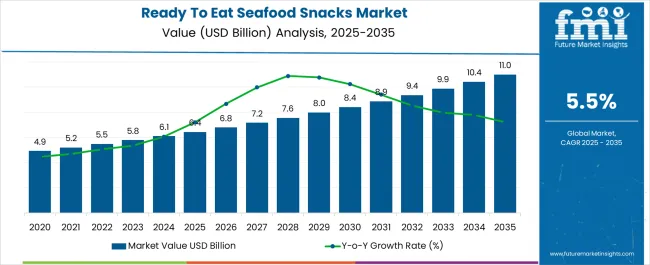

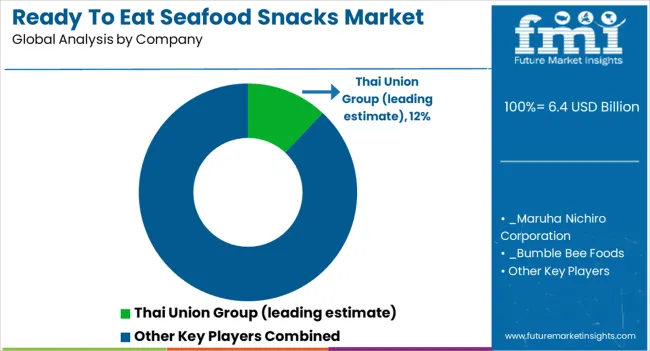

The ready to eat seafood snacks market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Between 2020 and 2024, the market increases from USD 4.9 billion to USD 6.1 billion, driven by rising consumer preference for protein-rich convenience foods and the growing popularity of seafood-based snacks in both developed and emerging economies. Annual gains such as USD 5.2 billion in 2021, USD 5.5 billion in 2022, USD 5.8 billion in 2023, and USD 6.1 billion in 2024 underscore steady adoption, supported by expanding retail availability, improved packaging formats, and heightened awareness of the health benefits of seafood consumption. From 2025 to 2030, the market advances from USD 6.4 billion to USD 8.4 billion, contributing around 36% of the total projected growth.

This stage reflects stronger penetration in urban markets, the introduction of innovative flavor varieties, and the development of shelf-stable and frozen seafood snacks catering to changing lifestyles. Annual increments such as USD 6.8 billion in 2026, USD 7.2 billion in 2027, and USD 8.0 billion in 2029 demonstrate consistent performance. Between 2031 and 2035, the market expands further from USD 8.9 billion to USD 11.0 billion, accounting for nearly 37% of overall growth. This phase benefits from growing global seafood trade, enhanced cold-chain infrastructure, and wider consumer acceptance of seafood snacks as mainstream convenience foods. Overall, the ready to eat seafood snacks market is positioned for sustained expansion through 2035, fueled by dietary shifts, innovation, and lifestyle-driven demand for healthy, ready-to-consume products.

| Metric | Value |

|---|---|

| Ready To Eat Seafood Snacks Market Estimated Value in (2025 E) | USD 6.4 billion |

| Ready To Eat Seafood Snacks Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The ready to eat seafood snacks market holds a distinct position within the global packaged seafood industry, contributing nearly 7–9% of the overall category, where frozen and canned seafood continue to dominate the supply chain. Within the wider convenience foods sector, this segment accounts for around 2–3%, as bakery snacks, confectionery, and savory products remain larger contributors. However, in the emerging subcategory of protein-rich ready to eat snacks, seafood-based formats command nearly 12–15% share, benefitting from rising consumer preference for high-protein, low-fat, and portable meal options. In the specialty seafood segment, which includes dried, smoked, and flavored offerings, ready to eat seafood snacks account for about 18–20%, driven by rising demand in retail convenience stores and e-commerce platforms. Within the healthy snacking landscape, this category holds close to 5–6%, supported by positioning as a functional and nutritious alternative to traditional chips or fried snacks.

The market is gaining stronger relevance in urban centers where time-pressed consumers seek ready-to-consume products without compromising on taste or nutrition. The share is reinforced by product launches that emphasize innovative flavor profiles, clean-label packaging, and portion-controlled packs targeted at both young professionals and health-conscious buyers. Although the category still trails behind larger packaged seafood forms, its distinct identity in the convenience snacking domain makes it one of the more dynamic contributors in the overall food processing and seafood supply chain, with room to gain further penetration through cold chain improvements, premiumization strategies, and wider retail distribution.

The market is experiencing notable growth, driven by increasing consumer preference for convenient, protein-rich snack options. Rising health awareness and demand for nutrient-dense foods have encouraged greater adoption of seafood-based snacks, supported by their rich omega-3 content and perceived health benefits. The growth of urban populations, coupled with busier lifestyles, is fueling demand for ready-to-eat formats that require minimal preparation.

Innovations in preservation technology and flavor diversification are enhancing product appeal, while sustainable sourcing initiatives are strengthening consumer trust. Expanding retail penetration across both developed and emerging markets is further broadening the customer base. Moreover, advancements in packaging solutions are extending product shelf life without compromising freshness, allowing for wider distribution.

With increasing investment from seafood processors and food manufacturers in value-added product lines, the market is positioned for steady expansion Regulatory support for healthy eating and clean-label initiatives is also expected to accelerate adoption in the years ahead.

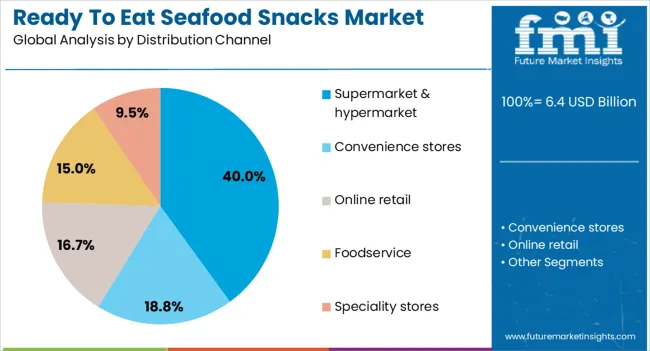

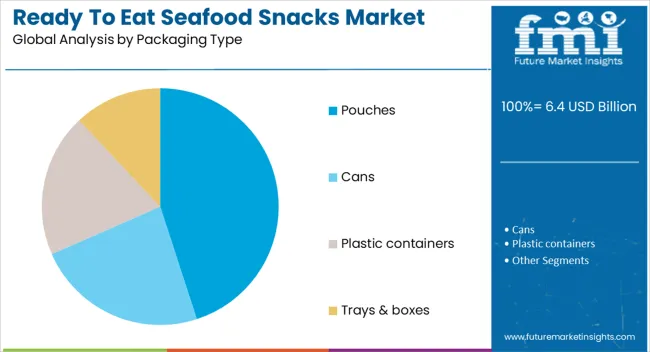

The ready to eat seafood snacks market is segmented by product, distribution channel, packaging type, and geographic regions. By product, ready to eat seafood snacks market is divided into canned, frozen, chilled, and others (smoked & etc.). In terms of distribution channel, ready to eat seafood snacks market is classified into supermarket & hypermarket, convenience stores, online retail, foodservice, and speciality stores. Based on packaging type, ready to eat seafood snacks market is segmented into pouches, cans, plastic containers, and trays & boxes. Regionally, the ready to eat seafood snacks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The canned product segment is projected to hold 40% of the teady to eat seafood snacks market revenue share in 2025, making it the leading product type. This segment's growth has been supported by the long shelf life and durability of canned seafood, which aligns with consumer demand for convenient and reliable food options. Canning technology preserves nutritional value while maintaining flavor, making it suitable for diverse consumer preferences. Its resistance to spoilage during transportation and storage has encouraged wider retail availability, including in regions with limited cold chain infrastructure. The ability to package a variety of seafood types in portion-controlled cans caters to single-serving and on-the-go consumption trends. Moreover, canned formats are compatible with software-based inventory and tracking systems used by large retailers, improving distribution efficiency The cost-effectiveness of canned seafood, along with its global consumer familiarity, has reinforced its dominant market position, ensuring sustained demand in both traditional and modern retail channels.

The supermarket and hypermarket distribution channel segment is expected to account for 40% of the market revenue share in 2025, establishing itself as the dominant sales channel. This leadership has been driven by the high visibility and accessibility these retail formats provide, allowing consumers to explore a wide range of products in a single location. Large-format stores offer competitive pricing through bulk purchasing, attracting both value-conscious and premium buyers. Their advanced storage facilities and in-store promotions have supported the growth of ready-to-eat seafood snacks by ensuring product freshness and stimulating impulse purchases. Supermarkets and hypermarkets also act as key platforms for launching new product variants, benefiting from established relationships with manufacturers and distributors. Strategic placement of seafood snacks within aisles, coupled with cross-promotional campaigns, has further enhanced sales As consumer footfall in organized retail continues to rise, these outlets are expected to remain the preferred channel for purchasing ready-to-eat seafood snacks.

The pouches packaging type segment is projected to capture 45% of the market revenue share in 2025, making it the leading packaging format. This growth has been attributed to the lightweight, portable, and flexible nature of pouches, which cater to the convenience needs of modern consumers. Pouches require less storage space and are easier to transport, lowering logistics costs for manufacturers and retailers. Advanced sealing technology and barrier materials used in pouches ensure product freshness, aroma retention, and extended shelf life without refrigeration. Their user-friendly design, often featuring resealable options, appeals to on-the-go consumers seeking portion control. Pouches also offer greater scope for innovative branding and high-quality printing, enhancing shelf appeal in competitive retail environments. Sustainability trends have driven the adoption of recyclable and eco-friendly pouch materials, aligning with environmentally conscious consumer preferences These combined factors have established pouches as a dominant and future-ready packaging choice in the seafood snacks segment.

Ready to eat seafood snacks are gaining prominence through protein-rich positioning, flavor innovation, and broader distribution. Regulatory compliance and food safety standards further reinforce trust, creating a strong foundation for long-term growth.

Demand for ready to eat seafood snacks is being shaped by a growing preference for protein-rich foods that offer both satiety and health benefits. Consumers are steadily moving away from calorie-dense fried snacks toward nutrient-dense seafood products that provide essential amino acids, omega-3 fatty acids, and minerals. This has strengthened the relevance of dried fish chips, seaweed seafood crisps, and flavored seafood bites. Supermarkets and convenience stores report consistent growth in this category as on-the-go snacking preferences rise. Market positioning has been boosted through premium packaging and flavor innovations that appeal to younger demographics. The protein narrative has created strong differentiation, making seafood snacks stand out in the wider healthy snacking landscape.

Expansion of modern retail, specialty outlets, and e-commerce platforms has considerably supported the growth trajectory of ready to eat seafood snacks. Convenience stores have emerged as key distribution points due to consumer inclination toward single-serve packs and instant availability. Online sales channels are also witnessing steady momentum as seafood snacks are promoted through direct-to-consumer brands and subscription models. The category has benefited from attractive product visibility on digital platforms where curated promotions, reviews, and influencer endorsements accelerate adoption. Supermarkets have provided extensive shelf space, highlighting seafood snacks under the health and protein-rich sections. This wider accessibility has contributed to accelerating consumption patterns across both developed and emerging regions.

Flavor diversification has emerged as a vital growth dynamic for ready to eat seafood snacks. Traditional plain dried seafood has been supplemented by flavors such as teriyaki, chili lime, black pepper, and wasabi to capture consumer curiosity. This innovation cycle has positioned seafood snacks as adventurous yet nutritious alternatives compared to mainstream snack varieties. Seasonal launches and limited-edition products have played a critical role in sustaining consumer engagement and preventing category fatigue. Global brands have experimented with fusion flavors combining regional spices with seafood bases, attracting diverse consumer segments. This continuous product differentiation has created repeat purchase opportunities and higher brand loyalty, thereby strengthening the overall market penetration of seafood-based snacks.

Food safety standards and compliance requirements are critical dynamics influencing the ready to eat seafood snacks category. Strict regulations around processing, packaging, and labeling have compelled manufacturers to adopt traceability systems and transparent ingredient disclosures. Compliance with hygiene certifications and allergen labeling has become essential to assure consumer trust, particularly in regions with stringent food regulations such as the EU, US, and Japan. Cold chain integrity and contamination prevention measures play a decisive role in market reputation. Such regulatory oversight has pushed producers to adopt advanced packaging technologies that extend shelf life and ensure freshness. As consumer sensitivity toward food origin grows, adherence to strict regulatory standards reinforces confidence and enhances repeat demand.

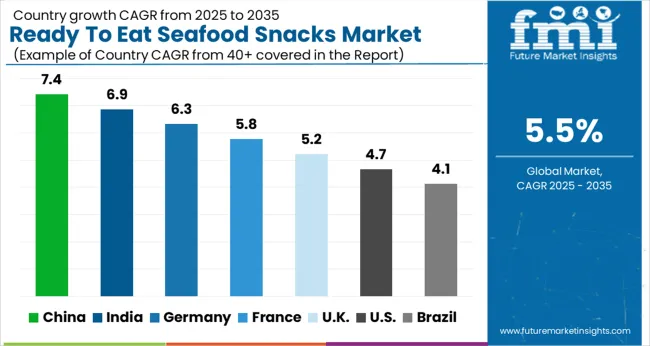

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The ready to eat seafood snacks market is projected to grow globally at a CAGR of 5.5% from 2025 to 2035, with China leading at 7.4% as rising packaged seafood consumption and retail penetration strengthen growth. India follows at 6.9%, driven by expanding middle-class demand and wider adoption of protein-based snacks. France posts 5.8% growth, supported by consumer preference for premium seafood formats and convenience packs. The UK records 5.2% as seafood snack adoption spreads across retail chains and quick-service outlets. The USA remains moderate at 4.7%, where growth is shaped by flavored seafood snack launches and health-conscious snacking preferences. Asia remains the center of momentum with stronger uptake compared to developed markets.

The CAGR for the ready to eat seafood snacks market in the United Kingdom stood at 4.1% during 2020–2024 and then improved to 5.2% in the 2025–2035 period. This upward shift in growth is influenced by evolving consumption habits where consumers preferred healthier snack substitutes over conventional fried options. A surge in supermarket promotions and convenience-driven launches also contributed to higher visibility of seafood snacks in retail aisles. Younger demographics embraced flavored seafood crisps, fish jerky, and value packs, which provided affordability and portability. With greater focus on health and wellness narratives, the category gained steady adoption across working professionals and students. Expansion of e-commerce platforms further supported distribution efficiency and created better access to premium seafood-based snacks, cementing stronger growth prospects for the UK market.

The CAGR for the Chinese ready to eat seafood snacks market was tracked at 6.1% during 2020–2024 and surged further to 7.4% during 2025–2035. This progression is anchored by strong seafood consumption patterns and high acceptance of packaged snack foods across urban regions. Local producers have introduced innovative seafood snack variants with regional flavors that cater to a wide base of consumers. Convenience retail and e-commerce played pivotal roles in expanding accessibility, particularly for flavored seaweed seafood crisps and dried fish-based snacks. Rising disposable spending on packaged seafood formats encouraged broader consumption across tier-1 and tier-2 cities. This robust growth trajectory highlights China’s position as a leading contributor in global seafood snacks adoption and retail penetration.

The CAGR for the Indian ready to eat seafood snacks market remained at 5.5% during 2020–2024 and advanced significantly to 6.9% during 2025–2035. This increase is connected to dietary changes where urban consumers displayed higher interest in protein-dense seafood snack alternatives. Strong seafood availability and the rise of modern retail distribution have promoted greater accessibility. Local startups and established food brands focused on regional flavors, spicy coatings, and value-driven multipacks to attract a wide consumer base. Growth was further aided by adoption in convenience-driven snacking among younger professionals. Marketing campaigns leveraging social media platforms amplified awareness and adoption. These structural changes positioned India as one of the fastest-expanding seafood snack markets.

The CAGR for the French ready to eat seafood snacks market was measured at 4.6% during 2020–2024 and increased to 5.8% in the 2025–2035 period. This increase is supported by the country’s strong seafood consumption culture where demand for gourmet snack offerings remains high. Product innovation in flavored seafood crackers, dried mussel snacks, and premium fish crisps has gained wide consumer approval. Retailers have expanded shelf presence under health and protein categories, positioning seafood snacks as a superior substitute to meat-based snack alternatives. The French inclination toward gourmet convenience products has reinforced repeat purchases and supported premiumization. Domestic producers also tapped into traditional culinary preferences by integrating regional flavors, strengthening market growth.

The CAGR for the USA ready to eat seafood snacks market was estimated at 3.9% between 2020–2024 and climbed moderately to 4.7% during 2025–2035. This improvement is attributed to increasing acceptance of seafood snacks as a health-focused substitute to traditional salty snacks. Consumers in coastal regions contributed heavily to adoption due to familiarity with seafood flavors. Expanding distribution across major retail chains and rising flavored seafood snack introductions created broader category visibility. Marketing strategies focusing on protein content, omega-3 benefits, and convenience influenced health-conscious demographics. Although growth remains moderate compared to Asia, seafood snacks are steadily carving a presence in the American snack aisle.

The ready to eat seafood snacks market is shaped by a mix of global seafood conglomerates and established regional players that emphasize brand trust, innovation, and wide distribution networks. Thai Union Group holds a leading position with an extensive product range across shrimp, tuna, and value-added seafood snacks that cater to global retail chains. Maruha Nichiro Corporation strengthens its portfolio through processed seafood products, leveraging strong Japanese seafood heritage to expand internationally. Bumble Bee Foods is recognized in North America for its diverse seafood snack formats, backed by longstanding consumer loyalty. Nomad Foods enhances its competitive stance with frozen and ready-to-consume seafood ranges across European retail outlets.

Gorton’s focuses on packaged seafood snacks with strong penetration in USA supermarkets, offering trusted family-oriented products. Alongside these established brands, numerous regional and local companies introduce culturally tailored flavors, dried seafood variants, and snack innovations, ensuring competitive diversity across Asia, Europe, and North America. Competitive differentiation in this market is shaped by innovation in flavors, clean-label packaging, and aggressive retail distribution strategies that emphasize affordability and nutritional benefits, positioning seafood snacks as an emerging staple in the global healthy snacking sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.4 billion |

| Product | Canned, Frozen, Chilled, and Others (smoked & etc.) |

| Distribution Channel | Supermarket & hypermarket, Convenience stores, Online retail, Foodservice, and Speciality stores |

| Packaging Type | Pouches, Cans, Plastic containers, and Trays & boxes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thai Union Group, Maruha Nichiro Corporation, Bumble Bee Foods, Nomad Foods, Gorton`s |

| Additional Attributes | Dollar sales, share by product type, form, and distribution channel, along with regional growth comparisons and country-level performance. |

The global ready to eat seafood snacks market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the ready to eat seafood snacks market is projected to reach USD 11.0 billion by 2035.

The ready to eat seafood snacks market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in ready to eat seafood snacks market are canned, frozen, chilled and others (smoked & etc.).

In terms of distribution channel, supermarket & hypermarket segment to command 40.0% share in the ready to eat seafood snacks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ready Mix Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Ready Meals Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready-made Food Bases Market Analysis - Size, Share, and Forecast 2025 to 2035

Ready-mix Concrete Market Trends & Outlook 2025 to 2035

Competitive Overview of Ready Meals Packaging Market Share

Ready to Use Intermittent Catheters Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink Coffee Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready-to-Finish Bakery Products Market Analysis - Size, Share and Forecast 2025 to 2035

Ready to Drink Shakes Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-Use Therapeutic Food Market Trends and Forecast 2025 to 2035

Ready-to-Drink Beauty Beverage Market Analysis by Ingredients, Flavor, Form and Distribution Channel Through 2035

Ready-to-Serve Cocktails Market Trends - Innovation & Demand 2025 to 2035

Ready To Drink (RTD) Tea Market Trends - Functional & Refreshing Beverage Growth 2025 to 2035

Ready-To-Use Supplementary Food Market Analysis Hospital & Clinics, Charities, NGOs, And Others Through 2035

Ready To Drink Cocktails Market Growth – Size, Trends & Forecast 2025-2035

RTD Packaging Market Trends & Industry Growth Forecast 2024-2034

Ready-to-Drink Beverage Market Analysis – Size, Share & Forecast 2024-2034

Ready-to-Eat Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-eat Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready-to-eat Cups Market Analysis by Product Type, Nature, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA