The growth of bakery processing equipment market across the globe, along with frequent innovations in product range, has primarily redefined the industry for bakery processing equipment and is expected to drive this industry significantly over the forecast period.

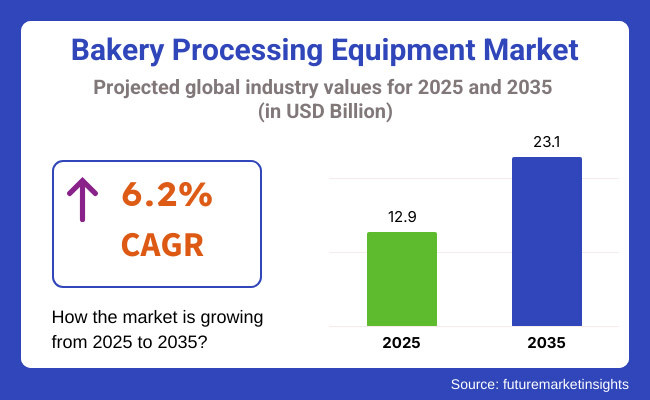

By 2025, the industry is anticipated to be worth USD 12.9 billion and is expected to be USD 23.1 billion in 2035, with a CAGR of 6.2% in the forecast period. In 2024, the market for bakery processing equipment will be driven by expanding automation, expanding demand for gluten-free and healthy baked foods.

Expanding bakery chains, especially in developing nations, and the tightening food safety standards are driving investments in sophisticated processing equipment. Trends such as the increasing number of bakery chains, rising demand for convenience foods, and expanding adoption will benefit the sales.

Further, the rising emphasis on cleanliness and food safety regulatory bodies necessitates the implementation of advanced equipment by manufacturers. Demand for modern processing equipment is expected to increase due to significant investments in bakery production facilities in emerging sectors in Asia Pacific and Latin America.

Technological advances in dough processing, oven technology, and packaging solutions will enable food manufacturers to operate with higher throughput and less dependence on labor. With increasing trends toward healthy and gluten-free baked goods, manufacturers are adopting more versatile machinery to meet changing industry demand.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on automation to enhance production speed and efficiency. | Advanced AI and IoT-driven equipment for predictive maintenance and real-time monitoring. |

| Adoption of energy-efficient ovens and mixers. | Widespread use of renewable energy sources in bakery processing. |

| Rising demand for gluten-free and healthier baked goods. | Customizable equipment to accommodate diverse dietary trends and ingredient variations. |

| Initial investments in robotics for dough handling and packaging. | Fully automated production lines with robotic integration for end-to-end processing. |

| Strict food safety regulations driving hygienic equipment design. | Enhanced focus on antimicrobial surfaces and self-cleaning technologies. |

| Industry growth driven by North America and Europe. | Significant expansion in Asia-Pacific and Latin America due to urbanization and rising incomes. |

Future Market Insights (FMI) carried out a detailed study of the bakery processing equipment industry, holding discussions with prominent stakeholders, such as manufacturers, suppliers, bakery owners, and industry experts.

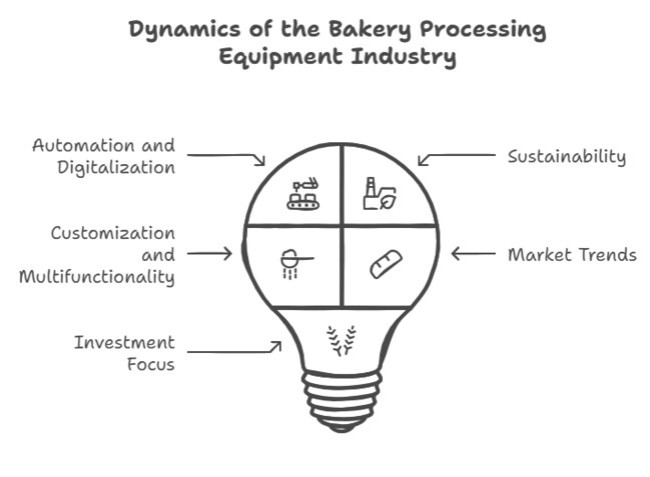

Automation and digitalization are the biggest priorities for companies have sought to optimize production efficiency and ensure product consistency, according to the survey. More than 65% of the respondents believed the introduction of AI and IoT driven solutions has helped in curtailing downtime and maintenance costs, leading to overall efficiency in operations.

Sustainability came out as a major issue with over 70% of bakery equipment manufacturers signaling that government policies and every consumers’ desire for environmentally-friendly production are spurring the use of energy efficient technologies.

The survey also noted that demand for customizing, and multifunctional equipment is on the rise, especially in high-growth areas, such as Asia-Pacific and Latin America, where bakery consumption is growing. While small and medium bakeries are interested in modular and affordable solutions, big manufacturers are purchasing fully automated production lines to scale their businesses. More than 60% of respondents believe that future investments will go towards robotic handling of dough, Ai driven quality control and smart baking systems that respond to real-time ingredient variations.

| Countries | Regulation Impact |

|---|---|

| United States | The FDA enforces the Food Safety Modernization Act (FSMA), requiring bakery equipment manufacturers to comply with strict hygiene and sanitation standards to prevent contamination. |

| European Union | The Eco-Design Directive mandates energy efficiency in industrial machinery, encouraging the adoption of low-emission ovens and mixers to reduce carbon footprints. |

| China | The government has introduced energy efficiency standards for food processing machinery, pushing companies to adopt more sustainable baking technologies. |

| India | The Food Safety and Standards Authority of India (FSSAI) requires bakery processing equipment to comply with stringent safety and hygiene protocols to enhance food quality and prevent adulteration. |

| Brazil | The National Environmental Policy Act enforces strict regulations on emissions and waste management, compelling bakery equipment manufacturers to adopt eco-friendly and recyclable materials. |

| Japan | The Act on Rational Use of Energy promotes the use of energy-saving technologies in food processing, driving demand for smart ovens and automated bakery systems. |

Key players in the bakery processing equipment industry are focusing on pricing strategies, innovation, strategic partnerships, and geographical expansion. Price competitiveness is the key issue, especially when small to mid-sized bakeries require cost-effective supplies. But many leading players are standing out through innovation by rolling out energy-efficient ovens, automated mixers, and AI-based process-optimization tools.

The growth strategies for this landscape are centered on increased global penetration, R&D, and acquisitions. With changing consumer tastes and urbanization, companies are venturing to untapped markets having increasing demand for baked goods.

Also, in automation and digitalization, where investments are made so that manufacturers will provide smart, connected equipment for greater productivity and lower operational costs. Mergers and acquisitions are also key to expanding product portfolios and consolidating a company's position in competitive regions.

The Middleby Corporation and GEA Group shared more than 18% of the bakery processing equipment industry share. With their competitive places held, they'd collectively yield about 18% industry share in 2025, which translates to approximately USD 2.36 billion in revenue.

There are other prominent players in the industry such as ALI Group S.R.L. A Socio Unico, John Bean Technologies Corporation, Markel Ventures Inc., Heat and Control, Inc., Rheon Automatic Machinery Co., Ltd, Fritsch Group, Baker Perkins Ltd. and Gemini Bakery Equipment Company.

The baking processing equipment sector witnessed significant mergers and acquisitions during 2024 in line with industry evolution. There are examples like Mars Incorporated's acquisition of Kellanova in a landmark USD 36 billion deal with well-established brands like Pringles and Cheez-It joining the mars family of brands

Similarly, Mondelez International has recently purchased a majority stake in Evirth in China, with an aim to expand into one of China's fastest emerging sectors; bakery, particularly premium western-style desserts. In addition, Jones Village Bakery in Wrexham was purchased by France's Menissez Bakery Group, which promised a significant investment to support its growth strategy.

Market Share Analysis of Leading Companies

| Company | Industry Share & Key Strengths |

|---|---|

| GEA Group AG | 10-12% - Advanced automation, energy-efficient baking solutions, global reach. |

| Bühler Holding AG | 9-11% - Strong R&D, high-tech dough processing, and sustainability initiatives. |

| JBT Corporation | 7-9% - Specializes in food safety, automation, and robotic bakery equipment. |

| Heat and Control Inc. | 6-8% - Expertise in high-speed processing, frying, and oven technologies. |

| The Middleby Corporation | 5-7% - Leader in commercial baking equipment, strong presence in North America. |

| Ali Group S.r.l. | 4-6% - Diversified food processing solutions, strong focus on Europe and Asia. |

| Rheon Automatic Machinery Co., Ltd. | 3-5% - Pioneering dough-handling automation and flexible baking systems. |

| Others | 40-50% - Includes regional players and niche manufacturers catering to specific bakery needs. |

Economic growth, consumer spending, technological developments, and regulatory policies are a few macro-economic factors impacting the global bakery processing equipment industry. A growing global population and increasing urban living are contributing to higher demand for convenience foods and baked goods especially in developing economies such as India, China, and Brazil.

This has driven investments in advanced technologies for food processing to improve efficiency, hygiene, and environment-friendly practices. The existing inflationary environment coupled with fluctuating raw material prices has adversely impacted manufacturing costs, driving companies to opt for energy-efficient machinery in order to lower operational costs. Moreover, labor shortages in the food industry have hastened the direction of automation and robotics in bakery production.

The changing scenario of regulations across industries is also an important factor that is shaping the industry. Government policies promoting sustainable production and energy efficiency are driving manufacturers to invest in eco-friendly baking solutions, such as electric ovens and waste-reducing technologies.

Despite this scenario the industry is projected to grow at a steady rate, being propelled by innovation, automation and increased consumption of bakery across the world. Companies that adapt to these changes through digitalization, sustainability, and customization will thrive in this industry.

The bakery processing equipment industry comprises a range of machines used for automating and improving the efficiency of the production process and quality of baked items. One of those integral part is the bread systems which nowadays are introduced with automation for the bakeries that can yield high-quality bread with the same texture and taste.

Bread slicers are constantly improving, becoming more and more precise to ensure that each cut is even and uniform to reduce waste. The solution: Switching bakery mixers to advanced control systems, which has allowed manufacturers to fine-tune dough consistency with minimal manual labor. Bakery ovens are still a vital investment, with new features emphasizing energy consumption, even baking, and smart technology integrations.

Bakery Processing Equipment Industry: Segment Analysis. The bakery processing equipment industry has been segmented based on end user. As the popularity of fresh, artisanal and specialty baked goods continues to increase, their retail and wholesale baking operations are creating demand for smaller space yet high-output equipment.

The food services industry, nested under both hospitality and manufacturing, encompassing cafes, restaurants, and catering services are increasingly investing in automated services to improve productivity and standardize the product. In-store baking solutions, including compact ovens and freezers, appeal to general stores and retailers looking to offer freshly baked goods without the need for large-scale bakery infrastructure.

Bakery processing equipment serves various applications in industrial settings, aiming to meet consumers' changing demands worldwide. Bread is still the largest segment, and growing demand for artisanal, gluten-free and fortified varieties is driving innovation in dough handling and baking technology.

Precision mixing and baking solutions applied in large-scale production also benefit biscuits and cookies, as they ensure consistent texture and taste. To satisfy an increasing demand for high-end bespoke cakes and pastries, high-precision depositors, ovens, and cooling systems are needed in addition. Pizza crust manufacturers are evolving, with automated systems generating high-speed production of fresh or frozen crust for commercial and retail shipment.

The bakery processing equipment industry is expected to witness lucrative growth prospects owing to changing consumer preferences, technological advancements, and growing demand for automation. Sustainable and energy-efficient baking solutions are one of the critical growth prospects. With the harsher environmental regulations that governments around the world are implementing, manufacturers can now invest in electric ovens, more energy-efficient refrigeration systems and waste-reducing technologies.

Firms incorporating biodegradable and recyclable materials into their processes will gain a competitive edge. Another key opportunity lies in automation and digitalization. Implementing AI models for predictive maintenance, IoT-connected smart ovens, and robotic handling systems can result in reduced downtime, increased efficiency, and more consistent products for bakeries.

There is also an increasing demand for tailored and artisanal baked products, opening new opportunities for production systems that are flexible enough to accommodate custom shapes, flavors, and nutritional profiles.

Untapped growth areas are in emerging industries. Rapid urbanization along with increased disposable income in Asia-Pacific, Latin America, and the Middle East has promoted greater consumption of baked goods. To penetrate these markets effectively, firms must strengthen their distribution networks, create localized partnerships, and develop regional product innovations.

This also leads to a growing niche for specialized equipment that caters to gluten-free, high-protein, and organic baked goods, as consumers are becoming more health-conscious.

Strategic mergers, acquisitions, and collaborations will be vital to remaining competitive in this landscape. Baking companies must team up with ingredient suppliers, bakery chain stores and food-tech startups to innovate and penetrate new customer segments. Investing in training and after-sales services, such as remote diagnostics and AI-powered maintenance, will help improve customer loyalty as well as differentiate brands.

The USA bakery processing equipment industry is projected to be approximately USD 780.6 million, assuming a 6% annual growth in 2025. Rising automation, demand for bakery-related convenience foods, sustainability initiatives, and trends of economic growth are expected to drive the growth of the USA bakery processing equipment industry over the forecast period.

USA Environmental Protection Agency (EPA) energy efficiency regulations are leading bakeries to add (or replace with) electric ovens and advanced refrigeration systems. A commercial app is the central management platform, complemented by an online store for selling premium QSR and café offerings. The app assists with streamlining operations, combining multiple locations, and eliminating inefficiencies in centralized production facilities away from metropolitan areas, where IoT-based baking technology is applied.

FMI opines that the United States bakery processing equipment sales will grow at nearly 5.9% CAGR through 2025 to 2035.

Bakeries across the UK are embracing clean-label, gluten-free, and plant-based products, driving developments in the UK bakery processing equipment industry and industry is expected to reach approximately USD 1.08 billion, holding around 22% of the industry share. Bakeries are turning to energy-efficient processing to meet the Net Zero Strategy.

As consumers gravitate towards premium, healthier bakery products, there is greater demand for versatile equipment able to process alternative ingredients and formulations. Demand from general stores and retailers for in-house baking operations is spurring demand for compact, automated baking equipment that retains product freshness. Furthermore, post-Brexit trade hurdles have nudged local producers to bolster domestic production.

FMI opines that the United Kingdom bakery processing equipment sales will grow at nearly 3.7% CAGR through 2025 to 2035.

France's rich traditional bakery culture nurtures strong demand for the latest bakery processing equipment in both the artisanal and hot baked food manufacturing (HF) segments. The industry is seeing a growing trend towards adoption of semi-automated and automated to help maintain production efficiency without destroying craft.

To acquire equipment that helps bakers reduce food waste, the Direction Générale de l'Alimentation (DGAL), a strict food regulation authority in France, agrees that bakeries must invest in equipment with hygiene and precision control.

The growing demand for frozen baked products is one of the factors creating the greater need for rapid cooling and freezing solutions. The industry is being influenced by sustainability trends; French bakeries are notably embracing eco-friendly ovens, water-saving dough processing systems and waste-minimizing systems.

FMI opines that the France bakery processing equipment sales will grow at nearly 3.5% CAGR through 2025 to 2035.

Germany is one of the key countries in Europe, both in terms of its size and the technological depth of its baking industry, and will hold approximately 21.6% market share in 2025. Investments in robotic bakery equipment, AI-powered production analytics, and high-speed dough processing systems are being driven by the country’s strong focus on automation and efficiency.

Moreover, strict food safety standards under the Bunde Ministerium für Ernährung und Landwirtschaft (BMEL) is directing bakeries to opt for advanced hygiene and quality control systems. Sustainability plays a large role, with bakeries building energy-efficient ovens, green refrigeration and smart production lines, which produce as little waste as possible and lower carbon footprints.

Specialized equipment that can process a variety of ingredients with extreme accuracy is being adopted as the demand for whole grain, gluten free, and functional bakery products continues to grow.

FMI opines that Germany's bakery processing equipment sales will grow at nearly 3.8% CAGR through 2025 to 2035.

Italy has a long-standing tradition of bread, pastries and pizza production, which is largely driving the bakery processing equipment industry. This industry continues to drive investments in high-quality ovens, mixers and dough sheeters that help maintain product authenticity while offering automation for increased throughput. To adhere to the Italian Ministry of Health and EU food safety regulations, bakeries must use hygienic, precise and controlled baking solutions.

Gluten-free, organic, and fortified baked goods are on the upswing, and manufacturers are increasingly upgrading processing equipment to ensure accurate handling of ingredients and allergen-free production lines. Exports of frozen pizza and bakery are on the rise in Italy, prompting demand for high-performance freezing and cold-storage equipment.

FMI opines that Italy's bakery processing equipment sales will grow at nearly 3.4% CAGR through 2025 to 2035.

Growing urbanization, increased bakery consumption, and a robust café culture are all contributing to the growth of the South Korea bakery processing equipment industry. For automated and AI-powered baking solutions, the demand is coming up with the increasing popularity of Western-style baked goods, such as croissants, bread, and pastries.

Stringent hygiene standards enforced by the Ministry of Food and Drug Safety (MFDS) have also driven bakeries to adopt automation and contactless handling systems that reduce human involvement. The surge in convenience store bakeries is driving demand for compact, high-efficiency ovens and proofers supporting small-batch, high-frequency production. South Korea's booming digital economy is leading bakeries to adopt smart ovens, intelligent data plates and robotic bakery assistants as seamless production partners.

FMI opines that the South Korea bakery processing equipment sales will grow at nearly 5.0% CAGR through 2025 to 2035.

Japan’s bakery processing equipment industry is characterized by a technological precision and quality focus. As consumer concerns about healthiness grow, the demand for functional bakery products is also on the rise, which is contributing to the adoption of advanced dough handling, fermentation and baking systems.

Strict food safety laws in Japan such as the regulations of the Ministry of Agriculture, Forestry and Fisheries (MAFF) prompt bakeries to invest in automated hygienic solutions, antimicrobial conveyor belts, and robotic cleaning equipment.

Emerging robotic bakeries and contactless automation are the latest developments, enabling bakeries to minimize the workforce while maintaining product consistency and efficiency. Demand for compact, high-speed baking systems continues to grow as the compact bakery segment of Japan’s convenience store sector expands.

FMI opines that the Japan bakery processing equipment sales will grow at nearly 3.6% CAGR through 2025 to 2035.

According to projections for 2025, the China bakery processing equipment sector is expected to reach approximately USD 1.08 billion, continuing its strong growth trajectory over the next decade. China's bakery industry is expanding swiftly amid urbanization, rising disposable income, and a rising liking for Western-style baked goods.

The China Food Safety Law encourages bakeries to adopt new hygiene and quality control technologies to guarantee product safety. The e-commerce phenomenon is also influencing the industry, with bakeries preparing for online sales through investments in advanced freezing, packaging, and storage systems.

Energy-efficient baking systems and smart production lines are among the sustainability trends moving forward as well. By virtue of the rapid advancement in digital transformation, artificial intelligence-powered automation and IoT-enabled bakery monitoring are expected to become an industry standard in China.

FMI opines that the China bakery processing equipment sales will grow at nearly 6.2% CAGR through 2025 to 2035.

The demand for health-conscious products, sustainability goals, and convenience foods influence the bakery processing equipment industry in Australia and New Zealand. As the food industry falls in line with the carbon-neutral movement, bakeries are increasingly employing energy-efficient baking equipment, waste-reduction technologies and sustainable packaging.

The growing population of gluten-free, high-protein, and plant-based bakeries is creating demand for concentrated baking equipment. The increasing number of in-house bakeries in supermarkets and foodservice providers is driving the demand for compact, high performance baking solutions. Digital transformation is on the rise as the future key trends include IoT-enabled bakery equipment, AI-powered production monitoring, and robotic baking systems.

FMI opines that the Australia & New Zealand bakery processing equipment sales will grow at nearly 4.2% CAGR through 2025 to 2035.

The Indian bakery processing equipment market is experiencing incredible growth, triggered by factors like urbanization, rising disposable income, and evolving lifestyles of consumers towards convenience foods. Growing consumption of biscuits, bread, cakes, and packaged baked food has led to increased investments in automated baking solutions by manufacturers across the world to enhance production efficiency.

The growth of QSRs and an increasing café culture have also accelerated demand for high-speed ovens, proofers, and dough-mixing equipment, especially with the rising popularity of Western-style bakery products. Furthermore, there is a growing trend for healthier baked products with increasing demand for whole grain, gluten-free, fortified and high-protein baked products, thus encouraging bakery product manufacturers to use versatile and allergen-free baking equipment.

FMI opines that the India bakery processing equipment sales will grow at nearly 6.5% CAGR through 2025 to 2035.

Bread Systems, Bread Slicers, Bakery Mixers, Bakery Ovens, Pan Greasers, Bakery Freezers

Retail and Wholesale Bakeries, Food Services Industry, Supermarkets and Retailers, Baked Snacks Industry (Baked Chips, etc.)

Bread, Biscuits & Cookies, Cakes & Pastries, Pizza Crusts, Others (Pretzels, Donuts, Pancakes, etc.)

North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa (MEA)

Recent innovations include AI-powered predictive maintenance, IoT-enabled smart ovens, robotic dough handling systems, and energy-efficient baking solutions. These advancements help improve efficiency, consistency, and sustainability in baking operations.

Automation reduces manual labor, increasing production speed, and enhancing precision in baking. Automated mixing, proofing, and packaging systems allow bakeries to maintain product quality while optimizing costs and meeting rising consumer demand.

Sustainability is a key focus, with manufacturers developing energy-efficient ovens, eco-friendly refrigeration systems, and waste-reduction technologies. Many bakeries are also adopting recyclable materials and biodegradable packaging to align with environmental goals.

With increasing consumer preferences for gluten-free, organic, and high-protein baked goods, bakeries require specialized equipment to handle alternative ingredients, maintain hygiene standards, and ensure consistency in product quality. Additionally, evolving food safety regulations and hygiene standards necessitate equipment designed for easy cleaning and strict allergen control, further driving demand.

Digital transformation is improving efficiency through AI-driven quality control, remote diagnostics, and real-time production monitoring. IoT-enabled bakery equipment allows for predictive analytics, reducing downtime and optimizing resource usage.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast By End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast By End User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast By End User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast By End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast By End User, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast By End User, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast By End User, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast By End User, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast By End User, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) By End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness By End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) By End User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness By End User, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) By End User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness By End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) By End User, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness By End User, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) By End User, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness By End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) By End User, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness By End User, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) By End User, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness By End User, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) By End User, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis By End User, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis By End User, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis By End User, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections By End User, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness By End User, 2023 to 2033

Figure 191: MEA Market Attractiveness by Application, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Bakery Ingredient Market Trends – Growth, Demand & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA