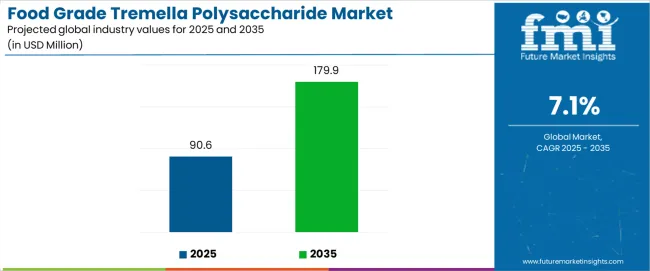

The global food grade tremella polysaccharide market is projected to rise from USD 90.6 million in 2025 to USD 179.9 million by 2035, advancing at a CAGR of 7.1% and recording total growth of 98.6%. Innovation trends are emerging across cultivation, extraction, formulation, and application development, creating new opportunities in food, nutraceutical, and functional beverage industries.

One of the key innovation areas lies in cultivation and biomass optimization. Traditional cultivation of tremella mushrooms often results in variability of polysaccharide yield and quality. Recent advancements in controlled fermentation processes and bioreactor-based cultivation are addressing this issue by ensuring consistent polysaccharide profiles. These techniques not only increase productivity but also reduce dependency on seasonal mushroom harvests, strengthening supply stability for large-scale food applications.

Extraction and purification technologies are evolving to improve efficiency and reduce costs. Conventional hot-water extraction methods are being complemented by enzyme-assisted extraction, ultrasonic treatment, and microwave-assisted processes. These innovations enable higher yield and preserve bioactive properties such as antioxidant and moisture-retention capacity. Green extraction technologies are also being developed, aligning with clean-label demands by reducing the use of synthetic solvents while maintaining purity levels required for food-grade applications.

In the domain of functional food and beverage innovation, tremella polysaccharide is increasingly being integrated as a natural thickener, stabilizer, and moisture-retention agent. Its ability to mimic the textural properties of hydrocolloids makes it an attractive alternative to synthetic additives. Functional beverage developers are experimenting with tremella polysaccharide to enhance mouthfeel and provide hydration benefits, particularly in sports drinks and wellness-focused formulations. Combination with probiotics, collagen, and plant-based proteins is another trend, creating multifunctional nutraceutical blends that appeal to health-conscious consumers.

R&D in health-linked applications is expanding rapidly. The polysaccharide is being studied for its immune-modulating, skin-hydrating, and cholesterol-lowering properties, which can drive new product launches in dietary supplements and fortified foods. Collaborative research between food manufacturers and biotech firms is targeting encapsulation and nano-formulation technologies that improve bioavailability in the human body, enhancing functional benefits and differentiating premium product offerings.

Packaging and product delivery innovations also contribute to the food grade tremella polysaccharide market. Single-serve sachets of tremella polysaccharide powder for at-home beverage preparation and ready-to-drink fortified formulations highlight how innovation extends beyond ingredient processing to consumer convenience.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 90.6 million |

| Forecast Value (2035) | USD 179.9 million |

| Forecast CAGR (2025-2035) | 7.1% |

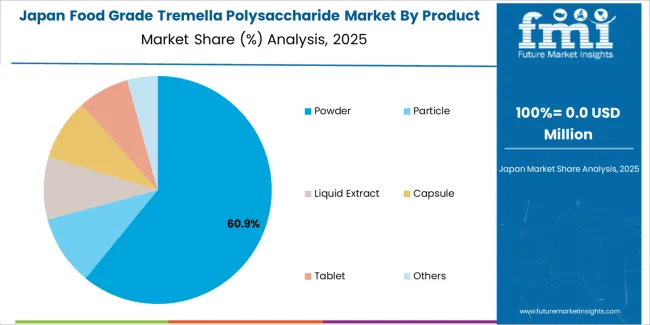

| Leading Product Type (2025) | Powder - 62.5% share |

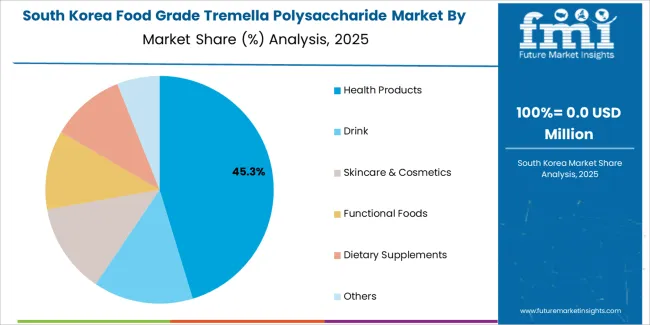

| Leading Application (2025) | Health Products - 45.2% share |

| Leading Distribution Channel (2025) | B2B Direct Sales - 68% share |

| Key Growth Regions | Asia Pacific; North America; Europe |

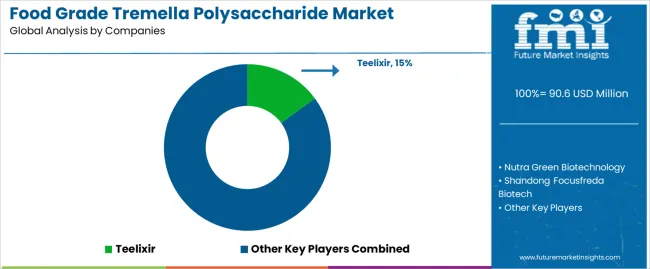

| Top Companies by Market Share | Teelixir; Nutra Green Biotechnology; Shandong Focusfreda Biotech |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 90.6 million |

| Market Forecast Value (2035) | USD 179.9 million |

| Forecast CAGR (2025-2035) | 7.1% |

| HEALTH & WELLNESS TRENDS | FUNCTIONAL INGREDIENT DEMAND | TECHNOLOGY & QUALITY STANDARDS |

|---|---|---|

| Natural Immunity Support — Increasing consumer preference for natural immune-boosting ingredients driving demand for tremella polysaccharide supplements across established and emerging markets. | Bioactive Compound Integration — Food and beverage manufacturers incorporating tremella polysaccharides for enhanced nutritional profiles and functional benefits in product formulations. | Extraction Technology Standards — Industry requirements establishing purity benchmarks favoring advanced polysaccharide extraction and purification processes. |

| Anti-Aging Market Growth — Growing emphasis on natural anti-aging solutions and skin health supplements creating demand for premium tremella-based functional ingredients. | Nutraceutical Innovation — Health product manufacturers investing in tremella polysaccharides offering proven bioactivity and superior moisture retention properties while maintaining product stability. | Quality Assurance Protocols — Regulatory standards requiring optimal extraction efficiency and minimal impurity levels in food-grade applications. |

| Functional Food Expansion — Superior hydrating properties and biocompatibility making tremella polysaccharides essential for premium functional food applications. | Cosmeceutical Applications — Certified polysaccharides with proven moisturizing specifications required for skincare and beauty supplement applications. | Standardization Requirements — Advanced molecular weight profiling and polysaccharide content specifications driving need for precision manufacturing capabilities. |

| Category | Segments / Values |

|---|---|

| By Product Type | Powder; Particle; Liquid Extract; Capsule; Tablet; Others |

| By Application | Health Products; Drink; Skincare & Cosmetics; Functional Foods; Dietary Supplements; Others |

| By Extraction Method | Water Extraction; Enzymatic Extraction; Ultrasonic Extraction; Supercritical Fluid Extraction; Others |

| By End User | Nutraceutical Companies; Food & Beverage Manufacturers; Cosmetic Companies; Contract Manufacturers; Research Institutions |

| By Distribution Channel | B2B Direct Sales; Online B2B Platforms; Specialty Ingredient Distributors; Trade Intermediaries; Export Agents |

| By Region | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

| Powder | Leader in 2025 with 62.5% market share; likely to maintain dominant position through 2035. Excellent solubility in various formulations, cost-effective processing, and versatile application compatibility. Momentum: strong growth across multiple applications. Watchouts: competition from liquid extracts in premium segments. |

| Particle | Specialized segment with 18.3% share, benefiting from controlled-release applications and enhanced stability in specific formulations requiring precise dosing. Momentum: rising in pharmaceutical and nutraceutical applications. Watchouts: higher processing costs and specialized equipment requirements. |

| Liquid Extract | Premium concentrated form primarily for high-end supplements and cosmetic applications, offering superior bioavailability and processing convenience. Momentum: growing due to formulation advantages in liquid products. |

| Capsule | Ready-to-consume format gaining traction in dietary supplement markets, providing convenience and standardized dosing for consumer applications. Momentum: moderate growth in direct consumer markets. |

| Tablet | Compressed format for pharmaceutical and nutraceutical applications requiring precise dosing and extended shelf life. Momentum: selective growth in regulated supplement segments. |

| Others (Gel, Film) | Includes specialized delivery formats for cosmetic and advanced nutraceutical applications. Limited but growing market for innovative product forms. Momentum: emerging growth in specialized applications. |

| Segment | 2025-2035 Outlook |

|---|---|

| Health Products | Largest application segment in 2025 at 45.2% share, supported by immune health trends and established supplement market. Driven by consumer awareness of tremella's bioactive properties and anti-aging benefits. Momentum: strong growth from wellness supplement demand and preventive health investments. Watchouts: regulatory changes and scientific validation requirements. |

| Drink | Key segment for functional beverage manufacturers requiring water-soluble polysaccharides for enhanced nutritional profiles and natural hydration properties. Momentum: steady growth through functional beverage expansion. Watchouts: taste and stability challenges in certain formulations. |

| Skincare & Cosmetics | Professional cosmetic applications rely on tremella polysaccharides for moisture retention and anti-aging formulations requiring proven efficacy and safety profiles. Momentum: strong growth in natural cosmetics and K-beauty influenced products. Watchouts: premium pricing sensitivity and formulation complexity. |

| Functional Foods | Specialized segment for food manufacturers incorporating bioactive compounds into everyday products, requiring specific processing stability and regulatory compliance. Momentum: emerging growth from functional food innovation and health-conscious consumer trends. Watchouts: regulatory approval processes and manufacturing integration challenges. |

| Dietary Supplements | Professional supplement manufacturers demand standardized polysaccharides for consistent potency and bioavailability in capsule and tablet formulations. Momentum: moderate growth in personalized nutrition and targeted health solutions. Watchouts: market saturation and competitive ingredient alternatives. |

| Distribution Channel | Status & Outlook (2025-2035) |

|---|---|

| B2B Direct Sales | Dominant channel in 2025 with 68% share for bulk polysaccharide ingredients. Offers technical support, custom formulation assistance, and quality assurance documentation. Momentum: steady growth driven by manufacturer relationships and technical service requirements. Watchouts: margin pressure from online competition and buyer consolidation. |

| Online B2B Platforms | Rapidly growing channel serving smaller manufacturers seeking competitive pricing and streamlined procurement processes. Provides value through product specifications and supply chain transparency. Momentum: strong growth as digital transformation accelerates ingredient sourcing adoption. |

| Specialty Ingredient Distributors | Traditional distribution channel for regional markets and specialized applications requiring local technical support and regulatory expertise. Momentum: stable growth in established markets, declining share in price-sensitive segments. Focus shifting toward value-added services and application development. |

| Trade Intermediaries | Expanding channel for cross-border transactions and emerging market access, particularly important for Asian suppliers serving global markets. Momentum: rising as manufacturers seek geographic expansion with reduced direct investment requirements and enhanced market entry capabilities. |

| Export Agents | Specialized channel facilitating international trade relationships and regulatory compliance for manufacturers seeking global market access. Expert knowledge of export documentation and international quality standards. Momentum: moderate growth fueled by international trade expansion and regulatory complexity management. |

| DRIVERS | RESTRaiNTS | KEY TRENDS |

|---|---|---|

| Growing health consciousness across global markets is driving demand for natural bioactive ingredients with proven wellness benefits and immune support properties. | High extraction costs and complex purification processes continue to limit widespread adoption and maintain premium pricing structures. | Development of advanced extraction technologies, precision purification techniques, and standardization protocols are enabling superior product quality. |

| Functional Food Innovation — Increasing incorporation of bioactive compounds in everyday food products is creating demand for versatile polysaccharide ingredients. | Regulatory Complexity — Varying international standards and approval processes limit market access and increase compliance costs for manufacturers. | Standardization Excellence — Enhanced molecular characterization, improved stability testing, and optimized bioavailability profiles are advancing market acceptance. |

| Natural Cosmetics Growth — Rising demand for plant-based skincare ingredients in beauty and anti-aging applications fuels steady polysaccharide adoption. | Supply Chain Constraints — Limited cultivation capacity and seasonal availability affect consistent raw material supply and pricing stability. | Application Diversification — Emerging demand for polysaccharides tailored to functional beverages, cosmeceuticals, and pharmaceutical applications. |

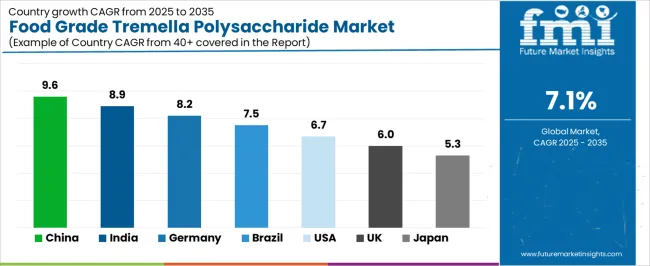

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

| United States | 6.7% |

| United Kingdom | 6.0% |

| Japan | 5.3% |

Revenue from Food Grade Tremella Polysaccharide in China is projected to exhibit strong growth with a market value of USD 52.4 million by 2035, driven by expanding biotechnology infrastructure and comprehensive fungal cultivation innovation creating substantial opportunities for ingredient suppliers across nutraceutical operations, functional food manufacturing, and specialty health product sectors.

The country's established traditional medicine foundation and expanding bioactive compound capabilities are creating significant demand for both powder and liquid extract polysaccharide systems. Major biotechnology companies and ingredient manufacturers including Shandong Focusfreda Biotech and Shanghai Lithy One Health Group Technology are establishing comprehensive local production facilities to support large-scale manufacturing operations and meet growing demand for efficient polysaccharide solutions.

Revenue from Food Grade Tremella Polysaccharide in India is expanding to reach USD 28.3 million by 2035, supported by extensive Ayurveda modernization and comprehensive wellness industry development creating demand for natural polysaccharide solutions across diverse supplement categories and functional food segments. The country's growing middle class and expanding health consciousness are driving demand for ingredient solutions that provide consistent bioactivity while supporting cost-effective manufacturing requirements. Ingredient distributors and nutraceutical manufacturers are investing in local market development to support growing consumer operations and wellness product demand.

Demand for Food Grade Tremella Polysaccharide in Germany is projected to reach USD 21.7 million by 2035, supported by the country's leadership in precision biotechnology and advanced polysaccharide processing requiring sophisticated extraction systems for pharmaceutical and nutraceutical applications. German biotechnology companies are implementing high-precision manufacturing systems that support advanced purification capabilities, operational reliability, and comprehensive quality protocols. The food grade tremella polysaccharide market is characterized by focus on engineering excellence, ingredient purity, and compliance with stringent food safety and pharmaceutical standards.

Revenue from Food Grade Tremella Polysaccharide in Brazil is growing to reach USD 18.9 million by 2035, driven by natural health product appreciation programs and increasing functional food enthusiasm creating opportunities for ingredient suppliers serving both consumer health operations and professional nutrition contractors. The country's extensive biodiversity heritage and expanding wellness awareness are creating demand for polysaccharide ingredients that support diverse health requirements while maintaining quality standards. Health product retailers and specialty supplement service providers are developing distribution strategies to support operational efficiency and consumer satisfaction.

Demand for Food Grade Tremella Polysaccharide in United States is projected to reach USD 16.4 million by 2035, expanding at a CAGR of 6.7%, driven by premium supplement excellence and specialized nutraceutical capabilities supporting advanced wellness product development and comprehensive functional ingredient applications. The country's established supplement manufacturing tradition and mature health-conscious consumer segments are creating demand for high-quality polysaccharide ingredients that support operational performance and regulatory standards. Ingredient manufacturers and nutraceutical suppliers are maintaining comprehensive development capabilities to support diverse consumer requirements.

Revenue from Food Grade Tremella Polysaccharide in United Kingdom is growing to reach USD 14.2 million by 2035, supported by natural health appreciation and established wellness communities driving demand for premium polysaccharide solutions across traditional supplement systems and professional nutrition applications. The country's strong regulatory framework and established ingredient manufacturing capabilities create demand for polysaccharide ingredients that support both conventional supplement formulations and modern functional food applications.

Demand for Food Grade Tremella Polysaccharide in Japan is projected to reach USD 12.8 million by 2035, driven by precision biotechnology tradition and established polysaccharide processing leadership supporting both domestic health product markets and export-oriented ingredient production. Japanese companies maintain sophisticated extraction development capabilities, with established manufacturers continuing to lead in purification technology and quality manufacturing standards.

European Food Grade Tremella Polysaccharide operations are increasingly concentrated between German precision biotechnology and specialized extraction facilities across multiple countries. German facilities dominate high-purity polysaccharide production for pharmaceutical and premium nutraceutical applications, leveraging advanced extraction technologies and strict quality protocols that command price premiums in global markets. Manufacturing operations in Netherlands and Switzerland maintain leadership in specialized processing techniques and regulatory compliance, with companies developing technical specifications that smaller suppliers must meet to access European health product contracts.

Eastern European operations in Poland and Czech Republic are capturing volume-oriented production contracts through skilled biotechnology labor advantages and EU regulatory compliance, particularly in powder formulations for mid-range supplement applications. These facilities increasingly serve as manufacturing capacity for Western European brands while developing their own extraction expertise.

The regulatory environment presents both opportunities and constraints. Novel Food Regulation requirements create quality standards that favor established European manufacturers over imports while ensuring consistent bioactivity specifications. Brexit has created complexity for UK ingredient sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and international distributors.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising raw material costs and precision extraction expenses. Vertical integration increases, with major nutraceutical manufacturers acquiring polysaccharide production facilities to secure ingredient supplies and quality control. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream health product requirements.

South Korean Food Grade Tremella Polysaccharide operations reflect the country's advanced biotechnology sector and export-oriented K-beauty business model. Major conglomerates including LG Household & Health Care and Amore Pacific drive ingredient procurement strategies for their cosmetic and health product divisions, establishing direct relationships with specialized polysaccharide suppliers to secure consistent quality and pricing for their skincare and wellness operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating tremella polysaccharides into cosmeceutical formats, with companies developing products that bridge traditional skincare and modern functional beauty systems. This integration approach creates demand for specific bioactivity specifications that differ from traditional supplement applications, requiring suppliers to adapt extraction techniques and molecular weight profiles.

Regulatory frameworks emphasize cosmetic safety and functional ingredient efficacy, with Korea Food and Drug Administration standards often exceeding international requirements for bioactive compounds. This creates barriers for smaller ingredient suppliers but benefits established manufacturers who can demonstrate comprehensive testing capabilities. The regulatory environment particularly favors suppliers with KFDA approval and comprehensive safety documentation systems.

Supply chain efficiency remains critical given Korea's technology advancement focus and competitive beauty market dynamics. Companies increasingly pursue development contracts with suppliers in China, Japan, and specialized biotechnology manufacturers to ensure access to advanced polysaccharide technologies while managing quality risks. Investment in research and development supports bioactivity advancement during extended product development cycles.

Profit pools are consolidating upstream in advanced extraction technology manufacturing and downstream in application-specific polysaccharide formulations for nutraceutical, cosmetic, and functional food markets where standardization, bioactivity certification, and consistent quality performance command premiums. Value is migrating from basic extraction processes to specification-driven, application-ready ingredients where biotechnology expertise, purification technology, and reliable bioactivity profiles create competitive advantages.

Several archetypes define market leadership: established Chinese manufacturers defending share through cultivation excellence and cost-effective processing; specialized biotechnology companies leveraging advanced extraction expertise and international quality certifications; ingredient distributors with regulatory compliance intellectual property and nutraceutical industry connections; and emerging manufacturers pursuing premium market positioning while developing technical capabilities.

Switching costs - formulation compatibility, regulatory qualification, supply chain integration - provide stability for established suppliers, while technological advancement and quality requirements create opportunities for innovative manufacturers. Consolidation continues as companies seek manufacturing scale; direct sales channels grow for specialized ingredients while traditional distribution remains relationship-driven. Focus areas: secure nutraceutical and cosmetic market positions with application-specific bioactivity specifications and technical support; develop extraction technology and purification manufacturing capabilities; explore specialized applications including pharmaceutical intermediates and cosmeceutical formulations.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Chinese Biotechnology Manufacturers | Cultivation excellence; cost-effective extraction; established supply chains | Traditional medicine integration; scaling production; regulatory compliance development |

| International Ingredient Specialists | Advanced purification technology; global quality certifications; premium market positioning | Technical innovation; international standards; specialized applications |

| Nutraceutical-Focused Suppliers | Application expertise; formulation support; industry relationships | Health product partnerships; clinical validation; regulatory navigation |

| Emerging Technology Developers | Innovation capability; specialized extraction methods; niche market focus | R&D investment; technology licensing; premium positioning strategies |

| Regional Distributors | Local market knowledge; regulatory expertise; customer service capabilities | Market development; technical education; supply chain optimization |

| Item | Value |

|---|---|

| Quantitative Units | USD 90.6 million |

| Product Types | Powder; Particle; Liquid Extract; Capsule; Tablet; Others |

| Applications | Health Products; Drink; Skincare & Cosmetics; Functional Foods; Dietary Supplements; Others |

| Extraction Methods | Water Extraction; Enzymatic Extraction; Ultrasonic Extraction; Supercritical Fluid Extraction; Others |

| End Users | Nutraceutical Companies; Food & Beverage Manufacturers; Cosmetic Companies; Contract Manufacturers; Research Institutions |

| Distribution Channels | B2B Direct Sales; Online B2B Platforms; Specialty Ingredient Distributors; Trade Intermediaries; Export Agents |

| Regions Covered | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Teelixir; Nutra Green Biotechnology; Shandong Focusfreda Biotech; Shanghai Lithy One Health Group Technology; Shanshihui; Xi'an Herb Bio-Tech; Shaanxi Mukelya Biotechnology; Hangzhou Molai Biotech; Naturalin Bio-Resources; Greaf Biotech; Shaanxi Joryherb Bio-Technology; Xi'an Day Natural Tech; Biogrund GmbH; Shaanxi sinuote Biotech; Hunan Nutramax; Botanical Cube; Changsha Vigorous-Tech |

| Additional Attributes | Dollar sales by product type and extraction method; Regional demand trends (APAC, NA, EU); Competitive landscape; B2B vs. online adoption patterns; Manufacturing and processing integration; Precision biotechnology innovations driving bioactivity enhancement, quality reliability, and technical excellence |

By Product Type

The global food grade tremella polysaccharide market is estimated to be valued at USD 90.6 million in 2025.

The market size for the food grade tremella polysaccharide market is projected to reach USD 179.9 million by 2035.

The food grade tremella polysaccharide market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in food grade tremella polysaccharide market are powder, particle, liquid extract, capsule, tablet and others.

In terms of application, health products segment to command 45.2% share in the food grade tremella polysaccharide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Solvent Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Food Grade Industrial Gases Market Size and Share Forecast Outlook 2025 to 2035

Food-Grade Mixing Tank Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Glass Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Food Grade Gas Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Grade Antifoams Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Food Grade Phosphate Business

Analysis and Growth Projections for Food Grade Carrageenan Market

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Food Grade Butyric Acid Market Growth - Trends & Forecast 2025 to 2035

Food-Grade Glycerin Market Outlook - Growth & Industry Trends 2025 to 2035

Food Grade Sodium Hypochlorite Market Growth -Industry Trends 2025 to 2035

Food Grade Alcohol Market Trends - Growth & Industry Forecast 2025 to 2035

Food Grade Silica Market Insights – Demand & Applications 2025 to 2035

Food Grade Activated Carbon Market Report - Applications & Growth 2025 to 2035

Food-Grade Calcium Hydroxide Market Trends – Industry Insights 2025 to 2035

Food Grade Alginate Market Report - Applications & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA