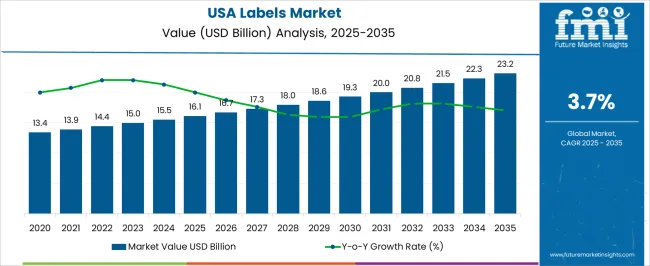

The USA Labels Market is estimated to be valued at USD 16.1 billion in 2025 and is projected to reach USD 23.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| USA Labels Market Estimated Value in (2025 E) | USD 16.1 billion |

| USA Labels Market Forecast Value in (2035 F) | USD 23.2 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The USA labels market is experiencing robust growth. Increasing demand for packaged goods, evolving consumer preferences, and regulatory requirements for product identification and safety are driving market expansion. Current dynamics are characterized by technological advancements in label printing, material innovations, and adoption of sustainable inks.

The market is influenced by growing brand differentiation strategies and the need for high-quality, durable labeling solutions across food, beverage, pharmaceutical, and personal care sectors. Future growth is expected to be supported by the rising popularity of smart and functional labels, expansion of e-commerce and retail sectors, and emphasis on eco-friendly and recyclable materials.

Growth rationale is founded on the ability of market participants to provide innovative, customizable, and compliant labeling solutions, ongoing process optimization in manufacturing, and integration of digital and automated printing technologies These factors collectively are expected to sustain adoption across industries, enhance operational efficiency, and drive long-term revenue growth in the USA labels market.

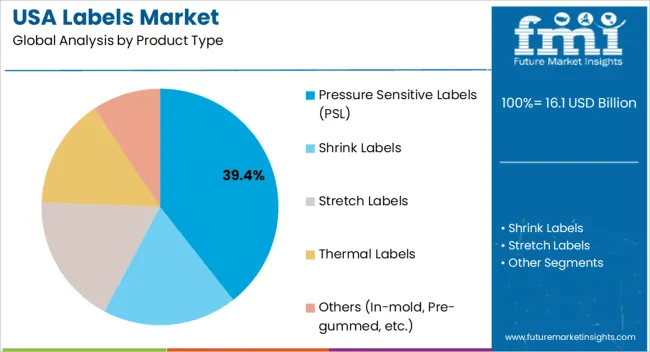

The pressure sensitive labels (PSL) segment, representing 39.4% of the product type category, has maintained its leading position due to its versatility, ease of application, and suitability for a wide range of packaging formats. Adoption has been supported by high efficiency in production and application processes, reduced labor requirements, and compatibility with automated labeling systems.

The segment has benefitted from consistent demand across food, beverage, and consumer goods industries, while advances in adhesive technology and label durability have reinforced market confidence. Growth is further supported by innovations in customizable and smart label solutions, which enhance brand visibility and consumer engagement.

The segment’s ability to meet regulatory and sustainability requirements ensures continued preference, solidifying its market share in the product type category.

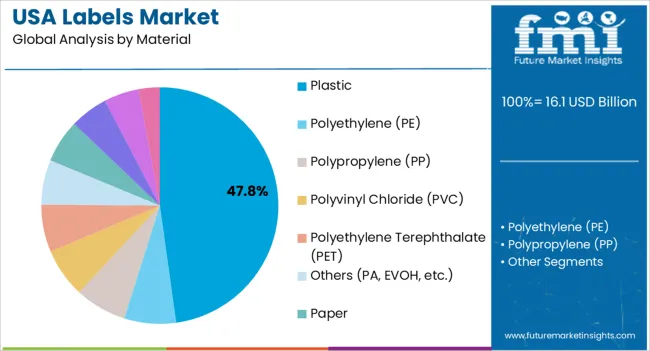

The plastic material segment, accounting for 47.8% of the material category, has emerged as the leading material due to its durability, resistance to moisture and chemicals, and adaptability to various label formats. Adoption has been facilitated by the need for long-lasting and high-quality labels in food, beverage, and pharmaceutical packaging.

The segment’s market share is supported by manufacturing consistency, ease of processing, and ability to integrate with different printing technologies. Technological advancements in biodegradable and recyclable plastics are enhancing sustainability credentials.

The combination of material performance, regulatory compliance, and alignment with brand requirements is expected to sustain its market dominance and promote incremental adoption in diverse labeling applications.

The water-based ink segment, holding 36.2% of the ink type category, has been leading due to its environmentally friendly profile, compliance with regulatory standards, and compatibility with multiple substrates. Adoption has been driven by increasing demand for sustainable packaging solutions and the shift towards low-VOC and non-toxic printing technologies.

Performance characteristics such as fast drying, color stability, and resistance to smudging have reinforced its use across food, beverage, and pharmaceutical labeling. Ongoing innovations in formulation and print quality have enhanced reliability and market acceptance.

The segment’s focus on sustainability and regulatory alignment is expected to maintain its leading share, supporting continued market growth and broad-based adoption in the USA labels industry.

The below table presents the expected CAGR for the USA Labels market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 3.7%, followed by a slightly higher growth rate of 4.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 3.7% (2025 to 2035) |

| H2 | 4.0% (2025 to 2035) |

| H1 | 3.6% (2025 to 2035) |

| H2 | 4.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.6% in the first half and increase to 4.1% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Innovations in Printing Technology to Drive the Market

The different label printing methodologies includes flexographic, offset, digital, gravure, and letterpress printing. These techniques have their own advantage in terms of quality, speed, and cost-effectiveness.

The recent innovations in the printing technology such as smart labels and digital printing, have impacted the sales of labels. These innovation allows personalization, better traceability, and interaction. The need for sustainable labeling solutions is also increasing with growing environmental awareness.

Labels must meet the variety of regulatory policies, especially for the sectors such as food & beverages and pharmaceuticals, where precision and transparent labeling is important to ensure customer safety.

Consumer behavior is changing in terms of demands for convenience, personalization, and merchandise traceability, that would influence the label design and its functionality.

The label business is competitive, with both domestic and foreign companies vying for share. Quality, pricing, innovation, and client service are all driving forces in competition.

Labels are considered to be a vital part of the packaging process and supply chain. As effective labeling solutions are essential to identify, track, and engage consumers, their demand can expand.

Labels are also powerful tools for that can be used for marketing and branding purpose. Labels that are unique and pleasing to the eye make products stand out on store shelves and communicate brand identity.

In the label business, ongoing research and development activities are concentrated on developing technologies, new products, and solutions to address shifting demands and difficulties.

Stringent Regulations & Advanced Features like RFID & QR Codes to Drive the Market

The RIFDs and QR codes in labels help manufacturers, distributors, and end users to track their products and reduce the risk of counterfeiting. These new technologies also help in understanding the adoption of their products and satisfaction in consumers.

Manufactures in many industries are adopting these new technologies for ensuring security and quality of their products until they reach to their customers.

In particularly manufacturers from the food, beverage, and pharmaceutical companies are adopting RFIDs and QR codes to a large extent compared to other sectors. Strict regulations implemented from the United States state government over the quality of food items forced the food & beverage firms to add data such as ingredients, expiry date, and nutritional value of the product on their packages.

These factors can partially be added to a single label due to size concerns and often require the help of QR codes and RFID tags.

The governing body in the United States has implemented the Fair Packaging and Labelling Act, which mandates the requirement of labels for all consumer commodities. As per this act, the label should contain the net content of the product, product identity, and information about the manufacturer, packer, and distributor.

The act further suggests the addition of product ingredients to eliminate consumer deception. These stringent regulations imposed by the US government is expected to drive the market.

Fluctuating Import Duties May Hamper the Market Growth

Many manufacturers from the different regions of US that depends on the imported raw materials and finished labels may face challenges due to the increase in the trade tariffs and import duties implemented.

This increase in the import duties increases the costs of these raw materials and eventually affect the profit margins and pricing stability.

These policies are impacted with the geopolitical tensions, economic policies, and trade agreements that changes the overall scenario increasing the cost of products for consumers. These increased product costs also impact the sales and thus may hamper markets growth.

The USA Labels industry recorded a CAGR of 1.7% during the historical period between 2020 and 2025. The growth of the Labels industry was positive as it reached a value of USD 14,909.4 million in 2025 from USD 13,942.3 million in 2020.

Digital printing methods in labels have changed the process of its productions in terms of shorter print runs making it more affordable and easy personalization in packaging solutions. This also changed the production outcome time which is becoming the trend that started in early 2024s and is said to be on the rise.

Sustainability these days are the key factors prioritize in all the industries including labels. This preference for sustainability is rising with the growing demand from the customers amid the environmental concerns. These demands resulted in the shift towards eco-friendly label materials.

The integration of radio frequency identification technology and smart labels is expanding in the industry that provides features such as authentication, tracking, and interface with digital devices. These label applications especially in the sectors such as food and pharmaceuticals, has affected the labeling requirements due to stricter guidelines for example nutritional information, allergen declaration, and serial number.

The growing concerns about counterfeiting in products have increased the focus for the incorporation of security aspects such as special inks, holograms, and tamper-proof seals into the labels. Advancements in the printing technology have made personalizing in labels much easier that allows brands to generate unique and attractive packaging.

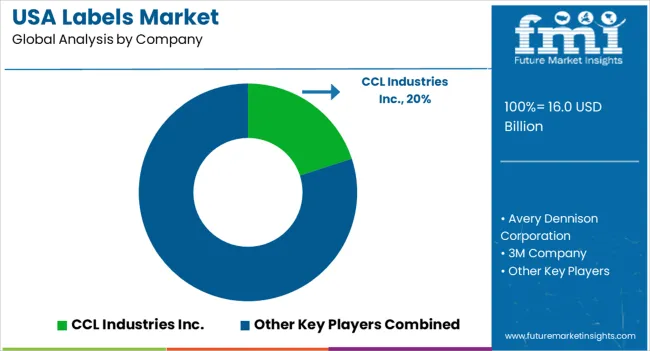

Tier 1 companies comprise market leaders with a market revenue of above USD 400 million capturing significant market share of 20% to 25% in USA labels market. These market leaders are characterized by high production capacity and a wide product portfolio.

These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality.

Prominent companies within tier 1 include CCL Industries Inc., Avery Dennison Corporation, Multi-Color Corporation, and 3M Company.

Tier 2 companies include mid-size players with revenue of USD 100 to 400 million having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge.

These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Resource Label Group, LLC, Fuji Seal International, Inc, BRADY Corp, and Mondi plc.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 100 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section contains information about the leading segments in the industry. By end use, food is estimated to grow at a CAGR of 3.2% throughout 2035. Additionally, the plastic materials are anticipated to offer an incremental opportunity worth USD 3,728 million and is predicted to reach a market valuation of USD 8,070.9 million by 2025.

| Ink Type | Water Based |

|---|---|

| Value Share (2035) | 43.3% |

The water-based Labels are anticipated to offer an incremental opportunity worth USD 3,074 million throughout the next ten years and are expected to grow at a CAGR of 3.5% during the assessment period. The water based inks are with water as the main element reduces the volatile organic compounds as compared to solvent-based inks.

Many manufacturers are opting it as the regulations are increasing with sustainability demands. In the food and beverage industry where products safety is the prime focus water based inks are mostly preferred for its less toxic thus increasing the adoption.

| Printing Technology | Digital |

|---|---|

| Value Share (2035) | 50.9% |

Digital are predicted to reach a market valuation of USD 8,135.5 million in 2025 and are set to capture a market share of 52.8% by 2025. Digital printing technology is known for its flexibility, speed and cost-effectiveness which is beneficial for the small and medium sized print runs. Digital print does not require plates making the setup quicker and less expensive.

This reduces the wastage and business can produce as per the requirements thus saving the inventory costs. The ability of digital printing to print custom designs and incorporate variable data, such as unique barcodes, QR codes and other contributing to segments growth.

Key players operating in the Labels market are investing in new technology including digital for improved product quality and easy customization in products of labels to meet customer demand and also entering into partnerships.

Key Labels providers have also been acquiring smaller players to grow their presence to further penetrate the Labels market across multiple regions.

Recent Industry Developments in the Labels Market

In terms of product type, the industry is divided into pressure sensitive labels (PSL), shrink labels, stretch labels, thermal labels, and others (in-mold, pre-gummed, etc.).

In terms of material, the industry is segregated into plastic, paper, and aluminum. Plastic is further classified as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and others (PA, EVOH, etc.). Paper are sub-categorized as kraft paper and recycled paper.

By ink type, the market is divided into solvent based, water based, UV based, and others (bio-based, oil based, etc.).

By printing technology, the market is divided into flexographic, digital, gravure, offset, and letterpress.

The market is classified by end uses such as food, beverages, healthcare, cosmetics & personal care, homecare & toiletries, chemicals, automobiles, and others industrial. Food is sub-categorised as bakery & confectionaries, dairy product types, baby food, chilled/frozen food, others (snacks, pet food, etc.). Beverage is classified as alcoholic and non-alcoholic. Healthcare is sub-divided into medical devices, medical supplies, pharma & biological.

Key states of Northeast, South West, West, South East, and Midwest have been covered in the report.

The global USA labels market is estimated to be valued at USD 16.1 billion in 2025.

The market size for the USA labels market is projected to reach USD 23.2 billion by 2035.

The USA labels market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in USA labels market are pressure sensitive labels (psl), shrink labels, stretch labels, thermal labels and others (in-mold, pre-gummed, etc.).

In terms of material, plastic segment to command 47.8% share in the USA labels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among USA Labels Providers

USA In-mold Labels Market Insights – Demand, Innovations & Growth 2025-2035

Labels Market Forecast and Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA