 1.8%. Germany and France are projected to register comparatively slower growth, with CAGRs of 1.3% and 1.2%, respectively.

The higher growth in the UK and Japan is driven by rising demand for convenience foods, sustainable technologies, and compact automation systems. In contrast, growth in Germany and France is stable, backed by strong domestic industries and innovation, yet limited by market maturity and slower digital transition.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA food processing equipment revenue is projected to grow at a CAGR of 1.8% from 2025 to 2035, driven by its strong industrial base and early adoption of automation technologies in food manufacturing.

The demand for food processing equipment in the UK is expected to expand at a CAGR of 2.1% between 2025 and 2035, supported by increasing demand for packaged and convenience foods and a shift toward sustainable, energy-efficient equipment.

Germany’s food processing equipment revenue is anticipated to grow at a CAGR of 1.3% over the forecast period.

Sales of food processing equipment in France are projected to witness moderate growth with a CAGR of 1.2% from 2025 to 2035, fueled by a strong processed food industry and emphasis on automation to enhance food quality and safety.

Sales of food processing equipment in Japan are forecasted to grow at a CAGR of 1.6% during the forecast period, supported by a high-tech manufacturing landscape and an aging population driving demand for ready-to-eat and functional food products.

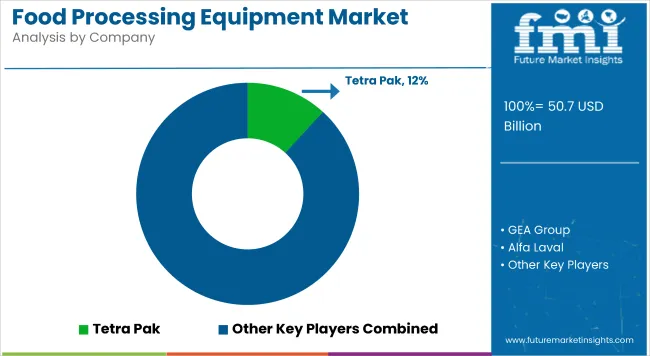

The market is moderately fragmented, with the presence of both global giants and regional specialists. Leading players such as Tetra Pak, GEA Group, Alfa Laval, and Middle by Corporation dominate through broad product portfolios, technological leadership, and strong distribution networks.

Top companies are leveraging expansion strategies, M&A activity, and partnerships to enter emerging markets and diversify their offerings. Tetra Pak and Alfa Laval remain innovation-driven, focusing on modular and energy-saving equipment. Regional growth is being tapped by players like Hoshizaki and Welbilt through targeted product development suited to local manufacturing needs.

Recent Food Processing Equipment Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 50.7 billion |

| Projected Market Size (2035) | USD 78.0 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in units |

| By Automation Type | Automatic, Semi-automatic, and Manual |

| B y Application | Storage Tank, Chiller, Pasteurizer, Filters, CIP Unit, Cream Separators, Spray Dryer, Homogenizer, Batch Collectors & Feeders, Pulverizing and Mixing, Fermenting, Peeling and Slicing, and Others (including Blanchers, Grading Machines, Roasters, and Cooling Tunnels) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Tetra Pak, Hoshizaki Corporation, GEA Group, Alfa Laval, Krones AG, Middle by Corporation, Bühler Group, Marelhf, Atlas Pacific Engineering Company Inc., Welbilt Inc., Dover Corporation, Rational AG |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is valued at USD 50.7 billion in 2025.

It is projected to grow at a CAGR of 4.4% from 2025 to 2035.

Peeling and slicing equipment leads with a market share of 20.1% in 2025.

The UK is the fastest-growing country with a CAGR of 2.1% during 2025 to 2035.

Automatic systems are leading with a 35.4% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hygienic Easy-to-Clean Food Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA