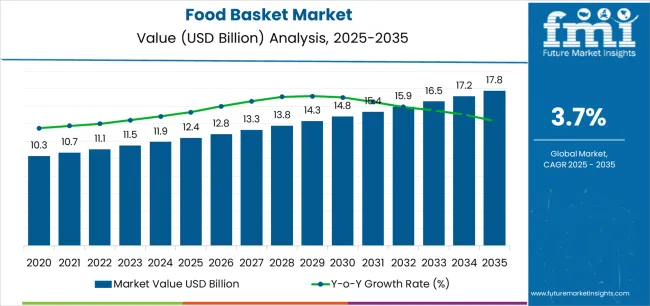

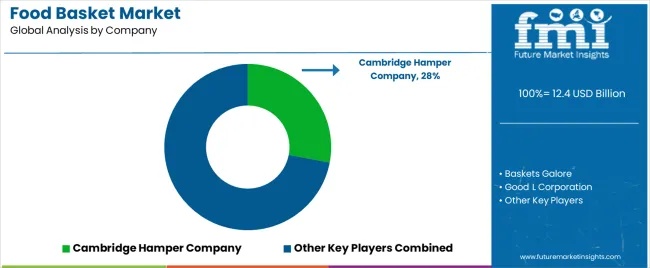

The Food Basket Market is estimated to be valued at USD 12.4 billion in 2025 and is projected to reach USD 17.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

The Food Basket market is witnessing steady growth driven by increasing consumer demand for sustainable, eco-friendly, and durable storage solutions for fresh produce. The future outlook for this market is shaped by rising awareness of environmental sustainability and the shift towards reusable and biodegradable materials in household and commercial applications. Growing preference for natural and non-plastic products has accelerated the adoption of bamboo-based food baskets, which are valued for their durability, lightweight nature, and aesthetic appeal.

Expanding retail and e-commerce networks have further enhanced accessibility, allowing consumers to conveniently procure high-quality food baskets. Additionally, increasing consumption of fresh fruits and vegetables and the need for hygienic storage solutions are boosting demand in both household and commercial kitchens.

The market is also benefiting from innovations in design and materials that improve functionality while aligning with eco-conscious trends As the global focus on sustainability and convenience intensifies, the Food Basket market is expected to sustain growth in both urban and rural regions.

| Metric | Value |

|---|---|

| Food Basket Market Estimated Value in (2025 E) | USD 12.4 billion |

| Food Basket Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

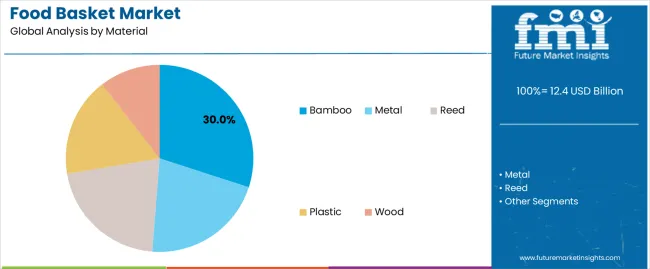

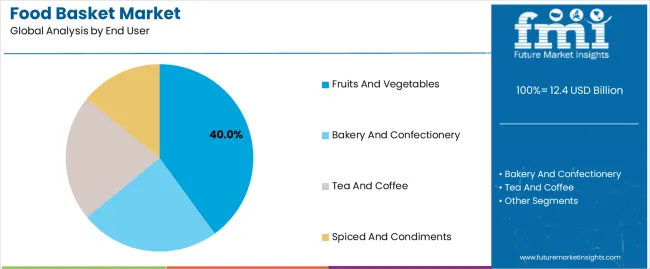

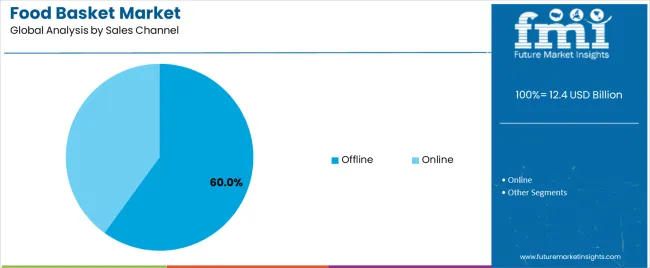

The market is segmented by Material, End User, and Sales Channel and region. By Material, the market is divided into Bamboo, Metal, Reed, Plastic, and Wood. In terms of End User, the market is classified into Fruits And Vegetables, Bakery And Confectionery, Tea And Coffee, and Spiced And Condiments. Based on Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bamboo material segment is projected to hold 30.0% of the Food Basket market revenue share in 2025, making it the leading material type. This growth is driven by the eco-friendly nature of bamboo, which is highly renewable and biodegradable, providing a sustainable alternative to plastic and synthetic materials.

The segment has benefited from rising consumer awareness of environmental concerns and preference for natural products that combine durability with aesthetic appeal. Bamboo baskets are also lightweight yet strong, allowing ease of handling and long-term usability, which reinforces their adoption in both household and commercial settings.

The increasing availability of bamboo baskets through diverse sales channels, including offline retail and specialty stores, has further supported the growth of this segment Moreover, innovative designs and treatments enhancing hygiene and durability have made bamboo baskets a preferred choice for storing fresh produce, solidifying their leading position in the market.

The fruits and vegetables end-user segment is expected to account for 40.0% of the Food Basket market revenue share in 2025, making it the dominant application segment. This growth is influenced by the rising consumption of fresh produce and the need for hygienic, convenient, and durable storage solutions. Food baskets are increasingly preferred for their ability to protect delicate items while providing ventilation to prevent spoilage.

The segment has been driven by growing household awareness about food safety and freshness, as well as the expanding demand from commercial kitchens, retailers, and farmers markets. The ability to store and display fruits and vegetables in an organized and visually appealing manner has further fueled adoption.

Additionally, the rising popularity of eco-friendly lifestyles and preference for reusable, biodegradable materials has reinforced the use of food baskets in this segment The convergence of functionality, sustainability, and aesthetic value continues to drive the fruits and vegetables end-user segment.

The offline sales channel segment is anticipated to hold 60.0% of the Food Basket market revenue share in 2025, making it the leading channel. The dominance of offline retail is supported by the ability of physical stores to provide consumers with a tactile experience, enabling them to assess the quality, texture, and durability of the baskets before purchase.

Retail outlets, supermarkets, and specialty stores have become key points of access, offering a wide variety of designs and sizes to meet diverse consumer preferences. The segment has also benefited from strong distribution networks that ensure product availability across urban and semi-urban regions.

Additionally, offline channels facilitate immediate purchase and reduce the uncertainty associated with online shopping, particularly for eco-friendly products like bamboo baskets Consumer trust, combined with the ability to interact with the product physically, continues to reinforce the growth and dominance of the offline sales channel in the Food Basket market.

Subscription-based Food Baskets are Becoming Common in Corporations

Corporates and large businesses are taking advantage of subscription-based deliveries of these baskets. This is an effective way of getting these baskets on the doorsteps. Subscription-based grocery baskets are also preferred as they save a lot of financial capital for these companies.

These baskets are also in great demand as companies use them to provide employee perks and enhance workplace wellness. Besides this, healthy fruit baskets in these settings are also a common sight.

Customized and Healthy Food Baskets are Devoured by Health-Conscious Consumers

Customizable and healthy grocery baskets have gained in popularity, driven by increasing awareness of health and well-being. Health-conscious buyers want tailored solutions for meeting their dietary requirements or preferences like organic, gluten-free, or vegan offerings.

People have also embraced the service of delivering nutritional foods that are either cooked ready to be served or can be prepared with minimal difficulties as an option for their schedules being very tight. Similarly, the intrusion of various types and classes of ingredients which are fresh and high class without going through the hustles of shopping is what motivates most people.

Supply Chain Management Challenges and High Costs Negatively Affect the Industry

Food baskets usually cost more than individually picking items of choice. This is one of the main factors impeding the adoption. Besides this, managing the logistics and delivering food items that are perishable in nature also is a challenge.

Businesses in this industry have to ace their supply chain management game which is very difficult in economically unprivileged societies. Smaller companies, thus, have to rely on third-party last-mile delivery services for this.

In 2020, the food basket market was valued at USD 10.3 billion. The period of 2020 to 2025 was majorly influenced by events like pandemics, civil wars, and economic recovery in most parts of the world. By the end of 2025, this valuation reached USD 11.5 billion. The reported CAGR for this period was around 3.2%.

The pandemic in this period meant that people were forced to remain at their homes. With this, the industry received a severe blow. Vacation spots and outings decreased, and so did the demand for these baskets. Celebrations stopped, which significantly denied the possibility of people giving gifts to each other. War-like conditions in the European region also had an adverse effect on the sales.

The industry did catch some pace as economies gradually opened. With the tourism sector on the track again, the sales of these baskets also surged. E-commerce and supply chain networks also improved. People, affected by the pandemic, also became more health-conscious. All these things served the industry.

With subscription-based food baskets and the proliferation of last-mile delivery services, the industry is following an upward trajectory. In the years to come, the industry is very likely to have a bright future.

HelloFresh, Blue Apron, and Home Chef are some of the pioneers in this industry. These tier-one companies dominate the international marketplace. They are also bringing a sense of innovation to the market by introducing a broad range of customizable meal plans.

Mobile apps and websites were leveraged by these companies to serve the consumers. These companies also procure their ingredients from high-quality stores. Organic and vegan options are also in their product offerings.

Tier two companies such as Sun Basket, Green Chef, and Purple Carrot are the ones focusing on domestic consumers. Large corporations and organizations also rely on these companies.

Subscription plans and specific diets like keto, paleo, vegan, and gluten-free are also one of their flagships. Sustainability is also in focus when it comes to these companies. These companies also allocate a part of their financial capital to frequent promotions.

Tier three companies, on the other hand, are the ones that cater to local consumers. These companies often have to rely on third-party delivery services. They hold their consumer base by offering affordable food baskets. Simplicity also is one of their unique selling points. Their low budget doesn’t allow them to invest in a website or applications. Although, word-of-mouth publicity is sufficient for their local market reach.

Region-wise analysis of the food basket market has been jotted down below. Based on these analyses, it can be inferred that Asian countries like India, Thailand, and China, are some of the most lucrative markets in this industry.

The United Kingdom and Germany are some of the leading economies in the European region. In the North American part, Canada and the United States are estimated to perform well in comparison to other countries.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Canada | 3.7% |

| United States | 3.8% |

| Germany | 3.6% |

| India | 4.2% |

| Thailand | 4.1% |

| South Korea | 3.7% |

| China | 3.9% |

| United Kingdom | 3.5% |

The food basket industry in India is estimated to exhibit a CAGR of 4.2% from 2025 to 2035. Significant migration toward urban and semi-urban centers has taken place in India, in the last few years. This has increased the demand for convenient and diverse meal options.

These baskets are a perfect solution for millennials looking for all-round groceries. The rising disposable incomes in the hands of the young demographic are also one of the main reasons for this.

The proliferation of e-commerce platforms in every nook and corner of the country is also responsible for this industry's growth. Indian consumers can now browse through a million options before ordering their baskets. India, being an agriculturally rich country, also helps businesses add fruits and healthy items in a cost-effective manner, which has also supported market growth.

China too, is one of the most promising markets in the Asian region. It is exhibiting a CAGR of 3.9% through 2035. China is one of the largest consumers of food in the entire world. This is primarily due to their humongous population. The middle class in the country is also moving away from conventional diets.

This is why the sales of meal baskets have gone up in China. The expansion of supermarkets and retail stores in the country offering grocery baskets is also aiding the market.

Government regulations regarding these baskets have also instilled a sense of trust among consumers. Consumers are even ready to pay a little extra for gourmet baskets with premium food baskets. Being agriculturally blessed, there’s also the availability of various food products in the country, making the job of key players in the industry easy.

In the United States, the industry is experiencing sluggish growth. It is slated to report a CAGR of 1.8% through 2035. The United States food basket industry is progressing as a result of consumers' increasing desire for convenient and healthful meal alternatives.

Due to their hectic schedules, customers are looking for fresh produce delivery services and meal packages. Food that is grown organically and locally is likewise becoming more and more popular. People are prepared to pay extra for sustainability and high quality.

Platforms for online grocery shopping have completely changed the way people buy food, making it easier and more comfortable. Grocery basket companies are thus leveraging these advanced networks of supply chains and delivery platforms.

The food basket market is categorized into material, end-use, and sales channels. The top two categories, material and end use, are discussed briefly below.

Food baskets are used to pack a broad spectrum of edible items. Fruits and vegetables, bakery and confectionery, spices and condiments, tea and coffee, etc. Consumers are mostly ordering baskets containing fruits and vegetables. They account for more than 27% of the overall revenue share.

| End Use | Fruits and Vegetables |

|---|---|

| Value Share (2025) | 27% |

Health-conscious trends, post-pandemic, have influenced the way people consume food. Even if it is for recreational purposes, consumers are actively seeking healthy food options. This has forced consumers to curate baskets that contain seasonal produce. To cater to the demands of premium consumers, these companies are also including exotic fruits in their baskets.

Their demand is also touching the skies as they help consumers avoid picking up different fruits and vegetables from different stores. Consumers get a curated collection of fruits and vegetables in one place. The trend of citrus fruits in everyday meals is also one of the main reasons for this industry's growth.

The food basket industry based on material, is segmented into bamboo, reed, plastic, wood, and metal. The bamboo segment is estimated to hold a market share of 24.3%, as of 2025.

| Material | Bamboo |

|---|---|

| Value Share (2025) | 24.3% |

Eco-friendliness is one of the major reasons why consumers are increasingly preferring baskets made from bamboo. These baskets are more sustainable as compared to their metal and plastic counterparts. Apart from being sturdy, bamboo baskets are also very lightweight, which makes stacking a less cumbersome activity.

These baskets also give a natural and rustic look to consumers seeking stylish yet eco-conscious alternatives. Besides these baskets can also be used again for various other purposes after the end of their life cycle. All these reasons have taken the sales of bamboo baskets to unprecedented levels.

The food basket market has reached a level of point where there is no scope for innovations. Industry giants are leveraging websites and apps to deliver their product offerings. Some of them are also coming up with subscription-based food baskets. Domestic companies are emphasizing including regional as well as international products in their baskets to give consumers a suave experience.

Very few mergers and acquisitions are seen in this field due to very limited players in the market. Although, the sustainability wave affected the industry and businesses are using bio-degradable materials in their baskets. Blue Apron, HelloFresh, Instacart, FreshDirect, and Misfits Market, are some of the most prominent companies in this market.

Recent Developments

The material category in the food basket industry includes bamboo, metal, reed, plastic, and wood.

The end user category encompasses fruits and vegetables, bakery and confectionery, tea and coffee, and spiced and condiments.

The industry based on sales channels is bifurcated into offline and online.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The global food basket market is estimated to be valued at USD 12.4 billion in 2025.

The market size for the food basket market is projected to reach USD 17.8 billion by 2035.

The food basket market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in food basket market are bamboo, metal, reed, plastic and wood.

In terms of end user, fruits and vegetables segment to command 40.0% share in the food basket market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA