The Seafood sales reached USD 1,10,200.0 million in 2022, worldwide demand for Seafood shows a year-on-year growth of 1.7% in 2023 and thus, the target product sales are expected to reach USD 110 billion in 2024. Over the projection period (2024 to 2034), global Seafood sales are projected to rise at a compound annual growth rate (CAGR) of 3.1% and reach a sales size of USD 149 billion by 2034 end.

Seafood is lean with high-nutrition sources of various nutrients such as proteins, vitamins, minerals, and omega-3 fatty acids accelerating the demand of the target product across the globe. Nowadays consumers becoming more conscious regarding the health of individuals and the consumption pattern of nutritional-rich food. Seafoods are of high perishable nature so need to be preserved by various methods to extend its shelf life. To increase the shelf life of the products, the processor and manufacturer developed value-added products that are enriched with extra nutrients with an extended shelf life.

The seafood industry is gaining traction due to the increasing tourism and hospitality globally which plays a crucial role in the expansion of the target product. The tourism and hospitality industry plays a vital role in providing various diverse seafood dishes to visitors and travelers. This trend explores the distinctive culinary experience in hotel restaurants, resorts, cruise ships, and other venues.

The seafood industry involves a wide range of activities such as capturing, storage, transportation, processing, distribution, and sales of seafood products. Seafood especially consists of a wide variety of aquatic organisms, most commonly fish and shellfish.

| Attributes | Description |

|---|---|

| Estimated Global Seafood Market Value (2024E) | USD 110 billion |

| Projected Global Seafood Market Value (2034F) | USD 149 billion |

| Value-based CAGR (2024 to 2034) | 3.1% |

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for the global target product industry.

This analysis reveals crucial shifts in business performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the domain growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 1.7% (2023 to 2033) |

| H2 | 2.1% (2023 to 2033) |

| H1 | 2.8% (2024 to 2034) |

| H2 | 3.1% (2024 to 2034) |

The above table presents the expected CAGR for the global target product sales growth over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2023 to 2033, the business is predicted to surge at a CAGR of 1.7%, followed by a slightly higher growth rate of 2.1% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase slightly to 2.8% in the first half and remain relatively moderate at 3.1% in the second half. In the first half (H1) the sales witnessed a decrease of 25 BPS while in the second half (H2), the target sales witnessed an increase of 35 BPS

Digital platforms are revolutionizing seafood traceability and transparency

The global seafood industry has to deal with a complex supply chain with several intermediates between the farm to fork. These complex steps in the supply chain make it difficult for the consumers or any processors to ensure the product is sourced sustainably and legally, without any fraud and environmental impact.

However, the availability of digital platforms such as blockchain, IoT (internet of things), and cloud-based computing are helping the end user to know information about the product across the supply chain in forward and backward steps.

Digital platforms are driving a revolution in seafood traceability and transparency, which is also empowering consumers. When customers have access to comprehensive product information, they may make decisions that are consistent with their beliefs, such as choosing seafood that is supplied responsibly or helping out local fishermen.

In turn, the seafood industry is moving toward more sustainable operations as a result of the rising customer consciousness and desire for transparency. A business that uses this technology differentiates itself from other competitors in many ways.

High-tech cold chain logistics are enhancing freshness and quality boosting sales of seafood and products in global trade

Seafood and other products are highly perishable so cold-chain logistics is mandatory to keep the quality fresh of the commodity in the domestic and international trade. Seafood is highly temperature-sensitive, any fluctuations in temperature control lead to the spoilage of the commodity.

Innovation in cold supply chain logistics in recent times helps to ensure the safe transportation of goods to long distances without any spoilage, thus expanding the target product sales across the globe.

Modern refrigeration technologies have significantly improved the ability to maintain consistent low temperatures throughout the seafood supply chain. These technologies include advanced insulated containers, refrigerated trucks and ships, and portable cooling systems.

Real-time temperature monitoring system integration is one of the most significant advances in cold chain logistics. Businesses may monitor seafood goods' temperature continually while they are in transit by using Internet of Things (IoT) sensors.

Logistics management can swiftly detect and resolve any temperature variations that can risk the product's quality. Thanks to the real-time data these sensors give. This degree of control lowers food waste and lessens the chance of spoiling, which is crucial for expensive seafood goods like shrimp, lobster, and tuna.

Real-time monitoring also improves accountability and transparency since it allows stakeholders to confirm that the items have been handled correctly along the supply chain.

Increased penetration of online grocery shopping especially seafood has led to growth in the target product sales

As consumers are increasingly addicted to digital platforms for various needs, they also use these services for the shopping of daily food products such as seafood and other items.

This trend of online shopping has surged the sales of target products with high demand for convenient, high-quality seafood delivered directly to the doorsteps. Due to this trend, consumers have access to a variety of fresh, frozen, and diverse variety of prepared seafood across the globe.

Online e-commerce such as Licious, Fresh to Home, Top Chop, etc. is dedicated to delivering products of animal origin such as seafood, chicken, mutton, etc. Their success in delivering the perishable commodity is due to integrating a cold supply chain with advanced technology throughout the transit from farm to fork.

Along with this cold chain technology, this online platform maintains the quality of end products as per the laid down standard by the authority or regulatory body or by any certifying agency which increases consumer confidence.

Innovative seafood processing helps to surge the sales for target products across the globe

As consumers become more health conscious with the changing dietary preferences, demand for seafood products continues to increase globally. Advanced processing technology such as freezing, canning, drying, smoking, etc. has boosted the seafood sales due to more accessibility of final commodities to a broader range of consumers.

This technology not only increases the shelf life of seafood but also preserves the quality and nutritional value of the product which helps to transport the product to a larger distance.

Canning is one of the processing techniques used by the major domestic and international processors. This technique involves the sealing of seafood such as tuna, salmon, sardines, prawns, etc. some kind of brine solution or other sauces in the airtight metal cans followed by heat in retort processing and then cold treatment which helps to cease the activity of microorganisms.

This canned seafood is popular in most developing countries due to its convenience, availability, affordability with long shelf life of the product.

Demand for organic seafood is growing targeting the health and environmental-conscious consumers

As more consumers become aware of the environmental impact of their food choices and the potential health benefits of organic products, they are increasingly seeking out organic seafood as a preferable alternative to conventionally farmed or wild-caught options.

This shift is being driven by a combination of factors, including growing concerns about sustainability, a desire for healthier and safer food options, and the influence of broader organic food trends.

Organic seafood, which is produced according to strict standards that prohibit the use of these substances, is perceived as a safer and healthier choice. Additionally, organic seafood is often associated with higher nutritional quality, as it is raised in conditions that more closely mimic the natural environment, potentially leading to better-tasting and more nutritious products.

Many consumers are becoming more concerned about the sustainability of their food sources and are seeking out products that minimize their ecological footprint. Organic seafood production emphasizes sustainable farming practices, such as minimizing water pollution, protecting local ecosystems, and reducing the carbon footprint of production.

Consumers are showing increased interest in wild-caught fish for its perceived higher quality boosts the seafood industry

The consumer's perception of wild-caught fish’s superior quality compared to other farmed alternatives. This trend of consumer preferences leads to the continued growth of the target product which is wild-caught from their natural habitat such as oceans. Wild-caught fishing is fueled by factors such as health and nutritional benefits, environmental and sustainability concerns, and the pursuit of authentic, natural flavors.

The search for authentic, natural flavors is also influencing consumer preferences for wild-caught fish. Many food enthusiasts and chefs claim that wild-caught fish have a distinct taste and texture that cannot be replicated by farmed fish.

Global Seafood sales increased at a CAGR of 1.7% from 2019 to 2023. For the assessment period of 2024 to 2034, the projections showcase that the sales value will expand at a CAGR of 3.1%.

The steady increase in the sales of seafood and other products in historic years continued to grow due to rising global populations, particularly in the urban areas which significantly boosted target product consumption. This urbanization in developed and developing countries often leads to higher disposable income which can afford a variety of seafood from the globe.

Expansion of the aquaculture and agriculture industry with improved technology and practices leads to higher yield and production output, reducing pressure on wild fish stocks. Also, increase in the trade of seafood across the globe between countries due to improved logistics, transportation, and cold chain management.

There is continued technological advancement in the process from harvesting, and processing to distribution, target product is boosting its sales across the globe. This includes precision farming with the pre-established standard for good aquaculture practices (GAqP) which focuses on farming methods that aim to improve animal welfare, food safety, sustainability, and maximizing the quality of the product while minimizing stress on the animal.

Consumers are becoming more concerned about the food they consume and the environment so opting for products that are healthier with less environmental impact. So there is a surge in the demand for organic and sustainable sourced seafood. This trend drives the sales in coming times for the forecast period of the next ten years from 2024 to 2034.

The manufacturer also focuses on mergers, acquisitions, partnerships, and collaboration with different companies, institutions, and research centers to hold the maximum revenue share by involving and improving the product quality and novelty in the process and product.

The global seafood industry has many big players such as American Seafoods Company, Austevoll Seafood ASA, Cooke Inc., Trident Seafoods Corporation, Faroe Seafood, Handy Seafood Inc., Hansung Enterprise Co. Ltd., High Liner Food Incorporated, Kangamiut Seafood A/S, Lee Fishing Company, Leroy Seafood Group, Lyons Seafoods Limited, Mowi ASA, Pacific Seafood, Phillips Foods Inc., and many more comprised a significant share of the global sales including in Tier 1 of the industry structure.

These tier 1 companies hold around 25-30% of the global revenue share. These companies have numerous manufacturing facilities with the capacity to harvest products from the sea. These companies are certified with several certifications from regulatory authorities for their product and process.

Widespread distribution networks with advanced cold chain facilities across the globe allow them to supply their products worldwide. They maintain rigorous quality checks across the processing line and throughout the supply chain and reduce costs due to advanced manufacturing technology with high efficiency. These big players often engage in partnership and collaboration to develop solutions that meet specific consumer needs and industry trends.

Tier 2 comprises companies such as mid-tier manufacturing firms with a significant revenue share that are operating in specific and limited geographic locations. These tier 2 companies hold around 40-45% of the global revenue share. Tier 2 companies equipped with processing plants and involved in private labeling with sound knowledge of the target product and industry.

These companies formed strategic partnerships with other companies to expand their reach beyond their limit. Companies like Princes Ltd., Sajo Group, Shanghai Fisheries Group Co. Ltd., Stolt Sea Farm, Surapon Foods Public Company Limited, Tassal Group Limited, etc come under the tier 2 structure.

Tier 3 structure comprises a local company that operates on a small scale and has limitations based on their product type with the distribution and supply chain network.

They operate with a local presence and serve a niche demand space. Such players focus on product quality with traditional artisanal processing methods or technology and customer satisfaction rather than commercialization. Tier 3 companies hold around 30-35% of the global revenue share.

The following table shows the estimated growth rates of the top three countries. China and the USA are set to exhibit target product sales, recording CAGRs of 4.5% and 5.2%, respectively, through 2034.

| Countries | CAGR 2024 to 2034 |

|---|---|

| China | 4.2% |

| USA | 5.7% |

| India | 6.5% |

The sales of Seafood in China are projected to exhibit a CAGR of 4.2% during the assessment period of 2024 to 2034. By 2034, revenue from the sales of the Seafood sales in the country is expected to reach USD 32,910.8 million.

Consumers in China are opting for seafood with diversified fishes including tilapia, carp, different shellfish, crabs, prawns, etc. China is one of the world’s largest producers, consumers, and traders of seafood across the globe. This demand for seafood is expected to continue due to the increasing population, urbanization, and improved technology involvement from the harvesting to the distribution of seafood in the cold supply chain.

The sales of Seafood in the USA are projected to exhibit a CAGR of 5.7% during the assessment period of 2024 to 2034. By 2034, revenue from the sales of the Seafood sales in the country is expected to reach USD 27,226.2 million.

A major portion of the USA population is health conscious with the food products they consume in their daily diet. Due to the high nutritional content of seafood which is a rich source of nutrients such as protein, omega-3 fatty acids, vitamins, and minerals is characterized by high consumption. The USA also imports a significant portion of raw seafood and processes it into a final product, makes the dominating destination for the exporting countries.

The sales of Seafood in India are projected to exhibit a CAGR of 6.5% during the assessment period of 2024 to 2034. By 2034, revenue from the sales of the Seafood sales in the country is expected to reach USD 21,392.0 million.

India has a widespread coastline of 7,516.6 km from 3 sides. Due to this coastal area and the improved farming with the help of good aquaculture practices booming the seafood industry. Along with farming, advanced processing of seafood as the end product provides the fastest growth to the industry. There is a strong demand for seafood in India for the international trade.

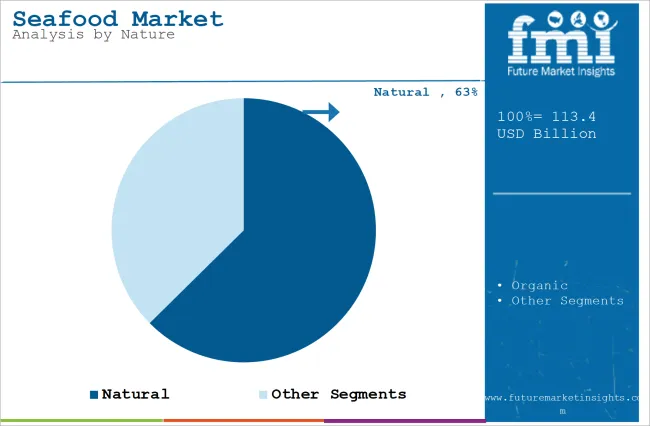

| Segment | Natural (By Nature) |

|---|---|

| Value Share (2024) | 62.6% |

Seafood in the natural type is dominant, which is anticipated to register a CAGR of 3.5% during the assessment period of 2024 to 2034, to reach a sales valuation of USD 93,646.2 million in 2034.

Natural type of seafood is dominated by nature in the sales, due to its widespread farming across the globe. These seafood farming does not require any special attention such as following the special standards laid down by the authorities such as to be followed by the organic seafood farming. Hence the cost of production and price of the final product is less than that of the organic nature seafood.

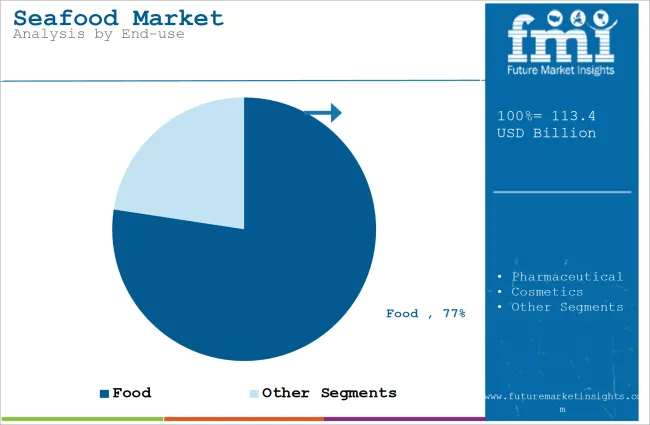

| Segment | Food (By End-use) |

|---|---|

| Value Share (2024) | 77.4% |

The use of Seafood in the preparation of food products dominates the maximum share of the market, which is anticipated to register a CAGR of 3.5% during the assessment period of 2024 to 2034, to reach a sales valuation of USD 93,646.2 million in 2034.

Preparation of different food cuisines as per the different regional or cultural preferences utilizes various seafood varieties from ground fish to crabs to prawns etc. Growing tourism and hospitality across the globe demand regional seafood boosting the target market.

The key players in the Seafood industry are continuously innovating to introduce new products with improved processes and products with diverse seafood varieties. Product development with innovation plays a crucial role in the market approach.

Manufacturers continuously work to improve the quality, and sensory attributes of Seafood while maintaining the organoleptic properties and safety of the final product via certifications. Through ongoing research and development, manufacturers aim to differentiate their products in terms of quality, reliability, and suitability for widespread consumers.

For instance

| Report Attributes | Details |

|---|---|

| Estimated Market Size (2024) | USD 110 billion |

| Projected Market Size (2034) | USD 149 billion |

| CAGR (2024 to 2034) | 3.1% |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2024 to 2034 |

| Quantitative Units | USD billion for value and million tons for volume |

| Nature Segments Analyzed (Segment 1) | Natural, Organic |

| Source Segments Analyzed (Segment 2) | Farm Raised, Wild Caught |

| Product Types Analyzed (Segment 3) | Ground Fish, Pelagics, Tuna, Salmonids, Molluscs, Crustaceans, Lobsters, Crabs, Shrimp, Others |

| Form Types Analyzed (Segment 4) | Fresh, Chilled, Frozen, Ambient |

| End Uses Covered (Segment 5) | Food, Pharmaceutical, Cosmetics, Industrial, Biotechnology, Household Retail |

| Sales Channels Covered (Segment 6) | Direct, Indirect, Modern Trade, Convenience Stores, Specialty Food Stores, Wholesale Stores, Discount Stores, Online Retail, Others |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Middle East & Africa |

| Countries Covered | China, USA, India, Germany, United Kingdom, France, Spain, Canada, Japan, South Korea |

| Key Players Influencing the Market | American Seafoods, Austevoll Seafood, Cooke Inc., Faroe Seafood, High Liner Foods, Leroy Seafood Group, Mowi ASA, Pacific Seafood, Phillips Foods, Princes Ltd., Sajo Group, Shanghai Fisheries, Stolt Sea Farm, Thai Union, Trident Seafoods, Young’s Seafood, Zhangjiang Guolin Aquatic Products |

| Additional Attributes | Dollar sales by nature and form, innovations in seafood processing, cold chain logistics impact, online sales growth, sustainability and organic trends |

| Customization and Pricing | Customization and Pricing Available on Request |

This segment is further categorized into organic and natural

This segment is further categorized into Farm Raised, and Wild Caught

This segment is further categorized into Ground Fish, Pelagics, Tuna, Salmonids, Molluscs, Crustaceans, Lobsters, Crabs, Shrimp, Others (Prawns, Trouts, etc.)

This segment is further categorized into Fresh, Chilled, Frozen, Ambient

This segment is further sub-segmented as Food, Pharmaceutical, Cosmetics, Industrial, Biotechnology, Household Retail

This segment is further classified as Direct, Indirect, Modern Trade, Convenience Stores, Specialty Food Stores, Wholesale Stores, Discount Stores, Online Retail, Other Retail Forms

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global Seafood sales are estimated at a value of USD 110 billion in 2024.

Sales of Seafood increased at 1.7% CAGR between 2019 and 2023.

American Seafoods Company, Austevoll Seafood ASA, Cooke Inc., Dongwon F&B, Faroe Seafood, Handy Seafood Inc., Trident Seafoods Corporation are some of the leading players in this industry.

The North American sales are projected to hold a revenue share of 17.6% over the forecast period.

The sales are projected to grow at a forecast CAGR of 3.1% from 2024 to 2034.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Seafood Flavors Market Growth - Innovations & Industry Demand 2025 to 2035

Evaluating Seafood Packaging Market Share & Provider Insights

Live Seafood Market Size and Share Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA