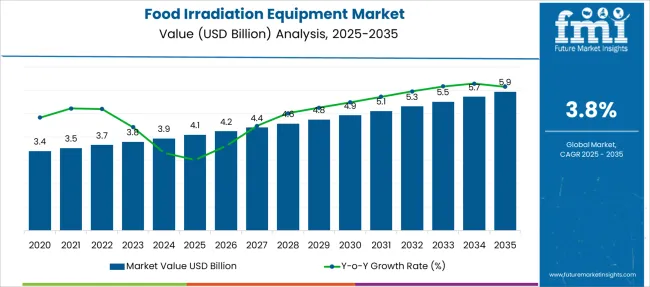

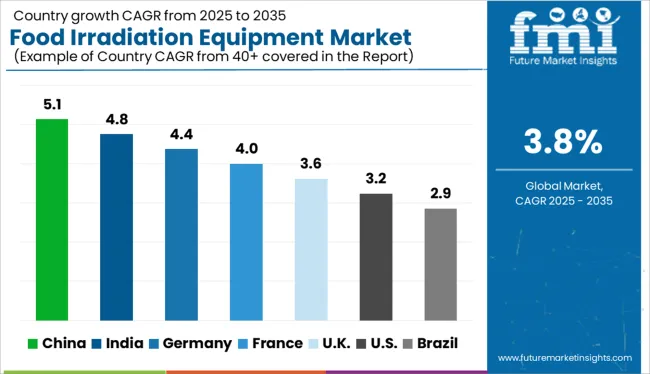

The Food Irradiation Equipment Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Food Irradiation Equipment Market Estimated Value in (2025 E) | USD 4.1 billion |

| Food Irradiation Equipment Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The Food Irradiation Equipment market is witnessing notable growth, driven by increasing demand for microbial decontamination, shelf-life extension, and enhanced food safety protocols across global supply chains. The current market scenario reflects heightened regulatory approvals for food irradiation technologies, with agencies such as the FDA and FAO highlighting its efficacy in reducing pathogens without compromising nutritional integrity. As per insights shared in food safety journals and corporate press briefings, consumer awareness around hygiene and contamination prevention has led to increased investments in non-thermal food processing.

Additionally, the growing complexity of global food distribution networks and the need for standardization in quality control have encouraged food manufacturers to adopt irradiation as a preventive safety measure. Future market expansion is expected to be supported by automation in irradiation chambers, improvements in source handling, and energy-efficient systems.

Sustainability goals and reduced chemical usage further position irradiation as a viable alternative in modern food processing These cumulative factors are expected to sustain market momentum over the forecast period.

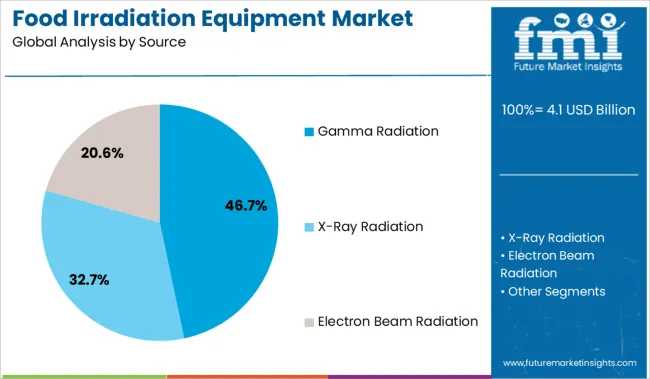

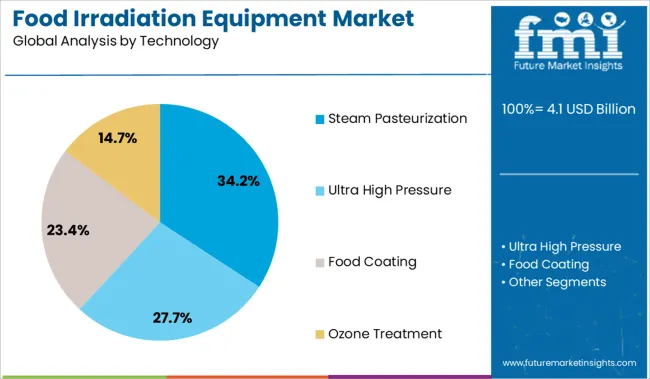

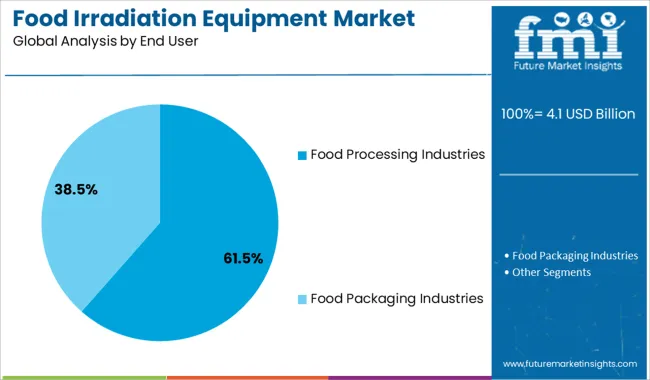

The market is segmented by Source, Technology, and End User and region. By Source, the market is divided into Gamma Radiation, X-Ray Radiation, and Electron Beam Radiation. In terms of Technology, the market is classified into Steam Pasteurization, Ultra High Pressure, Food Coating, and Ozone Treatment. Based on End User, the market is segmented into Food Processing Industries and Food Packaging Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gamma radiation segment is expected to hold 46.7% of the Food Irradiation Equipment market revenue share in 2025, making it the leading source segment. This position has been maintained due to the high penetration capability of gamma rays, allowing uniform treatment of bulk food items with dense packaging. Gamma radiation has been preferred by food processors for its reliability and deep penetration that ensures effective microbial reduction, particularly in spices, dried vegetables, and meat products.

Industry publications and technology supplier updates have emphasized its long-standing regulatory acceptance and operational stability. The cost-effectiveness of cobalt-60 sources and the ability to treat large volumes continuously have further enhanced its usage.

Gamma systems are being integrated into commercial-scale facilities with controlled dosimetry, ensuring product consistency and regulatory compliance These operational and functional advantages have led to its continued adoption, supporting the segment’s leadership in the global market.

The steam pasteurization segment is projected to account for 34.2% of the Food Irradiation Equipment market revenue share in 2025, establishing it as a key technology segment. This prominence has been attributed to the effectiveness of steam in reducing surface-level pathogens, particularly in meat and poultry processing.

Industry news sources and safety equipment bulletins have outlined that steam pasteurization provides a chemical-free and residue-free approach that aligns with food safety and labeling requirements. It has been noted that regulatory authorities have supported its application due to its minimal impact on nutritional and sensory attributes of food products.

The segment’s growth has also been supported by the integration of automated systems and precision controls, enabling processors to meet hazard analysis and critical control point standards As pressure builds around clean-label processing and consumer transparency, steam pasteurization continues to serve as a preferred solution in facilities that emphasize natural and non-invasive safety technologies.

The food processing industries segment is forecasted to contribute 61.5% of the Food Irradiation Equipment market revenue share in 2025, maintaining its position as the dominant end user. This segment’s growth has been driven by rising global food trade, consumer safety expectations, and the need for scalable contamination control measures in processing facilities.

Corporate reports and food industry updates have indicated that processors are increasingly turning to irradiation equipment to extend shelf life, meet export standards, and reduce spoilage across a variety of products including seafood, spices, and ready-to-eat meals. The ability of food irradiation systems to offer consistent treatment without altering the sensory characteristics of products has enhanced its appeal.

In addition, investments in infrastructure modernization and regulatory approvals in major exporting countries have supported wider integration The operational efficiencies achieved through irradiation, including reduced chemical usage and lower recall risks, have reinforced the commercial value proposition of these technologies within the processing segment.

As per FMI, the global food irradiation equipment market witnessed steady growth at a CAGR of 5.8% during the historical period from 2020 to 2025. As superior food quality and safety could be ensured by extensively using irradiation in conjunction with standard food safety procedures such as heat or chemical treatments, packaging, washing, and refrigeration or freezing, demand for food irradiation equipment is likely to surge in the next ten years.

Furthermore, the rising propensity to food irradiation on the back of high acceptance among modern consumers is another significant factor pushing sales in the global food irradiation equipment market. Rising awareness among consumers regarding food-borne disease prevention is also expected to bolster the market.

The ability of food irradiation technology to eliminate pathogenic microorganisms, accelerate decontamination & process safety, reduce the use of chemical disinfestation, and extend the shelf life of food is further estimated to fuel the global food irradiation equipment market. Based on the type of products that are permitted for irradiation in several regions across the globe, the level of irradiated food acceptance varies significantly.

Some of the most commonly irradiated food products around the world include dry seasonings, herbs, and spices. Owing to the aforementioned factors, the food irradiation equipment market is expected to witness a CAGR of around 3.8% from 2025 to 2035.

DRIVERS

RESTRAINTS

OPPORTUNITIES

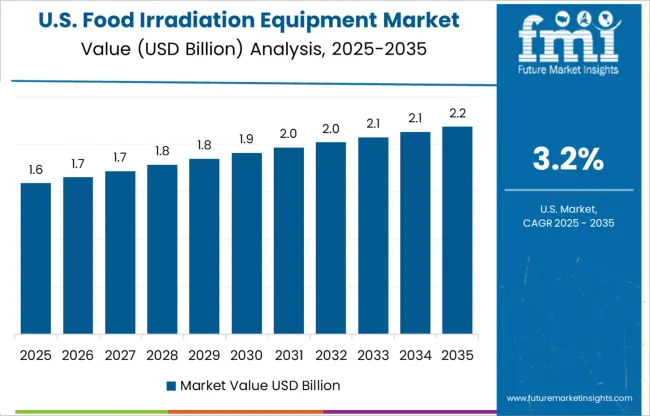

The USA Government to Place High Importance on Food Irradiation Machines by 2035

According to food safety experts in the USA, food irradiation, which is referred to as the application of radiation exposure to food, is an ideal food safety practice since it does not make food products radioactive, compromises the nutritional quality, and significantly alters their taste, texture, or appearance.

Some items imported into the country require this approach. In the US, some producers also irradiate uncooked ground beef. As a result, the demand for food irradiation equipment is quickly increasing in the country.

The USA Food and Drug Administration (FDA), the World Health Organization (WHO), the Centers for Disease Control and Prevention (CDC), and the United States Department of Agriculture (USDA) all view irradiated food as safe. The FDA is in charge of controlling food irradiation in the country. The above-mentioned organizations are projected to boost sales in the USA food irradiation equipment market during the next ten years.

Rising Export of Spices and Mangoes from India to Spur Sales of Gamma Irradiation Equipment

In India, food can be processed with radiation for both international and domestic markets. Food can also be treated for export to extend its life span, preserve production, and evade quarantine hurdles. India is well-known for its diverse culinary exports. Food irradiation equipment can be used to lower the costs of bulk materials in international markets and to immediately provide clients with value-added packaged items.

Using this technology, the country was reportedly able to export a famous Indian mango to the United States. India has one of the largest domestic markets in the world. Cereals, legumes, by-products, fruits & vegetables, seafood, and spice are all procured, stored, and delivered in massive numbers throughout the country. Infestations can be eradicated by radiation processing. As a result, the demand for food irradiation equipment is constantly expanding in India.

High Demand for Shelf-Stable Products in China to Augment the Need for High-Pressure Processing Equipment

According to FMI, China has long struggled to balance food supplies and needs. Regional shortages caused by natural disasters and other factors continue to be a severe worry. China, while being a top-ranking country in terms of population, only has around one-fifth of the world's fertile land. Rising food manufacturing alone may not have been the answer for China. Instead, China needs to expand shelf-stable products and thus food irradiation equipment is in high demand in the country.

More than 200,000 metric tons of food are allegedly radioactively treated in China. Around 13 irradiation facilities in Yunnan, Sichuan, Chongqing, Guizhou, Shanxi, Gansu, and Xinjiang treated a total of 6800 tons of beef pickled chicken, and other meats. There are around twenty (20) cobalt and 60 irradiation facilities in China.

Food Irradiation Tools are Likely to Be Used by Various Food Processing Companies

By end user, the food processing industry segment is estimated to remain at the forefront in the global food irradiation equipment market during the next ten years. Irradiation does not render foods radioactive, decrease nutritional content, or alter the taste, consistency, and texture of food in any noticeable way. The effects of irradiation are so minor that determining whether or not a foodstuff has been irradiated is difficult.

Ionizing irradiation is a novel method that reduces or eliminates bacteria and insects from foods, thereby improving their safety and extending their shelf life. Irradiation, like pasteurized milk and the canning of fruits and vegetables, can make the food safer for consumers. As a result, there is a good likelihood that demand for food irradiation equipment will rise in the food processing industry.

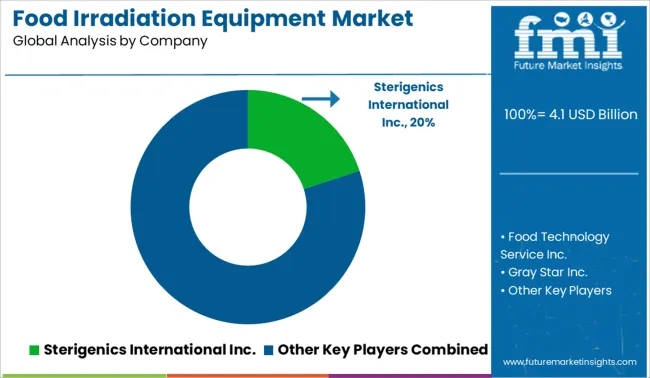

The global food irradiation equipment market is highly fragmented with the presence of a large number of medium- and small-scale companies. The majority of the companies are aiming to expand their portfolios by launching state-of-the-art products. A few others are joining hands with government organizations to distribute their in-house products in various parts of the globe by gaining fast-track approvals.

For instance,

For regulatory compliance, Sterigenics International Inc. has years of experience in lowering the pathogen count in packaging. Sterigenics provides radiation-based gamma processing through its global network of facilities to help its clients achieve their microbial reduction objectives. Processing with gamma radiation is non-intrusive and economical. The USA Food and Drug Administration (FDA) has also provided its approval for radiation-based gamma processing for pathogen reduction and sterilization of food and beverage packaging.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 4.1 billion |

| Projected Market Valuation (2035) | USD 5.9 billion |

| Value-based CAGR (2025 to 2035) | 3.8% |

| Forecast Period | 2020 to 2025 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | The US, Canada, Brazil, Mexico, Germany, France, The UK, BENELUX, India, Thailand, Indonesia, Malaysia, China, Japan, South Korea, Australia, Indonesia, New-Zealand, North America, South America |

| Key Segments Covered | Source, Technology, End User, Region |

| Key Companies Profiled | Food Technology Service Inc.; Sterigenics International Inc.; Gray Star Inc.; Ionisos SA; Nordion Inc.; Reviss Services Ltd.; Sadex Corporation; Sterix Isomedix Services; Scantech Sciences Inc.; Phytosan SA De C; Tacleor LLC. |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global food irradiation equipment market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the food irradiation equipment market is projected to reach USD 5.9 billion by 2035.

The food irradiation equipment market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in food irradiation equipment market are gamma radiation, x-ray radiation and electron beam radiation.

In terms of technology, steam pasteurization segment to command 34.2% share in the food irradiation equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA