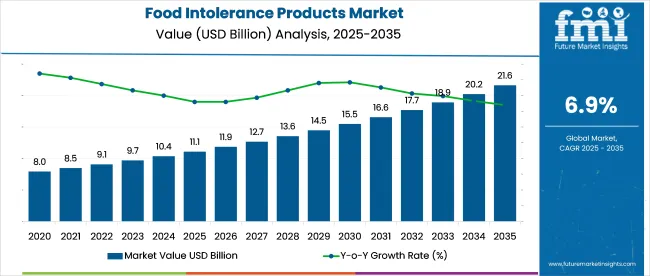

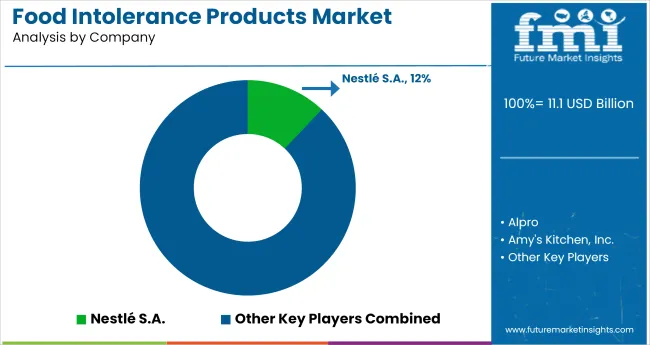

The global food intolerance products market is valued at USD 11.1 billion in 2025. Demand is projected to reach approximately USD 21.6 billion by 2035, registering a CAGR of 6.9% over the forecast period.

| Attribute | Detail |

|---|---|

| Industry Size (2025E) | USD 11.1 billion |

| Industry Size (2035F) | USD 21.6 billion |

| CAGR (2025 to 2035) | 6.9% |

The food intolerance products industry represents roughly 6% to 10% of its parent markets. Its strongest presence is in the free-from foods market, where it comprises around 25%, led by high demand for gluten-free and lactose-free options. In the health and wellness food sector, it accounts for approximately 8%, driven by rising dietary sensitivities and demand for cleaner ingredient labels.

Within the functional foods and beverages sectors, it holds a smaller share of about 5%, as many intolerance-friendly products overlap with functional health claims. The specialty foods industry witnesses a contribution of nearly 10%, fueled by niche product development. In the dietary supplements space, its share is close to 2%, primarily through digestive support solutions.

Nestlé is advancing its plant-based strategy with product innovations that serve both health-oriented consumers and those with dietary restrictions. According to the company, offerings such as gluten-free cauliflower crust pizza and natural bliss oat milk are designed to meet this dual demand without sacrificing accessibility or taste. At Expo West 2023, Nestlé introduced over 35 new intolerance-friendly products, positioning itself to capture a share of the projected USD 26 billion industry by 2032. This expansion reflects the company’s focus on scalable formulations that align with evolving consumer preferences in the food intolerance segment.

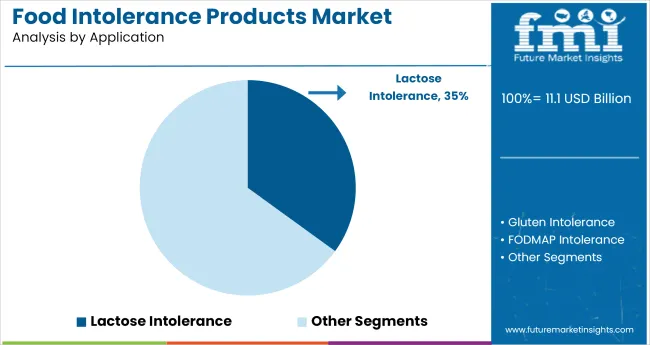

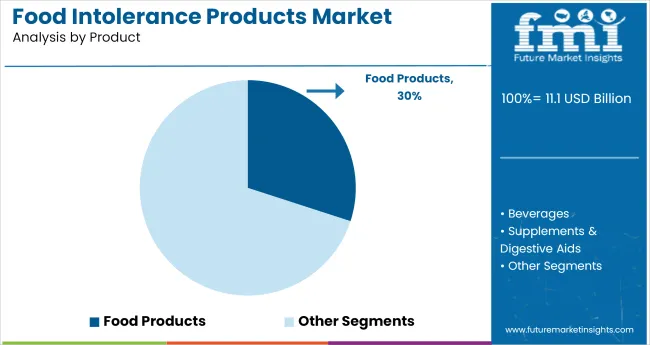

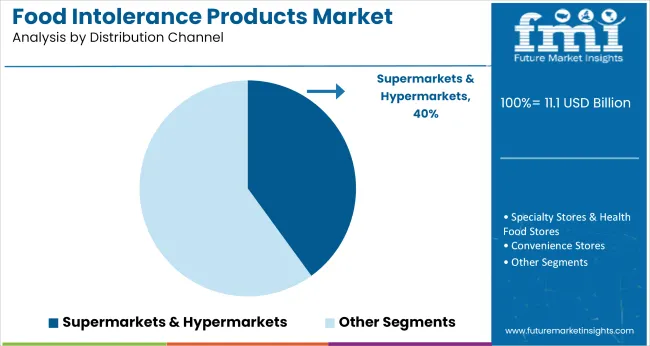

Growth in the industry is driven by heightened awareness of dietary sensitivities and functional nutrition. Lactose-free products hold a 35.0% share, followed by food products at 30%, while supermarkets lead distribution with a 40.0% channel share.

Rising cases of dairy intolerance globally have led to lactose-free products commanding 35.0% of the total market. In regions such as East Asia and sub-Saharan Africa, lactose malabsorption affects over 65% of the population, contributing to strong demand for dairy alternatives. Manufacturers like Alpro, Danone, and Silk now offer extended portfolios of almond, oat, and rice-based milks, yogurts, and creamers. Product reformulation has focused on achieving protein content parity (~3g/100ml) with cow’s milk and maintaining calcium fortification standards above 100mg per serving.

Driven by consumer demand for gluten-free, lactose-free, and nut-free offerings food products hold a 30% share of the market, Manufacturers are reformulating staple items such as pasta, cereals, and snacks using rice, buckwheat, and millet flours to match texture and nutritional quality. Leading brands like Enjoy Life Foods, Schär, and Made Good produce over 500 SKUs collectively, covering common allergens. 45-50% of free-from food launches in 2024 focused on bakery and snack items. Shelf-stable innovation has improved product lifespan from 6 to 9 months, reducing waste and returns.

Supermarkets and hypermarkets dominate the retail landscape, accounting for 40.0% of total sales in allergen-free food industry. Chains like Walmart, Carrefour, and Tesco now allocate over 15 to 20 shelf facings per aisle for free-from categories. Consumers benefit from visibility, in-store sampling, and direct brand comparisons under one roof. Surveys indicate that 65% of buyers prefer to purchase intolerance products in physical stores for label scrutiny and assurance. Promotional offers on allergy-friendly and certified goods (e.g., gluten-free, dairy-free) have increased trial rates across general shoppers.

The industry is evolving through clean-label innovations and improved intolerance awareness. Manufacturers are offering allergen-free, gluten-free, and lactose-free options to meet rising consumer demand for health and transparency.

Formulation Adjustments Drive SKU Consolidation in Retail Channels

Retailers in the UK, Germany, and Australia have trimmed lactose-free and gluten-free product assortments by 14% between Q3 2024 and Q1 2025 to reduce shelf redundancy and improve sell-through. Private-label players prioritized high-velocity lines, specifically almond-based milk and rice-based pasta-triggering a 19% delisting of slow-turning SKUs like quinoa-flour wraps and oat yogurt variants. Reformulation toward dual-intolerance claims (e.g., dairy- and gluten-free) rose 11% across European listings, enabling multipurpose positioning without requiring added shelf space.

Enzyme-Based Solutions Gain Clinical and Commercial Traction

A 2024 meta-analysis by Monash University confirmed that lactase and alpha-galactosidase enzyme supplements reduced IBS-related symptoms in 67% of food intolerance cases when taken pre-consumption. This validation prompted functional food manufacturers to incorporate microencapsulated enzymes into ready-to-drink nutritional beverages and meal replacement shakes. In the USA, market tracking shows a 22% increase in enzyme-fortified SKUs among intolerance-targeted products over 12 months. South Korea’s top three pharmacy chains began stocking these products in Q1 2025, correlating with a 15% lift in same-store supplement sales.

Cost Headwinds from Specialty Inputs and Packaging Materials

Ingredient inflation continues to compress margins, with rice starch and pea protein isolate prices up 12% and 9% YoY, as of May 2025. Specialty ingredient suppliers in India and Thailand cite poor harvests and cross-border regulatory delays as key contributors. also the multilayer PET film used in allergen-barrier pouches has risen 16% in price due to globe feedstock shortages. These input cost hikes have outpaced the 5-6% average shelf price increases in North America and Western Europe, resulting in a gross margin squeeze across intolerance-focused brands.

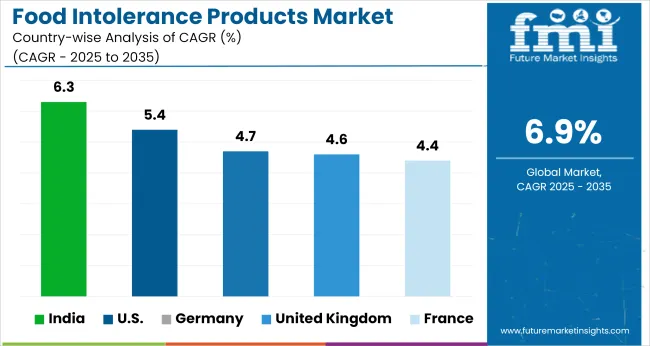

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

| United Kingdom | 4.6% |

| Germany | 4.7% |

| France | 4.4% |

| India | 6.3% |

Global demand for allergen-free food is expected to expand at a 6.9% CAGR between 2025 and 2035. India, a BRICS member, records 6.3%, trailing the global average by just 9%, indicating relatively aligned momentum. By contrast, OECD markets display slower growth: The United States posts 5.4% (-22% gap), Germany 4.7% (-32%), the United Kingdom 4.6% (-33%), and France 4.4% (-36%).

These deviations suggest maturity in product penetration and tighter competition in Western markets. India’s performance stems from growing health awareness and wider product accessibility in metro and secondary regions. Slower pace in OECD economies can be linked to already well-established intolerance offerings and plateauing consumer conversion. The divergence between BRICS and OECD economies shows how regional dynamics-ranging from evolving dietary habits to varying health infrastructure-continue to shape the pace of growth in this segment.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The USA food intolerance products industry is projected to grow at a CAGR of 5.4% from 2025 to 2035. Consumer adoption of gluten-free, lactose-free, and nut-free alternatives is rising steadily, supported by technological integration in food sensitivity diagnostics. A 2024 national survey indicated that over 30% of USA households actively avoid at least one major allergen. Food manufacturers are increasingly reformulating legacy products, while direct-to-consumer brands are scaling their allergen-free portfolios through subscription models.

The UK industry is advancing at a 4.6% CAGR, underpinned by strong regulatory enforcement and heightened consumer awareness. Following the implementation of Natasha’s Law, clear allergen labeling has become central to consumer trust. According to Coeliac UK, 1 in 10 UK consumers follows a gluten-free diet-either due to diagnosis or lifestyle preference. Demand has sharply increased for lactose-free yogurts, gluten-free breads, and low-FODMAP ready meals, especially across major grocery chains.

The intolerance-focused food sector in Germany is projected to expand at a CAGR of 4.7% through 2035. Ingredient transparency and product certification remain critical drivers, with over 66% of shoppers reviewing ingredient labels before purchase. The sector shows strong preference for gluten-free bakery products, lactose-free dairy, and soy-free alternatives. Multinational and regional manufacturers continue to focus on clean formulation, backed by EU-compliant allergen labeling.

The industry in France is evolving at a CAGR of 4.4%, shaped by consumer shifts toward health-aware, intolerance-friendly options. A growing segment of French consumers is embracing allergen-free diets, with gluten-free bakery and lactose-free dairy products gaining mainstream acceptance. Government-backed nutrition programs and food education campaigns are driving demand for labeled and reformulated products.

India is projected to lead global growth in intolerance food products with a steady CAGR of 6.3% from 2025 to 2035. Rising diagnoses of celiac disease, lactose intolerance, and nut allergies are contributing to strong uptake in allergen-specific products. A 2024 study by FSSAI found that 72% of urban Indian shoppers actively check food labels for allergen warnings. Millet-based flours, nut-free sweets, and lactose-free dairy alternatives are increasingly used in mainstream cooking.

The industry is structured around established multinational brands and smaller companies targeting niche dietary segments. Companies such as Nestlé S.A., Danone S.A., and General Mills Inc. retain a competitive edge by scaling their distribution and investing in research tied to lactose-free dairy and plant-derived alternatives.

Nestlé has expanded its oat-based beverage range, while Danone has grown its footprint through acquisitions in the free-from category, helping them address varying consumer dietary patterns. Smaller players like Dr. Schär AG/SPA and Amy’s Kitchen Inc. cater to specific gluten-free and organic demands. Barriers to entry remain high, driven by regulatory complexities, established retail partnerships, and ongoing brand-led innovation.

Recent Food Intolerance Products Market News

In 2024, Nestlé, through its Orgain brand, launched "Better Whey," an innovative animal-free, lactose-free whey protein powder produced using precision fermentation. This product replicates the nutritional profile of traditional whey, including all nine essential amino acids, while eliminating lactose, cholesterol, and animal-derived components. Marketed as easier to digest and more sustainable, Better Whey reflects Nestlé’s focus on clean-label, allergy-friendly offerings to meet the rising demand for allergen-free food industry in the USA specialty nutrition and plant-based industries.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.1 billion |

| Projected Market Size (2035) | USD 21.6 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Intolerance Types Analyzed (Segment 1) | Lactose intolerance products, Gluten intolerance products, Fodmap intolerance products, Histamine intolerance products, Sulfite intolerance products, Other intolerance products |

| Product Categories Analyzed (Segment 2) | Food Products, Beverages and Supplements & Digestive Aids |

| Distribution Channels Analyzed (Segment 3) | Supermarkets & hypermarkets, Specialty stores & health food stores, Convenience stores, Online retail, E-commerce platforms, Direct-to-consumer websites, Subscription services, Pharmacies & drugstores, Foodservice & HoReCa, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, the Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, UAE, Saudi Arabia, South Africa |

| Key Players | Alpro, Amy's Kitchen, Inc., Conagra Brands, Inc., Daiya Foods Inc., Danone S.A., Dr. Schär AG/SPA, Enjoy Life Foods (Mondelēz International), Follow Your Heart, Fody Food Co., General Mills, Inc., Glutino (The Glutino Food Group), Kellogg Company, Lactaid (McNeil Nutritionals, LLC), Mondelēz International, Inc., Nestlé S.A., Oatly Group AB, The Hain Celestial Group, Inc., The Kraft Heinz Company, The Lactalis Group, Udis Gluten Free (Boulder Brands, Inc.) |

| Additional Attributes | Dollar sales, share by intolerance and product type, demand rise in gluten-free and lactose-free categories, innovations in dairy alternatives, role of e-commerce in specialty product growth, regional dietary preference shifts |

The industry is segmented by product into food products, beverages, supplements & and digestive aids.

By application, the market covers lactose intolerance, gluten intolerance, FODMAP intolerance, histamine intolerance, sulfite intolerance, and other intolerance types.

Supermarkets & Hypermarkets, Specialty Stores & Health Food Stores, Convenience Stores, Online Retail (E-commerce Platforms, Direct-to-Consumer Websites, Subscription Services), Pharmacies & Drugstores, Foodservice & HoReCa, Others.

North America (USA, Canada), Europe (Germany, UK, France, Spain, Italy, Netherlands, Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of Middle East and Africa).

The global industry is anticipated to reach USD 21.6 billion by 2035, expanding from USD 11.1 billion in 2025, growing at a CAGR of 6.9% during the forecast period.

Gluten-free products dominate the market segment owing to rising gluten sensitivity cases, accounting for over 40% share in 2025.

The increasing prevalence of lactose intolerance and gluten sensitivity, coupled with consumer awareness regarding gut health and allergen-free diets, is propelling demand worldwide.

The leading market player include Nestlé S.A. holding 12% of market share.

North America is forecasted to maintain a dominant share, contributing approximately 35% of the global revenue by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy Food Products Market Analysis by food, beverages, oils and product type Through 2035 food, beverages, oils and product type

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Non-GMO Food Products Market Analysis - Size, Share & Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Nutrient Dense Food Products Market Analysis by Application, Ingredients, Sales Channel and Region Through 2035

Demand for Products From Food Waste in Western Europe - Size, Share and Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA