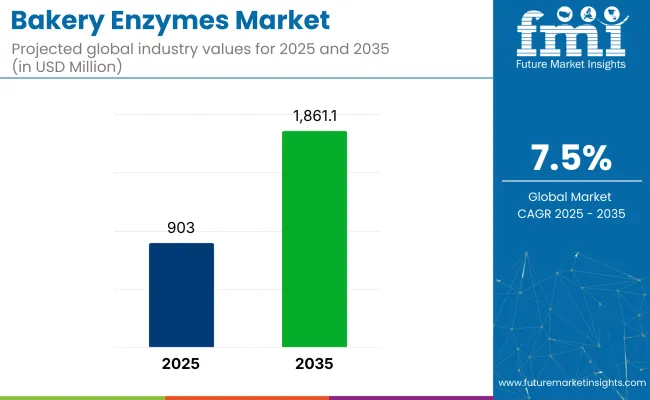

The bakery enzymes market is projected to grow from USD 903.0 million in 2025 to USD 1,861.1 million by 2035, registering a CAGR of 7.5% during the forecast period. Expansion is sustained by industrial demand for dependable dough conditioning, uniform rise, and longer ambient shelf life.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 903.0 million |

| Projected Global Value (2035F) | USD 1,861.1 million |

| Value-based CAGR (2025 to 2035) | 7.5% |

In the United States, commercial pan-bread producers raised enzyme inclusion by 28% between 2020 and 2024 to trim batch-to-batch variance and cut crumb staling claims. Pretzel and cookie facilities using inline liquid-dosing systems report a 9% reduction in mixed-dough waste.

Across Asia Pacific, millers and high-output bakeries are digitising fermentation control and starch-conversion profiles. China’s three largest instant-noodle bun plants installed cloud-linked carbohydrase stations in 2024, cutting proofing time by up to seven minutes per batch.

Regional enzyme sales surpassed USD 310 million in 2023, expanding at 11% CAGR as plant-based bakery categories scale. In Western Europe, clean-label mandates prompted multiphase lipase and protease usage to replace mono- and diglycerides; Austria’s cooperative mills showed a 12% fall in crumb-softener additives after switching to enzyme blends that meet the updated EU additives list.

Investment confidence is visible in new R&D hubs. Novozymes opened a precision-fermentation pilot in North Carolina in early 2025, targeting rapid strain development for high-temperature dough lines. Meanwhile, India’s Advanced Enzyme Technologies launched a cloud-monitored fermentation tank cluster, boosting output flexibility for regional sachet packers.

Liquid formulations now account for nearly half of global shipments as automated metering valves standardise activity per kilo of flour. Constant launches and development keeps the industry active. In October 2024, AB Enzymes launched VERON® POLARUM, an enzyme solution tailored for strengthening butter-containing bakery applications. This addition to their VERON® range is designed to enhance the quality and consistency of butter-rich products.

The bakery enzymes market holds a specific share within its parent markets. In the food enzyme market, it holds around 12-15%, as enzymes used in baking are a significant segment within the broader enzyme category. Within the baking ingredients market, the share is approximately 10-12%, driven by the role of enzymes in improving dough and bread quality.

The food and beverage market contributes about 3-5%, and enzymes are mostly applied in bakery products. The food processing market sees a share of 6-8%, as enzymes improve the processing efficiency and product quality in bakery production. The functional foods market holds a smaller share of 2-3%, with enzymes often included in health-focused bakery products.

Bakery enzyme demand in 2025 is anchored by carbohydrase formulations, bread applications, liquid enzyme delivery, and microbial production methods. Investment decisions are shaped by production efficiency, label compliance, dough processing tolerance, and moisture retention in mass bakery formats.

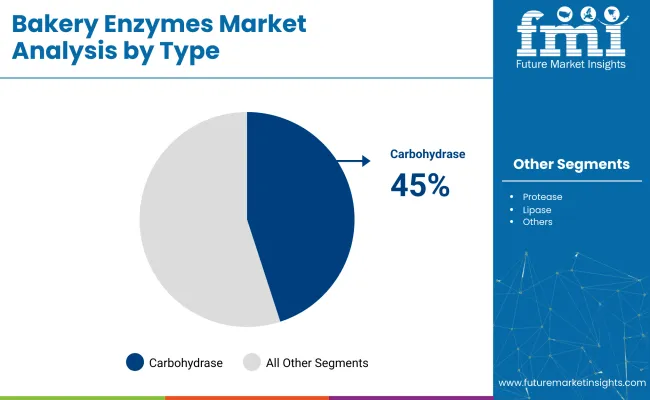

A 45% share has been accounted for by carbohydrase in 2025, driven by its role in enhancing dough extensibility, texture consistency, and crumb softness over time. These enzymes are important in industrial setups focused on high-speed production and reduced staling rates.

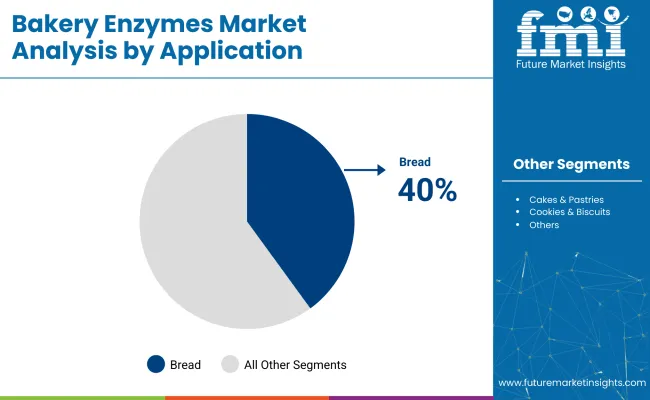

A 40% share has been held by bread applications in 2025, owing to their requirement for precise shelf-life extension, shape retention, and oven spring in fast-cycle commercial baking environments. Enzymes replace traditional improvers, enabling simpler labelling and better crumb texture.

The liquid form hold 37% share In 2025. Liquid enzymes have a good flow control, minimal dust risk, and can be integrated into automated metering systems in industrial bakeries. Their use enables consistent dispersion during scaling and minor ingredient addition stages.

A dominant share of 42% has been held by microbial enzyme sources, reflecting industry preference for label transparency, dietary compatibility, and predictable production yields through fermentation. These enzymes support non-allergenic, animal-free, and scalable formulations used in all bakery segments.

Tighter acrylamide thresholds and stricter clean-label scrutiny are shifting bakery enzyme applications. Procurement and R&D teams are prioritizing functional blends that meet both regulatory compliance and front-label acceptance in export regions.

Acrylamide Controls Propel Precision Enzyme Adoption

Revisions to acrylamide benchmarks under EU Regulation 2017/2158 have pushed bakeries to adopt targeted enzyme strategies. Asparaginase and glucose oxidase are being introduced to reduce free asparagine and lower bake temperatures. Procurement teams now require batch-level acrylamide testing before shipment. Mills lacking enzyme integration face rejection from EU-bound contracts. Pressure is rising to replace legacy processing aids with enzymatic alternatives that deliver equivalent output while meeting compliance documentation.

Clean-label Claims Driving Functional Enzyme Formulations

Retailers in the USA, EU, and Japan are phasing out tolerance for chemical conditioners. Functional enzymes-lipase, maltogenic amylase, hemicellulase-are being preferred for softness and volume control. “No E-number” policies in private-label contracts are forcing formulators to replace DATEM and mono-diglycerides. Enzyme suppliers are now offering custom blends that allow clean-label declarations without compromising performance. Frozen dough exporters are adopting these blends to meet buyer scorecards linked to label transparency.

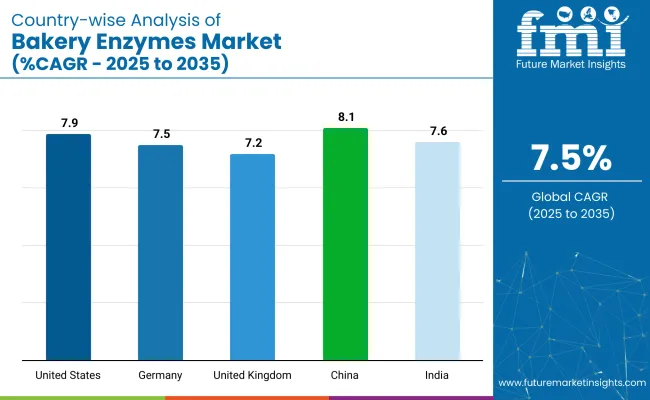

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

| Germany | 7.5% |

| United Kingdom | 7.2% |

| China | 8.1% |

| India | 7.6% |

In the United States, the bakery enzymes market is on track to grow at 7.9% CAGR, driven by FDA regulations and FSMA audits promoting enzyme-driven conditioners over chemical emulsifiers. State-level grants are accelerating enzyme adoption, especially in Illinois and Kansas, where bakeries are upgrading dough-processing lines.

Germany, growing at 7.5% CAGR, is seeing a shift toward enzyme-based solutions as part of the national strategy to reduce additives. The KfW Program is supporting local enzyme production, reducing dependency on imports and promoting high-purity granulated enzymes.

In ASEAN, India is expected to grow at 7.6% CAGR, fueled by FSSAI's additive amendments and PLI incentives, driving local enzyme manufacturing. China, within BRICS, is investing in microbial enzyme imports through Hainan Free Trade Port and offering subsidies for bakeries switching from chemical oxidizers. Enzyme adoption is gaining traction across all regions, with domestic production and clean-label requirements guiding reformulations and driving innovation in bakery formulations.

The report covers in-depth analysis of 40+ countries. The top five countries have been shared as a reference.

The bakery enzymes market in the United States is projected to advance at a CAGR of 7.9% from 2025 to 2035. FDA’s Food Enzyme Review Program demands pre-market evaluation of every amylase, protease, or xylanase deployed in bread. FSMA preventive-control audits encourage bakeries to replace chemical emulsifiers with enzyme-driven conditioners. Illinois and Kansas rebate equipment costs for plants installing enzymatic dough-processing lines.

The bakery enzymes market in Germany is projected to rise at a CAGR of 7.5% from 2025 to 2035. EU Regulation 1332/2008, implemented by the Federal Office of Consumer Protection, demands dossier approval before any bakery enzyme use. The national Reduction and Innovation Strategy incentivises bakers to cut additive emulsifiers, fuelling demand for combined amylase-xylanase solutions. KfW loans finance domestic microbial fermentation capacity.

The bakery enzymes market in the United Kingdom is forecast to grow at a CAGR of 7.2% from 2025 to 2035. Retained EU Regulation 1332/2008, enforced by the Food Standards Agency through the Regulated Products portal, requires safety dossiers before enzyme use. Innovate UK Transforming Food Production grants support thermostable amylase pilots lowering oven temperatures. DEFRA’s acrylamide code urges asparaginase adoption across large-scale bakeries.

The bakery enzymes market in China is predicted to climb at a CAGR of 8.1% from 2025 to 2035. National Standard GB 2760 treats enzymes as processing aids, requiring toxicity dossiers with the National Health Commission. Tariff cuts on microbial enzyme imports via Hainan Free Trade Port bolster supply. Provincial subsidies under the ‘Staple Food Diversification’ plan reward bakeries replacing chemical oxidisers with glucose-oxidase.

The bakery enzymes market in India is expected to register a CAGR of 7.6% from 2025 to 2035. FSSAI’s 2021 additive amendment set maximum residual limits for amylase and xylanase, prompting certified clean-label adoption. The Production-Linked Incentive scheme for fermentation-based biomanufacturing offers cashbacks on enzyme output. State Mega Food Parks in Maharashtra and Gujarat provide subsidised utilities for bakeries installing inline enzyme dispensers.

The bakery enzymes market is dominated by companies like Novozymes A/S, DSM, and DuPont, which lead through continuous innovation and extensive product portfolios. Novozymes A/S focuses on enzyme solutions that enhance dough processing and improve product quality, while DSM and DuPont leverage their strong R&D to offer diverse enzyme applications, from improving texture to increasing shelf life.

Kerry Group targets growth through regional partnerships and by providing tailored enzyme solutions. Smaller players such as AB Enzymes and Advanced Enzyme Technologies focus on specific market niches. The market is moderately fragmented, with global leaders maintaining a strong hold, but numerous regional and specialized companies offering innovative solutions to cater to varied consumer demands.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 903.0 million |

| Projected Market Value (2035) | USD 1,861.1 million |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| Type | Carbohydrase, Protease, Lipase, Others |

| Application | Bread, Cakes & Pastries, Cookies & Biscuits, Others |

| Form | Powder, Liquid |

| Source | Microbial, Plant, Animal |

| Region | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Novozymes A/S, DSM, DuPont, Kerry Group, AB Enzymes, Puratos Group, Advanced Enzyme Technologies, Amano Enzyme Inc., Chr. Hansen, Royal DSM, Others |

| Additional Attributes | Dollar sales, CAGR trends, type distribution, price range segmentation, competitor dollar sales & market share, regional growth patterns, consumer preferences, sales channel analysis |

The segmentation is into carbohydrase, protease, lipase, and others.

The segmentation is into bread, cakes & pastries, cookies & biscuits, and others.

The segmentation is into powder and liquid.

The segmentation is into microbial, plant, and animal.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The projected market value of the bakery enzymes market in 2025 is USD 903.0 million.

The forecast market value of the bakery enzymes market by 2035 is USD 1,861.1 million.

The expected CAGR for the bakery enzymes market from 2025 to 2035 is 7.5%.

The carbohydrase segment will lead the bakery enzymes market in 2035, with a 45% market share.

China is expected to experience the highest growth with an 8.1% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Bakery Ingredient Market Trends – Growth, Demand & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA