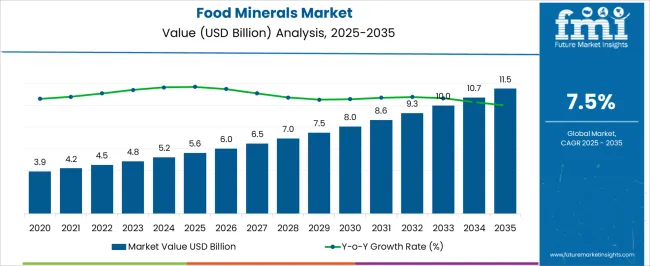

The food minerals market is projected to expand from USD 5.6 billion in 2025 to USD 11.5 billion by 2035, advancing at a CAGR of 7.5%. Rising consumer focus on nutritional adequacy and preventive health has been a key driver, as minerals such as calcium, magnesium, iron, and zinc are increasingly integrated into fortified foods, beverages, and dietary supplements. Growth is also encouraged by urban dietary shifts, where processed foods are often supplemented with essential minerals to address deficiencies linked to lifestyle changes. The expansion of functional foods, plant-based alternatives, and sports nutrition products is boosting applications across multiple categories. Regulatory support for fortification programs in emerging economies further adds momentum, ensuring wider consumption. On the supply side, innovation in bioavailable mineral compounds and improved encapsulation technologies enhances absorption and consumer acceptance.

| Metric | Value |

|---|---|

| Food Minerals Market Estimated Value in (2025 E) | USD 5.6 billion |

| Food Minerals Market Forecast Value in (2035 F) | USD 11.5 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The food minerals market is witnessing consistent expansion, underpinned by rising consumer awareness regarding nutritional fortification and the essential role of minerals in maintaining overall health. Demand is being supported by increasing prevalence of lifestyle-related deficiencies, growth in functional food and beverage consumption, and the integration of mineral fortification in mainstream product formulations.

Regulatory bodies are enforcing stricter labeling and composition standards, compelling manufacturers to adopt higher-quality and bioavailable mineral sources. Market expansion is further influenced by technological advancements in encapsulation and stabilization techniques, enabling improved shelf life and efficacy of mineral-enriched products.

In mature economies, demand is being sustained by a shift toward preventive healthcare and personalized nutrition, while in developing markets, increasing disposable incomes and expanding retail penetration are driving consumption. Over the forecast period, the market is expected to benefit from cross-industry applications, strategic collaborations between ingredient suppliers and food processors, and targeted product innovations aimed at addressing region-specific nutritional gaps.

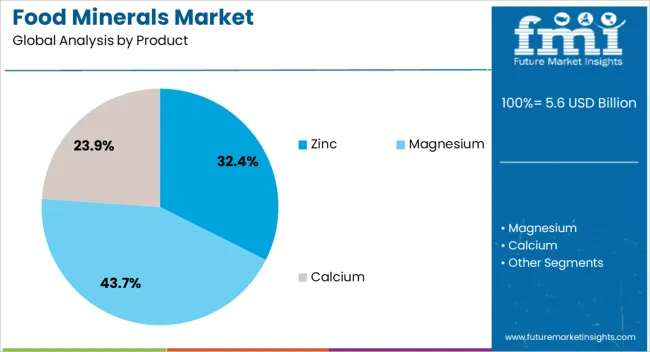

The food minerals market is segmented by product, and geographic regions. By product, food minerals market is divided into Zinc, Magnesium, Calcium, and Iron. Regionally, the food minerals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zinc segment, accounting for 32.40% of the product category, is maintaining its leadership due to its well-recognized role in supporting immune function, cell growth, and metabolic regulation. Its dominance is being reinforced by growing inclusion in fortified foods, dietary supplements, and functional beverages, as well as by expanding application in infant and clinical nutrition products.

Stable sourcing from both organic and inorganic mineral suppliers has ensured steady supply, while advancements in formulation have improved bioavailability and reduced sensory impacts in food products. Market growth is being further supported by rising consumer demand in emerging economies where zinc deficiency remains prevalent, prompting targeted fortification initiatives.

Strategic marketing emphasizing the health benefits of zinc, along with regulatory support for fortification programs, has strengthened adoption rates across both retail and institutional channels. The segment’s position is expected to remain robust as consumer preferences align with scientifically validated nutrient benefits and as industry stakeholders invest in innovative delivery formats to expand market reach.

The food minerals market is expanding as consumers and industries prioritize nutrition, fortification, and functional foods to address dietary deficiencies and support long-term health. Growth is driven by rising demand for calcium, magnesium, iron, zinc, and potassium in fortified foods, beverages, and supplements. Challenges include fluctuating raw material supply, limited bioavailability of certain compounds, regulatory complexity, and pricing pressures. Opportunities exist in plant-based fortification, bioavailable mineral formulations, and personalized nutrition solutions. Trends highlight encapsulation technologies, clean-label fortification, and integration of minerals into plant-based and functional food categories. Companies offering consistent quality, innovative delivery systems, and compliance with global food safety standards are best positioned to capture future demand.

Consumers increasingly seek foods and supplements enriched with minerals to address deficiencies and enhance immunity, bone strength, and cognitive health. Governments and NGOs back fortification programs in developing regions, boosting large-scale adoption. Fortified cereals, dairy, beverages, and nutraceuticals remain central growth drivers.

Barriers include fluctuating mineral extraction costs, limited absorption of certain compounds, and complex labeling rules across geographies. Strict safety and dosage compliance requirements increase research and development (R&D) and testing costs. Smaller players often face challenges in scaling due to high regulatory and certification demands.

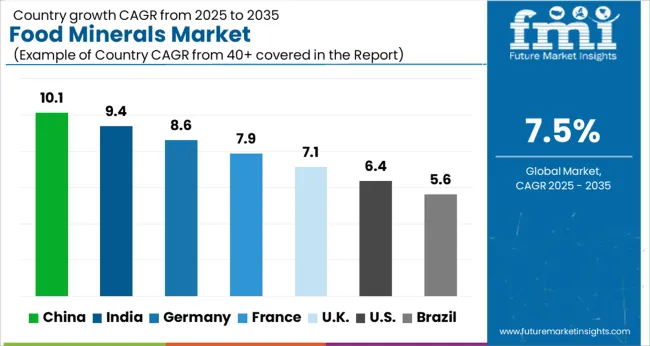

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| U.K. | 7.1% |

| U.S. | 6.4% |

| Brazil | 5.6% |

The global food minerals market is projected to grow at a CAGR of 7.5% from 2025 to 2035, supported by rising demand for fortified foods, supplements, and nutraceuticals across developed and emerging regions. Among BRICS nations, China leads with 10.1% growth, driven by large-scale adoption of fortified products and increasing focus on nutritional adequacy. India follows at 9.4%, supported by government-backed fortification programs and rising disposable incomes in urban and semi-urban areas. In Europe, Germany reports 8.6% CAGR, influenced by consumer preference for high-quality supplements and fortified beverages, while France grows at 7.9%, supported by strong healthcare awareness and regulatory initiatives. The United Kingdom, at 7.1%, reflects steady demand for functional foods and dietary supplements. In the Americas, the United States grows at 6.4%, propelled by strong adoption of sports nutrition and wellness products, while Brazil posts 5.6% CAGR, influenced by expanding middle-class consumption and increasing focus on dietary enrichment. The analysis covers more than 40 countries, with top markets highlighted below.

China is forecast to grow at a 10.1% CAGR, driven by government-led nutrition improvement programs, rapid expansion of fortified dairy, and growing demand for functional foods in urban centers. Local producers are investing in bioavailable mineral formulations and targeting middle-class consumers seeking immunity and wellness benefits.

Large-scale adoption of fortified foods and beverages

Expanding functional food and supplement portfolio

Bioavailable mineral innovation gaining momentum

India is expected to grow at a 9.4% CAGR, supported by government fortification mandates for staples such as rice and wheat, coupled with growing urban health awareness. Rising disposable income and broader retail access to mineral-fortified products strengthen adoption.

Fortification of staple foods supported by government programs

Growing middle-class demand for supplements and nutraceuticals

Expansion of e-commerce boosts availability in semi-urban areas

Germany is set to record 8.6% CAGR, fueled by strong consumer preference for quality dietary supplements and fortified functional beverages. Regulatory frameworks and high labeling standards drive product innovation and safety compliance.

Premium fortified beverages and supplements lead demand

Stringent quality standards encourage advanced formulations

Growing interest in mineral-based sports nutrition

France grows at a 7.9% CAGR, with healthcare providers actively promoting fortified foods for addressing deficiencies in aging populations. Consumer preference for clean-label and natural mineral sources strengthens premium segment adoption.

Healthcare initiatives promoting mineral fortification

Strong demand for clean-label, natural mineral sources

Aging population boosts fortified nutrition adoption

The U.K. is forecast to grow at a 7.1% CAGR, supported by consumer demand for functional foods and mineral-enriched supplements. Retailers and e-commerce platforms expand product accessibility, while health awareness initiatives encourage adoption.

Functional food and supplement adoption remains strong

Retail and online platforms expand market access

Health awareness campaigns support fortified product uptake

The United States grows at a 6.4% CAGR, with sports nutrition, wellness products, and fortified snacks driving demand. Manufacturers emphasize bioavailable formulations, convenience formats, and personalized nutrition offerings.

Strong sports nutrition and wellness product demand

Focus on personalized and bioavailable mineral formulations

Convenience-oriented fortified food adoption rising

Brazil posts a 5.6% CAGR, supported by a growing middle-class consumer base and increasing interest in dietary enrichment. Expansion of fortified dairy, cereals, and beverages is creating new opportunities.

Middle-class consumption drives fortified food adoption

Expanding fortified dairy and beverage offerings

Growing awareness of nutrition and wellness

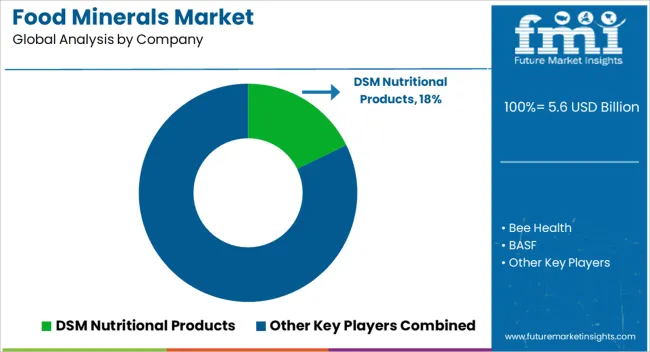

The competitive landscape of the food minerals market is shaped by global ingredient suppliers, nutraceutical firms, and food manufacturers investing in fortification technologies and bioavailable formulations. Leading companies such as DSM-Firmenich, BASF, Lonza, Archer Daniels Midland (ADM), and Tate & Lyle dominate through diversified mineral portfolios, R&D capabilities, and established partnerships with food and beverage producers. These players emphasize advanced delivery systems such as microencapsulation and chelated compounds to improve absorption and taste masking, meeting consumer expectations for efficacy and convenience. Mid-sized regional suppliers focus on cost-competitive solutions for fortifying staples in emerging economies, often aligning with government nutrition programs.

Innovation is increasingly centered on clean-label sourcing, plant-based mineral alternatives, and functional food applications, catering to the rising demand for natural and sustainable nutrition. Regulatory compliance plays a critical role, with suppliers required to adhere to global food safety and dosage guidelines, which in turn creates differentiation for those with strong quality assurance systems. Strategic collaborations with nutraceutical brands, dairy companies, and beverage manufacturers are common, enabling customized formulations that address specific demographic needs. Competition is intensifying as companies balance cost, efficacy, and sustainability, with success determined by the ability to deliver high-quality, bioavailable, and consumer-friendly mineral solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Product | Zinc, Magnesium, Calcium, and Iron |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM Nutritional Products, Bee Health, BASF, Youngevity, Bayer, Pharmaca, Solgar, and Novartis and Rainbow Light |

| Additional Attributes | Dollar sales by aircraft type (manned, unmanned), platform size (light, medium, heavy), and application (ISR, electronic warfare, maritime patrol, tactical transport). Demand dynamics are driven by rising defense budgets, modernization of air forces, and growing adoption of multi-mission capable aircraft. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by strategic military investments, increased border security initiatives, and defense modernization programs. |

The global food minerals market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the food minerals market is projected to reach USD 11.5 billion by 2035.

The food minerals market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in food minerals market are zinc, zinc acetate, zinc oxide, zinc chloride, zinc citrate, zinc sulfate, magnesium, magnesium sulfate, magnesium citrate, magnesium chloride, magnesium oxide, calcium, calcium carbonate, calcium phosphate, calcium citrate, calcium chloride, iron, ferrous sulphate, ferrous gluconate, ferrous fumarate and ferrous lactate.

In terms of , segment to command 0.0% share in the food minerals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA