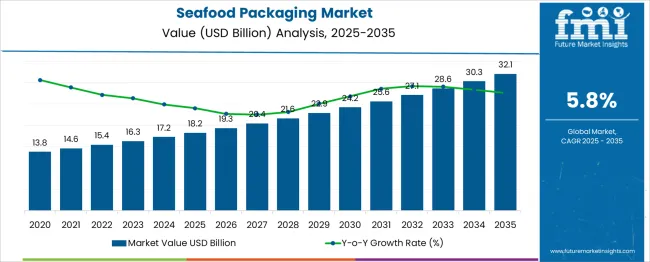

The Seafood Packaging Market is estimated to be valued at USD 18.2 billion in 2025 and is projected to reach USD 32.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. An examination of the annual growth trajectory reveals a consistent and gradual increase, with year-on-year (YoY) growth rates ranging between 5.5% and 6.4%. This indicates a low level of growth volatility, pointing to a market that is stable and largely insulated from sharp demand fluctuations. Between 2025 and 2030, the market grows from USD 18.2 billion to roughly USD 22.9 billion, with YoY growth averaging around 5.6%–5.9%.

From 2030 through 2035, the market expands further to USD 32.1 billion, and growth rates slightly improve, averaging 5.9%–6.4% annually. The gradual and linear upward trend across both halves of the forecast period reflects strong underlying demand patterns, driven by increasing seafood consumption, regulatory emphasis on packaging integrity, and broader logistics needs. Given the tight band of annual growth variation, the Growth Rate Volatility Index remains low, making the seafood packaging market attractive for stakeholders seeking consistent, demand-driven opportunities with minimal risk of abrupt slowdowns.

| Metric | Value |

|---|---|

| Seafood Packaging Market Estimated Value in (2025 E) | USD 18.2 billion |

| Seafood Packaging Market Forecast Value in (2035 F) | USD 32.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Seafood Packaging Market operates as a key segment within the broader Food Packaging Market, which encompasses a wide range of solutions designed to preserve, protect, and transport perishable food items. The global food packaging industry is valued at well over USD 400 billion, with seafood packaging accounting for a growing share due to the specific handling and preservation needs of fish, shellfish, and processed seafood products. Within the parent market, seafood packaging contributes approximately 4.5% to 5.0% of total revenue, reflecting its importance in cold chain logistics and export-oriented supply chains. The parent food packaging market is influenced by factors such as extended shelf life requirements, increasing focus on contamination prevention, demand for vacuum and modified-atmosphere packaging (MAP), and the growth of chilled and frozen food segments. Seafood, being highly perishable, requires specialized materials and technologies, including leak-proof trays, barrier films, and temperature-sensitive labeling. As such, seafood packaging often demands higher performance specifications compared to other food categories. This rising emphasis on product freshness, visual appeal, and transport durability is driving innovation and growth within the seafood segment. As global seafood consumption continues to expand, especially in Asia-Pacific and North America, the segment’s share within the parent food packaging market is expected to strengthen steadily.

The seafood packaging market is witnessing sustained growth, fueled by rising global seafood consumption, stricter safety regulations, and advancements in preservation technologies. Packaging formats are evolving to meet the need for extended shelf life, product traceability, and reduced contamination risks.

Food safety standards in major markets have led to increased adoption of high-barrier materials and intelligent packaging solutions. Logistics advancements in cold chain and temperature-controlled storage have supported the expansion of packaged seafood distribution in both domestic and export channels.

Manufacturers are focusing on packaging innovations that align with sustainability goals, including recyclable plastics, biodegradable films, and lower-emission production processes. Looking forward, demand for pre-portioned, ready-to-cook, and value-added seafood formats is expected to shape packaging design, material choices, and automation strategies in the sector

The seafood packaging market is segmented by material type, packaging type, product type, application type, seafood category, and geographic regions. The seafood packaging market is divided by material type into Plastic, Paper, Metal, and Others. The seafood packaging market is classified into Modified atmosphere packaging (MAP), Vacuum packaging, and Others. The seafood packaging market is segmented by product type into Bags and pouches, Trays, Cans, Boxes, Shrink films, and Others. The seafood packaging market is segmented by application type into Fresh and frozen, and processed. The seafood category of the seafood packaging market is segmented into Fish, Molluscs, Crustaceans, and Others. Regionally, the seafood packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

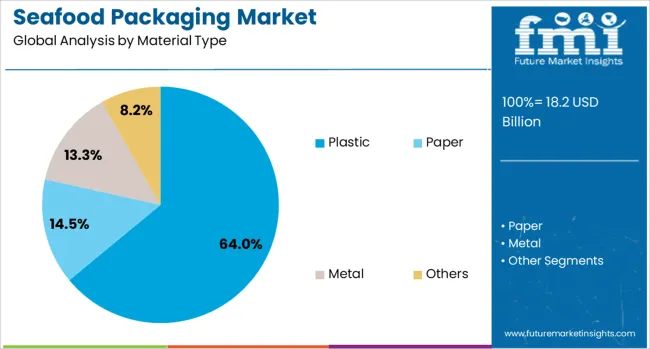

Plastic is anticipated to account for 64.0% of the total revenue in the seafood packaging market by 2025, establishing it as the leading material type. This dominance is attributed to its strong barrier properties, flexibility, and adaptability across various seafood forms, including frozen, fresh, and processed.

Plastics provide optimal moisture and oxygen control, ensuring product freshness and reducing microbial growth during transit. Technological advancements in multilayer films, vacuum-sealed formats, and recyclable polymers have increased the usability of plastic in packaging lines.

The material’s compatibility with high-speed machinery and its ability to meet stringent food-grade certifications have made it indispensable in modern seafood packaging operations. As producers balance sustainability with performance, recyclable and bio-based plastic variants are gaining traction without compromising food safety or shelf life

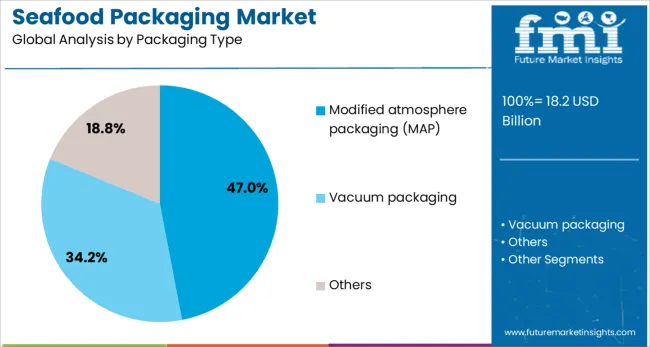

Modified atmosphere packaging (MAP) is projected to contribute 47.0% of the seafood packaging market revenue in 2025, making it the most widely adopted packaging type. This leadership is supported by MAP’s ability to significantly extend shelf life and maintain product quality through controlled gas composition.

By modifying oxygen, carbon dioxide, and nitrogen levels inside the package, MAP minimizes oxidation and bacterial growth, particularly in high-risk seafood products. It enables producers to distribute products across longer distances and offers retailers longer display times, reducing waste and spoilage.

MAP's effectiveness in preserving color, texture, and flavor has made it highly suitable for both fresh and frozen seafood categories. The segment’s strength is further amplified by the rising penetration of premium and minimally processed seafood products in organized retail and foodservice outlets

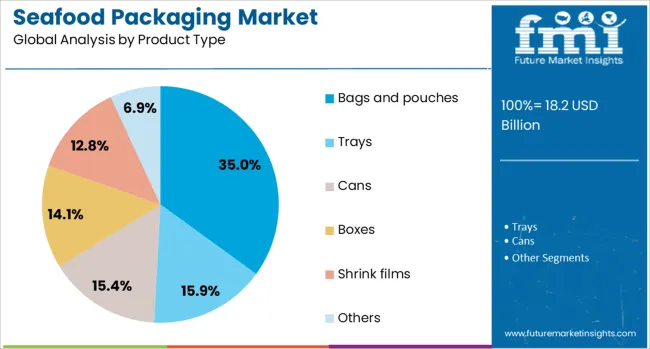

Bags and pouches are expected to represent 35.0% of the market share in 2025, ranking as the top product type segment. Their popularity stems from portability, lightweight construction, and superior sealing capabilities that support product integrity during storage and transit.

These flexible formats are ideal for both vacuum-sealing and MAP systems, offering versatile packaging for various seafood products such as fillets, shrimp, and marinated cuts. The reduced material usage compared to rigid containers contributes to lower environmental impact and cost savings in production and distribution.

Moreover, advancements in resealable zippers, anti-fog films, and tamper-evident designs are enhancing consumer convenience and safety. The growing demand for single-use and portion-controlled packaging formats across retail and e-commerce channels has further cemented the role of bags and pouches in the evolving seafood packaging landscape

The seafood packaging market is expanding due to growing demand for freshness, extended shelf life, and improved distribution efficiency. Key packaging formats include vacuum packs, trays, pouches, and films designed to handle moisture, odor, and delicate textures. As seafood consumption rises across retail and foodservice channels, packaging solutions must align with transport, storage, and hygiene requirements. Market participants differentiate by material resilience, tamper resistance, and regulatory compliance. Cold chain compatibility, labeling clarity, and portion flexibility further shape procurement preferences among seafood producers and retailers.

Maintaining seafood freshness during storage and distribution is a key factor influencing packaging selection. Exposure to air, light, and temperature fluctuations can accelerate spoilage and reduce product quality. Packaging formats such as modified atmosphere packs and vacuum-sealed containers help slow oxidation and microbial activity. These methods preserve texture, color, and flavor, making them favored for fresh fillets, shellfish, and value-added seafood products. Producers also rely on moisture-barrier films and leak-resistant seals to manage condensation and odor during transit. Shelf life extension allows retailers to plan inventory better and reduce waste, while consumers benefit from longer usability windows. Properly engineered packaging supports both chilled and frozen logistics, accommodating short-haul retail deliveries as well as international exports. Companies offering proven shelf life performance backed by lab data or third-party validation are often preferred by seafood brands. Freshness preservation will continue to define material selection and innovation focus within this market.

Seafood is a highly regulated food category due to its perishability and sensitivity to handling conditions. Packaging must comply with food safety standards, labeling regulations, and traceability requirements enforced by health authorities. In many regions, packaging materials must be certified as non-reactive and suitable for direct food contact. Clear, tamper-evident sealing is important to ensure consumer confidence. Labels must present accurate product information such as origin, processing date, and storage instructions. For exporters, compliance with international labeling formats and inspection protocols is critical to avoid shipment rejection or delays. Cold chain visibility and batch traceability features, such as printed codes or QR tagging, support transparency in the distribution process. Producers investing in packaging systems that streamline documentation and meet inspection criteria reduce regulatory risks. As scrutiny over seafood safety increases globally, packaging that facilitates compliance will play an even greater role in gaining market access and retailer approval.

Packaging design in the seafood sector must align with the varying needs of retail shelves, restaurant kitchens, and direct-to-consumer platforms. In supermarkets, consumer-ready portions with resealable features and clear product visibility are preferred for chilled items. Transparent films and rigid trays help highlight color and freshness. In foodservice and wholesale channels, bulk packs that withstand freezing and thawing without compromising seal integrity are essential. Convenience factors such as easy peel lids, pre-measured portions, and stackable shapes simplify kitchen operations. Online seafood sales are rising, and e-commerce shipments require packaging that maintains cold integrity during last-mile delivery. As buyers become more focused on ease of use and presentation, packaging also functions as a marketing tool. Brands incorporating user-friendly, durable, and visually appealing packaging formats stand out. Designing packaging to match channel-specific needs ensures better product turnover, reduces returns, and strengthens customer satisfaction across distribution points.

A key restraint in the seafood packaging market is the dependence on specialized materials and reliable cold chain coordination. Packaging materials must withstand moisture exposure and temperature variation while maintaining barrier properties. However, access to high-performance films, rigid plastics, and sealing components may be limited in some regions due to supply chain disruptions or raw material shortages. Costs fluctuate based on resin availability, affecting producer margins. Additionally, packaging must be tightly integrated into cold chain workflows to prevent breakdown during transit. Even high-quality packaging can fail if refrigeration lapses occur. Variability in infrastructure across distribution networks complicates standardization efforts. Suppliers that offer technical support, customized packaging lines, or regional stock availability often gain preference. Until raw material sourcing stabilizes and cold chain management becomes more uniform, scalability will remain difficult for seafood packaging providers expanding into new or less-developed markets.

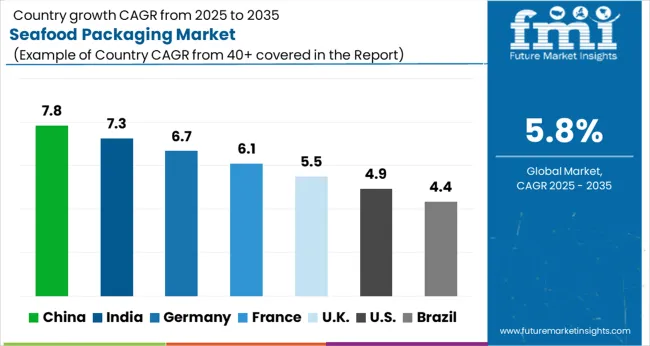

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global seafood packaging market is projected to grow at a CAGR of 5.8% through 2035, driven by rising seafood consumption, export demands, and advancements in cold chain logistics. Among BRICS nations, China leads with a 7.8% growth rate, supported by its dominant seafood processing industry and demand for high-barrier, export-compliant packaging. India follows at 7.3%, fueled by growing seafood exports, government initiatives, and improved hygienic packaging standards. Within the OECD region, Germany posts a 6.7% growth rate, reflecting demand for sustainable, recyclable materials and strict food safety regulations. The United Kingdom maintains steady growth at 5.5%, backed by high-end retail packaging innovations and traceability systems. The United States, a mature market expanding at 4.9%, focuses on automation, freshness retention, and eco-friendly packaging alternatives. These countries demonstrate how regulatory priorities and consumer preferences are reshaping seafood packaging globally. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China leads the seafood packaging market with a CAGR of 7.8%, driven by its vast aquaculture production and emphasis on food export quality. As seafood consumption and international demand rise, Chinese manufacturers are embracing advanced packaging techniques such as modified atmosphere packaging (MAP), vacuum sealing, and antimicrobial films. Regions like Fujian and Zhejiang are expanding cold chain infrastructure, allowing seafood to be transported over longer distances without compromising freshness. Packaging companies are also focusing on intelligent labels and tamper-evident seals to ensure traceability and safety. With government support for marine product exports, sustainable and recyclable materials are gaining traction, particularly for high-value items like shrimp and eel.

India records a strong CAGR of 7.3% in the seafood packaging market, driven by booming exports and modernization of processing hubs in coastal states. Andhra Pradesh and Kerala are leading in adopting leak-proof, export-compliant packaging solutions for products like prawns and pomfret. Domestic demand is also climbing as urban consumers seek frozen and ready-to-cook seafood in hygienic, tamper-proof packs. Indian manufacturers are rolling out eco-friendly packaging such as biodegradable films and moisture-resistant cartons, especially for sustainable certifications. Additionally, the government push to improve marine exports is resulting in investments in temperature-controlled logistics and insulated shipping containers.

Germany maintains a CAGR of 6.7% in the seafood packaging sector, driven by strong sustainability goals and innovation in eco-pack materials. German importers and retailers are moving toward compostable and recyclable packaging to comply with EU regulations. Packaging firms are developing cellulose-based films and reusable seafood trays to minimize plastic usage. Seafood sold in supermarkets is often packaged with transparent, resealable lids and smart indicators for freshness. German consumers prioritize traceability and safety, pushing brands to integrate QR code tracking and clear labeling. The country also sees rising demand for vacuum skin packaging, offering extended shelf life and visual appeal.

The United Kingdom seafood packaging market shows a CAGR of 5.5%, propelled by growing frozen seafood consumption and increased import activity. With limited domestic fishing output, the UK relies on efficient packaging for imports from Scandinavia and Asia. Retailers are investing in resealable, microwave-safe trays and freezer-grade wraps to support frozen meal segments. The post-Brexit regulatory environment has also prompted a shift to British-standard packaging solutions, especially for exports to the EU. Sustainable practices are becoming more mainstream, with retailers switching to ocean-safe plastics and recyclable cartons. Seafood processors are working closely with logistics providers to reduce spoilage during transit.

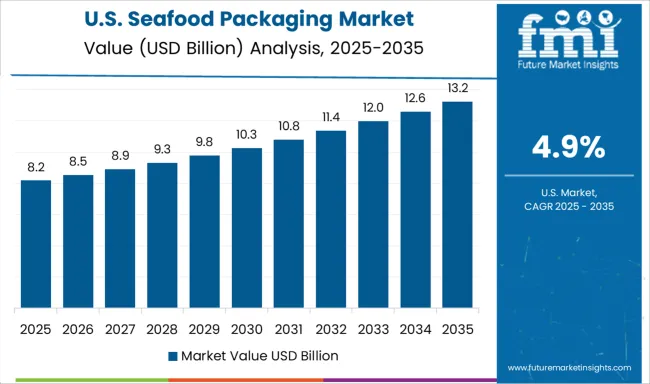

The United States shows a steady CAGR of 4.9% in the seafood packaging market, led by rising demand for convenience-based and sustainable packaging formats. Coastal regions such as Alaska, Maine, and Louisiana are key contributors, focusing on high-barrier films and insulated containers to preserve freshness. The growing meal kit and home delivery sectors are pushing for compact, tamper-evident, and recyclable packaging that can handle cold chain variability. USA manufacturers are also developing antimicrobial and odor-control packaging technologies suited for grocery retail. Retailers are demanding eco-conscious options that support brand image while meeting FDA regulations on seafood handling.

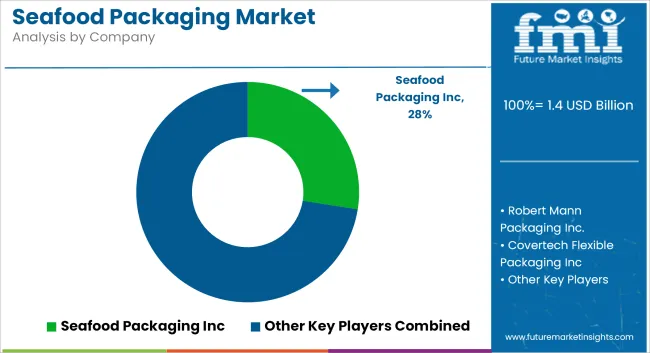

The seafood packaging market is shaped by suppliers offering solutions that extend shelf life, ensure food safety, and accommodate various product formats from fresh fillets to frozen, vacuum-sealed, or ready-to-cook seafood. Key players compete on packaging integrity, material flexibility, barrier protection, and logistical efficiency, as seafood products often require temperature-sensitive handling and strict contamination prevention throughout the supply chain. Amcor, Berry Global, Sealed Air, and ProAmpac are industry leaders providing flexible, thermoform, and vacuum packaging formats that help preserve freshness and resist puncture or moisture damage.

These firms offer tailored solutions for both retail and bulk seafood packaging, including MAP (modified atmosphere packaging) and skin-pack technologies. Printpack, Genpack, and ULMA Packaging also serve high-volume processors with form-fill-seal systems and vacuum-seal machinery suited for fast-paced processing environments. Meanwhile, players like DS Smith, Smurfit Kappa, WestRock, and Stora Enso lead in fiber-based and corrugated seafood packaging solutions designed for secondary packaging, export logistics, and sustainable cold chain shipping. Regional suppliers such as KM Packaging, Nelipak, and O F Packaging focus on high-barrier films and recyclable formats for frozen seafood and pre-portioned meals. With demand spanning industrial processors to specialty retailers, suppliers offering durable, contamination-resistant, and cold-chain-compatible formats are best positioned to support evolving seafood distribution models across global markets.

As announced by Berry Global on April 29, 2025, the company showcased its comprehensive seafood packaging solutions at Seafood Expo Global in Barcelona (May 6–8). The display included recyclable HDPE trays (up to 30% recycled content), sealing films, absorbers, and machines offering benefits like extended shelf life, hygiene, and logistics efficiency.

As reported by Amcor via a sustainability press release on October 23, 2024, the company disclosed that over 95% of its rigid packaging by weight and 94% of flexible packaging by area is now recyclable or recycle-ready. It also purchased 224,000+ metric tons of recycled plastic in FY23.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.2 Billion |

| Material Type | Plastic, Paper, Metal, and Others |

| Packaging Type | Modified atmosphere packaging (MAP), Vacuum packaging, and Others |

| Product Type | Bags and pouches, Trays, Cans, Boxes, Shrink films, and Others |

| Application Type | Fresh and frozen and Processed |

| Seafood Category | Fish, Molluscs, Crustaceans, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Berry Global, Disruptive Packaging, DS Smith, Genpack, KM Packaging, Nelipak Food Packaging, O F Packaging, Orora Packaging Australia, Printpack, ProAmpac, Sealed Air, Smurfit Kappa, Sonoco Products, StarBox, Stora Enso, Tri-pack Packaging Systems, ULMA Packaging, and WestRock |

The global seafood packaging market is estimated to be valued at USD 18.2 billion in 2025.

The market size for the seafood packaging market is projected to reach USD 32.1 billion by 2035.

The seafood packaging market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in seafood packaging market are plastic, paper, metal and others.

In terms of packaging type, modified atmosphere packaging (map) segment to command 47.0% share in the seafood packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Evaluating Seafood Packaging Market Share & Provider Insights

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Seafood Flavors Market Growth - Innovations & Industry Demand 2025 to 2035

Seafood Market Analysis - Size, Share, and Forecast 2024 to 2034

Live Seafood Market Size and Share Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA