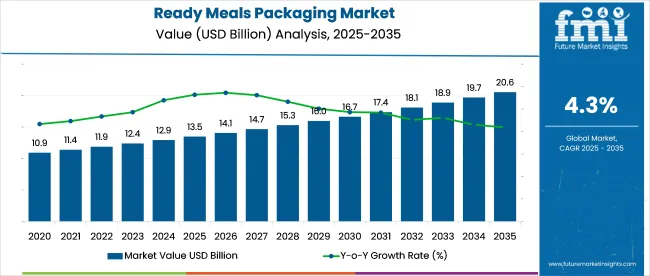

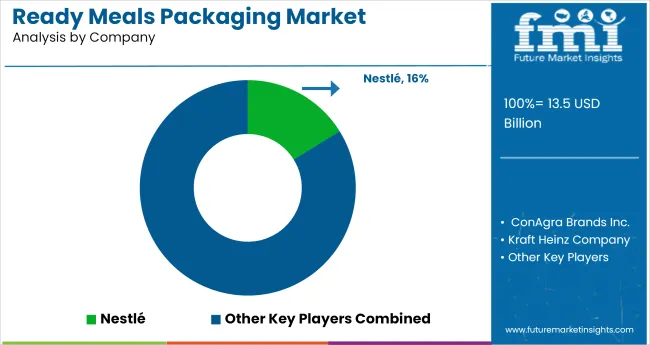

The Ready Meals Packaging Market is estimated to be valued at USD 13.5 billion in 2025 and is projected to reach USD 20.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The ready meals packaging market is witnessing consistent growth, supported by the global rise in demand for convenient, time-saving food solutions and the expansion of chilled and frozen food distribution networks. Urbanization, dual-income households, and changing dietary patterns are accelerating the consumption of pre-prepared meals, thereby increasing the need for functional, lightweight, and tamper-proof packaging formats.

Packaging solutions are being designed to improve heat retention, provide microwave compatibility, and meet regulatory standards for food safety. In parallel, sustainability considerations are influencing material choices, with an increasing shift toward recyclable, compostable, and mono-material formats.

The integration of high-barrier films, smart labeling, and portion-specific packaging is further transforming the competitive landscape. Future growth opportunities are expected to be driven by premiumization in meal offerings, expansion in private label brands, and increased penetration of ready-to-eat meals in developing economies where cold chain logistics are improving.

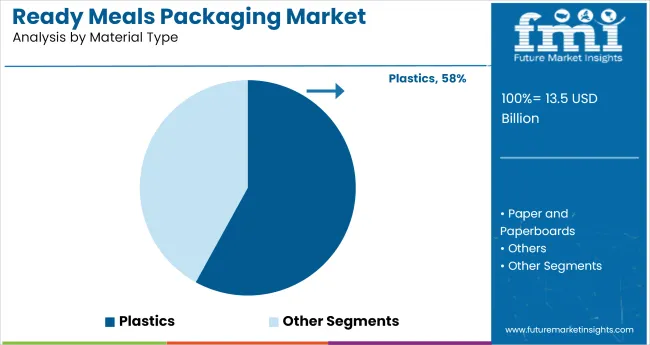

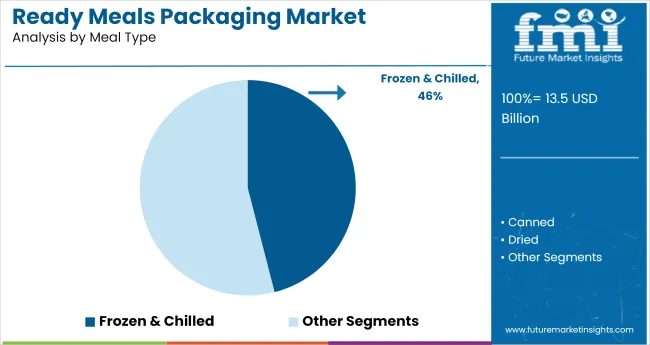

The market is segmented by Material Type and Meal Type and region. By Material Type, the market is divided into Plastics, Paper and Paperboards, and Others. In terms of Meal Type, the market is classified into Frozen & Chilled, Canned, Dried, and Others.

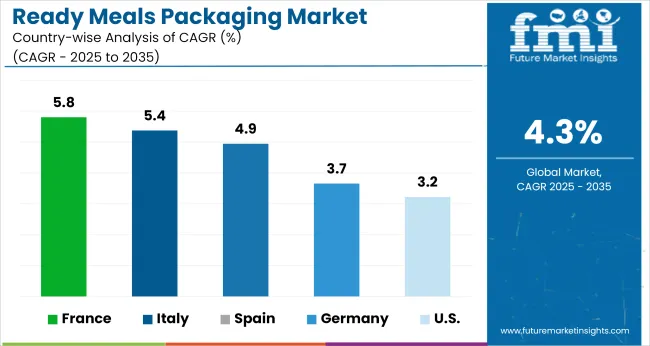

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastics are expected to account for 58.0% of the total revenue share in the ready meals packaging market in 2025, making it the leading material type segment. This dominance is being driven by plastic’s versatility, cost-effectiveness, and suitability for both hot-fill and cold storage applications.

High-performance plastics such as PET, PP, and CPET provide excellent barrier properties, heat resistance, and durability ensuring product integrity during transportation, storage, and reheating.

Plastics support complex container geometries, enabling the creation of single-serve trays, compartmentalized packs, and film-sealed units optimized for shelf appeal and functional use. Their lightweight nature also contributes to reduced transportation emissions and material cost savings. In addition, plastic packaging aligns with automation in food processing lines, improving throughput and reducing labor costs.

With ongoing advances in recyclable and bio-based plastic formulations, this material segment is expected to maintain its leadership while addressing increasing environmental compliance demands.

Frozen & chilled meals are projected to account for 46.0% of the total revenue share in the ready meals packaging market by 2025, establishing this as the dominant meal type segment. This growth is being driven by the demand for longer shelf life, freshness preservation, and safety in perishable prepared foods.

Packaging for frozen and chilled meals requires advanced material engineering to withstand low temperatures without compromising structural integrity or seal performance.

The segment’s expansion is supported by strong investments in cold chain logistics, retail freezer infrastructure, and e-commerce grocery delivery systems. Consumer preferences for clean-label, preservative-free meals have further reinforced the need for packaging that supports freshness through physical and atmospheric protection.

The adaptability of packaging solutions for this segment ranging from vacuum-sealed trays to peelable films has enhanced product appeal and convenience.

As meal variety and nutritional customization increase in this category, frozen and chilled ready meals are expected to remain a core growth driver in the global packaging landscape.

The major factor driving the market are the longer shelf life of the product because of proper packaging and easily availability. Due to hectic work life and changing lifestyles consumers are more inclining towards theready to eat food productswhich are easily consumed without any efforts and less time.

These preferences of consumers propelling the demand of ready meals packaging market. Packaging of these products done with proper material and process plays a vital role to protect them for getting contaminated and keep them safe for consumption for a longer duration of time.

Packaging plays a vital role in maintaining food safety and quality of the ready to eat meals, ensuring longer shelf life. Packaging is of high importance in this area because they are helpful by preventing the food products from spilling and also enables ease of handling & carrying for the consumers.

Plastic cling film are widely used for packaging purposes; they are easy to use with the advanced innovations in the cling film which are helpful for driving the market. Green packaging solutions are also being developed used to reduce the environmental pollution and provide the wide range of benefits in energy conservation, recycling and efficient transport which leads to the growth of this industry.

The sudden rise of online platforms offering home delivered ready to eat meals is a major factor augmenting market demand, since it has increased the scope and reach of the ready to eat meals sector to an unprecedentedly large audience base. These platforms are projected to help drive the sales of such meals and hence boost demand for its packaging during the forecast period.

Currently, the Asia-Pacific region is the largest market of global food packaging and is estimated to witness the highest CAGR for the ready meals packaging market. The increased demand for ready to eat meals and consumer spending on packed food are the key driving factors for demand in this region.

China is the major consumer forfood packagingand due to rising urban population increasing consumer disposable income, and rising awareness about ready to eat meals, it is easily one of the single largest markets for this product on a global level.

Changing lifestyles and shifting consumer preferences in markets such as India and ASEAN countries are also driving demand for ready to eat meals, thus driving demand for its packaging in these markets.

The significant growth in the food and beverages industries in various countries of Europe such as Germany, France, Italy, and others have boosted the demand of ready meals packaging in these countries.

USA is the largest consumer of ready-to-eat product and meals. Due to rapid increase in awareness pertaining to healthy lifestyle & shifting consumers demand patterns towards the high-quality packaged food, the demand for this product is projected to grow rapidly in these markets.

Some of the leading manufacturers and suppliers include

Ready Meals Packaging market is growing steadily, and with the growing number of opportunities key players are also focusing on acquisitions of small and medium size players and collaborations with other market participants either for the food industry or to manufacture the product at a large scale.

Significant growth of the packaging sector in food and beverages industry is projected to drive the market in future.

The Ready Meals Packaging report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global ready meals packaging market is estimated to be valued at USD 13.5 billion in 2025.

The market size for the ready meals packaging market is projected to reach USD 20.6 billion by 2035.

The ready meals packaging market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in ready meals packaging market are plastics, paper and paperboards and others.

In terms of meal type, frozen & chilled segment to command 46.0% share in the ready meals packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Ready Meals Packaging Market Share

Ready-to-Eat Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Shelf Ready Packaging Market

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready to Drink (RTD) Packaging Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

USA Frozen Ready Meals Market Analysis – Growth, Applications & Outlook 2025-2035

Frozen Cooked Ready Meals Market Report – Demand, Trends & Industry Forecast 2025-2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Sales of Plant‑based Ready Meals in US Analysis - Size, Share & Forecast 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Ready-to-eat Canned Tuna Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Ready to Use Intermittent Catheters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA