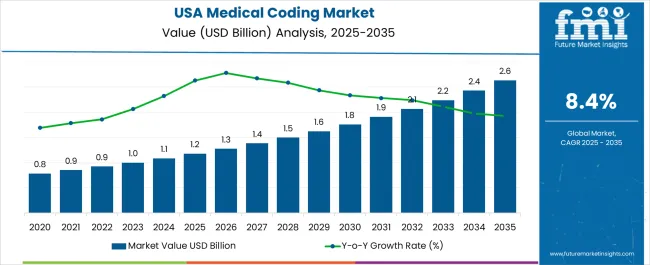

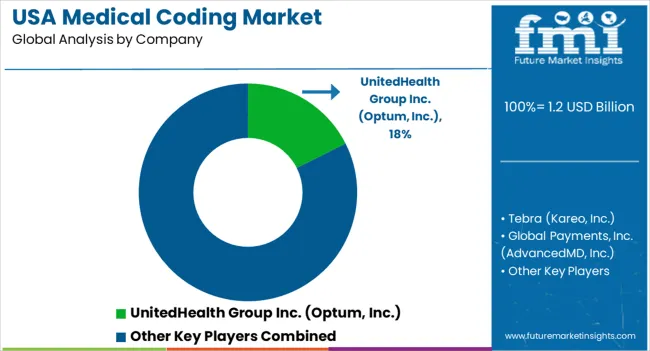

The USA Medical Coding Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| USA Medical Coding Market Estimated Value in (2025 E) | USD 1.2 billion |

| USA Medical Coding Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The USA medical coding market is undergoing steady growth driven by the rising demand for accurate clinical documentation, stringent compliance requirements, and the increasing integration of digital health solutions. Current dynamics are shaped by the widespread adoption of ICD-10 and CPT coding standards, along with ongoing updates in reimbursement guidelines that require continuous coder training and system upgrades. Expansion of healthcare data volumes and the shift toward value-based care models are reinforcing the importance of precise coding for both regulatory compliance and revenue cycle optimization.

The outlook is being strengthened by technological adoption, including computer-assisted coding and AI-driven automation, which are enhancing coder productivity and reducing error rates. Growth rationale is anchored in the rising complexity of medical procedures, the growing reliance on electronic health records, and the increasing burden on healthcare providers to maintain efficiency while adhering to evolving payer policies.

These factors collectively ensure consistent demand for professional coding services and systems across the USA healthcare ecosystem.

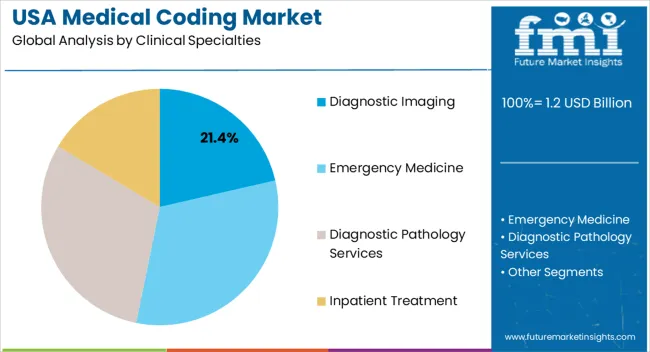

The diagnostic imaging segment, holding 21.40% of the clinical specialties category, has maintained leadership due to the critical role of imaging services in patient diagnosis and treatment planning. The high volume of imaging procedures and the complexity of codes associated with advanced modalities such as MRI, CT, and PET scans have supported the segment’s prominence.

Demand has been reinforced by the necessity of accurate coding for reimbursement, as imaging services often represent a significant portion of healthcare costs. Ongoing adoption of digital imaging and integration with electronic medical records have further increased coding requirements.

Continuous regulatory updates in radiology-related codes and payer scrutiny on imaging claims are expected to sustain strong demand for specialized coders, ensuring this segment retains its share within the broader market.

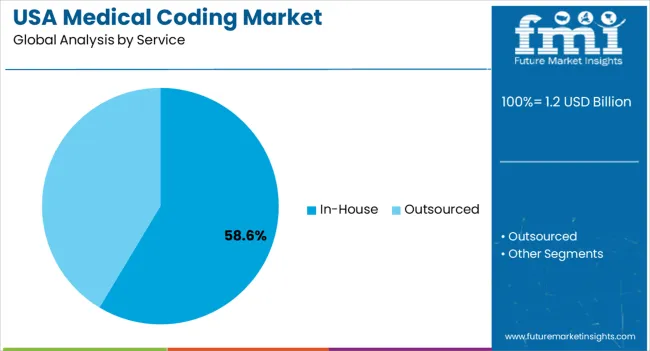

The in-house service segment, accounting for 58.60% of the service category, has remained dominant as healthcare organizations continue to prioritize internal control over coding operations. This preference has been reinforced by the ability to closely monitor compliance, streamline workflows, and ensure immediate integration with electronic health record systems.

Adoption is being sustained by the availability of skilled coders within large hospitals and healthcare systems, enabling institutions to maintain cost efficiency while ensuring high accuracy. The segment has also benefited from investments in coder training and computer-assisted coding platforms that enhance productivity.

Despite growing outsourcing trends, the in-house model remains favored for its reliability and direct oversight, and continued reliance on this approach is expected to strengthen its leadership within the market.

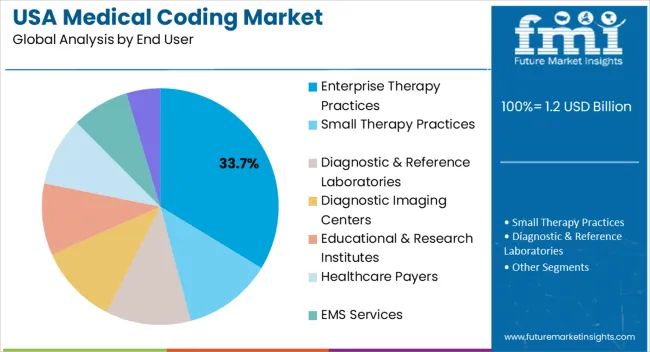

The enterprise therapy practices segment, representing 33.70% of the end user category, has emerged as a leading contributor due to the rising demand for precise coding in physical therapy, occupational therapy, and behavioral health services. These practices are increasingly reliant on accurate coding to secure timely reimbursements and avoid claim denials, particularly as payer requirements for therapy services become more complex.

Growth has been reinforced by the expansion of therapy networks and the integration of electronic systems that require coders with specialized expertise. Market adoption is also supported by the rising prevalence of chronic conditions and post-acute care needs, which are driving therapy volumes.

As healthcare providers continue to emphasize patient outcomes and operational efficiency, enterprise therapy practices are expected to maintain strong demand for coding solutions, ensuring their sustained share within the USA medical coding market.

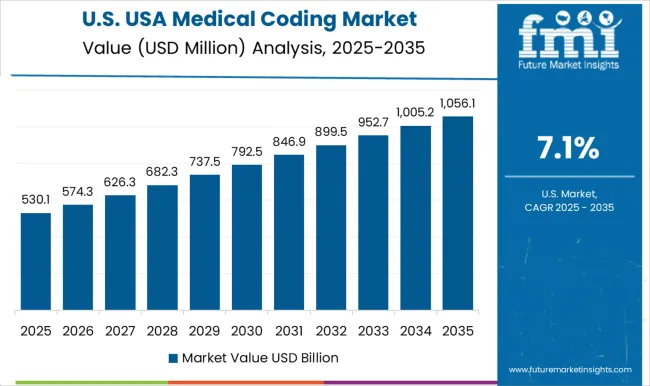

The market for medical coding market in USA recorded a historic CAGR of 6.9% in the last 7 years from 2020 to 2025.

The market value of the USA medical coding was around 12.9% of the overall ~USD 1.2 Billion of the USA revenue cycle management market in 2025.

Due to the rising prevalence of diseases, there is an increase in patient visits and admissions in healthcare settings. This will lead to increasing demand for rising adoption of digital technologies so that smooth administrative workflow can be achieved within healthcare settings.

Electronic medical records can be very efficiently used in order to check for symptoms, diseases, illnesses, and even causes of death. Apart from this, it helps healthcare professionals to check for previous medical, surgical, and diagnostic procedures that the patient has gone through. In order to facilitate the smooth documenting of medical records and enable accurate medical billing, medical coding software, and services assist in the translation of healthcare diagnosis, procedures, medical services, and equipment into universal medical alphanumeric codes. The increasing prevalence of diseases will eventually increase the number of patient visits and admissions in healthcare settings, which will require more administrative functionality. Hence, this can be considered an effective driver for the growth of the medical coding market.

The administrative practices of a hospital or any other healthcare setting are the focus of medical coding. Incorrectly manually inputted codes may result in claim denials, which can cost additional money to resolve. The hospital loses out on important revenue if the claim denials are not resolved and it is difficult to get the patient to pay what is owed. To avoid fines and other legal implications, State and Federal regulations must also be followed effortlessly in the USA

This points to the increasing need for medical coding and billing software to help in reducing the chances of these errors. Numerous errors in denied claims may actually be avoided, and by doing so, one can greatly increase collection rates. This points to the increasing use of medical coding software and services hence would impact the USA market in a positive manner.

The USA market is thus likely to show significant growth over the coming years with a CAGR of 8.4%, and reach a market size of around USD 2.6 Billion by 2035.

Introduction and Revisions of Codes

Medical codes are used by healthcare providers and insurance companies for billing and record-keeping purposes. There are three types of medical codes being referred in the USA, the International Classification of Diseases (ICD) Codes, Current Procedural Terminology (CPT) Codes and Healthcare Common Procedure Coding (HCPCS).

For faster coding operations, medical coding software combines knowledge from all the top coding and reference books in one location. Hence, its use and demand are increasing. The introduction and revision of codes can be considered one of the driving factors for the medical coding market in USA

Apart from this, the rising demand for certified medical billers and coders creates lucrative opportunities for this market. Doctors' reports are translated into useful, standardized medical codes by medical coders. These professionals operate behind the scenes in a variety of settings, ensuring that all pertinent data is correctly coded to ensure accuracy and consistency. The insurance company or government provider has to know what was done after a medical professional evaluates or treats a patient in order to process the bill. Because the common language used to describe medical treatments is too imprecise to provide the insurance company with the precise information it requires, a set of precise codes has been created. It is the responsibility of the medical coder to convey this knowledge in a clear and effective manner.

Medical coders are required to possess a certification from the American Health Information Management Association in order to be called certified medical coders. As the horizons of digital health are widening in the USA, the demand for such professionals in the field of healthcare will increase, impacting the USA market for medical coding in a positive manner.

Other than this, the usage of AI in medical coding is considered to be the future because this brings ease to the functioning of medical coders. This presents lucrative opportunities for developers and providers of software and services in the field of medical coding.

Confidentiality and Security Concerns

Medical coders are given access to patient data that is highly confidential, and therefore, concerns regarding data security are quite high in the USA The companies have to comply with HIPAA in order to prove their compliance. This will pose a challenge to the growth of this market.

Other than this, the dearth of trained and certified medical coders is another factor that can restrain the growth of the USA market. Although there are various job positions for medical coders in the USA, the country has faced and is facing a shortage of medical coders for hospitals, physician practices, and other healthcare facilities. It is mostly the northeastern and western parts of the country that have experienced a shortage of trained medical coders. This shortage is due to the lack of awareness regarding the medical record coding professions among various graduates in the USA

Apart from this, the individuals who are currently in the profession are not able to keep up with the continuous updates and changes in the field of medical coding, leading to fewer individuals opting for this profession. This can hamper the growth of the medical coding market in the USA

The emergency medicine segment held around 21.6% share of the total USA market in 2025.

Emergency medicine is a branch of medicine that specializes in providing immediate care for illnesses and injuries. Their area of expertise is the management of unplanned, undifferentiated patients of all ages.

According to the Centers for Disease Control and Prevention (CDC), in the United States, emergency rooms see close to 136 million patients annually, with injuries accounting for about 30% of those visits.

This points to the increasing number of billing generation in emergency medicine and hence increasing the use of medical coding software and solutions in this clinical specialty. This makes emergent medicine the dominant segment among the various clinical specialties of the USA market.

The outsourced segment held around 72.6% share of the USA market in 2025. This segment is expected to surge at a CAGR of 8.6% over the period of 2025 to 2035.

Healthcare providers are increasingly outsourcing their needs for medical coding in order to reduce administrative costs. Time is saved, costs are reduced, and workflow is streamlined by outsourcing. Hence, healthcare practitioners may prioritize the standard of patient care and patient involvement.

Market expansion is being positively impacted by the increase in onshoring and offshoring of revenue cycle management, particularly medical coding. Any hospital or healthcare facility would benefit from the well-known fact that hiring outsourced medical coding workers can reduce administrative expenditures by 25% to 30%. This makes outsourced service the dominant segment of the USA market.

Enterprise therapy practices held a significant share of about 59.0% with a market value of around USD 1.2 Million in 2025. The enterprise therapy practices include hospitals, ambulatory surgical centers, cancer research institutes and long-term care centers. The use of medical coding solutions and software is quite high in facilities like these and therefore enterprise therapy practices held a significant share of the end user segment of the market.

The focus of leading companies is on expansion and growth in the various regions of this market. Many companies are concentrating on coming up with new software and solutions in the medical coding field and along with this, the companies focus on expansion through acquisitions and partnerships.

For instance:

Similarly, recent developments have been tracked by the team at Future Market Insights related to companies in the USA medical coding space, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Countries Regions | Northeast USA, Midwest USA, Southeast USA, Southwest USA, West USA |

| Key Market Segments Covered | Clinical Specialties, Service, End User and Region |

| Key Companies Profiled | Tebra (Kareo, Inc.); Global Payments, Inc. (AdvancedMD, Inc.); EverCommerce Inc. (DrChrono Inc.); The 3M Company (3M Health Information Systems, Inc.); Greenway Health, LLC; Dolbey; GeBBS Healthcare Solutions (Aviacode Inc.); AQuity; Baruch Business Solutions; Infinx; athenahealth, Inc.; BUDDI.AI; Context4 Healthcare, Inc.; Eclat Health Solutions Inc.; Maverick Medical AI Ltd.; UnitedHealth Group Inc. (Optum, Inc.); NYM; Practolytics; Outsource Strategies International; Datavant (Ciox); PCS (Precyse Coding Solutions, LLC); Novigo Health Care Services; I-conic Solutions |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global USA medical coding market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the USA medical coding market is projected to reach USD 2.6 billion by 2035.

The USA medical coding market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in USA medical coding market are diagnostic imaging, radiology imaging, interventional radiology, nuclear medicine, emergency medicine, diagnostic pathology services, inpatient treatment, radiology imaging, interventional radiology, nuclear medicine, anaesthesia and critical care, cardiology & cardiac surgery, gastroenterology & hepatology, obstetrics and gynecology, nephrology, urology, neurology & neurosurgery, general surgery, orthopedics, spinal and pulmonology, reproductive medicine, rheumatology, dental sciences & cranio-maxillo facial surgery, oncology, diabetology & endocrinology, pediatrics & neonatology, psychiatry & clinical psychology, organ transplant, outpatient treatment & diagnostics, ophthalmology, dermatology, ent, clinical nutrition, ambulatory surgery, physician office visits, ancillary services, observation services and others.

In terms of service, in-house segment to command 58.6% share in the USA medical coding market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA