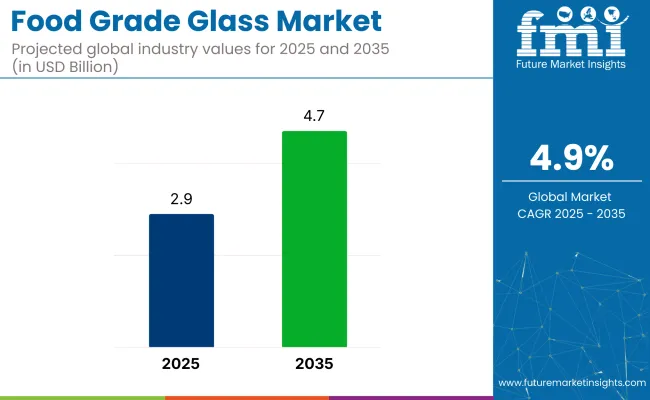

The global food grade glass market is projected to grow from USD 2.9 billion in 2025 to USD 4.7 billion by 2035, expanding at a CAGR of 4.9% during the forecast period.

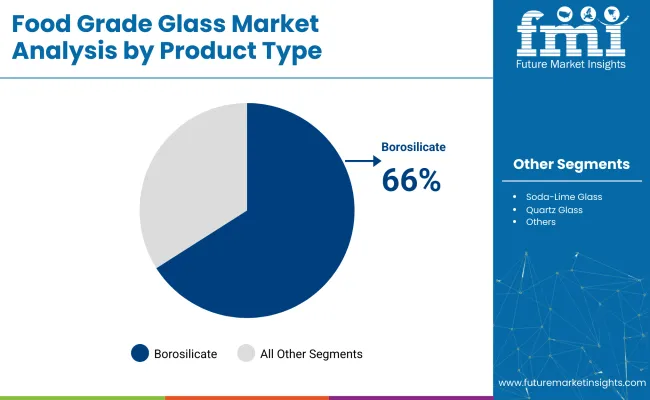

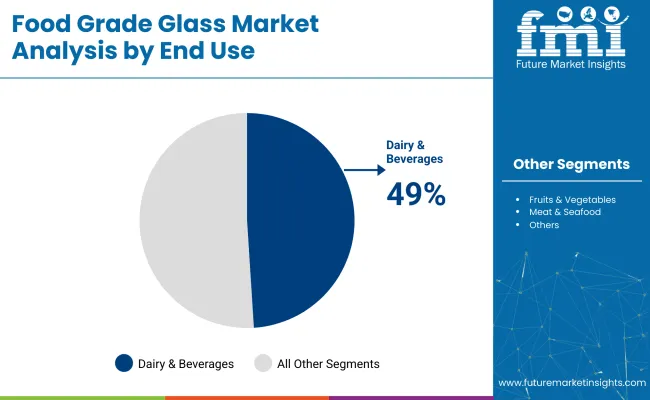

Borosilicate glass is expected to account for about 66% of the market in 2025, reflecting steady demand for its durability and chemical resistance. The dairy & beverage sector is likely to remain the largest end-use category, with an estimated 49% share. These trends are expected to shape the market through 2035.

The food grade glass industry comprises approximately 85-90% of the total glass packaging industry, as the majority of glass containers are used for food and beverage applications. This translates to nearly 90-95% of glass used specifically in consumable goods packaging. Within the broader food and beverage packaging materials industry, food grade glass holds an estimated 11-12% share, competing with plastics, metal, and paper-based materials.

Its presence in the wider food grade packaging sector is smaller, typically under 5%, due to the dominance of flexible and lightweight alternatives. However, in the beverage packaging segment, glass remains prominent, accounting for roughly 38-46% of usage, particularly in alcoholic and premium non-alcoholic drinks where quality preservation and branding are priorities.

In May 2025, GCA (Gürok Glass Packaging), part of Türkiye’sGürok Group, successfully retained its prestigious AA+ rating under the BRCGS Global Standard for Packaging Materials (BRC PM) after an unannounced audit conducted by RINA.

This certification, recognized by the Global Food Safety Initiative (GFSI), reaffirms GCA’s commitment to top-tier food safety, hygiene, and packaging quality standards. As the first Turkish glass packaging producer to achieve this rating, GCA continues to supply over 40 countries worldwide. The company also focuses on incorporating environmentally friendly practices into its operations to meet the rising global demand for safe, high-quality food-grade glass containers.

The industry has been segmented by product type, material composition, and end use. Borosilicate glass, lead-free formulations, and dairy & beverage applications are projected to dominate in 2025. This leadership has been attributed to durability, non-toxicity, and widespread demand for hygienic, premium packaging formats in industries.

Borosilicate glass is projected to maintain its dominance in the industry, accounting for a 66% share in 2025 due to its superior thermal resistance, chemical durability, and safety profile. Its extensive usage in beverage bottles, storage jars, and food containers highlights its versatility across various food-grade applications.

The dairy & beverages segment is forecasted to retain the largest end-use share of 49% in 2025, driven by the global consumer preference for glass-packaged milk, juices, carbonated drinks, and alcoholic beverages. Glass enhances product integrity, taste preservation, and food safety-critical features valued in premium beverage packaging.

Lead-free glass is expected to lead the material composition category, capturing a 40% share in 2025, as demand rises for toxin-free, eco-friendly food packaging solutions. This glass type offers safe storage without harmful leaching, aligning with strict international food safety standards.

Growing consumer preference for safe, inert packaging and rising environmental regulations are reshaping the food grade glass industry. Demand is being driven by the need for chemical-free storage and strong branding, while recyclability mandates are compelling manufacturers to innovate in design, material usage, and post-consumer recovery systems.

Rising Adoption of Inert and Premium Packaging

Food grade glass is being increasingly selected for its non-reactive nature and visual appeal. Its use is being prioritised in baby food, sauces, and specialty beverages to maintain purity and taste integrity. Brands are positioning glass as a reusable, premium option that aligns with consumer health and lifestyle expectations.

Recycling Mandates and Sustainable Design Pressures

Environmental legislation is pushing the industry toward lighter, recyclable, and closed-loop packaging systems. EPR regulations in regions like the EU and California are requiring producers to meet recovery targets. In response, manufacturers are increasing the use of recycled glass and adopting energy-efficient production methods.

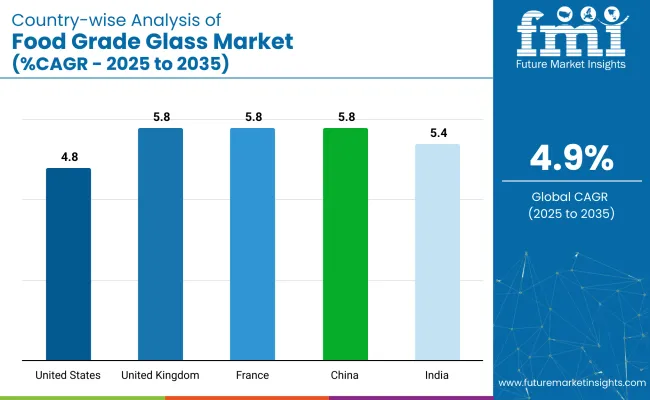

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

| United Kingdom | 5.8% |

| France | 5.8% |

| China | 5.8% |

| India | 5.4% |

The food grade glass industry is expected to expand steadily across both OECD and BRICS nations between 2025 and 2035. Among OECD countries, the United Kingdom and France are each projected to grow at a CAGR of 5.8%, outperforming the global average of 4.9%.

This growth is being driven by strong regulatory frameworks, consumer demand for plastic-free alternatives, and innovations in aesthetic, reusable packaging. The United States follows with a 4.8% CAGR, supported by smart packaging integration and lightweight design adoption. In the BRICS group, China matches OECD leaders with a 5.8% CAGR, propelled by policy-led plastic reduction. India, growing at 5.4%, benefits from rising health awareness and expanding domestic production. Together, BRICS economies are leading volume-driven growth, while OECD nations steer premiumisation.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The market in the United States is set to grow steadily at a CAGR of 4.8% from 2025 to 2035. This growth is fueled by the country’s well-established packaging industry, which is increasingly adopting recyclable materials and eco-friendly solutions in response to stringent environmental regulations and policies.

Innovative trends such as smart glass technologies offering enhanced barrier properties and longer shelf life are gaining traction, particularly in premium food and beverage packaging. Major producers focus on developing lightweight and energy-efficient glass variants to reduce carbon footprints. The rising demand for eco-friendly and high-performance packaging solutions continues to reinforce the United States' leadership in this industry globally.

The market in United Kingdom is projected to expand at a CAGR of 5.8% through 2035, fueled by growing consumer preference for environmentally conscious, plastic-free packaging solutions. Regulations like the Plastic Packaging Tax push manufacturers toward glass alternatives. Premium alcoholic beverages, specialty condiments, and gourmet foods are increasingly packaged in glass to meet aesthetic and functional demands.

Local producers are innovating with design trends such as embossed bottles and reusable jars, catering to environmentally conscious consumers. The UK industry’s emphasis on eco-innovation and high-end product presentation reinforces its rapid growth and positions it as a key European player in food-grade glass packaging.

Food grade glass industry in France is anticipated to grow at a CAGR of 5.8% during the forecast period, owing to its rich culinary heritage and a national drive toward eco-friendly packaging. French food producers prioritize glass jars and bottles for gourmet items like sauces, wines, and preserves to maintain authenticity and premium image.

Government-backed initiatives supporting recycling and circular economy practices encourage wider use of food-grade glass. The industry also benefits from consumer expectations for artistic and elegant packaging, reinforcing glass as the material of choice for premium food and beverage products. These factors collectively contribute to France’s steady industry expansion.

The market in China is expected to expand at a strong CAGR of 5.8%, supported by modernization of food distribution systems. The rising middle class demands high-quality, safe, and attractive food packaging, where glass offers a superior alternative to plastic. China’s large-scale industrial base allows cost-effective production of food-grade glass containers for both domestic use and export.

Environmental policies restricting single-use plastics also stimulate glass adoption across beverage, sauce, and condiment industries. The government’s focus on renewable and resource efficiency is pushing manufacturers to scale up recycled and lightweight glass packaging production, reinforcing China’s industry position globally.

The industry in India is forecasted to grow at a CAGR of 5.4% between 2025 and 2035, driven by increasing health awareness and the shift toward eco-conscious packaging. Rising consumer concerns regarding plastic contamination in food have elevated demand for safe, reusable glass containers.

The expanding processed food sector, particularly for traditional sweets, pickles, and ready-to-eat meals, is fueling this transition. Government initiatives encouraging recyclable packaging solutions further support industry growth. Domestic glass manufacturers are also enhancing their capabilities to meet local and export demand, positioning India as one of the fastest-growing industries in the Asia Pacific food-grade glass industry.

The food grade glass industry is being led by established suppliers such as O-I Glass, Inc., Stölzle Glass Group, Ardagh Group, and Verallia, supported by advanced production systems and extensive global distribution networks. Significant investments are being made in R&D to improve recyclability, product strength, and aesthetic appeal. Innovations in premium packaging formats are being introduced by Stölzle and Verallia to meet evolving consumer expectations.

Emerging players like BEAUSINO and JiningBaolin Glass are being recognised for offering cost-effective solutions in developing regions, though industry access is being restricted by high capital requirements and stringent food safety regulations. Industry consolidation is being observed, with mergers and acquisitions being pursued to strengthen technological capabilities and expand regional presence.

Recent Food Grade Glass Market News

In April 2025, Ardagh Glass Packaging’s Bridgeton, New Jersey facility achieved the globally recognized FSSC 22000 food safety certification, as officially announced by the company. This certification underscores Ardagh’s commitment to ensuring the highest food safety and quality management standards for its glass packaging solutions. The achievement boosts customer confidence, particularly among food and beverage brands seeking secure, compliant, and premium-grade glass containers for their products.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 2.9 billion |

| Projected Industry Size (2035) | USD 4.7 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million metric tons for volume |

| Product Types Analyzed (Segment 1) | Borosilicate Glass, Soda-Lime Glass, Quartz Glass, Others |

| Material Compositions Analyzed (Segment 2) | Lead-Free Glass, Recycled Glass, Coated Glass, Laminated Glass, Others |

| End Uses Analyzed (Segment 3) | Dairy & Beverages, Bakery & Confectionery, Fruits & Vegetables, Meat & Seafood, Others (Ready-to-Eat Meals, Sauces) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, UAE |

| Key Players | O-I Glass, Inc. (Owens-Illinois), Stölzle Glass Group, Vidrala, Ardagh Group (Luxembourg & USA), Verallia (France, Europe & USA), Bormioli Rocco (Italy & Europe), Evergreen Resources (USA), Croxsons (UK), BEAUSINO, Guangdong Huaxing Glass Co., LTD., Jining Baolin Glass. |

| Additional Attributes | Dollar sales, share by pr oduct type and end use, rise in recycled glass demand, expansion of dairy & beverage packaging, technological innovations in coated and laminated glass, regional supply chain trends |

The industry is segmented by product type into borosilicate glass, soda-lime glass, quartz glass, and others.

By material composition, the industry is divided into lead-free glass, recycled glass, coated glass, laminated glass, and others.

By end use, the industry is classified into dairy & beverages, bakery & confectionery, fruits & vegetables, meat & seafood, and others (ready-to-eat meals, sauces).

By region, the industry is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The food grade glass industry is forecasted to reach USD 4.7 billion by 2035.

The industry is anticipated to grow at a CAGR of 4.9% over the forecast period.

The food grade glass industry was valued at USD 2.9 billion in 2025.

Borosilicate glass accounts for 66% of the industry in 2025.

Glass represents about 38-46% of the beverage packaging segment within the food grade glass industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA