The USA Bakery Ingredients Market is projected to reach USD 5,491.4 million in 2025, growing at a CAGR of 12.6% over the next decade to an estimated value of USD 17,991.6 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Size in 2025 | USD 5,491.4 Million |

| Projected Value in 2035 | USD 17,991.6 Million |

| Value-based CAGR from 2025 to 2035 | 12.6% |

The USA bakery ingredients market continues to expand rapidly because consumers seek advanced baked products of premium quality. The consumer movement toward wholesome alternatives has created a strong market demand for ingredients that use natural components along with whole grains and monopoly sweeteners. The changing consumer food preferences force manufacturers to develop new product formulations for their products.

Rose in demand directs key ingredients including flour, sweeteners, fats, and emulsifiers especially because special techniques and baked product models are becoming more sought after. The changing market dynamics for gluten-free and plant-based products have stimulated manufacturers to create new flour varieties and creative binding agents suitable for these dietary patterns.

The bakery industry grows due to innovative food technology that helps bakers improve their products with enhanced characteristics longer shelf stability and improved textures. Suppliers have started adopting sustainable practices because of rising environmental concerns by conducting responsible ingredient sourcing and waste reduction.

The market encounters two main difficulties including unpredictable material price shifts and interruptions throughout supply chains. Market growth in the USA bakery ingredients sector keeps expanding because of technological innovation and health-oriented market patterns together with sustainable production commitment.

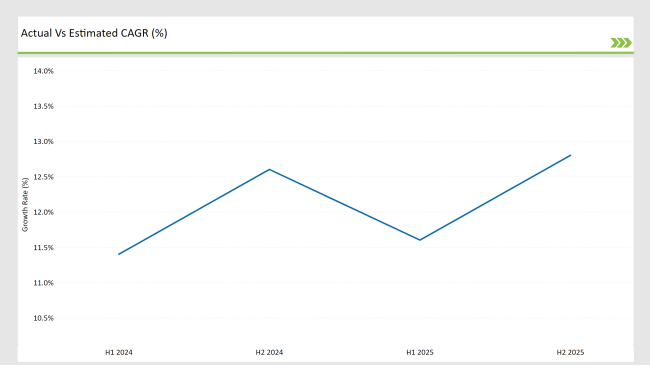

The USA Bakery Ingredients Market shows important changes between the first and second half of 2024. The consumer interest in specific dietary needs including alternative sweeteners along with specialty flours for gluten-free and high-protein consumption increased in H1 because of both health-oriented demands and government policies supporting natural ingredients.

The market transitioned in H2 to focus on functional formulations with clean-label products along with sustainable sourcing of ingredients. Mergers combined with acquisitions created new product innovation which increased alongside enzyme and emulsifier advancements that enhanced both product texture and shelf life as the market reacted to changing consumer needs.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 20 24 | FDA B ans Red Dye No. 3 - The FDA prohibited Red Dye No. 3 in food and drinks, citing health risks, requiring reformulations by 2027. |

| March 20 24 | Bimbo Bakeries vs. FDA on Sesame Labeling - Bimbo Bakeries challenged the FDA’s sesame allergen labeling requirements, arguing their strategy protects allergic consumers. |

| May 2024 | King Arthur Baking’s "Baking Pitchfest " Initiative - King Arthur Baking launched a contest to support POC-owned bakeries, providing mentorship and funding. |

| June 2024 | Tate & Lyle Acquires CP Kelco - Tate & Lyle purchased CP Kelco for $1.8 billion to expand its natural ingredients portfolio, focusing on healthier food products. |

| July 2024 | Dominique Ansel Introduces French Pastry Flour - Partnering with Grands Moulins de Paris, Dominique Ansel launched a high-quality French pastry flour in the USA |

Surge in Alternative Sweeteners and Clean Label Ingredients

USA bakery ingredients market is witnessing a paradigm shift towards alternative sweeteners and clean-label formulations as customers prefer healthier baked goods instilling demand for healthy alternatives in their diet. Now, the fruits of nature and low-glycemic alternatives, such as allulose, monk fruit extract, and coconut sugar, are the competitive ones with refined sugars.

However, this progress is not without some setbacks as a part of the population is still using the sugar taste they have been used to. The time involved in this transformation might be long, yet it is marking consent the purchase of awareness in the public on health and nutrition.

To meet newly established consumer preferences, Cargill and ADM are pioneering sugar replacements in becoming the major players in that reduced-sugar bakery products sector. The other trend, the clean label trend, which is the main reason for the abandonment of products containing artificial preservatives, emulsifiers, and stabilizers, is expected to result in the use of natural enzyme-based dough conditioners and plant-derived emulsifiers to a greater extent.

Expansion of Functional and Protein-Enriched Bakery Ingredients

USA Bakery is making its mark as one of the ambers and the focus is on protein-enriched and gut-health-enriched bakery ingredients. A huge jump as well as in high-protein diets and keto-friendly baked goods will be the likeliness and the growth of manufacturers of bakery plant products, who develop new ones.

Manufacturers in the field, including Puratos and Kerry Group, are instead turning their attention to pea, chickpea, and lentil flour-based plant protein blends, to reap the maximum rewards from the ascendant plant protein sector. Even bakery applications are now using ingredients that have gastrointestinal benefits, such as inulin and resistant starch, high in dietary fiber.

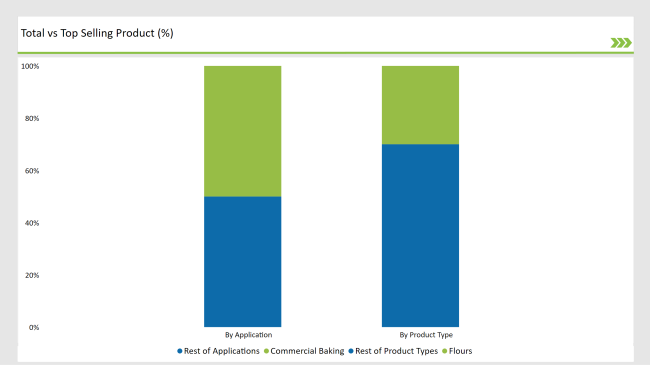

% share of Individual categories by Product Types and Applicationin 2025

The USA bakery ingredients market shows flour as the leading category which will maintain a 30% market share by 2025 because consumers expand their preference for specialty and different flour types. Whole wheat flour occupies 40% of the flour segment whereas it represents the biggest subsegment because it continues to grow as clean-label and high-fiber baked goods gain popularity.

Consumers choose whole wheat flour instead of refined flour because it gives them the advantage of essential micronutrients with higher fiber content. Green whole wheat flour totals 40% of the flour segment and King Arthur Baking and Bob's Red Mill plan to expand their production due to higher consumer demand from health-focused individuals together with artisan bakers.

Multiple flour alternatives such as almond flour together with coconut and chickpea flour have gained preference due to gluten-free and low-carb dietary changes. Suppliers shift their focus towards expanding premium flour options because customers increasingly choose non-GMO and organic flour products in the market.

The USA bakery ingredients market proposes that its market comes from commercial baking operations which enjoy increasing demand from bakeries alongside cafés and quick-service restaurants (QSRs). Bread production stands as the biggest segment (45%) within commercial baking because consumers demand healthier alternatives of sourdough bread and whole grain and high-protein varieties.

Panera Bread together with specialty bakeries utilizes clean-label and preservative-free formulations because consumers desire these ingredients. The market trend for artisan bread and functional products triggered manufacturers to start using ancient grains and sprouted flours which contain protein and high fiber content in their products.

Plant-based and gluten-free bakery products have gained substantial popularity in commercial baking environments which has caused ingredient suppliers to launch new solution offerings. The QSR expansion combined with food service bakeries along with higher attention towards sustainability and organic ingredients will keep commercial baking dominant in the market.

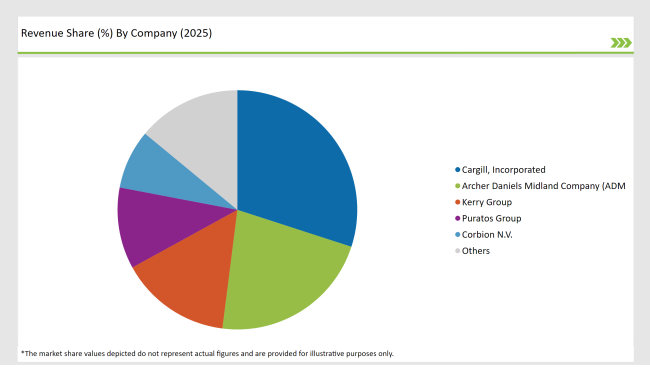

2025 Market share of USA Bakery Ingredients Market suppliers

Note: above chart is indicative in nature

Tier 1 multinational corporations join mid-sized companies operating at Tier 2 and emerging firms at Tier 3 to form the moderate concentration profile in the USA bakery ingredients market sector. Cargill together with Archer Daniels Midland (ADM) Kerry Group and Corbion lead the market through their broad ingredient ranges and world-class supply systems and innovation research labs. The companies implement a strategy to offer clean-label plant-based ingredients and functional additives that align with consumer preferences in evolution.

Tier 2 companies Puratos USA and Dawn Foods together with Lallemand Inc. control major segments of specialty baking ingredients which include enzyme emulsifiers and organic sweeteners. The company provides custom-developed ingredients suitable for commercial and boutique bakery operations.

The specialty bakery ingredients business is handled by Tier 3 firms Bob’s Red Mill along with King Arthur Baking and Hain Celestial through their provision of gluten-free, organic, and high-protein flours. Consumer interest has increased due to people adopting home baking and demanding clean-label products in the market. Companies must keep innovating their products due to active competition increasing M&A activities private label expansion and regulatory changes.

The USA Bakery Ingredients Market is segmented by product type into Flours, Sweeteners, Leavening Agents, Fats and Oils, and Others.

By application, the market is categorized into Commercial Baking, Home Baking and Industrial Baking

The market is projected to reach USD 17,991.6 Million.

The market is expected to grow at 12.6%CAGR.

Commercial baking is anticipated to be the fastest-growing segment due to increasing consumer preference for healthier, fortified, and functional bakery products in food service and retail.

Growth is driven by rising demand for alternative sweeteners, clean-label ingredients, gluten-free flours, functional bakery products, and regulatory changes favoring natural formulations.

Leading players include Cargill, Archer Daniels Midland (ADM), Kerry Group, General Mills, and Lesaffre, which collectively hold a significant market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA