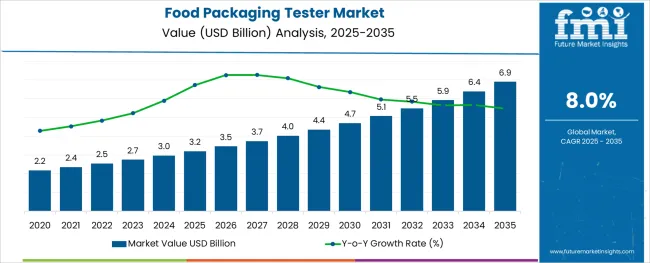

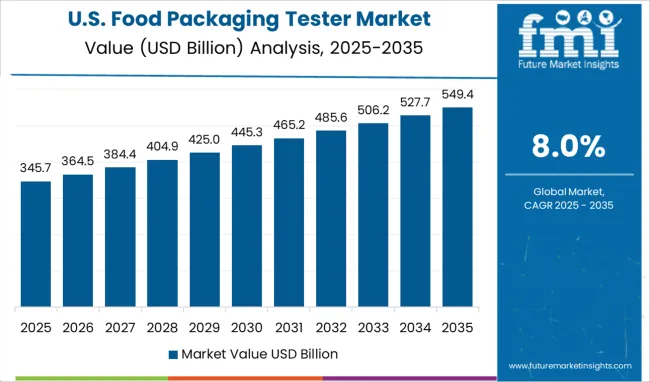

The Food Packaging Tester Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The food packaging tester market is expanding at a steady pace driven by the rising focus on product safety and packaging quality across the food industry. Packaging has become an essential element in ensuring product shelf life and consumer safety which has led manufacturers to invest in advanced testing technologies. Industry publications and technical papers have highlighted how regulatory frameworks and sustainability goals are pushing food companies to validate the performance of their packaging materials.

With the growing shift toward ready-to-eat and packaged foods packaging quality testing is becoming a critical quality control step in production lines. The need for faster testing cycles and accurate assessments of barrier properties durability and integrity is further fueling demand.

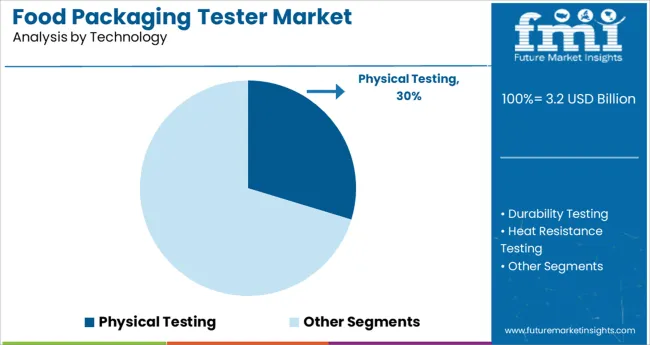

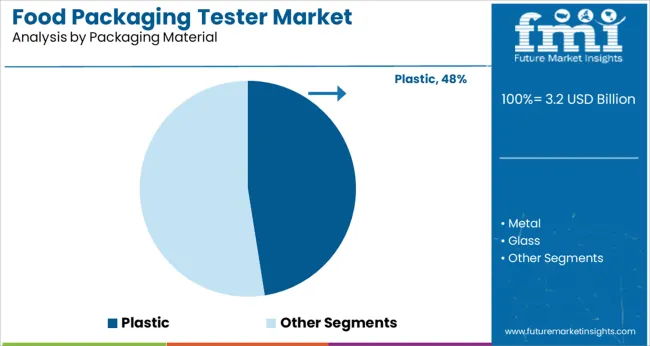

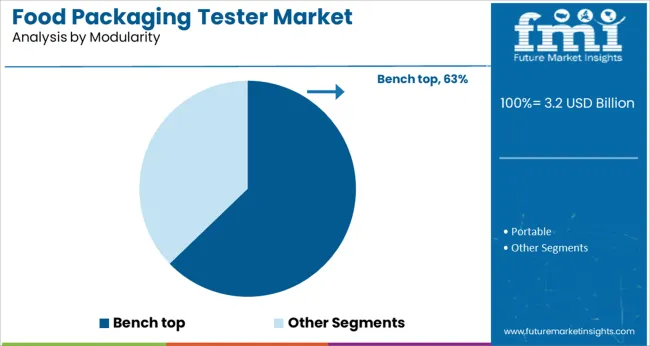

Looking ahead advancements in user-friendly testing equipment and integration with digital quality management systems are expected to create new growth opportunities. Segment growth is primarily influenced by the adoption of Physical Testing technologies the increasing use of Plastic packaging materials and the preference for Bench top modularity that supports space-saving and efficient laboratory setups.

The market is segmented by Technology, Packaging Material, and Modularity and region. By Technology, the market is divided into Physical Testing, Durability Testing, Heat Resistance Testing, Water Gas/Vapor Permeability Testing, Chemical Testing, Migration Testing, Extractable Testing, Leachable Testing, and Others.

In terms of Packaging Material, the market is classified into Plastic, Metal, Glass, Paper, Board, and Layered Packaging. Based on Modularity, the market is segmented into Bench top and Portable. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Physical Testing segment is anticipated to hold 29.7% the food packaging tester market revenue in 2025 reinforcing its role as the key technology segment. Physical testing methods are commonly chosen to assess critical packaging parameters such as tensile strength compression resistance and burst strength ensuring packaging can withstand the rigors of transportation and storage.

Food manufacturers have found these tests essential for maintaining product integrity and preventing packaging failures that could compromise food safety. Quality control teams rely on standardized physical testing techniques to validate the mechanical performance of packaging formats before products reach consumers.

This approach offers reliable data that supports packaging design improvements and regulatory compliance. As production lines continue to require accurate and timely quality checks the Physical Testing segment is expected to maintain consistent demand.

The Plastic segment is forecasted to contribute 47.5% the food packaging tester market revenue in 2025 sustaining its position as the leading packaging material category. Plastic has remained widely used in food packaging due to its versatility lightweight nature and protective barrier properties.

Testing of plastic materials has become crucial for verifying their strength seal integrity and barrier performance against moisture and gases. The market’s dependence on plastic packaging in various food categories including snacks beverages and ready-to-eat meals has driven the demand for specialized testing solutions.

Additionally the need to assess recycled plastics and biodegradable plastic alternatives has further increased the volume of testing requirements. As manufacturers strive to balance sustainability with performance the Plastic segment is projected to remain a key focus for packaging quality testing.

The Bench top segment is projected to account for 62.8% the food packaging tester market revenue in 2025 maintaining its lead in modularity preferences. Bench top testing equipment has been widely adopted due to its compact design and suitability for laboratory environments where space is often limited.

These systems allow food producers and packaging material suppliers to perform routine tests quickly and efficiently without the need for large-scale testing facilities. Bench top units are favored for their ease of use and flexibility enabling operators to conduct multiple test types with interchangeable modules.

This segment has also gained traction due to its ability to meet the needs of small and medium-sized enterprises that require reliable testing solutions at a reasonable footprint. As quality control processes continue to evolve toward faster and more flexible solutions the Bench top segment is expected to retain its market leadership.

Increasing demand for durable food products in the food and beverage industry will aid growth in the market. Food products have a higher chance of getting spoiled owing to the presence of the toxic elements. Presence of adulterants decrease the quality of the product by a significant margin.

As food packing must ensure the quality of the product, it is crucial for testing the quality of the food package. Thus, food packaging testing is done to determine whether a certain product package can perform the desired function of ensuring the food quality.

Quality food packaging that is also visually attractive is important for establishing brand identity. This necessitates the use of food packaging testers, which will boost sales in the market. Ongoing expansion of the foodservice sector will propel demand for food packaging testers over the assessment period.

Rising awareness about health and hygiene has led to high demand for hygienic packaging of food. Advancements in technology have ensured that the food packaging is safer, dependable and faster. In addition to this, governments across the world have created strict laws and regulations to guarantee food safety. All these factors necessitate food packaging testing, thereby fueling the growth in the market.

The cost of production for food packaging testers is high owing to the involvement of technology and testing equipment. This makes it difficult for small-scale industries to invest in the food packaging tester market. Thus the high cost of production associated with food packaging testers might limit demand in the market.

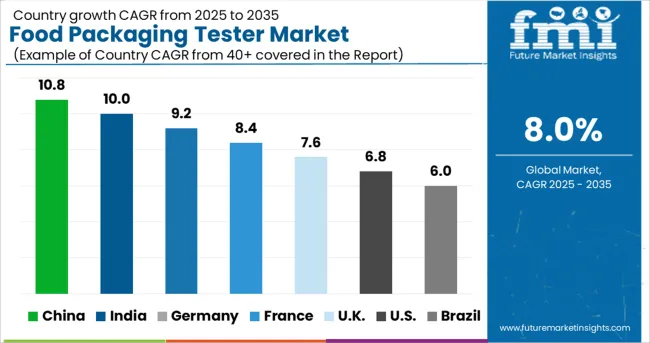

North America is anticipated to dominate the food packaging tester market during the forecast period. Rising adoption of new and advanced technologies, and growing awareness regarding health, hygiene and food safety will boost the market in the forthcoming years.

Beside this, surging preference for hygienic and durable food packaging systems is estimated to boost food packaging tester sales in the North America market. Further, there has been a notable increase in the adoption of food packaging tester in different industries due to strict food safety regulations. This is expected to bode well for the growth in the market.

Expansion in the food & beverage and foodservice sectors across countries such as India, China, South Korea and Japan will spur demand for food packaging testers. Food packaging enables the food industry to retain a higher shelf life for their products and ensures quality. Increasing concerns about food safety and durability in countries such as India and China is estimated to bolster the food packaging tester market.

Online shopping and home delivery of food and beverages will further elevate the demand for food packaging and food packaging testers in Asia Pacific. Demand for flexible packaging solutions for fruits and vegetables is growing at a considerable pace, thereby driving the food packaging tester market.

Due to growing awareness regarding plastic waste disposal, consumers are seeking convenient but sustainable food packaging solutions. Thus, manufacturers are launching cost-effective and sustainable food packaging solutions that ensure product quality and lower the garbage output.

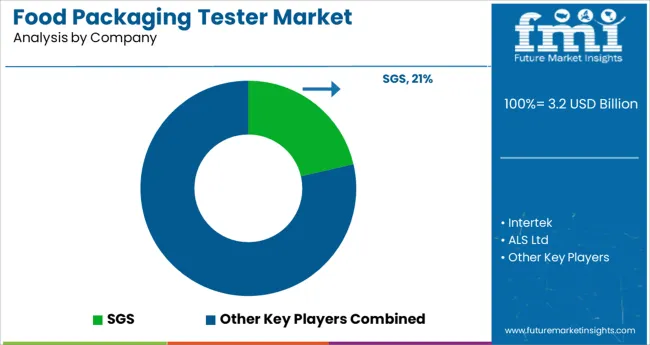

Some of the leading players present in the global food packaging tester market are SGS, Intertek and ALS Ltd, Robert Bosch, GEA Group, IMA Group, COESIA Group, Ishida, ARPAC, Multivac, Nichrome India, Adelphi Group, and Lindquist Machine Corporation.

The food packaging tester market is a fairly competitive market. Key players are investing in strategic partnerships and product development to improve sales and retain consumers with an extensive product portfolio.

| Report Attribute | Details |

|---|---|

| Growth Rate | 8% |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Technology, Packaging Material, Modularity, Region |

| Countries Covered | North America (USA., Canada), Latin America (Mexico, Brazil, Argentina, Peru, Chile, Rest of LATAM), Europe (Germany, Italy, UK, Spain, France, Nordic countries, BENELUX, Eastern Europe, Rest of Europe), CIS & Russia, Japan, Asia Pacific Excluding Japan ( Greater China, India, South Korea, ASEAN Countries, Rest of APEJ), Middle East and Africa (GCC Countries, Turkey, Iran, Israel, S. Africa, Rest of MEA) |

| Key Companies Profiled | SGS; Intertek and ALS Ltd; Robert Bosch, GEA Group; IMA Group; COESIA Group; Ishida; ARPAC; Multivac; Nichrome India; Adelphi Group; Lindquist Machine Corporation |

| Customization | Available Upon Request |

The global food packaging tester market is estimated to be valued at USD 3.2 billion in 2025.

It is projected to reach USD 6.9 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are physical testing, durability testing, heat resistance testing, water gas/vapor permeability testing, chemical testing, migration testing, extractable testing, leachable testing and others.

plastic segment is expected to dominate with a 47.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA