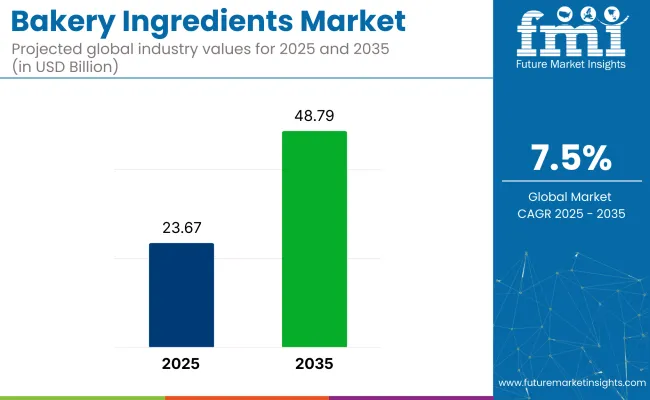

The global bakery ingredients market is estimated to reach a value of USD 23.67 billion by 2025, and it is projected to more than double, hitting USD 48.79 billion by 2035.This market is expected to grow at a CAGR of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 23.67 billion |

| Market Value (2035F) | USD 48.79 billion |

| CAGR (2025 to 2035) | 7.3% |

This substantial growth underscores the increasing demand for diverse and innovative bakery products worldwide, driven by shifting consumer preferences toward healthier, functional, and more sustainable ingredients.

The market represents an estimated 8-10% of the global food ingredients market, valued above USD 400 billion. Within the processed food market, exceeding USD 4 trillion, its share is comparatively modest at less than 1%, as it contributes to a specific product category. In the functional ingredients market, bakery ingredients account for approximately 10-12%, given the frequent use of emulsifiers, enzymes, and leavening agents in baked goods.

In the broader baking industry, bakery ingredients represent about 25-30% of the value chain, reflecting their essential role in formulation and product quality. Within the convenience foods market, the share is estimated at around 4-6%, with rising demand for ready-to-eat and pre-mix bakery solutions contributing to moderate expansion.

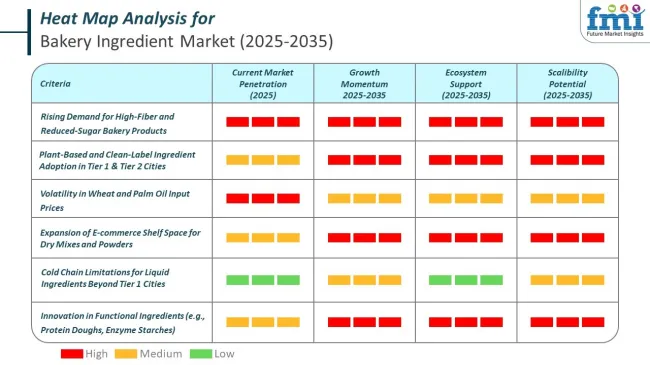

One of the primary driving factors behind the rapid growth of the market is the ongoing demand for innovative and healthier alternatives. Consumers are increasingly seeking out gluten-free, organic, low-calorie, and clean-label bakery products, leading to a surge in demand for ingredients that cater to these preferences.

As awareness of dietary restrictions such as gluten intolerance, diabetes, and obesity rises, the demand for ingredients that offer functional and nutritional benefits continues to climb. This shift has encouraged ingredient suppliers to innovate and introduce new products that are not only healthier but also deliver improved taste and texture, ensuring that bakery goods remain appealing to a wide range of consumers. As of December 2023, 23 USA states reported an adult obesity prevalence at or above 35%, according to CDC.

Market expansion is being supported by the increasing global consumption of baked goods and growing consumer preference for healthier, functional ingredients in bakery products. Modern consumers are seeking products with enhanced nutritional profiles including high protein, fiber-enriched, and low-sugar formulations. The shift toward clean-label ingredients and organic formulations is driving innovation among ingredient suppliers who are developing natural alternatives to synthetic additives and preservatives.

The growing complexity of bakery product formulations and increasing demand for extended shelf-life solutions are creating opportunities for specialized ingredient suppliers. Commercial bakeries require consistent, high-performance ingredients that can maintain quality standards across large-scale production while meeting diverse consumer preferences. Technological advancements in enzyme applications, emulsifier systems, and natural preservation methods are enabling bakers to create products that meet both functional and nutritional requirements.

The market is segmented by form, ingredient type, application, and region. By form, the market is divided into dry and liquid. By ingredient type, the market is categorized into fiber, emulsifiers, enzymes, starches, oils/fats/shortenings, baking powder and mixes, preservatives, colors and flavors, and leavening agents. By application, the market is segmented into foodservice industry (bread, cookies and biscuits, rolls and pies), cakes and pastries, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia and Pacific, Latin America, and Middle East & Africa.

The bakery ingredients market is advancing steadily due to increasing health consciousness among consumers and growing demand for convenient food options. However, the market faces challenges including volatile raw material prices, complex regulatory requirements for food additives, and the need for continuous innovation to meet evolving consumer preferences. Supply chain disruptions and sustainability concerns continue to influence ingredient sourcing strategies and product development priorities.

Growing Demand for Healthier Bakery Products

The increasing consumer shift toward healthier alternatives is driving significant growth in functional and nutritionally enhanced bakery ingredients. Consumers are seeking products with reduced sugar, increased fiber, added protein, and clean-label formulations that avoid artificial additives. This trend is creating opportunities for ingredient suppliers to develop natural sweetener systems, plant-based protein additions, and organic ingredient alternatives that maintain product quality while meeting health-conscious consumer demands.

Advancements in Baking Technology and Automation

Modern bakery operations are adopting advanced processing technologies and automated systems that require specialized ingredients optimized for high-speed production. Ingredient suppliers are developing formulations that perform consistently under automated mixing, shaping, and baking processes while maintaining product quality and reducing waste. Integration of digital monitoring systems enables precise ingredient dosing and quality control throughout production cycles.

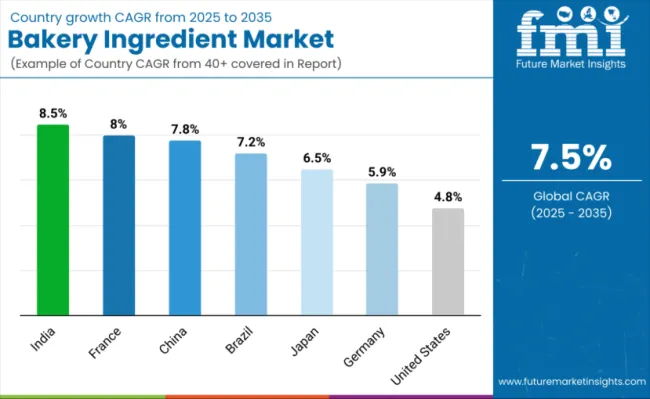

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

| France | 8.0% |

| China | 7.8% |

| Brazil | 7.2% |

| Japan | 6.5% |

| Germany | 5.9% |

| United States | 4.8% |

The bakery ingredients market demonstrates varied growth patterns across key markets, with India leading at 8.5% CAGR through 2035, driven by rapid urbanization, changing dietary patterns, and increasing adoption of Western-style baked goods. France records 8.0% growth, emphasizing artisanal and organic ingredient innovation while maintaining traditional bakery excellence. China follows at 7.8%, supported by expanding middle-class consumption and growing interest in premium bakery products. Brazil demonstrates strong potential at 7.2%, benefiting from evolving food habits and expanding retail infrastructure. Japan grows at 6.5%, focusing on functional and health-oriented ingredients for aging demographics. Germany maintains steady development at 5.9%, leveraging advanced manufacturing capabilities and quality standards. The United States shows 4.8% growth, driven by clean-label trends and specialty product development in mature markets.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from bakery ingredients in India is projected to exhibit the highest growth rate with a CAGR of 8.5%, driven by accelerating urbanization and changing food consumption patterns among growing middle-class populations. The country's expanding retail infrastructure and increasing penetration of organized bakery chains are creating significant demand for standardized, high-quality ingredients. Modern trade channels and e-commerce platforms are facilitating access to imported and specialty ingredients that support both traditional and Western-style bakery products.

Demand for bakery ingredients in France is projected to grow at a CAGR of 8.0%, supported by the country's strong traditional bakery culture and increasing consumer demand for organic and artisanal products. French bakeries are adopting innovative ingredient solutions that enhance traditional formulations while meeting modern consumer preferences for health-conscious and sustainable products. The market benefits from established supply chains and sophisticated ingredient technologies developed by local and international suppliers.

Revenue from bakery ingredients in China is projected to expand at a CAGR of 7.8%, supported by continued urbanization and evolving breakfast consumption habits that increasingly include Western-style baked goods. The country's large-scale industrial bakery operations and expanding retail networks are creating substantial demand for both traditional and innovative ingredient solutions. International bakery brands and domestic manufacturers are investing in production capacity and distribution infrastructure to serve growing consumer demand.

Revenue from bakery ingredients in Brazil is expanding at a CAGR of 7.2%, driven by evolving food consumption patterns and expanding organized retail infrastructure that supports modern bakery operations. The country's growing middle class and increasing urbanization are creating demand for convenient, quality bakery products that require sophisticated ingredient solutions. Traditional padarias are modernizing operations while new bakery chains establish presence in urban markets, creating opportunities for both traditional and innovative ingredient suppliers.

Revenue from bakery ingredients in Japan is projected to grow at a CAGR of 6.5%, driven by aging demographics and increasing demand for health-oriented bakery products with functional benefits. Japanese consumers are seeking products enhanced with nutrients, probiotics, and other health-promoting ingredients that support active lifestyles and wellness goals. The market is characterized by sophisticated ingredient technologies and precise formulations that meet stringent quality standards.

Demand for bakery ingredients in Germany is projected to expand at a CAGR of 5.9%, supported by the country's established industrial baking sector and sophisticated ingredient supply networks. German manufacturers emphasize quality standards and technical innovation that support both traditional and modern bakery applications. The market benefits from advanced research and development capabilities and close collaboration between ingredient suppliers and bakery operations. Consumer preference for organic and sustainable products is driving innovation in clean-label formulations and environmentally responsible ingredient sourcing practices.

Demand for bakery ingredients in the United States is projected to expand at a CAGR of 4.8%, driven by increasing consumer preference for clean-label products and transparency in ingredient sourcing. American consumers are seeking bakery products made with recognizable, natural ingredients that avoid artificial additives and preservatives. This trend is creating opportunities for ingredient suppliers to develop plant-based alternatives and organic formulations that maintain product functionality and shelf-life.

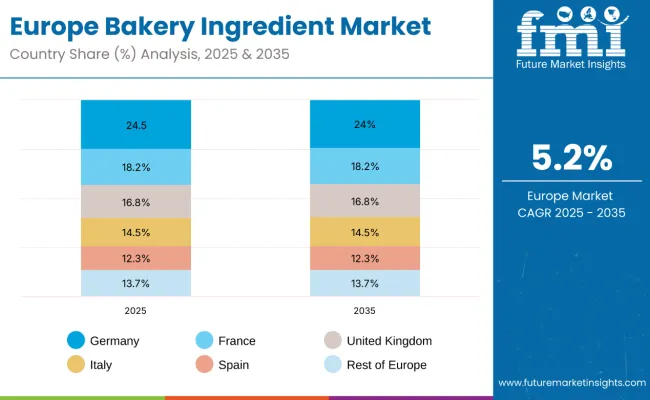

The bakery ingredient market in Europe is projected to grow steadily at a CAGR of 5.2% from 2025 to 2035. Germany is expected to maintain its leadership position with a 24.5% market share in 2025, moderating slightly to 24.0% by 2035, supported by its strong bakery manufacturing base and established artisanal traditions. France follows with an 18.2% share, remaining stable through 2035, driven by premium bakery consumption and clean-label ingredient adoption. The United Kingdom holds a 16.8% share in 2025, unchanged by 2035, reflecting resilient demand for baked goods despite market maturity. Italy accounts for 14.5%, underpinned by its heritage bakery sector, while Spain captures 12.3%. The Rest of Europe represents 13.7% of the market, with steady contribution expected through 2035, supported by growing industrial bakery penetration in Nordic and Eastern European countries.

The United States has an annual supply of about 60 kilograms of wheat flour per person, supported by 30 kilograms of sugar and caloric sweeteners and 35 kilograms of vegetable oils. Egg availability averages 280 per person per year, while dry yeast use, concentrated in home and retail baking, is roughly 64 grams per capita. These figures show a balanced but yeast‑leaning bakery profile compared with other regions.

Germany supplies about 65 kilograms of flour per person each year, alongside 30 kilograms of sugar and a lower 25 kilograms of vegetable oils. Egg availability stands at 230 per person annually, with dry yeast consumption estimated at 110 grams per capita. The numbers reflect a bread‑heavy culture, though industrial bakeries rely primarily on fresh yeast.

Japan’s population has access to about 32 kilograms of flour and 20 kilograms of sugar per person each year, paired with 27 kilograms of vegetable oils. Egg supply is the highest among these markets at 330 per person annually, while dry yeast consumption averages 40 grams per capita. These figures indicate lighter flour reliance but greater emphasis on eggs and steady yeast use.

The bakery ingredients market is characterized by competition among multinational ingredient suppliers, specialized technology providers, and regional manufacturers. Companies are investing in research and development, sustainable sourcing practices, clean-label formulations, and technical support services to deliver innovative, cost-effective, and environmentally responsible ingredient solutions. Strategic partnerships, acquisitions, and geographic expansion are central to strengthening product portfolios and market presence.

Cargill Inc., United States, provides comprehensive ingredient solutions with focus on sustainable sourcing, functional performance, and technical innovation across global markets. DuPont De Nemours and Company, United States, offers advanced enzyme technologies and specialized ingredient systems for commercial bakery applications. Archer Daniel Midland, United States, delivers integrated ingredient solutions combining traditional and innovative formulations for diverse bakery requirements.

Ingredion Inc., United States, emphasizes plant-based ingredients and clean-label solutions that meet evolving consumer preferences. Tate & Lyle PLC, United Kingdom, focuses on sweetener systems and texture solutions that enable sugar reduction without compromising taste or functionality. DSM N.V., Netherlands, provides enzyme technologies and nutritional ingredients that enhance product quality and health benefits.

Associated British Foods, United Kingdom, offers comprehensive ingredient portfolios supporting both commercial and specialty bakery applications. Corbion N.V., Netherlands, specializes in natural preservation systems and sustainable ingredient solutions. Novozymes N.V., Denmark, delivers advanced enzyme technologies that improve processing efficiency and product quality. Puratos Group N.V., Belgium, provides specialized ingredients and technical expertise for artisanal and industrial bakery operations.

The bakery ingredients market lies at the convergence of urbanization-driven consumption, rising health-consciousness, and innovation in functional/clean-label formulations. Growth is fueled by demand for convenience foods, premium artisanal bakery products, and fortified or allergen-free alternatives. The market’s scalability depends on synergy across governments, industry associations, manufacturers/OEMs, suppliers, and financial investors. Together, they can transform bakery ingredients into a cornerstone of global food security, nutrition, and indulgence.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 23.67 billion |

| Projected Market Size (2035) | USD 48.79 billion |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in kilo tons |

| Form Analyzed (Segment 1) | Dry and Liquid. |

| Ingredient Type Analyzed (Segment 2) | Fiber, Emulsifiers, Enzymes, Starches, Oils, Fats, And Shortenings, Baking Powder And Mixes, Preservatives, Colors And Flavors, And Leavening Agents. |

| Applications Analyzed (Segment 3) | Foodservice Industry (Bread, Cookies And Biscuits, Rolls And Pies), Cakes And Pastries, And Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill Inc., DuPont De Nemours and Company, Archer Daniel Midland, Ingredion Inc., Tate & Lyle PLC, DSM N.V., Associated British Foods, Corbion N.V., Novozymes N.V., Puratos Group N.V., and other market players. |

| Additional Attributes | Dollar sales, market share, growth trends, consumer preferences, competitive landscape, emerging ingredients, and regional demand variations to make informed business decisions. |

The industry is valued at USD 23.67 billion in 2025.

It is forecasted to reach USD 48.79 billion by 2035.

The industry is anticipated to grow at a CAGR of 7.5% during this period.

Dry form is projected to lead the market with a 65% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 8.5%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Bakery Ingredient Market Trends – Growth, Demand & Forecast 2025–2035

Europe Bakery Mixes Market Report – Growth, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA