The Global Bakery Mixes Market is moderately consolidated in nature with a combination of multinational titans, regional producers, and new-age niche brands. The multinational titan’s control 55% of the market share, utilizing massive production, established networks, and brand name. General Mills, ADM, Cargill, Associated British Foods, and Dawn Foods are among them.

Regional players acquire 25% of the market share through selling locally formulated bakery mixes specific to regional flavor palates and historical recipes. Industry players like Lesaffre Group (France), Puratos Group (Belgium), and ITC Limited (India) dominate both the B2B market and the retail space through specialty formulations.

Niche products and start-up players capture 15% of the market and emphasize organic, gluten-free, and functional ingredient blends. These companies, such as King Arthur Baking Company (USA) and BakeMark (USA), are expanding based on demand for artisan and health-oriented bakery items. While multinationals control mass-market sales, regional and niche players are pushing innovation, especially in clean-label, specialty, and dietary-specific bakery mixes.

| Market Structure | Top Multinationals |

|---|---|

| Industry Share % | 55% |

| Key Companies | General Mills, ADM, Cargill, Associated British Foods, Dawn Foods |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share % | 25% |

| Key Companies | Lesaffre Group, Puratos Group, ITC Limited, Kerry Group, Conagra Brands |

| Market Structure | Startups & Niche Brands |

|---|---|

| Industry Share % | 15% |

| Key Companies | King Arthur Baking Company, BakeMark, Europastry, Aryzta, Rebisco |

| Market Structure | Private Labels |

|---|---|

| Industry Share % | 5% |

| Key Companies | Walmart’s Great Value, Tesco’s Own Brand, Aldi’s Baker’s Corner |

The market tilts towards moderate consolidation, where multinational companies are leading but regional players and start-ups are building strong specialty niches.

Bread mixes account for the largest proportion (35%) of the bakery mixes market, fueled by strong global bread consumption among households, bakeries, and foodservice operators. Lesaffre, Puratos, and General Mills are among the top companies in this category with yeast-based, whole grain, and artisan bread mixes. Cake mixes (30%) are closely followed by convenience trends, led by Dawn Foods and Betty Crocker. Pastry and cookie mixes are picking up pace as there is increasing demand for premium bakery products and home baking trends. Specialty blends, like gluten-free and high-protein blends, are also growing, which mirrors changing consumer dietary habits.

Homes (40%) is the largest end-user category, which is increasing as home baking, do-it-yourself kits, and online activity through e-commerce expansion. Companies such as King Arthur Baking and Duncan Hines have driven direct-to-consumer (D2C) sales. Commercial bakeries (30%) use bulk ingredient mixes from ADM, Cargill, and Associated British Foods, taking advantage of their low-cost, high-volume production. Foodservice restaurants and retailers consume much of the ready-to-bake solutions, particularly in QSRs and supermarkets, which are dominated by Dawn Foods and Aryzta. Organic and clean-label bakery mix is on the rise across all markets as well.

The bakery mix industry experienced great developments in 2024, with business entities concentrating on innovation in products, clean-label formulation, sustainability, and retail collaborations. Businesses launched high-protein, gluten-free, and organically certified mixes, with the channels of wholesaling and D2C models growing. Pressure on sustainably sourced ingredients and retail collaborations defined the competitive landscape.

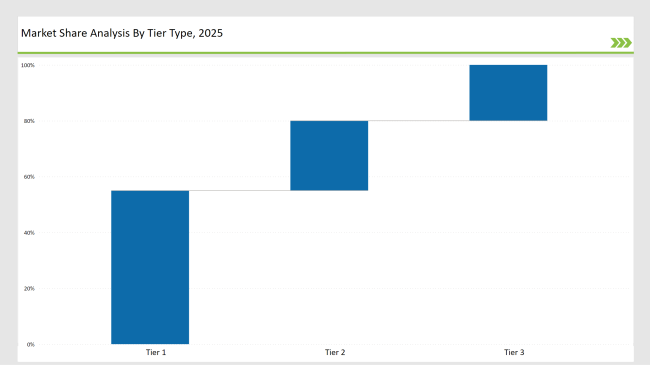

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | General Mills, ADM, Cargill, Associated British Foods, Dawn Foods |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Lesaffre Group, Puratos Group, ITC Limited, Kerry Group, Conagra Brands |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | King Arthur Baking, BakeMark, Aryzta, Europastry, Rebisco |

| Brand | Key Focus |

|---|---|

| General Mills | Invested in AI-driven demand forecasting to improve supply chain efficiency for its bakery mixes. |

| ADM | Expanded plant-based emulsifiers to enhance texture and moisture retention in bakery mixes. |

| Cargill | Developed alternative sweetener-based bakery mixes targeting the low-sugar and diabetic-friendly segment. |

| Associated British Foods | Opened a new bakery mix production facility in Eastern Europe to strengthen its distribution network. |

| Dawn Foods | Introduced customizable bakery mixes for artisanal bakeries, allowing flexibility in ingredient composition. |

| Puratos | Partnered with AI-based food trend analysis firms to develop innovative bakery mix flavors. |

| ITC Limited | Entered the Middle East market with bakery mixes tailored to traditional Middle Eastern flavors. |

| Kerry Group | Invested in fermented ingredient technology to improve the taste and shelf life of its bakery mixes. |

| King Arthur Baking | Launched a baking education initiative to promote DIY baking using its specialty mixes. |

| Aryzta | Expanded its ready-to-bake frozen bakery mix solutions to target airline catering and travel retail sectors. |

As shopping becomes more digitized, manufacturers will continue selling bakery blends over direct-to-consumer (D2C) platforms. King Arthur Baking and General Mills have already taken advantage of this trend by marketing exclusive baking kits online. Subscription-based models offering personalized, seasonal, or limited-batch bakery mixes will be responsible for customer engagement. Moreover, AI-based platforms will scan customers' baking habits and recommend personalized products. Brands need to invest in easy-to-use online platforms and mobile applications to facilitate convenient purchases. Digital advertising and social media partnerships with baker influencers will increase brand exposure and customer loyalty even more.

Increasing the need for speed and reliability of bakery solutions will make foodservice and QSR chains rely on pre-mixed bakery solutions. Dawn Foods and Aryzta are already supplying bespoke bakery mixes to large fast-food chains and coffee shops. Future developments will be frozen and shelf-stable bakery mixes enabling QSRs to simplify their operations. Further, collaborations with hotel chains, airlines, and food service companies will generate new business opportunities. Bulk packaging and low-cost formulations must be the emphasis of brands to capture food service sales. Ready-to-bake and thaw-and-serve technologies will also drive faster adoption of bakery mix in foodservice.

The market is moderately consolidated, with 55% controlled by multinational brands like General Mills, ADM, and Cargill. Regional and niche brands are growing, focusing on clean-label and functional bakery mixes.

Demand for gluten-free, high-protein, and plant-based mixes, D2C expansion, regional flavors, and sustainable ingredient sourcing are key growth drivers.

Sustainability is a major competitive factor. Companies are sourcing ethically produced ingredients, using biodegradable packaging, and optimizing production for minimal waste.

Companies are introducing functional ingredients, plant-based options, and regionally inspired flavors to cater to changing consumer preferences.

ADM, Puratos, Kerry Group, and ITC Limited are at the forefront of innovation, developing protein-enriched, gut-health-friendly, and clean-label bakery mixes.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA