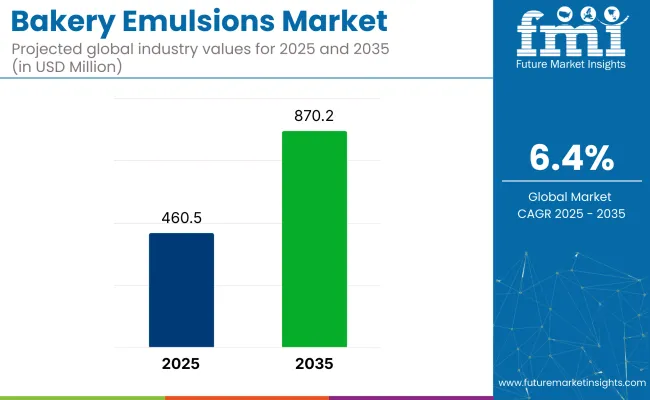

The bakery emulsions market is expected to grow from USD 460.5 million in 2025 to USD 870.2 million by 2035, reflecting a 6.4% CAGR over the period. Growth is supported by requirements for consistent crumb structure, extended moisture retention, and freeze-thaw tolerance across high-output pastry and cake lines.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 460.5 million |

| Projected Global Value (2035F) | USD 870.2 million |

| Value-based CAGR (2025 to 2035) | 6.4% |

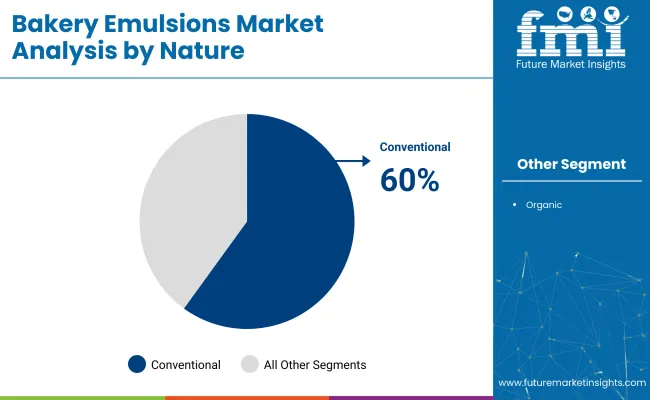

Plant-derived sources-projected to hold 42.5% share in 2025-are preferred because allergen-light lipid profiles align with global ingredient-labelling mandates. Conventional formulations retain 60% share, as proven emulsifier blends deliver stable aeration across a broad pH spectrum at competitive cost.

Carbohydrate-rich baked goods rely on emulsions to stabilise gas cells and prevent crumb drying during ambient storage. Plant-based lecithins and mono- and diglycerides have been adopted for their oxidative stability and ease of dosage in liquid form, which simplifies integration into automated metering systems. Hypermarket dominance in distribution is maintained through private-label programmes that secure long-term supply contracts with emulsifier blenders.

Scalability in production is achieved by modular esterification reactors and enzymatic interesterification units that accommodate flexible batch sizes, ensuring uninterrupted supply during peak seasonal demand. Baking centers are constantly being developed, which keeps the industry active. DSM-Firmenich inaugurated its Princeton Baking Innovation Center in New Jersey, aiming to accelerate innovation and co-create applications such as breads, rolls, pastries, tortillas, cookies, and snack foods.

The industry holds a defined share within its parent markets. In the food emulsion market, it holds around 5-7%, as bakery emulsions are a key segment in the broader emulsion category. Within the baking ingredients market, the share is approximately 8-10%, given the role emulsions play in improving the texture and consistency of baked goods.

In the food and beverage market, the bakery emulsions market contributes about 3-5%, driven by their widespread use in bakery products. The food processing market sees a share of 4-6%, as emulsions enhance the efficiency of food production. The functional foods market holds a smaller share of 2-3%, with emulsions being used in healthier bakery options.

Bakery-emulsion spending in 2025 concentrates on plant-derived sources, hypermarket distribution, conventional formulations, industrial end-use adoption, and bakery-specific applications. Each focus area attracts capital through regulatory alignment, logistics economies, processing stability, and output consistency demanded by high-throughput baked-goods production lines.

A 42.5% share has been accounted for by plant sources in 2025, as allergen avoidance, supply predictability, and non-animal certification strengthen purchasing contracts across flavor houses and emulsifier blenders demanding tight specification control.

A 43.3% share has been held by hypermarkets in 2025, supported by centralized procurement hubs, aisle adjacency to home-baking kits, and weekly flyer promotions that trigger impulse purchases among price-sensitive hobby bakers.

A 60% share has been held by conventional emulsions in 2025, because recipe familiarity, predictable rheology, and broad regulatory acceptance reduce reformulation downtime when multiple bakeries run parallel SKUs under license.

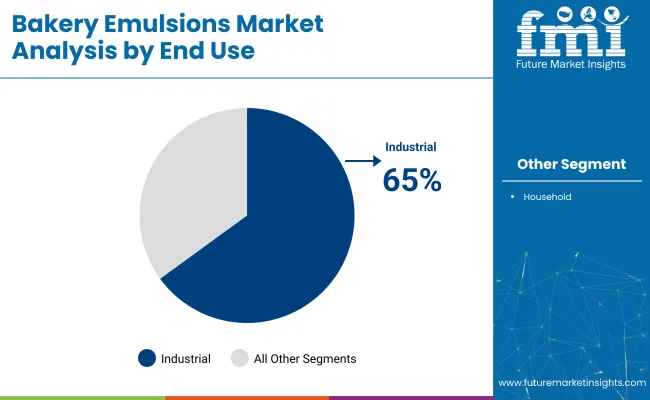

A 65% share has been accounted for by industrial users in 2025, as multi-shift plants demand flow-controlled emulsions that support uninterrupted dough preparation and finished-product texture targets across high-speed automated lines.

A 55% share has been held by bakery applications in 2025, since crumb tenderness, moisture retention, and slice integrity rely on finely tuned oil-water interfaces throughout proofing, baking, cooling, and slicing operations.

Regulatory labeling restrictions and flavor stability demands are reshaping formulation priorities in the industry. Manufacturers are investing in non-alcoholic emulsions and reformulation protocols to retain product claims while meeting region-specific compliance rules and shelf-life requirements.

Flavor Stability Driving Reformulation of Emulsion Blends

Increased demand for consistent flavor retention under frozen and ambient storage has led to a shift toward high-performance emulsifiers. Water-based emulsions offering oxidative stability and low volatility are being prioritized by industrial bakers supplying frozen pastry and pre-mix categories.

Cargill and LorAnn have developed bakery emulsions using micro-encapsulation techniques that preserve flavor integrity under variable pH and temperature. These emulsions are replacing alcohol-based extracts in frozen dough systems where ethanol evaporation caused flavor loss.

Labeling Restrictions Reshaping Emulsion Ingredient Declarations

Labeling restrictions on synthetic carriers and artificial solvents have forced reformulations across bakery emulsions intended for export industries. EU regulations disqualify certain glycol-based solvents and flavor fixatives under natural labeling schemes. USA clean-label programs led by top retailers now flag emulsions containing BHA, propylene glycol, and certain co-solvents. In response, manufacturers are replacing these with glycerol or triacetin-based systems that meet “natural flavor” classification.

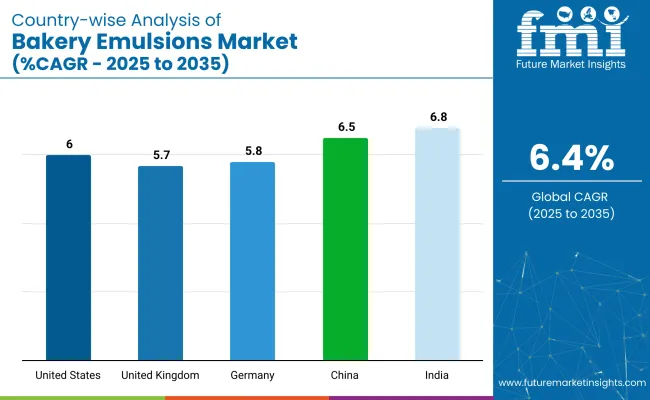

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6% |

| United Kingdom | 5.7% |

| Germany | 5.8% |

| China | 6.5% |

| India | 6.8% |

In the United States, the bakery emulsions market is growing at a 6.0% CAGR, with regulations like the Food Labeling Modernization Act pushing for clearer emulsifier labeling. The shift toward clean-label emulsifiers, such as lecithin and enzymatic alternatives, is encouraged by school-lunch nutrient profiles and FDA sodium reduction targets. Germany follows closely, expanding at 5.8% CAGR, with trans-fat regulations and the Reduction and Innovation Strategy driving demand for cleaner emulsions like enzyme-modified sunflower lecithin.

In BRICS, India’s market is rising at 6.8% CAGR, bolstered by FSSAI’s stricter additive limits and state-level support for enzyme-emulsion plants. China, growing at 6.5% CAGR, benefits from tariff exemptions and the “Healthy China 2030” blueprint, which incentivizes replacing synthetic emulsifiers with protein-polysaccharide complexes. In ASEAN, Indonesia and other regions see similar trends as domestic emulsifier production expands, reflecting global movements towards cleaner, more natural alternatives in bakery formulations.

The bakery emulsions market in the United States is forecast to advance at a CAGR of 6.0% from 2025 to 2035. Proposed Food Labeling Modernization rules are expected to mandate front-of-pack disclosure of mono- and diglycerides, accelerating reformulation toward enzymatic and lecithin-based alternatives.

FDA’s Voluntary Sodium Reduction targets push bakeries toward emulsions that improve dough rheology without chemical salts. State procurement contracts now award preference to clean-label emulsified mixes that meet school-lunch nutrient profiles.

The bakery emulsions market in the United Kingdom is projected to progress at a CAGR of 5.7% between 2025 and 2035. Retained EU Regulation 1333/2008 requires safety dossiers for every emulsifier, while the UK Nutrient Profiling Model pressures manufacturers to lower saturated fat. Innovate UK grants support trials of rapeseed-lecithin blends that replace palm-derived esters. Retailers enforce “no E-471 unless sustainably sourced” pledges, prompting investment in domestic enzyme-activated oil emulsions.

The bakery emulsions market in Germany is expected to grow at a CAGR of 5.8% from 2025 to 2035. Federal Reduction and Innovation Strategy incentives reward bakeries lowering additive emulsifiers by switching to enzyme-modified sunflower lecithin. EU Regulation 2019/649, restricting industrial trans fats, has eliminated hydrogenated monoglyceride blends, driving demand for clean emulsions. KfW low-interest loans finance continuous emulsification systems installed in midsize bread plants across North Rhine-Westphalia.

The bakery emulsions market in China is slated to expand at a CAGR of 6.5% between 2025 and 2035. National Standard GB 2760 classifies bakery emulsifiers as processing aids, demanding residue testing by provincial laboratories. Tariff exemptions through Hainan Free Trade Port reduce costs for enzyme-modified soy lecithin imports. The “Healthy China 2030” blueprint encourages bakeries to replace synthetic emulsifiers with protein-polysaccharide complexes, improving bread softness without extra fats.

The bakery emulsions market in India is projected to grow at a CAGR of 6.8% from 2025 to 2035. FSSAI’s 2022 Food Additive Amendment capped mono- and diglyceride inclusion, steering manufacturers toward rice-bran-based emulsions. Production-Linked Incentive (PLI) benefits for fermentation-derived additives support local enzyme emulsion plants. State Mega Food Parks provide subsidised steam and electricity for bakeries adopting in-house lecithin hydration systems, boosting regional self-sufficiency.

The bakery emulsions market is led by key players like Archer Daniels Midland Company (ADM), Cargill Inc., DuPont de Nemours, Inc., and Corbion N.V. ADM and Cargill focus on offering a broad range of emulsions that improve texture and extend shelf life, leveraging their vast distribution networks.

DuPont and Corbion focus on innovation in developing emulsions that cater to the growing demand for clean-label products. Kerry Group and Puratos Group use strategic partnerships to enhance their presence in the bakery sector by providing specialized emulsions for specific formulations. The industry remains moderately fragmented, with large players holding large shares, while smaller, niche companies continue to innovate and target specialized applications.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 460.5 million |

| Projected Market Value (2035) | USD 870.2 million |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| Source | Plant, Animal, Synthetic, Microbial, Egg-derived, Milk-based, Synthetic/Bio-based |

| Nature | Conventional, Organic |

| End-Use | Industrial, Household |

| Application | Bakery, Hotels, and Restaurants |

| Distribution Channel | Store-Based Retail, Specialty Stores, Online Retail, Supermarkets, Hypermarkets |

| Region | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Archer Daniels Midland Company (ADM), Cargill Inc., DuPont de Nemours, Inc., Corbion N.V., Kerry Group plc, Puratos Group, DSM-Firmenich, Palsgaard A/S, Lasenor Emul S.L., Bakels Group, Others |

| Additional Attributes | Dollar sales, CAGR trends, product type segmentation, regional growth patterns, competitor dollar sales & market share, price range segmentation, application-specific demand, distribution channel analysis |

The segmentation is into plant, animal, synthetic, microbial, egg-derived, milk-based, and synthetic/bio-based.

The segmentation is into conventional and organic.

The segmentation is into industrial and household.

The segmentation is into bakery, hotels, and restaurants.

The segmentation is into store-based retail, specialty stores, online retail, supermarkets, and hypermarkets.

The segmentation is into North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The projected valuation of the industry in 2025 is USD 460.5 million.

The forecast valuation of the industry by 2035 is USD 870.2 million.

The expected CAGR for the industry from 2025 to 2035 is 6.4%.

The industrial end-use segment will lead the bakery emulsions market in 2035, with a 65% share.

India is expected to experience the highest growth, with a 6.8% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Bakery Ingredient Market Trends – Growth, Demand & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA