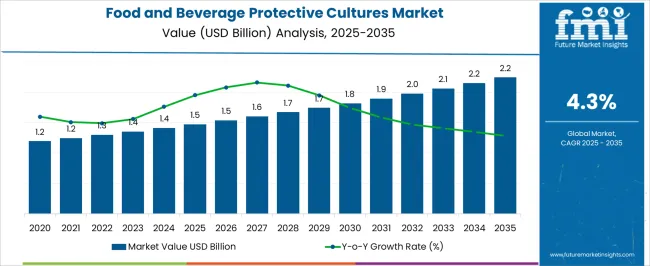

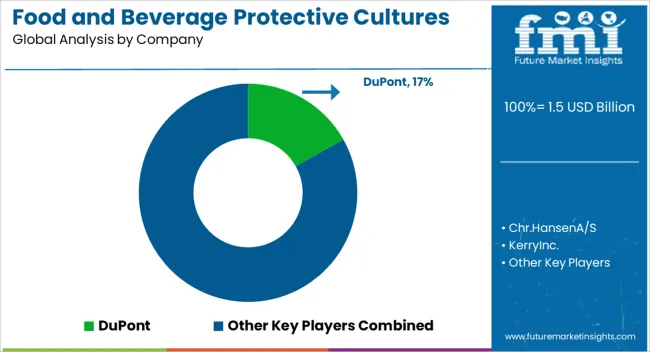

The Food and Beverage Protective Cultures Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Food and Beverage Protective Cultures Market Estimated Value in (2025 E) | USD 1.5 billion |

| Food and Beverage Protective Cultures Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The food and beverage protective cultures market is advancing rapidly, supported by rising consumer demand for clean-label, naturally preserved products. Manufacturers are increasingly shifting from chemical preservatives to microbial-based cultures to extend shelf life and maintain food safety without compromising product integrity. Functional cultures are being adopted across dairy, beverage, and fermented food categories, driven by health-conscious consumption and regulatory acceptance of bio-protective ingredients.

Industry stakeholders are investing in strain development that targets specific spoilage organisms while preserving flavor, texture, and nutritional value. Enhanced cold-chain infrastructure and probiotic synergies are also facilitating widespread adoption across emerging markets.

Further momentum is being provided by sustainability goals and zero-waste strategies, which favor natural solutions that reduce product returns and losses. As R&D in strain specificity and application versatility continues to progress, the market is expected to evolve toward precision-based formulations tailored to product type, regional preferences, and storage conditions.

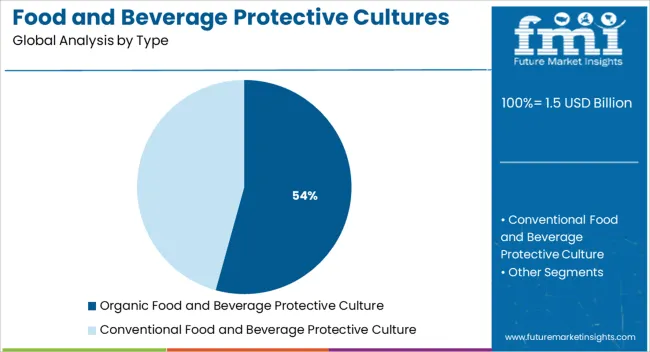

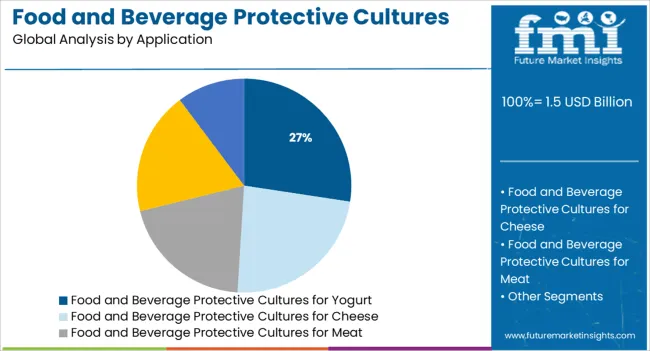

The market is segmented by Type and Application and region. By Type, the market is divided into Organic Food and Beverage Protective Culture and Conventional Food and Beverage Protective Culture. In terms of Application, the market is classified into Food and Beverage Protective Cultures for Yogurt, Food and Beverage Protective Cultures for Cheese, Food and Beverage Protective Cultures for Meat, Food and Beverage Protective Cultures for Seafood, and Food and Beverage Protective Cultures for Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Organic food and beverage protective cultures are projected to contribute 54.3% of total revenue within the type segment in 2025, positioning them as the leading subcategory. This dominance is attributed to the rising global demand for organic food products, where consumers seek transparency, minimal processing, and functional health benefits.

Organic protective cultures align with certified organic standards, making them the natural choice for clean-label and eco-conscious product lines. The subsegment has benefited from regulatory backing and growing retail shelf space dedicated to organic offerings, particularly in dairy and ready-to-eat foods.

Their ability to naturally inhibit spoilage microorganisms without synthetic additives has increased acceptance among manufacturers targeting health-aware demographics. Furthermore, supply chain integration of organic cultures has been supported by advancements in production scalability and microbial preservation techniques, ensuring stable quality and extended product life under organic compliance frameworks.

The yogurt application segment is expected to account for 27.4% of the total market revenue in 2025, making it the leading application within food and beverage protective cultures. This leadership is influenced by the widespread consumption of yogurt globally and its susceptibility to spoilage and texture degradation due to microbial imbalances.

Protective cultures have become essential in stabilizing shelf life, preserving sensory attributes, and preventing post-acidification during storage and distribution. The segment has been driven by rising demand for natural preservation methods in both dairy-based and plant-based yogurt alternatives.

In addition, yogurt producers are leveraging specific protective cultures to ensure product uniformity and consumer safety, particularly in probiotic and high-protein formulations. Expansion into functional health markets and personalized nutrition categories has also elevated the importance of bio-protection in yogurt, securing its top rank among application segments.

Consumers with a strong health-conscious attitude drive competition among major players in the global food and beverage industry. It is imperative for brands and manufacturers in the food and beverage industry to communicate the value of their products to their target audiences while maintaining the highest quality of shelf life.

In recent years, packaged food has come under the spotlight of attention due to changing lifestyles and peculiar eating habits. Market revenue for food and beverage protective cultures is expected to increase gradually in the future. Companies that manufacture protective cultures for food and beverages provide alternatives to artificial preservatives.

Food and beverage manufacturers commonly use artificial preservatives in the fabrication of food and beverages, especially fermented foods, in order to extend their shelf lives. As dairy and meat products are highly perishable, it is highly important to use protective cultures in these products to ensure that they do not rapidly deteriorate.

Food and beverage brands have become increasingly concerned with extending the shelf life of their products. Hence, protective cultures are increasingly being used to extend shelf life. When serving a large global market, shelf life is crucial when it comes to inventorying and supply chain management.

Retail shelves are filled with brands that have product portfolios that last a long time. Compared to artificial preservatives, protective cultures are more expensive. Even though protective cultures are relatively more expensive, food and beverage brands are increasingly adopting them since they allow them to target consumers who demand natural alternatives to processed foods.

In addition to communicating the benefits of natural ingredients over artificial preservatives, ingredient marketing is a growing trend among manufacturers and marketers. Recent advances have been made in the development of protective cultures that do not require fermentation to be added to food and beverages.

In response to consumer demands for organic foods and beverages, food and beverage manufacturers are highly investing in protective cultures for food and beverages. The global market for protective cultures faces limited or restricted scope for foods that are heat treated.

However, continuous product innovation and new product development processes are expected to broaden the scope of application for the food and beverages protective cultures market.

Protective cultures will face major challenges as a result of stringent laws and regulations imposed by the government. A growing demand for vegan food products and concerns about health issues related to these preservatives are expected to further diminish this market's growth.

There will be further declines in the scope for growth for the protective cultures market owing to fluctuations in prices of raw materials and disruptions in the supply chain as a result of the pandemic. Research and development costs associated with protective cultures will also hinder the growth rate of the future market.

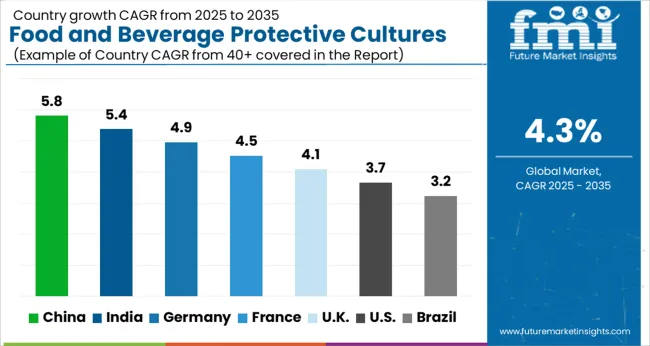

The North American market has emerged as a major powerhouse in the food and beverage sector in recent decades, and the market is predicted to continue to grow between 2025 and 2035 as a result of environmental factors. With a market share of 33% by the end of 2025, North America is predicted to account for a significant share of that growth.

Several retail chains and outlets in North America have contributed to an increase in demand for protective cultures in the food and beverage industry. The increasing consumption of dairy and meat products in these regions will also propel the growth of food and beverage protective cultures.

Consumption of beverages in these regions is expected to increase, creating a large total incremental opportunity between 2020 and 2035. The combined effects of all these factors are driving the market for protective cultures in the food and beverage sector.

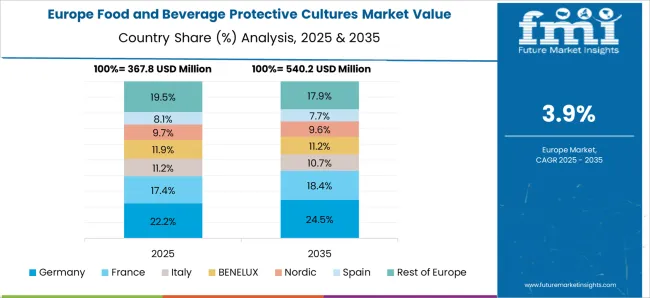

According to Future Market Insights, Europe is accounted for the second largest share of the market with 28.5%. Dairy production in Europe accounts for one of the major factors that is contributing to the region's position as the dominant region on the market.

Increasing milk production and strong global demand have positively impacted the European dairy market. Protective cultures have experienced significant growth as a result of support from the European dairy market.

In addition to resurging adoption of various food safety trends, increasing innovation across the food and beverage sector has contributed to significantly growing business opportunities for protective cultures.

The majority of European consumers prefer dairy products that are natural, organic, and sustainable, containing minimal processing and a simple list of ingredients. A transparent product labeling system also facilitates the knowledge of ingredients used in dairy products among health-conscious consumers in the region. These factors have propelled the growth of protective cultures in the market.

According to Future Market Insights, during the assessment period 2025-2035, protective cultures for organic foods and beverages will gain a maximum share of the global market. Considering the rapid development of clean label food products, the demand for vegan food and beverage products in the food and beverage industry is expected to have a positive impact on the global market.

Increasing allergies and serious health issues associated with chemical cultures used in labs have further increased the market demand for organic protective cultures. A recent trend in the dairy industry has been focusing more on 'clean label' foods because of the growing demand for natural dairy food products.

As a way to extend the shelf life of dairy products, dairy producers historically used artificial additives and preservatives. Millennials and families with children are concerned about the risks posed by artificial ingredients, which have led them to scrutinize the use of these ingredients. All these factors to propel the growth for organic cultures in the market.

As cheese becomes a staple ingredient in various junk foods and beverages, it is expected to account for the largest share in the market in 2025. Food manufacturers are expected to invest significantly in cheese market as it is predicted to grow at a CAGR of 4% in the global market.

Shelf life remains a key consideration for consumers when making purchases of cheese in the market. Hence, manufacturers of cheese products are encouraged to consider the product's open shelf life in order to support a more sustainable supply chain in the future. With more on-the-go customers and ready-to-eat meals, the protective cultures in the food and beverage industry will be driven in the market.

With an improved shelf life, waste will be reduced, which contributes to a more sustainable world, and this allows producers to expand geographically and increase their revenues in the market. As a result, cheese protective cultures will continue to be in demand in the market.

How are Food and Beverage Industries Transforming Protective Culture Global Market Dynamics?

Numerous start-ups offering food and beverage protective cultures are making headlines due to the popularity of clean label packaging solutions in the market. The start-up companies also offer a range of products, services, and distribution that include food and beverage protective cultures.

Due to the increasing use of artificial alternatives to package numerous products, most protective cultures are deployed across the food and beverage industries.

A number of global and local competitors compete in the global food and beverage protective cultures market. Companies use a variety of marketing methods to market themselves, including mergers and acquisitions, expansions, collaborations, and partnerships.

Some of the key participants present in the global food and beverage protective cultures market include Competition Deep Dive, Chr.Hansen A/S, Dupont, Sacco Srl, Prayon S.A., Kerry Inc., DSM N.V., Dalton Biotechnologie S.r.l., OCP Group, PK Chem Industries Ltd., BIOPROX INGREDIENTS, and Meat Cracks Technologie GmbH.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% from 2025 to 2035 |

| Market Value in 2025 | USD 1.5 billion |

| Market Value in 2035 | USD 2.2 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Type, Application, Region |

| Regions Covered |

North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled |

Chr. Hansen A/S; DuPont; Sacco s.r.l; Prayon S.A; Kerry Inc.; DSM N.V; Dalton Biotechnologie S.r.l; OCP Group; BIOPROX INGREDIENTS; Meat Cracks Technologie GmbH; PK Chem Industries Ltd. |

| Report Customization & Pricing | Available upon Request |

The global food and beverage protective cultures market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the food and beverage protective cultures market is projected to reach USD 2.2 billion by 2035.

The food and beverage protective cultures market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in food and beverage protective cultures market are organic food and beverage protective culture and conventional food and beverage protective culture.

In terms of application, food and beverage protective cultures for yogurt segment to command 27.4% share in the food and beverage protective cultures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA