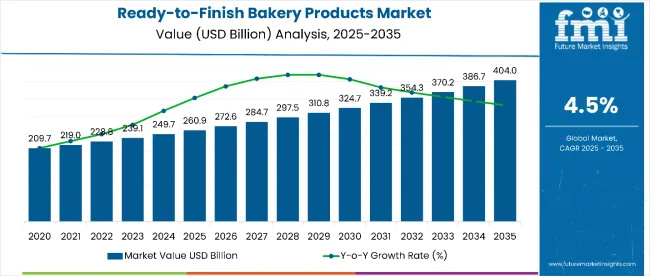

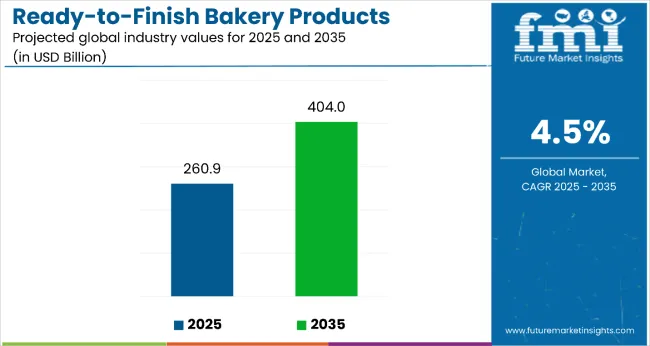

The ready-to-finish bakery products market is estimated to be valued at USD 260.9 billion in 2025. It is projected to reach USD 404 billion by 2035, registering a CAGR of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 260.9 billion |

| Forecast Value in (2035F) | USD 404 billion |

| Forecast CAGR (2025 to 2035) | 4.5 % |

The market is projected to add an absolute dollar opportunity of USD 143.1 billion over the forecast period. This reflects 1.57 times growth at a compound annual growth rate of 4.5%. The market's evolution is expected to be shaped by rising demand for convenience foods, expansion of the food service industry, and increasing consumer preference for premium baked goods that require minimal preparation time.

By 2030, the market is likely to reach approximately USD 338.7 billion, accounting for USD 70.9 billion in incremental value over the first half of the decade. The remaining USD 82.6 billion is expected during the second half, suggesting a moderately accelerated growth pattern. Product differentiation through healthier ingredients, organic formulations, and specialized dietary offerings is gaining traction due to consumers' evolving lifestyle preferences and increasing health consciousness.

Companies such as Dawn Foods and Rich Products Corporation are advancing their competitive positions through investment in frozen dough technologies and scalable production systems. Quality-led procurement models are supporting expansion into commercial bakeries, food service operations, and retail channels. Market performance will remain anchored in food safety standards, shelf-life optimization, and consistent product quality benchmarks.

The market holds approximately 42% of the convenience bakery segment, driven by time-saving benefits and consistent quality delivery in commercial and retail applications. It accounts for around 28% of the frozen bakery market, supported by advanced freezing technologies and extended shelf life capabilities. The market contributes nearly 15% to the overall bakery ingredients and supplies sector, particularly for establishments seeking labor-efficient solutions. It holds close to 22% of the food service bakery solutions market, where ready-to-finish products enable operators to serve freshly baked items with minimal skilled labor requirements. The share in the retail frozen food market reaches about 8%, reflecting growing consumer acceptance of premium frozen bakery products for home use.

The market is undergoing structural change driven by rising demand for labor-efficient bakery solutions and consistent product quality. Advanced processing methods using blast freezing technology and modified atmosphere packaging have enhanced product integrity, texture retention, and flavor preservation, making ready-to-finish products viable alternatives to scratch baking. Manufacturers are introducing portion-controlled formats and specialized formulations tailored for different end-use applications, expanding their role beyond traditional bakery operations. Strategic partnerships between food service distributors and ready-to-finish product suppliers have accelerated adoption in restaurants, cafes, and institutional feeding. Supply chain optimization has improved cold chain distribution networks, enabling wider market penetration and product availability.

Ready-to-finish bakery products' convenience factor, labor cost reduction benefits, and consistent quality output make them attractive alternatives to traditional scratch baking methods for commercial operations. Growing demand for premium bakery items in food service establishments, combined with skilled baker shortages, is driving adoption of ready-to-finish solutions that deliver artisanal quality with simplified preparation processes. Technological advances in freezing, packaging, and formulation have significantly improved product quality and shelf life capabilities.

As food service operations expand globally and consumer expectations for fresh-baked products increase, ready-to-finish bakery products are well-positioned to bridge the gap between convenience and quality. With operators prioritizing operational efficiency, food safety compliance, and menu consistency, ready-to-finish solutions provide scalable alternatives that support business growth without compromising product standards.

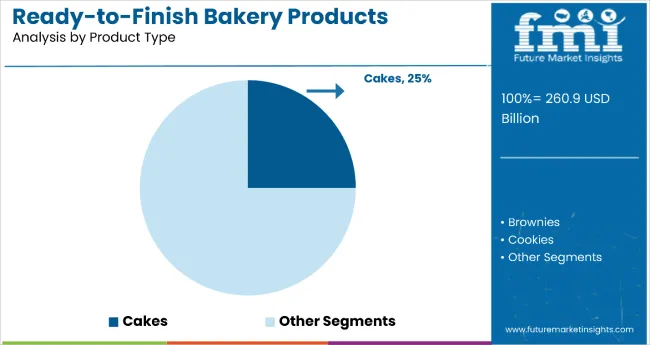

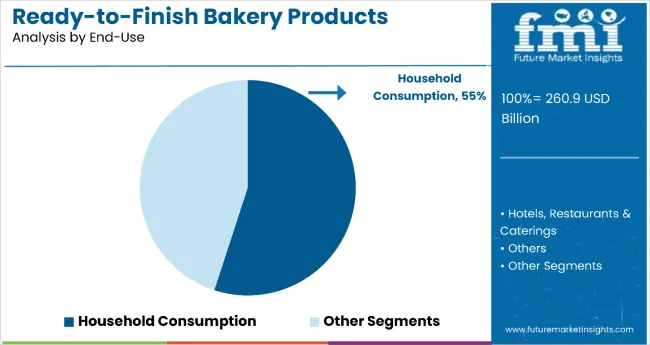

The market is segmented by product, end-use, sales channel, and region. By product, it includes brownies, cakes, cookies, donuts, muffins, pastries, and other (such as tarts, croissants, and scones). Based on End-use, the market is divided into household consumption, hotels, restaurants & catering services, and others (institutional cafeterias and bakery training centers). Based on sales channel, the market is classified into B2B, B2C, supermarkets/hypermarkets, convenience stores, online stores, specialty stores, and others (such as vending machines and pop-up bakeries). Regionally, the market is analyzed across North America, Latin America, Western and Eastern Europe, Asia-Pacific, the Middle East and Africa.

The cakes segment accounts for a significant 25.0% share in the product category, underscoring its strong appeal among both individual consumers and commercial users seeking indulgent, customizable baked offerings. Ready-to-finish cakes are especially popular due to their versatility across multiple consumption occasions, including birthdays, celebrations, and everyday dessert indulgence.

This segment benefits from evolving consumer demand for convenience without compromising on freshness, as products can be quickly baked or decorated just before serving. Frozen or par-baked cakes allow for flexible inventory management while maintaining product quality, enabling retailers and food service providers to reduce waste and offer varied flavor profiles, portion sizes, and formats.

Manufacturers are investing in innovation through clean-label formulations, eggless and vegan options, and premium inclusions such as fruit fillings, chocolate ganache, and artisanal frostings. The segment continues to grow as consumers seek bakery-style quality at home, and businesses look to expand dessert menus without additional labor or overhead costs.

The household consumption segment leads the end-use category with a commanding 55.0% market share, reflecting the rise of at-home baking experiences and the demand for convenient yet high-quality baked goods. Consumers increasingly seek ready-to-finish products that offer the aroma and freshness of homemade baking with minimal preparation effort.

This segment has gained momentum due to changing lifestyle dynamics, particularly post-pandemic, where consumers favor in-home indulgence, family baking activities, and control over final product customization. Products like ready-to-bake cakes, muffins, and pastries provide the satisfaction of baking without requiring time-intensive preparation or technical skill.

Growth in this segment is supported by the expanding availability of ready-to-finish bakery items in modern retail, online grocery platforms, and direct-to-consumer channels. Manufacturers are enhancing their offerings with premium packaging, clear baking instructions, and allergen-friendly options to meet the preferences of health-conscious and convenience-driven consumers. As home baking continues to blur the line between retail and food service quality, the household consumption segment is expected to remain dominant.

From 2024 to 2025, food service operations adopted automation-compatible ready-to-finish products to streamline kitchen workflows, reduce preparation time, and maintain consistent output quality. This shift positions suppliers offering equipment-integrated solutions as key enablers of operational efficiency in commercial food preparation environments.

Labor Shortage Solutions Drive Ready-to-Finish Adoption

The persistent shortage of skilled bakers and increasing labor costs have been identified as primary catalysts for growth in the ready-to-finish bakery products market. In 2024, food service establishments faced significant challenges in recruiting and retaining qualified baking personnel, prompting widespread adoption of ready-to-finish solutions that require minimal specialized skills. By 2025, commercial kitchens will be increasingly equipped with ready-to-finish products that enable general kitchen staff to produce high-quality baked goods, reducing dependency on specialized labor while maintaining product standards.

These developments demonstrate that operational efficiency rather than cost reduction alone is driving market expansion. Manufacturers providing comprehensive training programs and equipment support alongside their ready-to-finish products are positioned to capture sustained demand from labor-constrained operations.

Automation Integration Creates Market Opportunities

In 2024, commercial kitchen equipment manufacturers began developing specialized ovens and preparation systems designed specifically for ready-to-finish bakery products, enabling fully automated baking processes with minimal manual intervention. By 2025, integrated solutions combining ready-to-finish products with smart cooking equipment were being deployed in high-volume operations to ensure consistent results and reduce operational complexity.

These implementations demonstrate that ready-to-finish products can evolve from convenience solutions to integral components of automated food preparation systems. Suppliers that offer products compatible with computerized equipment and provide integrated solutions are positioned to serve the growing market for technology-enhanced food service operations.

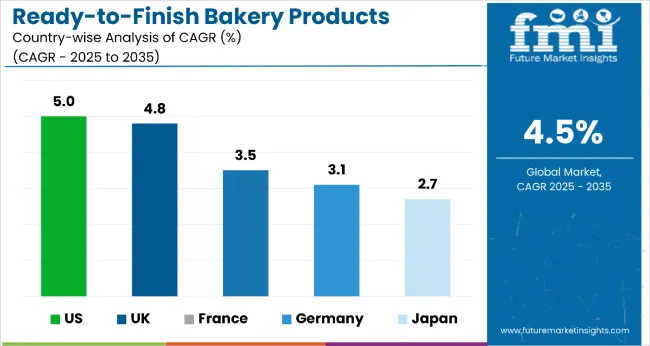

| Countries | CAGR |

|---|---|

| USA | 5% |

| UK | 4.8% |

| France | 3.5% |

| Germany | 3.1% |

| Japan | 2.7% |

In the ready-to-finish bakery products market, the USA leads growth projections with a robust CAGR of 5.0%, reflecting strong consumer demand for convenience and premium baked offerings. The UK follows at 4.8%, fueled by operational efficiencies post-Brexit and growing acceptance of frozen goods. France and Germany show moderate growth at 3.5% and 3.1%, respectively, with France balancing artisanal heritage and efficiency, while Germany’s industrial bakeries push adoption through private labels and cost savings. Japan lags slightly with a CAGR of 2.7%, shaped by a mature market focused on quality, portion control, and premium retail channels for baked goods.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

Revenue from ready-to-finish bakery products in the USA is forecast to expand at a CAGR of 5.0% from 2025 to 2035, driven by rising consumer demand for convenience, premium quality, and clean-label bakery items. The retail and food service sectors increasingly rely on ready-to-finish solutions to optimize operations, minimize waste, and deliver consistent product quality. Quick-service restaurants, cafés, and grocery chains are expanding frozen and par-baked bakery lines to meet growing expectations for fresh-baked taste with minimal in-store preparation.

The widespread availability of advanced cold chain logistics and well-developed retail infrastructure enables efficient distribution across urban and suburban areas. Manufacturers are focusing on allergen-friendly and plant-based formulations to cater to evolving dietary trends.

The ready-to-finish bakery products market in the UK is projected to grow at a CAGR of 4.8% through 2035, supported by the resurgence of the food service industry and increasing consumer familiarity with frozen and par-baked bakery items. Labor shortages and rising wage costs post-Brexit have led commercial kitchens and retail bakeries to adopt ready-to-finish solutions that reduce dependency on skilled bakers.

Retailers are offering more premium frozen options in both private label and branded formats. At the same time, cafes and casual dining chains introduce ready-to-bake pastries and breads to expand menus cost-effectively. Health-conscious formulations, such as high-fiber or reduced-sugar options, are seeing increased uptake.

Revenue from ready-to-finish bakery products in France is anticipated to rise at a modest CAGR of 3.5% between 2025 and 2035, shaped by its deep-rooted artisanal baking culture. However, commercial operations, particularly in urban centers, are increasingly adopting ready-to-finish bakery solutions to balance tradition with modern efficiency.

Par-baked baguettes, croissants, and viennoi series are widely used in hotels, cafés, and institutional settings where consistency, speed, and quality are paramount. Domestic manufacturers are innovating with formulations that retain traditional textures and flavor profiles post-baking. Despite cultural resistance to frozen products, premiumization and ingredient transparency have improved consumer perception.

Sales of ready-to-finish bakery products in Germany are projected to flourish at a CAGR of 3.1% during the forecast period, supported by modernization in the industrial bakery sector and demand for consistency across commercial food service outlets. The country’s strong retail and logistics infrastructure enables efficient frozen food distribution nationwide.

Demand is largely driven by private label offerings, discount supermarket chains, and institutional catering companies seeking cost-efficient solutions. German consumers favor premium-quality bakery items, pushing manufacturers to develop better-for-you products with organic, vegan, and gluten-free positioning.

The ready-to-finish bakery products market in Japan is expected to grow at a CAGR of 2.7% from 2025 to 2035, reflecting a mature yet quality-driven landscape. Urbanization and smaller household sizes have led to greater demand for conveniently packaged, portion-controlled frozen bakery goods.

Frozen pastries and cakes dominate the segment, driven by consumer expectations for high visual and taste quality. Department stores and gourmet retailers are key distribution points for premium offerings, while home baking trends support demand for ready-to-bake mixes. Despite relatively slow growth, innovation in packaging, flavor, and texture preservation ensures continued market relevance.

The ready-to-finish bakery products market is moderately consolidated, featuring established food processing companies with strong distribution networks and specialized product portfolios. Dawn Foods and Rich Products Corporation lead through comprehensive product ranges, technical support services, and established relationships with commercial bakeries and food service operations.

Grupo Bimbo and Associated British Foods leverage global manufacturing capabilities and distribution networks to serve diverse market segments. Aryzta AG and Lantmannen Unibake focus on premium product development and European market leadership through quality positioning and innovation capabilities.

Regional players such as General Mills and Flowers Foods maintain strong domestic positions through brand recognition and distribution advantages. The market structure supports both global suppliers and specialized regional producers, with competition based on product quality, technical support, and supply chain reliability.

Entry barriers include significant capital requirements for specialized production facilities, regulatory compliance needs, and established customer relationships that favor incumbent suppliers. Success factors include product innovation capabilities, cold chain distribution networks, and technical support services that help customers optimize product utilization.

| Item | Value |

|---|---|

| Quantitative Units | USD 260.9 Billion |

| Product | Brownies, Cakes, Cookies, Donuts, Muffins, Pastries, a nd Other Baked Goods |

| End-use | Household Consumption, Hotels, Restaurants & Catering Services, a nd Others |

| Sales Channel | B2b, B2c, Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Specialty Stores, a nd Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Oceania, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40 + countries |

| Key Companies Profiled | Dawn Foods, Rich Products Corporation, Grupo Bimbo, Aryzta AG, Lantmannen Unibake, General Mills, Flowers Foods, Associated British Foods, Conagra Brands, and Kellogg Company |

| Additional Attributes | Dollar sales by product category and end-use application, regional demand trends, competitive landscape, operational efficiency benefits, integration with commercial kitchen equipment, innovations in freezing technology and product formulations for enhanced quality and convenience |

The global ready-to-finish bakery products market is estimated to be valued at USD 260.9 billion in 2025.

The market size for the ready-to-finish bakery products market is projected to reach USD 404 billion by 2035.

The ready-to-finish bakery products market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The cakes segment will dominate with 25% of the market share in the ready-to-finish bakery products market.

In terms of end-use, the household consumption segment is expected to command a 55% share in the ready-to-finish bakery products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personalized Bakery Products Market Analysis by Product Type, Price Range, Sales Channel, End-User and Region 2025 to 2035

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA