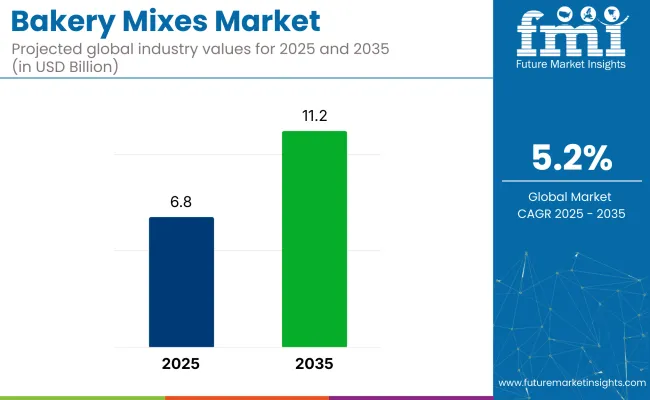

The global bakery mixes market is expected to reach a market valuation of USD 6.8 billion in 2025 and is projected to expand to USD 11.2 billion by 2035. This growth reflects a consistent CAGR of 5.2% during the forecast period. The industry has shown resilience and predictable expansion following the acceleration in demand for convenient food preparations.

| Metrics | Values |

|---|---|

| Industry Size in 2025 | USD 6.8 billion |

| Value in 2035 | USD 11.2 billion |

| Value-based CAGR from 2025 to 2035 | 5.2% |

The industry continues to benefit from the structural integration of baking solutions into foodservice chains, industrial bakeries, and even domestic kitchens across mature and emerging markets. Bakery mixes, which include a blend of flour, starch, leavening agents, emulsifiers, and other baking aids, have carved out a reliable niche in food processing.

The market holds approximately 20-25% share within the bakery ingredients market. Its share in the broader food ingredients market is about 1-2%. In the processed food market, bakery mixes account for less than 0.1%. Within the dry food premixes segment, they represent nearly 30-35% of the market. In the convenience foods market, bakery mixes contribute around 4-6%, reflecting their growing role in ready-to-use baking solutions for both domestic and industrial applications.

The market has been driven by rising consumer reliance on time-saving baking alternatives, particularly across North America, Europe, and select parts of Asia. In both commercial and institutional baking, bakery mixes help standardize output, eliminate inconsistency, and support volume production. These blends reduce formulation complexity, offering uniformity across product batches, an increasingly necessary factor for franchise operators, QSR chains, and regional bakeries seeking predictable outputs at scale.

Demand has also seen tailwinds from price-conscious baking solutions. In cost-sensitive regions, bakery mixes have become popular due to reduced wastage and simplified logistics. These mixes also allow product innovation at the R&D level, particularly as manufacturers respond to dietary shifts such as low-gluten, high-protein, or plant-based formulations.

Per capita spending on bakery mixes differs across regions, largely influenced by lifestyle, income levels, and baking culture. In developed markets, home baking is more established and supported by a wide range of convenient mix products. These countries have higher individual spending due to product variety and consumer preference for time-saving options. Emerging markets, while currently spending less per person, are witnessing rising demand as urbanization and disposable incomes increase.

The global trade of bakery mixes is growing steadily, supported by rising demand for convenience foods and increasing interest in home baking. Trade flows are influenced by manufacturing capacities, supply chain efficiency, consumer preferences, and food safety regulations. Both developed and developing countries actively participate in this market, either as exporters or importers based on domestic production and consumption trends.

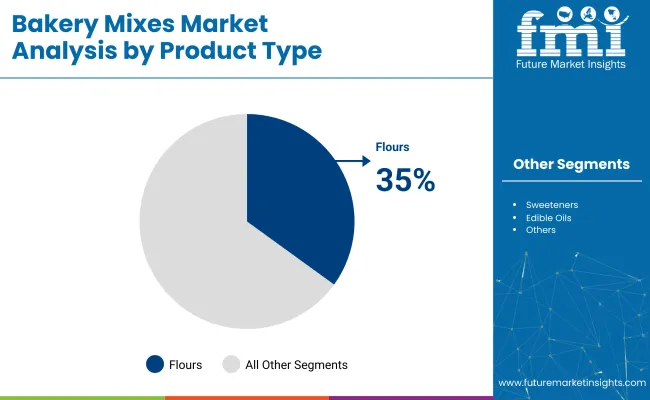

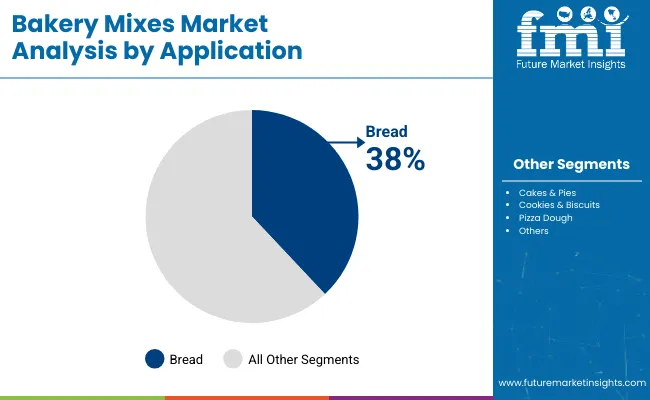

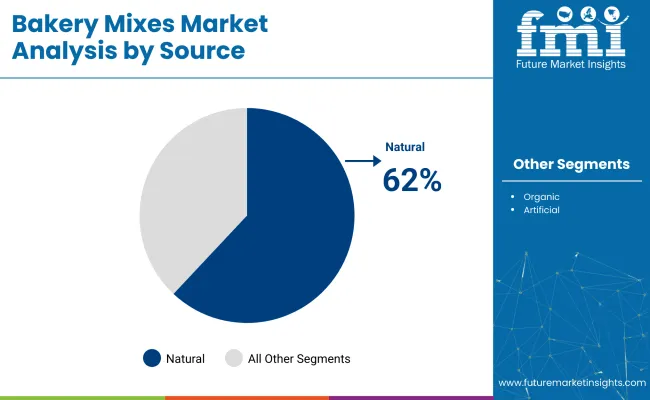

The bakery mixes market is segmented by product type into flours, sweeteners, edible oils, cocoa and chocolate, and others. By application, it includes bread, cakes and pies, cookies and biscuits, pizza dough, and others. By source, the segmentation is into natural, organic, and artificial. By region, the market covers North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

Flours are expected to account for the largest share of the market by product type in 2025, with an estimated contribution of nearly 35% to revenue. This dominance can be attributed to the foundational role flours play in virtually all bakery mix formulations, whether for bread, cakes, or cookies.

Bread is projected to hold the largest share in the market by application, accounting for 38.0% market share in 2025. This lead is supported by the entrenched global demand for bread as a daily staple across both developed and emerging economies.

Natural sources are projected to dominate the market by source, contributing nearly 62% share in 2025. The dominance of natural-based mixes stems from their wide acceptability among commercial bakers, institutional food producers, and retail consumers seeking reliable formulations without synthetic additives.

Operational efficiency in commercial baking is being strengthened by wider reliance on bakery premixes, viewed as essential for scalable, consistent output. Clean-label momentum is being reinforced through simplified, plant-based formulations, positioning transparent ingredient mixes as the likely benchmark for future differentiation.

A shift toward operational efficiency has accelerated the adoption of the product across commercial baking operations. These premixed formulations are being utilized to streamline batch consistency, reduce production time, and cut labor dependency critical for high-volume producers managing SKUs across bread, cake, and cookie categories. Bakery premixes enable manufacturers to reduce formulation errors and respond faster to fluctuating demand without sacrificing quality. Ingredient suppliers have capitalized on this trend by offering customized blends that cater to regional palates and baking standards.

Formulations using the product are being reshaped to meet evolving clean-label and ingredient transparency expectations. Artificial additives and preservatives are being phased out in favor of natural alternatives, with increasing pressure on manufacturers to publish full disclosures on mix contents.

In response, food ingredient companies have been introducing simplified bakery bases derived from recognizable components such as stone-ground flours, natural sweeteners, and plant-based emulsifiers. This trend has also been observed in private-label brands targeting health-conscious consumers across North America and Europe.

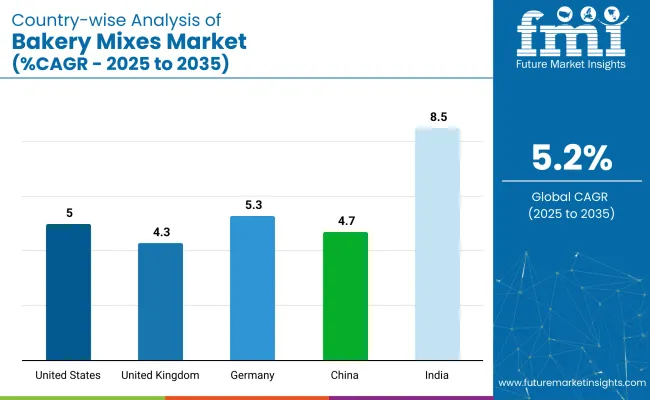

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5% |

| United Kingdom | 4.3% |

| Germany | 5.3% |

| China | 4.7% |

| India | 8.5% |

Sales of bakery mixes worldwide are projected to grow at a 4.0% CAGR from 2025 to 2035. All five markets highlighted from a 40-country survey are forecast to surpass that pace, led by India at 8.5%. Germany follows at 5.3%, the United States at 5.0%, China at 4.7%, and the United Kingdom at 4.3%.

These rates translate into growth premiums ranging from +7% (United Kingdom) to +113% (India) versus the global baseline. Divergence reflects local catalysts: tier-2 urban expansion and private-label mixes in India, clean-label demand and regional flavour profiles in Germany, specialty keto and gluten-free launches in the United States, institutional procurement and Western-style bakery uptake in China, and at-home indulgent baking trends in the United Kingdom.

The USA bakery mixes market is estimated to grow at 5.0% CAGR during the forecast period. Expansion is being underpinned by steady demand for time-saving dough bases in retail and foodservice, where consistent output and labor efficiency remain core purchasing criteria. Bread and cake mixes have been adopted by quick-service restaurant commissaries to streamline SKU management, while gluten-free and high-protein variants are being favored by health-aware consumers who require convenient baking aids.

Ingredient suppliers have intensified product localization, ensuring formulations align with American labeling codes and shelf-life expectations. E-commerce grocery platforms have been leveraged by private-label brands, boosting mix visibility among home bakers seeking predictable results without measuring errors.

The India bakery mixes market is estimated to grow at 8.5% CAGR from 2025 to 2035. Growth well above the 5.2% global average is being enabled by rising middle-class adoption of Western-style bakery items, combined with an entrenched affinity for value-priced convenience foods. Domestic mills have diverted wheat output toward packaged premixes, encouraged by reduced post-harvest losses and consistent demand from urban hypermarkets.

Mixes formulated for egg-free and dairy-free recipes have found expanding acceptance, meeting vegetarian requirements without compromising texture. Government support for smaller food-processing units has encouraged co-packing arrangements, bringing cost-effective bread and cake bases to tier-two cities. Online grocery platforms have widened distribution reach, while celebrity baking shows have popularized home baking, lifting retail volume.

The China bakery mixes market is estimated to grow at 4.7% CAGR between 2025 and 2035. Market momentum is being maintained by premium café chains that prefer standardized sponge and brioche bases to ensure uniform taste across rapidly multiplying outlets. Urban consumers value single-serve packaged buns and breakfast rolls prepared from ready-to-bake formulations, perceived as hygienic and portion-controlled.

Domestic ingredient firms have partnered with global players to access high-protein wheat isolates, improving dough elasticity, while rice-based mixes have been promoted for gluten-sensitive patrons. Digital retail festivals have been leveraged to launch seasonal cake-mix bundles, triggering demand spikes that local contract packers can meet through flexible filling lines.

The Germany bakery mixes market is estimated to grow at 5.3% CAGR during the forecast period. Growth roughly in line with the global average is being driven by a well-established artisanal culture that is increasingly relying on specialty rye and spelt premixes to balance tradition and efficiency. Home bakers, encouraged by cooking-show influence, are purchasing small-batch bread mixes featuring heritage grains, whereas industrial bakeries have installed automated dispensers calibrated for high-hydration dough bases.

The clean-label movement has led to greater transparency, prompting formulators to exclude artificial emulsifiers and opt for enzyme systems compliant with EU additive codes. Demand for convenience has risen as dual-income households turn to ready-proof bakery kits available in discounters.

The United Kingdom bakery mixes market is estimated to grow at 4.3% CAGR during the forecast period. Growth marginally below the global mean is being sustained by an enduring home-baking culture inspired by televised competitions and social-media recipe sharing. Retailers have expanded private-label cake and scone mixes, frequently highlighting reduced-sugar formulations aligned with national health guidelines.

Gluten-free blends formulated with oat and buckwheat flours are being embraced by consumers seeking digestive comfort without flavor compromise. Convenience stores have broadened shelf space for microwave-ready muffin pots, targeting quick indulgence occasions. Manufacturers have responded by developing water-only mixes that eliminate the need for fresh eggs, prolonging pantry life and reducing preparation barriers.

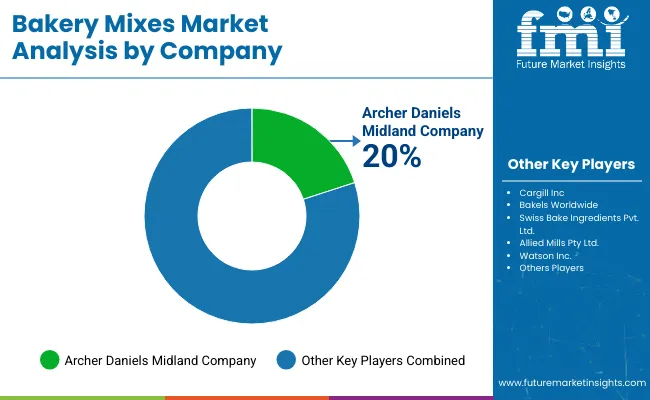

The market is shaped by a mix of established industry leaders and regional innovators specializing in premix customization, flour fortification, and industrial baking applications. Key companies such as Cargill Inc., Archer Daniels Midland Company, and Bakels Worldwide continue to lead with expansive portfolios covering bread, cake, and specialty mix formulations. Swiss Bake Ingredients Pvt. Ltd. and Allied Mills Pty Ltd. support mid-scale and regional bakery operations with tailored dough bases and ready-mix solutions.

Watson Inc. and Mahindra Group have strengthened their foothold through investments in functional blends and ingredient technologies, while Puratos Ltd. and Lesaffre SA are known for their proprietary yeast and enzyme systems integrated into bakery premixes. Pillsbury Company LLC and King Arthur Flour Company Inc. dominate in the North American home baking segment, offering retail-ready baking kits. Pamela’s Products Inc. and Enhance Proteins Ltd. are gaining traction in gluten-free and protein-enhanced bakery mix categories respectively, targeting evolving consumer preferences.

In March 2025, Cargill inaugurated a new corn milling plant in Gwalior, India, with an initial output of 500 tons per day, expandable to 1,000 tons per day, to serve the food and bakery sectors.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6.8 billion |

| Projected Market Size (2035) | USD 11.2 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in kilo tons |

| Product Type Analyzed (Segment 1) | Flours, Sweeteners, Edible Oils, Cocoa a nd Chocolate, and Others |

| Application Analyzed (Segment 2) | Bread, Cakes & Pies, Cookies & Biscuits, Pizza Dough, and Others. |

| Source Analyzed (Segment 3) | Natural, Organic, and Artificial. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill Inc., Archer Daniels Midland Company, Bakels Worldwide, Swiss Bake Ingredients Pvt. Ltd., Allied Mills Pty Ltd., Watson Inc., Mahindra Group, Puratos Ltd., Lesaffre SA, Echema Technologies LLC, Pillsbury Company LLC, King Arthur Flour Company Inc., Pamela’s Products Inc., and Enhance Proteins Ltd. |

| Additional Attributes | Dollar sales, share, growth forecast, key application trends, top-performing product types, regional demand shifts, competitor strategies, pricing dynamics, sourcing patterns, distribution insights, regulatory outlook, private-label growth. |

The industry is segmented into flours, sweeteners, edible oils, cocoa and chocolate, and others.

The industry finds applications in bread, cakes & pies, cookies & biscuits, pizza dough, , and others.

The industry is segmented into natural, organic, and artificial.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 6.8 billion in 2025.

It is forecasted to reach USD 11.2 billion by 2035.

The industry is anticipated to grow at a CAGR of 5.2% during this period.

Natural source is projected to lead the market with a 62.0% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 8.5%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Bakery Mixes Suppliers

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA