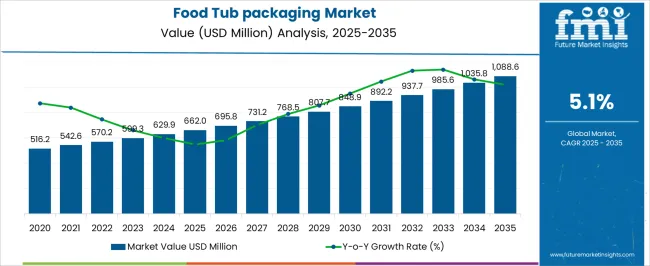

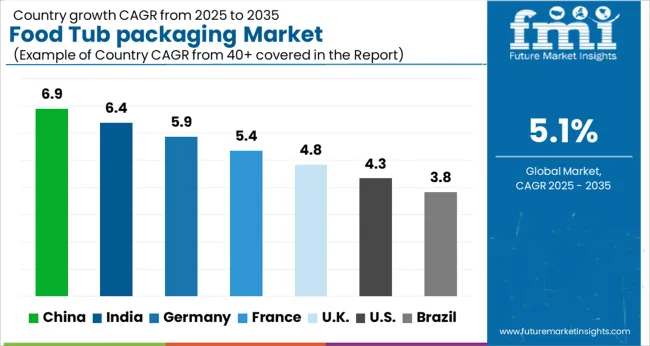

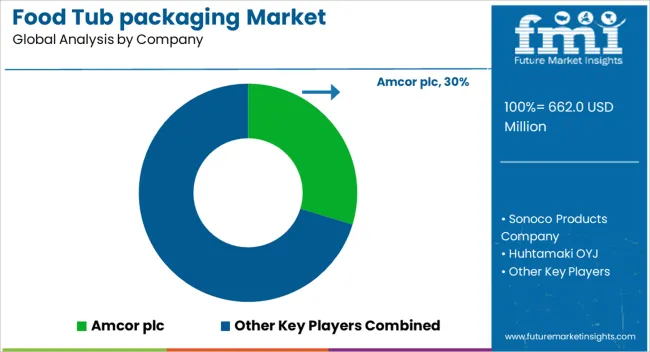

The Food Tub packaging Market is estimated to be valued at USD 662.0 million in 2025 and is projected to reach USD 1088.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Food Tub packaging Market Estimated Value in (2025 E) | USD 662.0 million |

| Food Tub packaging Market Forecast Value in (2035 F) | USD 1088.6 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The food tub packaging market is experiencing stable growth fueled by rising demand for portion controlled, ready to eat, and chilled food products across retail and foodservice sectors. Increasing preference for hygienic and tamper evident packaging formats has encouraged the adoption of tub packaging in dairy, frozen desserts, and convenience food categories.

Advancements in lightweight materials and sealing technologies have enhanced the structural integrity, insulation properties, and shelf life of packaged goods. Growing emphasis on recyclability and material efficiency is driving innovation in polymer based tubs that balance sustainability with performance.

As urbanization and changing consumption patterns drive greater demand for packaged food, the market outlook remains positive with opportunities centered around customization, branding flexibility, and sustainable packaging formats.

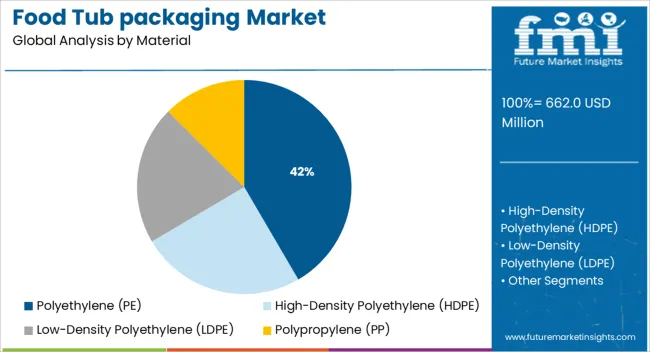

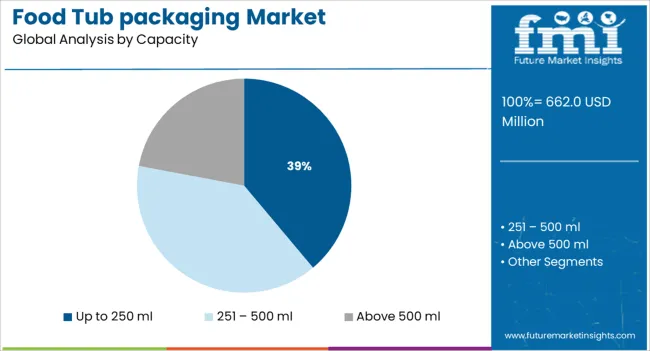

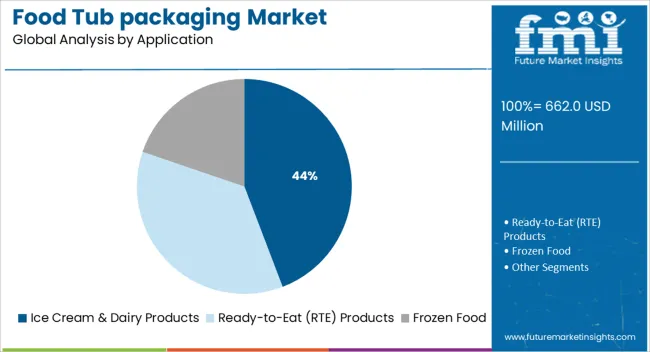

The market is segmented by Material, Capacity, and Application and region. By Material, the market is divided into Polyethylene (PE), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Polypropylene (PP). In terms of Capacity, the market is classified into Up to 250 ml, 251 – 500 ml, and Above 500 ml. Based on Application, the market is segmented into Ice Cream & Dairy Products, Ready-to-Eat (RTE) Products, and Frozen Food. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment is projected to hold 41.60% of total revenue by 2025 within the material category, establishing it as the leading segment. Its widespread use is driven by cost effectiveness, durability, and excellent barrier properties against moisture and contaminants.

Polyethylene offers flexibility in molding and compatibility with various sealing and labeling methods, making it suitable for automated production lines and high volume packaging applications. Its recyclability and lightweight profile further align with sustainability goals and transportation cost savings.

These benefits make polyethylene the preferred choice for manufacturers seeking reliable and efficient packaging solutions in food tub formats.

The up to 250 milliliters capacity segment is expected to contribute 38.90% of the overall market revenue by 2025, positioning it as the dominant volume range. This capacity is ideal for single serve and portion controlled packaging, addressing growing consumer demand for convenience and on the go consumption.

It also aligns well with dietary control and freshness preservation, particularly in dairy and dessert categories. The format is favored by both brands and retailers due to its compactness, visual appeal, and ease of stacking in cold chain logistics.

As the food industry continues to emphasize personalized nutrition and packaging efficiency, this segment remains the most widely adopted.

The ice cream and dairy products application segment is forecasted to hold 44.20% of the market revenue by 2025, leading the application category. This is driven by high consumption of dairy based items such as yogurt, cream, custards, and frozen desserts that require protective and thermally stable packaging.

Food tubs offer tamper resistance, insulation, and product visibility which are critical for chilled and frozen applications. The demand for indulgent, premium, and portioned dairy products has further increased the usage of aesthetically designed tubs that support both branding and functional requirements.

As demand for cold chain compatible and sustainable dairy packaging grows, this segment continues to maintain its lead in application share.

The global food tub packaging market noted a CAGR of 4.6% during the historic period with a market value of USD 629.9 Million in 2024.

A food tub is a type of packaging used to store and transport food items. It is typically made of plastic and has a lid that can be sealed to keep the contents fresh. Food tub packaging is among the easiest packaging formats to produce, requiring only the filling of the primary product and the effective sealing of the packaging.

The continuously growing food industry is predicted to drive the demand for food tub packaging during the forecast period. The food tub packaging for ice creams, ready-to-eat food, and frozen food is available in different shapes, sizes, and quantities. This tub is dimensionally stable, and reusable, and the raw material also carries a high rate of investment. With a variety of lidding options, label colors, and customization, food tub packaging is a highly preferred format among manufacturers.

The food tub packaging is also compatible with automated filling equipment; they can be molded effortlessly and can also be easily transported in the supply chain. This makes them ideal containers for frozen food as well as flavored food packaging segment for manufacturers. Overall, the global food tub packaging market is projected to experience a positive growth rate during the forecast period.

According to the International Dairy Foods Association (IFDA), an average American citizen devours approximately 10.43 kilograms (or 23 pounds) of ice cream and frozen desserts each year. In the year 2024, the production of ice cream in the USA went up by 6% from 2020.

The increasing demand for ice cream is fueling the market for food tub packaging. A shift in customer preference for tubs has been observed due to cost-saving, additional quantity, and family pack features in ice creams, sorbets, and gelatos.

This is allowing players to offer these desserts in various tub sizes and shapes. Overall, the increasing consumption of ice creams and frozen foods fuels the demand for food tub packaging.

Food tub packaging is available in a variety of size options and colors. High-graphic printing is very easy to carry out on food tub packaging. Various brand aesthetics, warning label instructions, and promotional offers can be easily printed on foo tub packaging.

For example, the safety of the product is always Magnum Ice Cream’s top priority. As shoppers are affected by allergens and intolerances, including coeliac disease, for a shopper to access this information quickly and easily is important.

For this, the brand provides information regarding allergens that are added as ingredients in CAPITAL or BOLD letters along with precautionary allergen labeling (PAL) wherever there is a risk of the presence of unintended allergens because of cross-contact.

Under Polyethylene (PE) segment by material, High-Density Polyethylene (HDPE) holds a major portion by material segment for the production of food tub packaging.

The target segment is projected to hold around 88% of the PE material segment for the food tub packaging market by the end of 2025. Due to increasing environmental concerns, HDPE material is grasping the interest of end users. Due to its high strength-to-density ratio, resistance to most chemicals, and ability to be recycled such factors boost the usage of HDPE material in food tub packaging.

Thus, High-Density Polyethylene (HDPE) holds a major portion of the food tub packaging market.

Based on application, the ice cream & dairy products segment generates heavy demand for the food tub packaging market. The same segment is projected to register a CAGR growth of 5.4% during the forecast period.

The usage of food tub packaging is huge in ice cream and dairy products due to its durable and reusable qualities. The tub packaging is used to store and transport these products.

The food tub packaging is also used to display these products in supermarkets and other retail outlets. They can be used to store both processed and fresh food packages. Thus, the ice cream and dairy products segment driving the global food tub packaging market.

According to FMI research analysis, the USA market contributes around 80% to the North American food tub packaging market by the end of 2025. Consumption of dairy products due to their growing popularity is increased. One reason is that people are becoming more health conscious and are looking for ways to improve their diets.

Dairy products are a good source of protein, calcium, and other nutrients that are essential for good health. Another reason for the growing popularity of dairy products is that they are convenient and easy to eat. They can be eaten on the go, and they don't require any preparation.

The USA exports around USD 6.5 Billion in dairy products every year to more than 133 countries according to International Dairy Foods Association, these large exports offer huge demand for food tub packaging, due to increasing demand for packaged food products by consumers is expected to boost the food tub packaging market during the forecast period.

FMI analysis states that India’s food tub packaging market is estimated to grow 1.6x the current market value from 2025 to 2035. India is one of the largest producers of ice cream in the world, but most of its ice cream is consumed domestically. India has a large population of young people, who are more likely to consume ice cream than older age groups.

India has a growing middle class with more disposable income, which has led to increased demand for ice cream. Moreover, the hot climate in India means that people are always looking for ways to cool down, and ice cream is a popular choice. Such factors increase demand for ice cream and subsequently enhance the sale of the food tub packaging.

The key players working in the food tub packaging market are trying to focus on increasing their sales and revenues by escalating their capabilities to meet the rising demand. The key players are trying to adopt a merger & acquisition strategy to expand their resources and are developing new products to meet customer needs. Also, the players are focusing on improving their facilities to cater to the demand.

Some of the recent key developments by the leading players are as follows -

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.1 % from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Tonnes, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Capacity, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Amcor plc; Sonoco Products Company; Huhtamaki OYJ; Berry Global Company; Magnum UK; Polyoak Packaging; Argento Plastic Manufacturers; Innovations; Bergen Plastics AS; Pact Group Holdings Ltd; Shalam Packaging; Greiner Packaging; Parkers Packaging; Interpack Ltd.; INSTA POLYPACK |

The global food tub packaging market is estimated to be valued at USD 662.0 million in 2025.

The market size for the food tub packaging market is projected to reach USD 1,088.6 million by 2035.

The food tub packaging market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in food tub packaging market are polyethylene (pe), high-density polyethylene (hdpe), low-density polyethylene (ldpe) and polypropylene (pp).

In terms of capacity, up to 250 ml segment to command 38.9% share in the food tub packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA