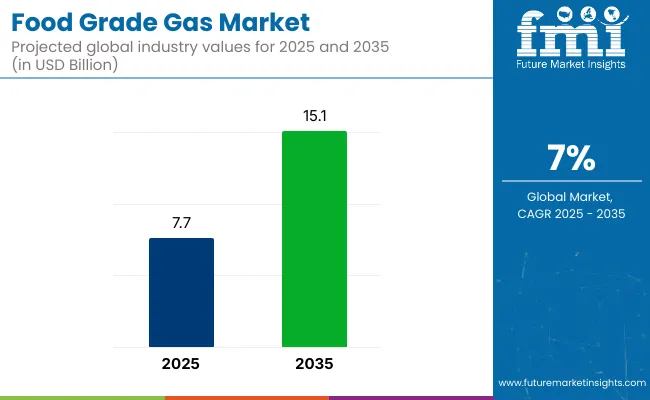

The global food grade gas market is projected to grow from USD 7.7 billion in 2025 to USD 15.1 billion by 2035, registering a CAGR of 7%. The market expansion is driven by the rising demand for safe, preservative-free food products and continued innovation in packaging technologies such as modified atmosphere packaging and cryogenic freezing.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7.7 billion |

| Forecast Value (2035) | USD 15.1 billion |

| Forecast CAGR | 7% |

Adoption of food grade gases is increasing for applications including carbonation, chilling, preservation, and packaging across beverage, dairy, meat, bakery, and convenience food sectors, as the global food supply chain prioritizes hygiene and shelf life extension.

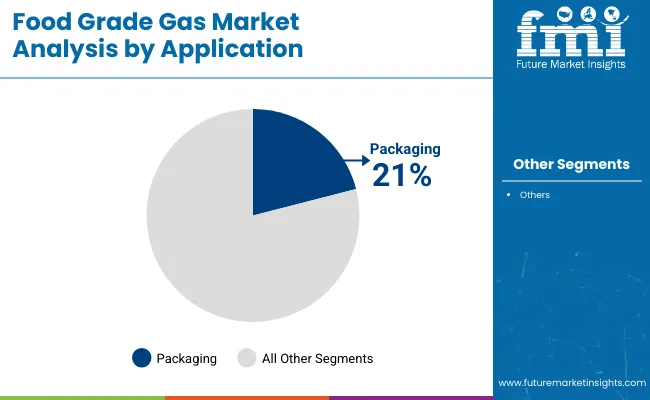

The market holds an approximately 21% of the food-grade packaging gas segment, highlighting its central role in ensuring freshness and product stability. The food grade gas category contributes around 1.5%. It also makes up close to 4% of the cryogenic gas equipment sector, mainly due to high usage of nitrogen and carbon dioxide in cold chain logistics. However, in the overall global industrial gas industry, its share remains limited at under 0.3%.

Government regulations impacting the market focus on ensuring safety, purity, and compliance with food processing standards.International standards, such as the US FDA CFR Title 21, the EU Regulation EC No 1333-2008, and the Codex Alimentarius, guide the quality, purity, and traceability requirements for gases used in food applications.

In regional markets, national codes such as BIS IS 307-1966 in India and China GB 10621-2006, support the development of consistent manufacturing practices. These regulatory frameworks are encouraging the adoption of highly purified food-grade gases along with safe storage and dispensing systems, leading to improved quality assurance and consumer confidence across the value chain.

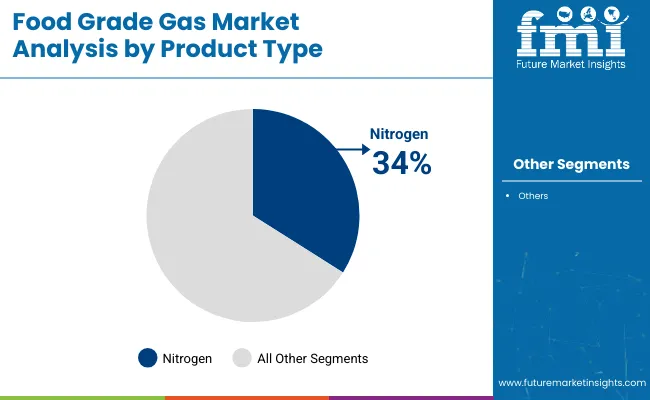

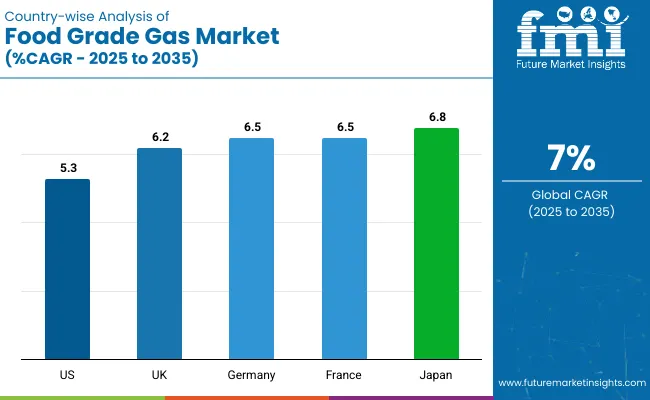

Japan is projected to be the fastest-growing market, expanding at a CAGR of 6.8% from 2025 to 2035. Nitrogen will lead the product type segment with a 34% market share, while packaging applications will dominate the application segment with a 21% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 5.3% and 6.5%, respectively.

The food grade gas market is segmented by product type, application, end-use, and region. By product type, the market is divided into carbon dioxide, nitrogen, oxygen, sulfur dioxide, and others (argon, helium, hydrogen, and nitrous oxide). In terms of application, the market is segmented into packaging, carbonation, freezing & chilling, and others (modified atmosphere packaging, pasteurization, baking, and brewing).

Based on end-use, the market includes meat, dairy & frozen products, fish & seafood, beverages, bakery & confectionery, fruit & vegetables, and others (sauces & dressings, snacks, ready meals, and dairy alternatives). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

Nitrogen are projected to lead the product segment, accounting for 34% of the global market share by 2025. These are widely used in packaging and chilling applications.

The packaging is expected to lead the application segment, accounting for 21% of the global market share in 2025.Food grade gases are widely used in modified atmosphere packaging (MAP) to extend the shelf life of perishable products such as meat, dairy, bakery items, fruits, and ready-to-eat meals.

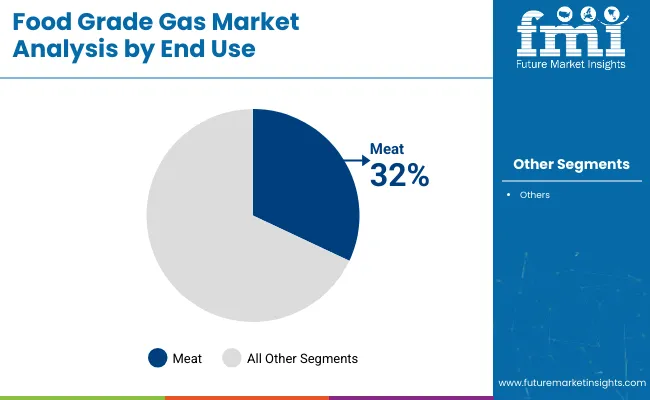

Meat is expected to capture 32% of the market share in 2025. The meat processing industry is a leading consumer of food grade gases due to the critical need for freshness, microbial control, and safety during packaging and storage.

The global food grade gas market is experiencing steady growth as the food and beverage industry focuses on safety, freshness, and longer shelf life. Food processors and packaging companies are adopting gases like nitrogen, carbon dioxide, and oxygen to meet consumer expectations and regulatory standards.

Recent Trends in the Food Grade Gas Market

Challenges in the Food Grade Gas Market

Japan leads the food grade gas market driven by its strict food safety regulations, growing demand for ready-to-eat and convenience foods, and widespread adoption of modified atmosphere packaging (MAP) to extend shelf life. While the USA food grade gas market is growing at 5.3% CAGR, Germany at 6.5%, France at 6.5%, and the UK at 6.2%.

The USA leads in CO₂-based carbonation and nitrogen-sealed meat packaging, driven by FDA regulations and supermarket-led retail chains. Germany and France emphasize sustainability and export-focused MAP systems, encouraged by EU food safety policies. The Japan food grade gas market shows strong integration with chilled food logistics and compact nitrogen systems suited to small-format retail. The United Kingdom continues to prioritize workplace safety and food labeling standards while expanding MAP adoption across bakery and meal kits.

This report covers in-depth analysisof 40+ countries; five top-performing OECD countries are highlighted below.

The USA food grade gas revenue is growing at a CAGR of 5.3% from 2025 to 2035. Growth is driven by widespread use of CO₂ in beverages and nitrogen in processed meats, snacks, and dairy.

The UK food grade gas market is projected to expand at a CAGR of 6.2% over the forecast period. The demand is driven by clean-label food regulations and post-Brexit updates to food safety and import standards.

The sales of food grade gas in Germany are projected to grow at a CAGR of 6.5% from 2025 to 2035. Growth is driven by meat exports, dairy processing, and baked goods, where nitrogen and CO₂ are essential for maintaining freshness and hygiene.

The French food grade gas market is forecasted to grow at a CAGR of 6.5% from 2025 to 2035. Growth is supported by increasing need for decarbonization and reduction of food waste are encouraging use of nitrogen and CO₂ across seafood, dairy, and pastry segments.

The demand for food grade gas in Japan is projected to grow at a CAGR of 6.8% during the forecast period. Growth is driven by increasing focus on compact, high-efficiency nitrogen systems used in convenience store meals, ready-to-eat bento boxes, and chilled desserts.

The food grade gas market is moderately consolidated, with prominent players such as Linde Group, Air Liquide, Air Products and Chemicals, Inc., Messer Group GmbH, Wesfarmers Ltd SOL Group, Gulf Cryo, Air Water, Inc., Massy Group, PT Aneka Industri, National Gases Limited, and Taiyo Nippon Sanso. These companies provide high-purity gases and integrated gas solutions catering to food and beverage processing, packaging, chilling, and carbonation applications.

Key players continue to invest in purity validation, gas distribution innovation, and automation to meet global regulatory standards such as FDA CFR Title 21 and EU Regulation EC 1333/2008.

Recent Food Grade Gas Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 7.7 billion |

| Projected Market Size (2035) | USD 15.1 billion |

| CAGR (2025 to 2035) | 7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value /volume in tons |

| Product Types Analyzed | Carbon Dioxide, Nitrogen, Oxygen, Sulfur Dioxide, and Others ( Argon, Helium, Hydrogen, and Nitrous Oxide) |

| Applications Analyzed | Packaging, Freezing and Chilling, Carbonation, Others ( Modified Atmosphere Packaging, Pasteurization, Baking, and Brewing) |

| End - Use Analyzed | Meat, Dairy and Frozen Products, Beverages, Bakery and Confectionery, Fish and Seafood, Fruits and Vegetables, Others ( Sauces & Dressings, Snacks, Ready Meals, and Dairy Alternatives) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Linde Group, Air Liquide, Air Products and Chemicals, Inc., Messer Group GmbH, Wesfarmers Ltd SOL Group , Gulf Cryo ,, Air Water, Inc. , Massy Group , PT Aneka Industri , National Gases Limited , and Taiyo Nippon Sanso |

| Additional Attributes | Market share analysis by source and grade, country-wise CAGR analysis, and brand positioning insights |

The market is valued at USD 7.7 billion in 2025.

The market is forecasted to reach USD 15.1 billion by 2035.

Nitrogen will lead the product type segment with a 34% market share in 2025.

The packaging segment is expected to hold approximately 21% share in 2025.

Japan is anticipated to be the fastest-growing market, with a CAGR of 6.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Industrial Gases Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA