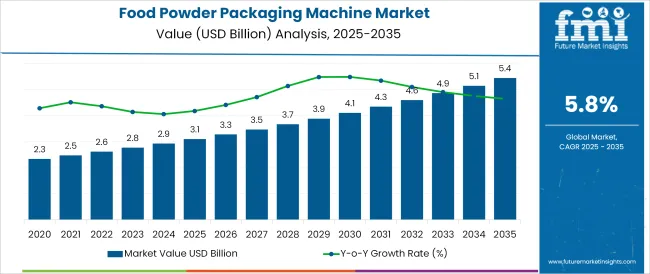

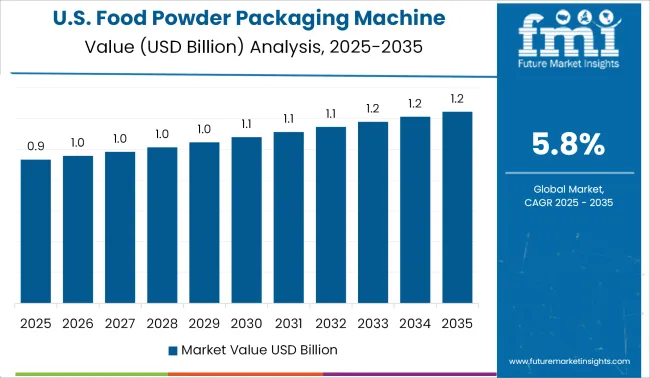

The Food Powder Packaging Machine Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The food powder packaging machine market is advancing steadily as food manufacturers prioritize efficiency, hygiene, and sustainability in packaging operations. Growth is being propelled by rising consumption of packaged food powders, stricter food safety regulations, and the need for automated, contamination free handling.

Machines offering faster throughput, precise dosing, and minimal wastage are gaining prominence, particularly as manufacturers face pressure to optimize production costs while meeting consumer expectations for consistent quality. Demand is further supported by innovations in materials compatibility and intelligent controls, which enhance adaptability to various food powders.

Future prospects are being shaped by increasing investments in automation, focus on minimizing human intervention, and adoption of energy efficient technologies. Market opportunities are emerging through integration of smart sensors, real time monitoring capabilities, and sustainable design features, which are setting the stage for broader adoption and competitive differentiation.

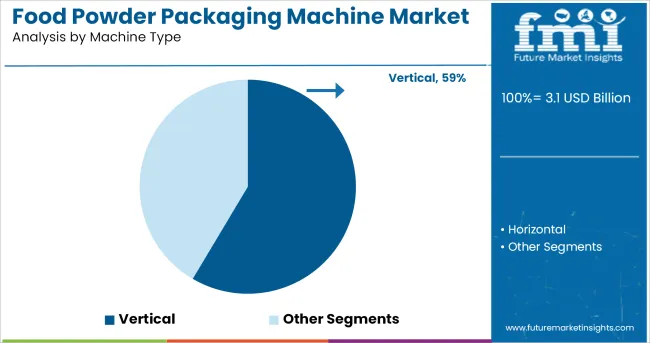

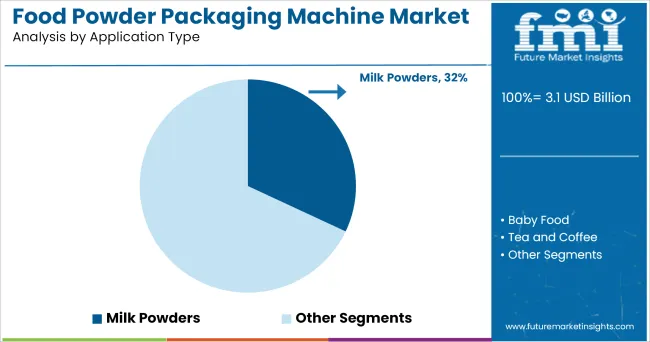

The market is segmented by Machine Type and Application Type and region. By Machine Type, the market is divided into Vertical and Horizontal. In terms of Application Type, the market is classified into Milk Powders, Baby Food, Tea and Coffee, Flour, Protein Supplements, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by machine type, the vertical segment is anticipated to account for 58.5% of total market revenue in 2025, establishing itself as the dominant configuration. This leadership is attributed to the vertical machine’s ability to deliver space efficient designs, high speed operations, and reliable sealing capabilities, which are essential in large scale food powder production environments.

Its modular design and adaptability to different pouch sizes and materials have enabled seamless integration into existing production lines without major infrastructure changes. Enhanced hygiene features and ease of maintenance have contributed to reduced downtime and compliance with stringent food safety standards.

Furthermore, the cost effectiveness achieved through minimal footprint and high output rates has strengthened its adoption, particularly among manufacturers targeting high volume, standardized packaging formats. This combination of operational efficiency, versatility, and compliance has reinforced the vertical machine’s position as the preferred choice in the market.

When segmented by application type, milk powders are expected to represent 32.0% of the market revenue in 2025, maintaining their lead among application categories. This prominence has been driven by the significant demand for milk powder across diverse end use markets such as infant nutrition, bakery, confectionery, and dairy based beverages, all of which require hygienic and reliable packaging solutions.

The sensitivity of milk powder to moisture and contamination has necessitated the use of advanced machines capable of ensuring precise dosing, airtight sealing, and extended shelf life. The need for consistent quality and compliance with rigorous food safety regulations has further fueled investment in dedicated packaging solutions for this application.

Additionally, the increasing consumption of convenient, long shelf life dairy products has amplified the requirement for machines specifically optimized for milk powder characteristics, solidifying this segment’s leadership within the market.

Development of new food products can be a costly and labour-intensive investment for many customers. To boost productivity, many players are adopting fully automated packaging machines which includes single use packaging and on the go packaging. The rising demand for hygiene has propelled the manufacturers to replace the traditional methods with the new automated machines.

Food sector, being the most important sectors that require hygiene, cleanliness and sterility, the growth in these sectors is expected to fuel the market growth. Manufacturers in the food powder packaging machines market are particularly focusing on launching environment-friendly food powder packaging machines to establish a solid presence in both, domestic as well as regional markets.

More number of packaging companies is investing into automation of packaging machinery by integrating advance features like touch screen, PLC controllers and PC connectivity.

There is surge in the number of small-scale food manufacturers worldwide because of Technological advancements and automation in food packaging machinery. These are some of the key factors that are likely to aid the growth of the food powder packaging machines market.

To achieve greater confidence in the safe and repeatable production of food products prior to market release, GEA has built dedicated test centres, designed to aid development and trial at a small scale before releasing for larger scale production.

The test centres are of Vertical packaging, lollipop and sugar cube manufacturing is at Weert (Netherlands) and of food processing and packaging is at Frisco (TX, USA).

Syntegon, Beringen, Switzerland has expanded its secondary packaging portfolio by introducing Sigpack TTMD. Integrated with Delta robot cells, the solution has camera based vision control system which detects products on infeed belt. Optima consumer has introduced Optima EGS machine, awarded with Foodtec Prize by German Agricultural Society (DLG).

It handles fully automated evacuation, gassing and seaming of baby milk powder containers in the high-care room, and considerably increases production reliability.

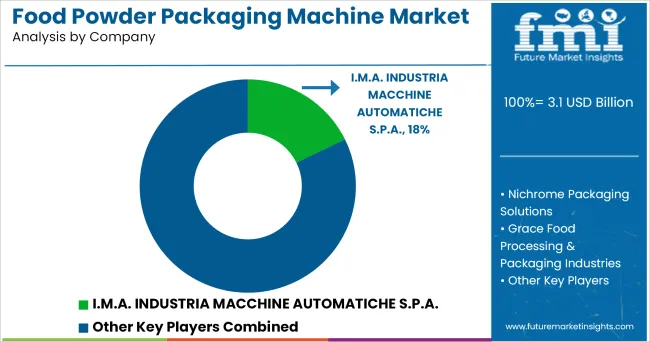

Some of the key players operating in the food powder packaging machine market

Syntegon introduces Sigpack TTMD cartoner with integrated Delta robots to its portfolio on 28.01.2024. Sigpack TTMD, combines core components of the TTM platform with one or more seamlessly integrated Delta robot cells-this allows flexible packaging of different products.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global food powder packaging machine market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the food powder packaging machine market is projected to reach USD 5.4 billion by 2035.

The food powder packaging machine market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in food powder packaging machine market are vertical and horizontal.

In terms of application type, milk powders segment to command 32.0% share in the food powder packaging machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Food Powder Packaging Machine Market Share & Industry Trends

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Tester Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Food Packaging Equipment Market

Food Tub packaging Market Size and Share Forecast Outlook 2025 to 2035

Packaging Machine Heaters Market Growth – Trends & Forecast 2025 to 2035

Packaging Machinery Market Insights – Growth & Forecast 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Food Grade Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Evaluating Seafood Packaging Market Share & Provider Insights

Food Warmer Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA