The USA Fish Protein market is expected to reach USD 161.3 million in 2025 and is projected to experience a steady year-over-year growth to reach a total value of USD 327.7 million by 2035. This represents a compound annual growth rate (CAGR) of 7.3% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 161.3 million |

| Projected USA Value in 2035 | USD 327.7 million |

| Value-based CAGR from 2025 to 2035 | 7.3% |

The USA Fish Protein market has huge growth prospects, driven by the rising awareness of healthy quality protein from sustainable sources among consumers. The growth of the market is further catalyzed by the shifting trend for clean-label and natural ingredients across food and beverages, dietary supplements, and cosmetics.

Main drivers would be the desire for healthy lifestyles and an aging population seeking functional nutrition. Also, fish protein inclusion in new foodstuffs, such as protein-enriched snacks and health-based beverages, accelerates growth in this direction.

Improved technologies in fish protein extraction and processing allow for better product quality, expanding the scope of application, and reducing costs. Hydrolysis, for example, and more recent filtration systems improve the yield to high-purity protein, ensuring that products better fit niche markets such as medical nutrition and high-end cosmetics. The market is moderately consolidated; the top firms invest heavily in research and development with a view toward innovative and sustainable solutions.

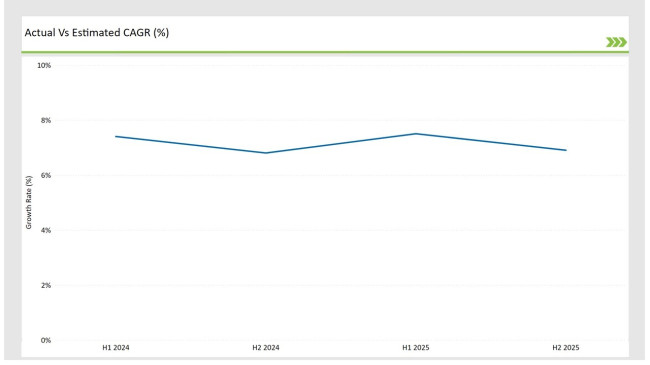

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the USA Fish Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Half-Year | 2023 |

|---|---|

| H1 Growth Rate (%) | 7.4% |

| H2 Growth Rate (%) | 6.8% |

| Half-Year | 2023 |

|---|---|

| H1 Growth Rate (%) | 7.4% |

| H2 Growth Rate (%) | 6.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the USA market, the natural food colors sector is predicted to grow at a CAGR of 7.4% during the first half of 2023, with an increase to 6.8% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 7.5% in H1 but is expected to rise to 6.9% in H2.

These figures illustrate the dynamic nature of the USA Fish Protein market, driven by increasing demand for natural protein solutions and innovation in product applications. This semi-annual breakdown is critical for businesses planning their strategies to capitalize on anticipated growth.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Omega Protein Corporation launched a premium fish protein hydrolysate targeting the high-performance sports nutrition market, emphasizing superior bioavailability and sustainability. |

| 2024 | TripleNine North Atlantic expanded operations with a state-of-the-art sustainable fish processing plant, focusing on waste minimization and efficiency. |

| 2024 | Nissui Corporation announced a strategic partnership with major USA retailers to enhance its distribution network and boost market accessibility for its fish protein products. |

| 2024 | Scanbio Marine Group acquired a smaller fish protein firm, broadening its portfolio to include specialty proteins designed for medical nutrition and pet food applications. |

| 2024 | Biomega AS developed an innovative enzymatic extraction technology for producing high-purity protein tailored for dietary supplements and clinical applications. |

Technological Innovations in Collagen Processing

Advanced biotechnology has revolutionized the fish protein production industry. With enzymatic hydrolysis, fermentation, and membrane separation, companies in the business will increase yield, purity, and functionality of fish protein for production. For instance, Biomega AS will be able to get more high-purity proteins that could easily be used in medical and clinical applications.

It's also backed up by government policy and funding focusing on sustainable, green, and more environmentally friendly business practices in the United States. Finally, these trends match growing customer needs for premium protein products that are natural and as little processed as possible, establishing the USA as a front runner in sustainable protein technology.

Growing Popularity of Marine-Sourced Collagen

Bioactive peptides and essential amino acids have led to increased incorporation of fish protein into health and wellness products. The key application areas are dietary supplements, functional beverages, and medical nutrition. Omega Protein Corporation is one of the companies that innovate in performance nutrition products, while cosmetics manufacturers use fish protein hydrolysates for anti-aging solutions.

Clean-label products have therefore had a high impact on this industry, hence the innovation for novel solutions that support consumers who place a premium on transparency and sustainability. Finally, the adoption of fish protein in nutraceuticals and personalized nutrition has increased because it addresses the specific health needs of muscle recovery and aging.

% share of Individual categories by Product Type and Form Type in 2025

Fish protein concentrate holds the prominent share of 50% because of its cost-effectiveness and wide functionality in various applications of food & beverages. Its versatility is shown by its ability to be added in a range of products from soups to protein bars. It is also a main ingredient in low-cost protein solutions targeting mass-market consumers.

Fish Protein Hydrolysate is another key product with a 20% market share. It is rapidly becoming adopted in both medical and sports nutrition applications as it offers better bioavailability and has easier digestion. Further, there are improvements in hydrolysate processing techniques such as enzymatic processing that have further increased adoption in the medical and diet application space targeting niche but increasing consumer segments.

Powders account for a market share of 75%. The factor leading to its huge demand has primarily been that these have shelf life, save money, and transportation is much easier. Attributes which make this alluring for manufacturing at a bulk and then exporting, therefore, create significant demand. In food and food supplements for consumption and pet animal feed products, powdered fish protein is broadly consumed in this segment.

In contrast to the above, liquid formulations make up 25% of the market. Liquid formulations are set to find their niche in pharmaceutical and beverage industries. Their solubility and convenience in the formulation process are therefore critical factors driving demand. They are in high demand specifically in health drinks and intravenous nutritional solutions, where a rapid absorption rate and high efficacy are required.

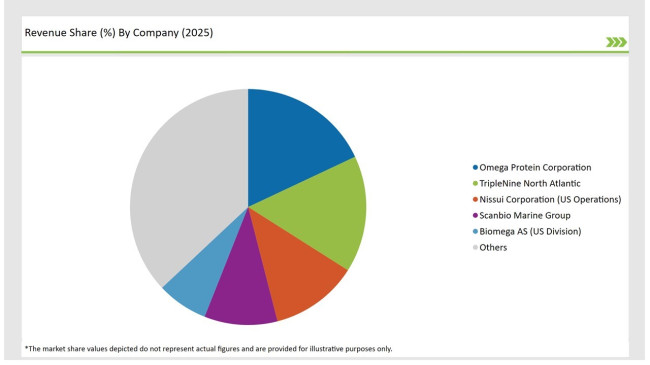

The USA Fish Protein market is moderately concentrated. Tier-1 players include Omega Protein Corporation, TripleNine North Atlantic, and Nissui Corporation, capturing around 55% of market share.

Those players dominate via extensive product offerings, significant investments in R&D, and strategic collaborations. Their focus on sustainability has led them to develop and advance eco-friendly harvesting methods with zero-waste processing, something that appeals more to the increasingly environmentally conscious consumers.

Players, like Scanbio Marine Group and Biomega AS, which command 30% of the market, focus their strength on niche applications and regional networks of distribution. Their business focuses on niche applications and networks of regional distribution. These companies generally serve sectors that are perhaps more susceptible to customization, such as medical nutrition or pet food.

Tier-3 and regional players like HofsethBioCare and Nutrifish, that emphasize localized production and serve particular markets, comprise the remaining 15%. Such a competitive structure will ensure the right balance of innovation, market reach, and customer-centric solutions across the industry, thereby making it dynamic and resilient in terms of changing consumer demands.

The USA Fish Protein market has been segmented by product type into Fish Protein Concentrate, Fish Protein Isolate, and Fish Protein Hydrolysate.

The market is divided into Powder and Liquid forms.

Applications of fish protein include Food & Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, and Others.

The USA Fish Protein market is expected to grow at a CAGR of 7.3% from 2025 to 2035.

The industry’s value is projected to reach USD 327.7 million by 2035.

Rising consumer awareness of health benefits, demand for clean-label products, and advances in protein extraction technologies are major growth drivers.

Food & Beverages lead the applications, with 45% share in 2025, followed by Dietary Supplements.

Key players include Omega Protein Corporation, TripleNine North Atlantic, Nissui Corporation, Scanbio Marine Group, and Biomega AS, among others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA