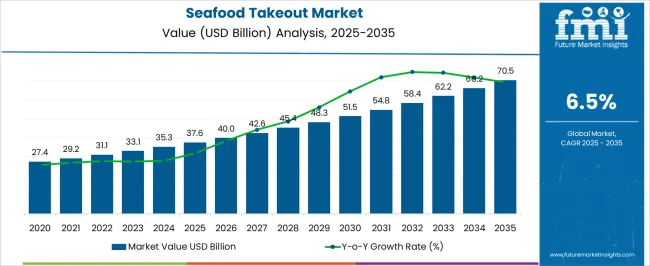

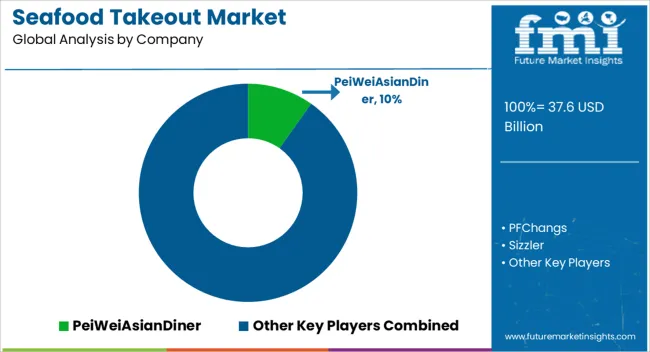

The Seafood Takeout Market is estimated to be valued at USD 37.6 billion in 2025 and is projected to reach USD 70.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Seafood Takeout Market Estimated Value in (2025 E) | USD 37.6 billion |

| Seafood Takeout Market Forecast Value in (2035 F) | USD 70.5 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The seafood takeout market is witnessing notable expansion as urbanization, changing dietary preferences, and time-constrained lifestyles drive the demand for convenient, protein-rich meals. Increased awareness around the health benefits of seafood combined with the growing influence of online food delivery platforms has expanded the market's consumer base. Restaurants are focusing on streamlining operations and integrating digital ordering technologies to enhance service speed and food quality.

The proliferation of cloud kitchens and takeaway-focused outlets has allowed seafood offerings to diversify across both traditional and modern culinary formats. Sustainability concerns have led many operators to source responsibly caught seafood, appealing to environmentally conscious consumers.

Moreover, the rise of multicultural cuisines and fusion dishes is reshaping product menus and influencing supply chain strategies. As disposable incomes rise and digital delivery infrastructure matures, particularly in metropolitan regions, seafood takeout is expected to capture greater market share across multiple dining categories.

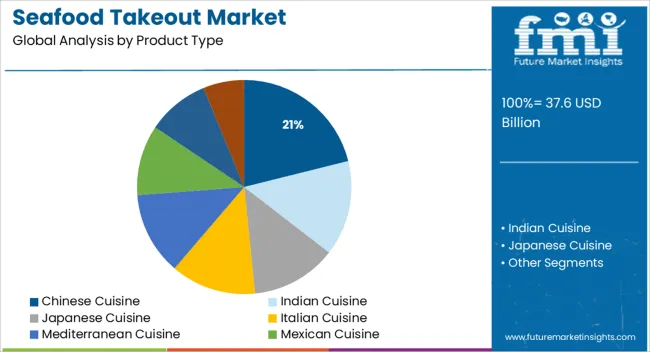

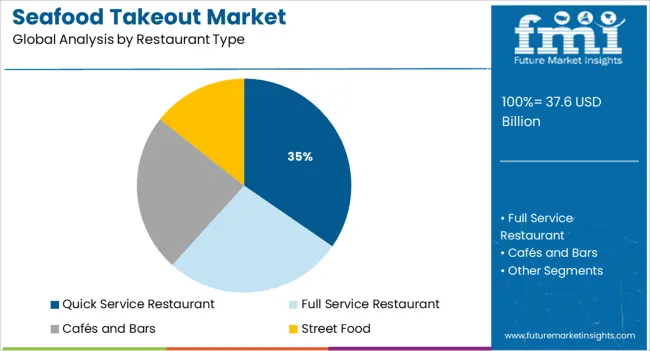

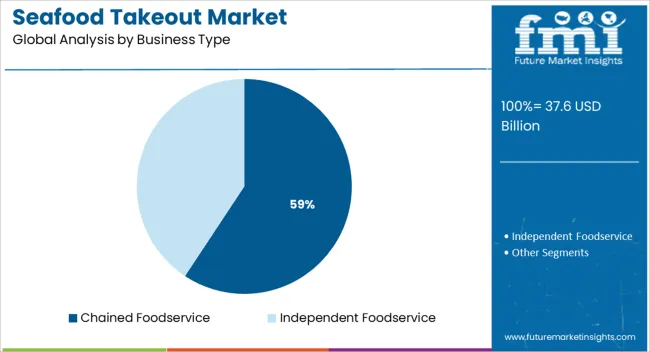

The market is segmented by Product Type, Restaurant Type, Business Type, Purchase Model, and Payment Type and region. By Product Type, the market is divided into Chinese Cuisine, Indian Cuisine, Japanese Cuisine, Italian Cuisine, Mediterranean Cuisine, Mexican Cuisine, Turkish Cuisine, and Others (Greek, Spanish, Korean). In terms of Restaurant Type, the market is classified into Quick Service Restaurant, Full Service Restaurant, Cafés and Bars, and Street Food. Based on Business Type, the market is segmented into Chained Foodservice and Independent Foodservice. By Purchase Model, the market is divided into Direct-to-Consumer and Platform-to-Consumer. By Payment Type, the market is segmented into Cash, Debit Cards, Credit Cards, Digital Wallets, and Electronic Bank Transfers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Chinese cuisine subsegment is projected to hold a 21.1% revenue share within the product type category in 2025, making it the most dominant culinary offering in seafood takeout. This leadership is supported by the widespread popularity of Chinese seafood dishes that blend bold flavors, quick cooking methods, and adaptable ingredients.

Consumer familiarity with Chinese-style seafood combined with its strong compatibility with takeout and delivery formats has contributed to its sustained demand. Additionally, Chinese cuisine's emphasis on stir-frying, steaming, and saucing allows for seafood to retain its texture and taste even after transport, which has enhanced customer satisfaction in off-premise consumption.

The format's menu flexibility and ability to incorporate locally available seafood options have also driven operational advantages for foodservice providers. This has positioned Chinese seafood dishes as a staple offering across urban delivery ecosystems, solidifying its segmental leadership.

The quick service restaurant segment is expected to account for 34.6% of the market's revenue under the restaurant type category in 2025. Its dominance is driven by its ability to deliver consistent, fast, and cost-effective seafood meals tailored for high-volume service environments.

Quick service operators have adopted streamlined kitchen designs, pre-portioned seafood components, and integrated POS-to-delivery platforms that minimize wait times while maintaining quality. Their affordability and accessibility have made them a preferred choice for both daily commuters and families seeking convenient meal options.

Strategic collaborations with food delivery aggregators and investment in takeaway-focused packaging solutions have further enhanced their reach and order frequency. Additionally, many QSR chains have introduced seafood-specific offerings and value meal promotions, strengthening their appeal and contributing to their share leadership in the seafood takeout market.

The chained foodservice segment is anticipated to command 59.3% of total revenue in the business type category in 2025, establishing it as the leading operational model. This prominence is being driven by the expansion capabilities, brand recognition, and standardized quality assurance that chain models offer.

Chained operators have leveraged economies of scale in seafood procurement, centralized logistics, and supply chain traceability to ensure consistent delivery of seafood products across locations. Their robust marketing budgets, loyalty programs, and omnichannel ordering platforms have amplified customer engagement and repeat business.

Additionally, the adoption of technology-enabled kitchen automation and inventory forecasting has enabled efficient handling of perishable seafood items, reducing waste and operational risks. As consumer trust remains high in established chains that offer seafood in takeout-friendly formats, their dominance is expected to persist and expand further across emerging markets.

Consumer awareness of the health benefits of seafood and changes in lifestyle have contributed to the growth of the seafood market. Non-vegetarian consumers are slowly changing their lifestyles, and pescetarians are consuming seafood along with vegetarian foods.

Pescetarianism refers to a diet consisting of fish and vegetarian foods, without the consumption of meat such as beef, pork, or poultry.

Increasing consumer expenditure on various seafood dishes like sushi and consumer preference for fish dishes like pescetarianism are some key factors leading to the growth of the market. Foods that come in fresh form are highly preferred by consumers owing to their health benefits.

Various factors, such as sedentary lifestyle habits, an increase in income levels and an increase in chronic diseases have resulted in a shift in individuals' consumption habits.

The improvement in economic conditions and the growth of disposable income propel market growth, and middle-income groups and high-income consumers, in combination, add to the middle-class population.

In addition, North America and the Asia-Pacific are experiencing increased disposable income as urban consumers shift from essential to premium goods and services. As a result, seafood suppliers & institutions are enhancing their seafood product line and service offerings.

The market is undergoing a change attributed to consumers' preference for a healthy diet. As meat & meat products often contain harmful pesticides and chemicals, their high consumption can be harmful to consumers, causing them to search for alternatives to meat and meat products.

Furthermore, an increase in consumer awareness regarding the living conditions of cattle in cattle farms has influenced consumers' preferences for meat products, propelling the growth of the global seafood takeout market.

Currently, the depletion of sea species has restricted the growth of the seafood market, but sustainable fishing may increase the supply of seafood takeout to meet the emerging demand.

Collaboration of fishermen and fish farmers with processors, distributors, retailers, restaurants, and foodservice providers is expected to resolve the environmental issues and help in advancing the market's sustainability on many levels, including economically, ecologically, and socially.

Many seafood restaurants focus on providing only sustainable seafood options today, such as Miya's in the United States and Fisheries Innovation in Scotland.

These restaurants & seafood service providers focus on sustainable seafood options such as catfish and tilapia. All of these factors work in tandem to propel the growth of the global seafood takeout market.

Over 79% of households in India prefer instant food, a result of changing standards of living, the increase in disposable incomes, and an increase in disposable incomes, according to a recent survey conducted by the Associated Chamber of Commerce and Industry of India.

In addition to consumers' interest in pescetarian cuisine and the presence of a higher nutritional value, a rise in consumer expenditures on seafood dishes like sushi is one of the major factors for the growth of the seafood takeout market, boosting the demand for seafood takeout.

Owing to this increase in demand, the market is expected to grow in the future, providing opportunities for the seafood takeout market.

In an effort to increase consumer appeal, chefs have developed recipes and dishes that include fish, trout, and prawns. The popularity of these recipes has aided in the growth of the seafood takeout market.

The food industry must recognize seafood as an important part of their offerings; responding to the needs of consumers of all ages and preferences has popularized seafood around the world, in turn, driving the market growth.

The USA Commercial Fisheries and Seafood Industry estimate that roughly 80% of aggregate catch seafood, that is, fresh and frozen, is consumed as human food, proving the high demand for seafood takeout in the country.

Furthermore, apart from manufacturers, retailers like Walmart Corporation have started their own seafood brands due to the high demand across the country.

The Asia Pacific is a region where developing economies like China and India have become the centers of some of the most popular fish-related cuisines in the world.

Plus, the country has a strong tradition of producing and consuming authentic fish-related dishes, which is evident by the sheer range of offerings on restaurant menus across the region; numerous producers & sellers are cashing in on the seafood takeout market key trends & opportunities.

Furthermore, the development of organized food service outlets and the trend toward out-of-home dining in the market are forecast to boost the sale of seafood takeout, as well as premium servings, including crustaceans, across quick service and full-service outlets.

Among the leading markets for restaurants in the Asia Pacific over the past few years have been the developing economies, which have provided new opportunities for the seafood takeout market to scale up their sales channels and revenues.

Furthermore, online ordering from restaurants has exploded at a remarkable rate in recent years, giving restaurants even more opportunities to scale up their sales channels and revenues.

Seafood takeouts are manufactured and marketed by P.F. Changs, Sizzler, Bahama Breeze Island Grille, Rubio's, Long John Silver's, Red Lobster, Captain D's Seafood Kitchen, Bonefish Grill, Joe's Crab Shack, Bubba Gump Shrimp Co., Arthur Treacher's, Landry's Seafood House, Chart House, King's Fish House, Ocean Prime, Eddie V's Prime Seafood, McCormick & Schmick's, Captain D's Seafood Kitchen, Legal Sea Foods, Truluck's, Pappadeaux Seafood Kitchen, and Other Players (On Additional Requests).

Companies that have developed new products to increase their market share among consumers are also adopted by leading companies. It is these strategies that have led to the development of the seafood takeout market.

Key players are focusing on expanding their product offering, thus producing a bigger selection of seafood products, such as fillets, portions, rings, and others. Furthermore, the main product range of key players is dominated by fillets and portions, due to their high consumer demand for seafood takeout in these countries because they are used for both foodservice and retail markets.

Additionally, some companies are also collaborating with digital marketing and other companies to improve their supply chain and marketing efficiency, as well as securing the farming for long-term industry growth. Mergers and acquisitions are some of the most preferred strategies globally for the emerging trends in the seafood takeout market.

Seafood takeout account for large shares in the takeout market, some of the prominent players within the market include P.F. Changs, Sizzler, Bahama Breeze Island Grille, Rubio's, Long John Silver's, Red Lobster, Captain D's Seafood Kitchen, Bonefish Grill, Joe's Crab Shack, Bubba Gump Shrimp Co., and Arthur Treacher's.

Recent Developments in the Seafood Takeout Market:

The global seafood takeout market is estimated to be valued at USD 37.6 billion in 2025.

The market size for the seafood takeout market is projected to reach USD 70.5 billion by 2035.

The seafood takeout market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in seafood takeout market are chinese cuisine, indian cuisine, japanese cuisine, italian cuisine, mediterranean cuisine, mexican cuisine, turkish cuisine and others (greek, spanish, korean).

In terms of restaurant type, quick service restaurant segment to command 34.6% share in the seafood takeout market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Takeout Dinner Market Trends - Convenience & Gourmet Expansion 2025 to 2035

Seafood Flavors Market Growth - Innovations & Industry Demand 2025 to 2035

Evaluating Seafood Packaging Market Share & Provider Insights

Seafood Market Analysis - Size, Share, and Forecast 2024 to 2034

Live Seafood Market Size and Share Forecast Outlook 2025 to 2035

Lunch Takeout Market Analysis by Payment Type, Restaurants Type, Product Type, Nature, Purchase Model and Region Through 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Chinese Takeout Market analysis by Product, Restaurant Type, Nature, Purchase Model, Payment Type, and Ownership

Healthy Takeout Market Trends - Convenience & Clean Eating Growth 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Demand for Breakfast Takeout in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA