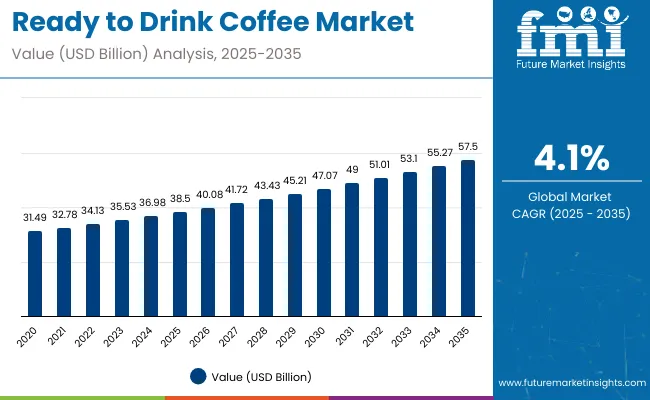

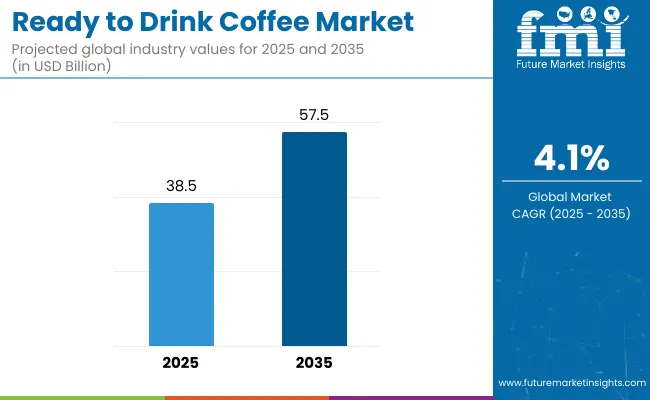

The ready-to-drink (RTD) coffee market is estimated to be valued at USD 38.5 billion in 2025 and is projected to reach USD 57.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 19.0 billion over the forecast period. This reflects a 1.49 times growth at a compound annual growth rate of 4.1%.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 38.5 billion |

| Forecast Market Value (2035) | USD 57.5 billion |

| CAGR (2025 to 2035) | 4.1% |

The market’s evolution is expected to be shaped by increasing consumer demand for convenient, on-the-go beverages, rising popularity of cold brew and functional coffee variants, and expanding distribution through e-commerce and modern retail channels, particularly in urban and health-conscious consumer segments.

By 2030, the market is projected to reach approximately USD 47.1 billion, reflecting steady mid-term growth supported by expanding espresso-based offerings and sustained demand for regular caffeinated products. The growth trajectory is backed by health-conscious consumer trends and sustainability initiatives among leading companies.

From 2025 to 2035, the RTD coffee sector is projected to achieve an absolute growth of USD 19.0 billion, underscoring consistent consumer preference for on-the-go coffee options and incremental innovations that enhance taste, packaging, and functional benefits globally.

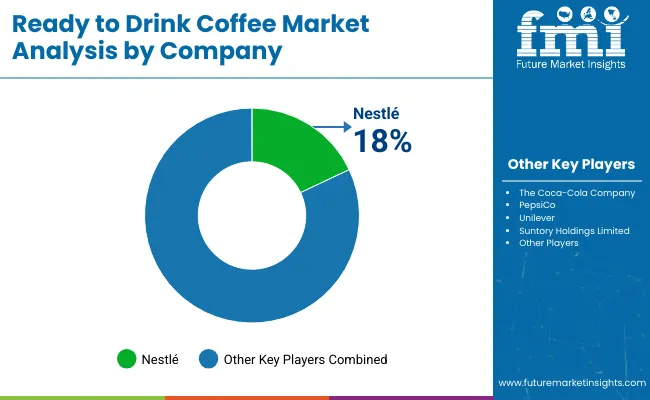

Leading companies such as Nestlé, The Coca-Cola Company, PepsiCo, Unilever, and Suntory Holdings Limited are consolidating their positions by expanding product portfolios and advancing next-generation Ready to Drink (RTD) coffee innovations.

Their focus includes developing specialty coffee blends, functional ingredients like added protein and probiotics, and sustainable packaging solutions that cater to evolving consumer preferences. Through investments in research, brand building, and global distribution networks, these players are enhancing market penetration across both established and emerging economies.

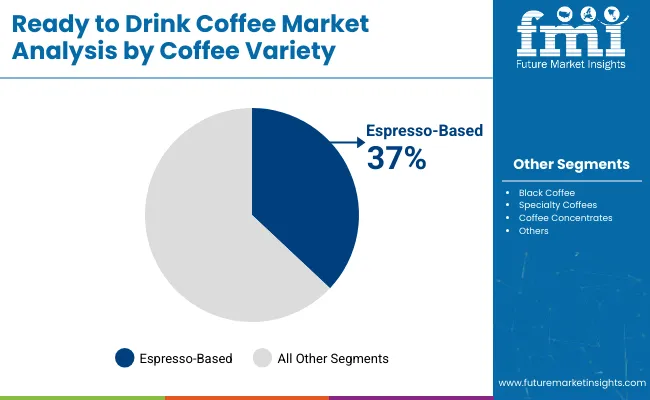

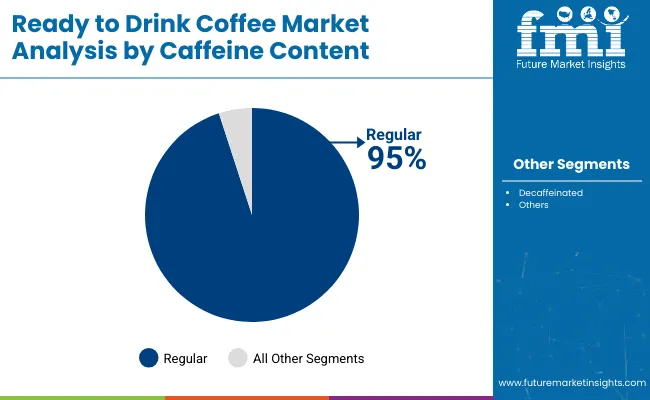

The market holds a critical position in the global beverage sector, driven by consumer demand for convenient, on-the-go, and health-oriented coffee options. Espresso-based products, commanding 37% of the market share, remain central to consumer appeal due to their robust flavor and caffeine content. Regular (caffeinated) coffee dominates the caffeine segment with a 95% share, supported by widespread consumer acceptance and its energy-boosting benefits.

The market is evolving with innovations such as cold brew and nitro coffee variants, plant-based and sugar-free options, and advanced brewing technologies that enhance flavor and nutritional profiles. Companies are strengthening their portfolios with premium, organic, and ethically sourced offerings aimed at health-conscious millennials and Gen Z consumers. Strategic collaborations with retailers, e-commerce platforms, and sustainability initiatives are reshaping accessibility and positioning RTD coffee as a staple in modern consumer lifestyles worldwide.

The ready to drink (RTD) coffee market is experiencing significant growth due to multiple converging factors that cater to evolving consumer lifestyles and preferences. A primary driver is the increasing demand for convenience among busy consumers who seek quick, on-the-go beverage options without compromising quality or flavor. RTD coffee offers a portable, ready-to-consume solution that aligns perfectly with fast-paced urban living.

Health consciousness is another critical growth factor. Consumers are gravitating towards functional beverages that not only energize but also offer added health benefits, such as probiotics, antioxidants, and plant-based ingredients. Manufacturers are innovating by incorporating these functional components, appealing to millennials and Gen Z, who prioritize wellness and clean-label products.

Flavor diversification and premiumization also boost the market. Specialty coffee varieties, such as espresso-based drinks, cold brews, and nitro coffee, enhance consumer experience with richer taste profiles, attracting coffee connoisseurs and casual drinkers alike. Additionally, sustainability efforts through eco-friendly packaging and ethically sourced ingredients resonate with environmentally aware consumers, increasing brand loyalty.

The market is segmented by coffee variety, caffeine content, packaging type, sales channel, flavor, and region. By coffee variety, the market is divided into black coffee, espresso-based, specialty coffees, and coffee concentrates. Based on caffeine content, the market is regular and decaffeinated. In terms of packaging type, the market is divided into glass bottles, cans, plastic bottles, pouches, and others (tetra packs, cartons, and sachets).

By sales channel, the market is segmented into food service, physical retail, travel retail, and online retail. Based on flavor, the market is classified into unflavoured/classic/original and flavoured varieties such as vanilla, hazelnut, caramel, chocolate, and others (mocha, caramel mocha, seasonal blends). Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The most lucrative segment in the market by coffee variety is the espresso-based segment, commanding a substantial market share of 37% as of 2025. The espresso-based segment’s dominance is driven by its strong, rich flavor profile and higher caffeine content, which appeals to both traditional coffee enthusiasts and younger, urban consumers seeking a quick energy boost. The versatility of espresso as a base allows for numerous product innovations, including lattes, mochas, and specialty blends, enabling brands to offer differentiated and premium options that command higher price points.

Consumer trends toward premiumization and specialty coffee consumption have accelerated growth in this segment, with increasing interest in authentic café-style experiences accessible conveniently through bottled or canned deliveries. Moreover, rising disposable incomes and expanding coffee cultures in emerging markets such as India and China further amplify demand. The combination of product diversity, strong consumer preference, and adaptability for functional enhancements like added protein or probiotics positions espresso-based RTD coffee as the most lucrative and fast-growing segment within the global RTD coffee market.

The regular (caffeinated) segment is the cornerstone of the market, commanding an overwhelming majority with 95% market share as of 2025. This segment’s dominance stems from the global consumer preference for caffeine as a stimulant that enhances alertness and energy, making it a staple in daily beverage consumption patterns worldwide. Regular RTD coffee is widely accepted across diverse demographic groups, from working professionals needing a quick energy boost to young consumers valuing convenience and flavor variety.

The segment benefits from a vast and versatile product range that spans classic black coffee, espresso-based drinks, specialty blends, and functional beverages infused with additives like protein, antioxidants, and probiotics. This diversity allows brands to target multiple consumer niches and price points, boosting both volume and revenue. Additionally, regular RTD coffee is favored for its strong sensory appeal, robust aroma, rich taste, and varied intensity levels, which consumers perceive as authentic and satisfying.

The ready to drink (RTD) coffee market from 2025 to 2035 will be driven by increasing consumer demand for convenient, premium coffee options, rising urbanization, and expanding retail and e-commerce infrastructure globally. Product innovations such as cold brew, nitro coffee, and functional blends with added protein or probiotics are enhancing appeal and boosting market penetration. Growing health consciousness and sustainability awareness among consumers are influencing product development and packaging innovations, further encouraging market growth, particularly in emerging regions like India and China.

Health Awareness and Functional Innovation Boost Ready to Drink Coffee Market Growth

Increasing awareness about health and wellness among consumers is a significant driver of the RTD coffee market. Consumers seek products that offer not only energy but also functional benefits such as antioxidants, digestive health support, and reduced sugar content. The rise of specialty coffee variants and authentic café experiences in ready-to-drink formats caters to evolving tastes. The increasing popularity of premium, organic, and ethically sourced products aligns with shifting consumer preferences, supporting sustained market expansion.

Innovation and Sustainability Expanding Ready to Drink Coffee Market Opportunities

Innovation in RTD coffee technology is broadening market opportunities across product segments. Developments include unique flavor infusions, plant-based milk alternatives, and eco-friendly packaging solutions that attract environmentally conscious buyers. Smart packaging that preserves freshness and promotes transparency on ingredient sourcing appeals to health-savvy consumers. Manufacturers prioritize sustainable sourcing, fair-trade certifications, and waste reduction to reinforce brand loyalty and comply with evolving regulatory standards, positioning the market for continued growth globally.

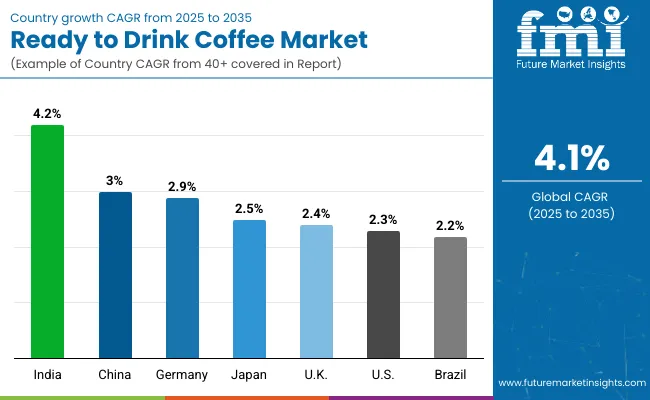

| Country | CAGR (%) |

|---|---|

| India | 4.2 |

| China | 3.0 |

| Germany | 2.9 |

| Japan | 2.5 |

| United Kingdom | 2.4 |

| United States | 2.3 |

| Brazil | 2.2 |

The ready to drink coffee market shows diverse growth rates globally. India leads with a strong CAGR of 4.2%, driven by urbanization, rising incomes, and a growing coffee culture favoring premium RTD products. China follows at 3.0% CAGR, boosted by expanding café culture and retail networks. Germany grows at 2.9%, with health-conscious consumers prioritizing organic and sustainable options.

Japan and the UK have similar CAGRs around 2.4-2.5%, focusing on high-quality and ethical products. The USA and Brazil show moderate growth at 2.3% and 2.2%, balancing established consumption with evolving preferences. Emerging markets lead growth; mature markets emphasize innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from ready to drink coffee in India is projected to expand rapidly at a CAGR of 4.2%, led by rising urbanization and an evolving coffee culture shifting from traditional tea. Increasing disposable incomes and a youthful population are driving demand for convenient, premium espresso-based and flavored RTD coffee products. Localized flavor innovations and strategic retail and e-commerce expansion are further fueling growth.

The surge in health awareness encourages functional blends with added benefits like protein and probiotics. Aggressive marketing by global brands tailored to Indian preferences strengthens consumer engagement. The convenience lifestyle and digital adoption showcase sustained demand in urban and semi-urban regions. India emerges as a pivotal growth engine, shaping the future trajectory of the RTD Coffee Market.

Revenue from ready to drink coffee in Germany maintains steady growth with a CAGR of 2.9%, shaped by health-conscious consumers prioritizing sugar-free, organic, and plant-based options. Premium and specialty coffee varieties gain increasing traction thanks to strong consumer demand for transparency and sustainability. Rigorous food safety regulations drive companies to innovate around clean labels and ethical sourcing.

The market benefits from a robust retail presence, with specialty coffee drinks widely available in modern grocery chains and cafés. Eco-friendly packaging adoption is reshaping consumer perceptions and brand loyalty. Germany exemplifies a mature market focusing on product quality and environmental responsibility within the global RTD Coffee space.

Revenue from ready to drink coffee in the United States grows at a CAGR of 2.3%, propelled by evolving consumer preferences for convenience and wellness. Cold brew, nitro coffee, and functional beverages augmented with probiotics and protein dominate new product launches. Omni-channel retailing seamlessly blends physical stores and e-commerce platforms, enabling broader consumer reach.

Millennials and Gen Z consumers drive demand for bold, innovative flavor profiles and health-oriented products. Digital marketing and loyalty programs enhance brand interaction and retention. The USA market reflects a dynamic landscape where tradition meets innovation, setting benchmarks for RTD coffee consumption globally.

Demand for ready to drink coffee in China is rapidly evolving with a CAGR of 3.0%, fueled by urban lifestyle shifts and growing coffee culture adoption. Rising disposable incomes and increasing café culture exposure elevate demand for premium and specialty RTD coffees. Expanding modern retail and convenience store networks alongside surging e-commerce sales boost accessibility.

Domestic players collaborate increasingly with international brands to capture varied consumer preferences and regional tastes. Health-consciousness and functional product interest are growing trends. China represents a fast-growing market significantly contributing to the global RTD Coffee Market expansion.

Demand for ready to drink coffee in Japan is projected to grow steadily at a CAGR of 2.5%, dominated by canned RTD coffee products that blend convenience with high-quality flavors. Consumer trends emphasize sugar-free, low-calorie, and functional beverages that cater to health-conscious buyers. Packaging innovations focus on portability and product freshness.

The segment enjoys strong support from domestic brands blended with international influences. Unique regional flavor profiles and premium blends maintain consumer interest. Japan epitomizes a mature market balancing tradition with innovation in RTD coffee consumption.

Demand for ready to drink coffee in the United Kingdom is expected to grow at a CAGR of 2.4%, driven by consumer demand for on-the-go coffee and premium ethical products. Increasing interest in plant-based and sustainably sourced coffee reinforces market differentiation. Retail expansion in convenience stores and supermarkets enhances product availability.

Consumers are willing to pay a premium for quality and sustainability. Marketing campaigns effectively target younger demographics emphasizing ethical consumption. The UK showcases steady progress in blending convenience with corporate social responsibility within RTD coffee.

Revenue from ready to drink coffee in Brazil grows at a CAGR of 2.2%, powered by the integration of traditional coffee culture with convenient RTD formats. Urban middle-class consumers show rising preference for flavored and specialty coffee beverages aligning with local tastes.

Improvements in cold chain logistics and modern retail infrastructure enhance availability and freshness. International brands increase their presence while local players innovate with novel flavors. Brazil represents a transforming market balancing heritage with convenience and innovation within the RTD coffee landscape.

The market is characterized by intense rivalry among global and regional players striving to capture market share through innovation, branding, and expansive distribution networks. Leading companies such as Nestlé, The Coca-Cola Company, PepsiCo, Unilever, and Suntory Holdings Limited dominate the market with robust product portfolios that cater to diverse consumer preferences, including espresso-based blends, specialty coffees, and functional variants. These players invest heavily in research and development to introduce novel flavors, sustainable packaging, and health-oriented formulations, appealing to a growing base of health-conscious and environmentally aware consumers.

Emerging trends such as premiumization, organic certification, and clean-label products drive companies to differentiate their offerings. Additionally, strategic partnerships with retailers, e-commerce platforms, and local distributors enhance market penetration and geographic reach. Smaller and regional players compete by focusing on niche segments, localized flavors, and innovative marketing strategies targeting millennials and Gen Z consumers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 38.5 billion |

| Coffee Variety | Black Coffee, Espresso-Based, Specialty Coffees, Coffee Concentrates |

| Caffeine Content | Regular, Decaffeinated |

| Packaging Type | Glass Bottles, Cans, Plastic Bottles, Pouches, Others (Tetra Packs, Cartons, Sachets) |

| Sales Channel | Food Service, Physical Retail, Travel Retail, Online Retail |

| Flavor | Unflavoured/Classic/Original, Flavoured (Vanilla, Hazelnut, Caramel, Chocolate, Others - Mocha, Seasonal Blends) |

| Regions Covered | India, Germany, United States, China, Japan, United Kingdom, Brazil |

| Countries Covered | India, Germany, United States, China, Japan, United Kingdom, Brazil, France, Canada, Australia, and 40+ countries |

| Key Companies Profiled | PepsiCo., The Coca-Cola Company, Nestle S.A., JAB Holding Company, Asahi Group Holdings, Ltd., McDonald’s Corporation, Danone S.A., Suntory Beverage & Food, Lotte Chilsung Beverage Co. Ltd., Starbucks, Unilever, Monster Beverage Co. |

| Additional Attributes | Revenue by coffee variety and packaging type; regional demand trends; competitive landscape; adoption of functional ingredients and sustainable packaging; e-commerce and retail expansion; specialty and premium blend innovation; consumer preference for health and wellness products |

The global ready to drink coffee market is estimated to be valued at USD 38.5 billion in 2025.

The market size for ready to drink coffee is projected to reach USD 57.5 billion by 2035.

The ready to drink coffee market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The espresso-based segment is projected to lead in the ready to drink coffee market with 37% market share in 2025.

In terms of caffeine content, the regular (caffeinated) segment is projected to command 95% share in the ready to drink coffee market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ready Mix Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Ready Meals Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready-made Food Bases Market Analysis - Size, Share, and Forecast 2025 to 2035

Ready-mix Concrete Market Trends & Outlook 2025 to 2035

Competitive Overview of Ready Meals Packaging Market Share

Ready-to-eat Canned Tuna Market Size and Share Forecast Outlook 2025 to 2035

Ready to Use Intermittent Catheters Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-Eat Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-Finish Bakery Products Market Analysis - Size, Share and Forecast 2025 to 2035

Ready-to-eat Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready-to-Use Therapeutic Food Market Trends and Forecast 2025 to 2035

Ready-to-Serve Cocktails Market Trends - Innovation & Demand 2025 to 2035

Ready-to-eat Cups Market Analysis by Product Type, Nature, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast through 2035

Ready-To-Use Supplementary Food Market Analysis Hospital & Clinics, Charities, NGOs, And Others Through 2035

Ready to Drink (RTD) Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink Shakes Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-Drink Beauty Beverage Market Analysis by Ingredients, Flavor, Form and Distribution Channel Through 2035

Ready To Drink (RTD) Tea Market Trends - Functional & Refreshing Beverage Growth 2025 to 2035

Ready To Drink Cocktails Market Growth – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA