The USA & Canada secondhand apparel market size is valued at USD 24.8 billion in 2025 and is expected to grow at a 12.9% CAGR from 2025 to 2035. The industry is projected to reach USD 83.3 billion by 2035.

This dynamic growth is fueled by the expanding consumer shift toward sustainability, affordability, and personalized fashion choices, alongside the rapid digitization of resale platforms and increasing social acceptance of pre-owned clothing.

Secondhand fashion is now a mainstream retail channel, no longer associated with necessity alone but embraced for its environmental consciousness and unique style offerings. Millennials and Gen Z consumers are leading this shift, driven by their demand for ethical consumption and rejection of fast fashion's environmental toll. Vintage apparel, brand resale, and designer re-commerce are high-performing segments.

The emergence of peer-to-peer resale apps, AI-driven curation, and integrated marketplace-logistics models has streamlined the user experience. Companies such as ThredUp, Poshmark, and Depop, along with traditional retailers entering the resale space, are contributing to strong industry scalability. Additionally, luxury brands are partnering with resale platforms to reclaim product lifecycle value and reach younger demographics.

Physical resale stores are also undergoing transformation, emphasizing boutique-style layouts, selective inventory curation, and community engagement. Major retail chains and department stores in the USA and Canada are adopting recommerce strategies, including trade-in programs and secondhand sections in-store, reflecting a broader push toward circular fashion ecosystem.

The North American regulatory climate is increasingly supportive of sustainability in fashion. Incentives for textile recycling, extended producer responsibility policies, and waste reduction targets are encouraging both brands and consumers to participate in secondhand commerce. With fashion sustainability gaining legislative and consumer momentum, secondhand apparel is positioned as a core solution in closing the fashion waste loop.

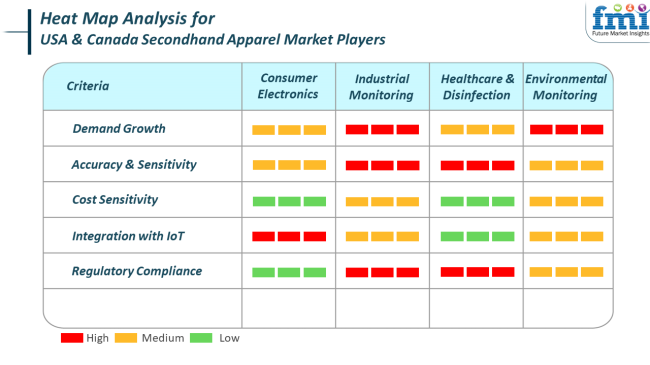

The secondhand apparel industry reflects trends seen in consumer electronics and environmental monitoring segments, where lifecycle extension, sustainability, and value-for-money dominate purchasing decisions. Consumers increasingly expect authentication, condition grading, and environmental impact transparency in product listings, particularly when buying high-value or branded items.

Demand growth is strongest in digital resale environments, especially those offering personalized recommendations, virtual try-on tools, and style inspiration from influencers. Hybrid online-offline models are emerging as dominant strategies, blending convenience with community and tactile assurance. Integration with mobile wallets, real-time chat, and AI-based curation is raising the bar for user experience.

While cost sensitivity remains a factor, many consumers are motivated equally by ethical considerations and uniqueness. Marketplace trust, ease of returns, and transparent seller ratings are critical to conversion. Regulatory compliance, particularly around product hygiene, counterfeit prevention, and consumer protection laws, is becoming more stringent as the category matures.

Despite its momentum, the secondhand apparel industry in the USA and Canada faces several risks that could influence long-term success. Chief among them is the challenge of quality assurance and counterfeit detection. As the industry scales and luxury resale expand, authentication and trust mechanisms must keep pace to preserve platform credibility and consumer confidence.

Inventory inconsistency is another operational risk. Unlike first-sale retail, secondhand models rely on unpredictable supply streams. This can limit scalability or product depth in fast-moving categories. To mitigate this, platforms must build strong sourcing partnerships, incentive programs, or proprietary seller networks to ensure sustainable inventory pipelines.

The ising competition and margin pressure may impact profitability. With a growing number of entrants including large retailers launching in-house resale platforms-the industry may experience pricing compression, especially in general apparel. Players must differentiate through technology, brand positioning, or niche specialization to retain loyal users and protect long-term value.

From 2020 to 2024, the industry saw a total transformation as people became more conscious about the environment and sought budget-friendly fashion. Sites like Poshmark, ThredUp, and Depop gained immensely in popularity, and economic and social pressure ensured that thrifting and circular fashion became even more trendy. Brands slowly came into the space as resale partnerships in smaller ways or small trials.

These also came because of the pandemic that pushed individuals to declutter their closets and find value in resale. Therefore, second-hand fashion became fashionable and economically sound from niche. During 2025 to 2035, the industry is going to evolve into a fully tech-integrated mainstream system.

Resale will be a central part of brand strategy, with most fashion brands creating branded resale platforms and take-back programs. Technologies like AI curation, virtual try-on, and blockchain authentication will redefine customer experiences.

Consumers will demand transparency, customized shopping, and strong sustainability commitments. Subscription-based resale modes and smarter logistics will be developed, rendering the fashion loop frictionless, scalable, and eco-friendly, satisfying affordability and sustainability requirements.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Awareness of sustainability and affordability of prices. | Digital personalization and circular lifestyle patterns. |

| Peer-to-peer resale websites with minimal resale interfaces. | Curated experience and AI-powered virtual fitting room platforms. |

| Early resale collaborations or pilot initiatives. | Resale as a bundled product by most fashion brands. |

| Consumer-led, eco-consumption of fashion. | Policy-influenced, brand-initiated circular economy action plans. |

| Low-grade quality control and consumer-managed shipping. | Automated shipping, central locations, and environmentally friendly shipping networks. |

| Equated with sustainability and niche fashion cultures. | Seen as high-fashion, smart, and sustainable fashion mainstream. |

| Restricted to social selling and e-commerce. | Enabled by AI, blockchain for authenticity, and AR for try-ons. |

| Commissioned sales and consignment sales. | Subscription resale, real-time pricing, and resale-as-a-service platforms are the new normal. |

In 2025, jeans and pants will lead the industry of the USA & Canada Second-hand apparel industry with a projected share of around 25%, followed by dresses and tops at 22%.

From the lightweight and fashionable side of things, jeans & pants (25%) will definitely be the leading product category for second-hand buying as it is the most versatile. Somehow, timeless in its appeal, and wide consumer appeal across all age groups, denim has proved itself as an article that everybody must have in a second-hand industry. It is very durable, comfy, and can be used on vast occasions, so denim is the most popular in second-hand markets.

The further increase in popularity of vintage denim or upcycled jeans will also fuel this category's growth. Significant requests for the use of second-hand jeans and pants have been experienced by companies such as ThredUp and Poshmark, owing to consumers' desire to have high-quality, sustainable, and affordable solutions to fast fashion in their wardrobes. With this growing concern regarding sustainability and eco-conscious fashion choices, the second-hand jeans industry is booming because people now appreciate long-term and durable products.

Dresses & tops (22%) will still take a considerable part of the industry. The greatest pull of this segment would emanate from an ever-stronger demand for clothing items that are cheap but stylish for most occasions. Second-hand dresses and tops usually reach customers who are looking for something unique, designer, or vintage that mainstream stores simply do not stock.

An example showing how this trend is truly growing is the specialist online platforms, e.g., Depop and The RealReal, that are entering this category. These are offering quality formulations of previously owned products, including branded dresses and tops. Vintage fashion trends and retro styles also come into play here, increasing the appeal of second-hand dresses that are at the top of the minds of eco-conscious shoppers.

The USA & Canada Secondhand apparel industry will continue seeing increased growth from older Jeans & Pants along with other dresses and tops. Because of the increasing recognition and importance given by consumers to sustainability, affordability, and individuality in fashion, the products mentioned above will continue to grow.

In 2025, the resale sector is expected to take the lead in the USA & Canada secondhand apparel industry with a 60% industry share, and traditional thrift stores will account for 40% of the industry.

Resale (60% share) is expected to lead, driven by online resale platforms like Poshmark, ThredUp, and Depop, which increase convenience, accessibility to a variety of products, and curated shopping from the secondary clothing industry.

Consumers value the convenience of browsing and buying second-hand apparel via their smartphones, thereby making resale the biggest contributor to the present industry growth. The demand for resale platforms is also supported by the increasing consciousness of sustainability and the yearning to have something one-of-a-kind, designer, or vintage. Moreover, these platforms are integrating features like live auctions, virtual styling, and direct peer-to-peer selling, making them even more attractive.

Traditional thrift stores (40%) still command significant industry share but are gradually overshadowed by resale platforms. Although thrift stores like Goodwill, Salvation Army, and Value Village offer an in-person shopping experience with low-cost second-hand apparel, they have lost some growth potential against online platforms that favor convenience and variety.

However, for many traditionalist buyers, thrift stores are still a favorite destination: they offer a physical approach to obtaining affordable, sustainable fashion, and many shoppers simply enjoy navigating the treasure-hunt process of this second-hand shopping experience. In fact, thrift stores are now embracing e-commerce initiatives to create a hybrid model of the traditional shopping experience complemented by online retail options.

The industry in America is rapidly growing, and it is proving to be a key component of the global sustainable fashion movement. The industry size is estimated at approximately USD 15.4 billion in 2024, with prospects of surpassing USD 38.7 billion by the year 2035. Accelerated customer desire for circular fashion, fueled both by economic determinants as well as increased green awareness, is spurring development.

Internet marketplace reselling destinations such as Poshmark, thredUP, and Depop are keeping transactions simple while pushing fashion reselling into mainstream status. Big brands and retailers are also beginning to launch their resale programs, adding secondhand products to their product offerings to appeal to ecologically conscious consumers. Gen Z and millennials, particularly the younger generations, are leading the use of pre-owned apparel as a lifestyle choice that maintains affordability without sacrificing individuality.

One-of-a-kind designer pieces and vintage apparel are in higher demand through online resale outlets. Customers are also drawn towards the value proposition of quality clothing at affordable prices, often finding superior or barely worn goods that meet sustainability requirements.

Secondhand chain stores and local community resale events are also contributing to the growth in the region. With the expansion of omni-channel platforms, AI-driven pricing platforms, and authentication services, the USA secondary clothing industry is set to experience robust and sustainable growth in the decade ahead.

The industry in Canada is exhibiting strong growth prospects with an estimated valuation of around USD 1.9 billion in 2024 and growth estimates to USD 4.5 billion by the year 2035. The growth is propelled by consumer demand for sustainable living, cost-cutting practices, and online stores that make the secondhand shopping experience easier and more engaging.

Even though the industry is smaller than the United States industry, Canadian consumers are rapidly adopting resale attitudes, particularly in urban centers like Toronto, Vancouver, and Montreal, where fashion and environmentalism intersect.

The sector is seeing more participation from independent sellers and veteran resale companies, as well as classic thrift shop owners modernizing operations. Channels like Facebook Marketplace, Vinted, and smaller Canadian e-commerce players are offering up a digitally linked audience for lower-cost, curated fashion. Moreover, increasing awareness about the environmental effects of fast fashion is leading consumers to seek out alternative secondhand sources that extend the life cycle of clothing.

Brands and retailers introducing take-back programs and resale alliances are further validating the industry's long-term viability. With healthy demographics, technology uptake, and growing social acceptability, Canada's secondhand clothing industry is on track to be a dynamic force in the country's apparel retail scene.

The secondhand apparel industry has turned into a battleground with online-first resale platforms and traditional thrift channels burning the midnight oil to build brand equity, sustainability messaging, and tech-enabled user experiences. The industry is being led by ThredUpInc, Poshmark, The RealReal, Depop, and Goodwill Industries, which diversify their inventory sources while farming in AI personalization onto logistics for easy seller-to-buyer transaction flow.

ThredUp Inc. works on a consignment model while partnering with retailers like Walmart and Madewell to extend resale-as-a-service, thereby gaining a bargaining edge in terms of scale and B2B integration. Poshmark is continuing to build itself as a community-driven platform, monetizing social commerce while empowering peer-to-peer resale through real-time discovery tools. The RealReal, a player in authenticated luxury resale, uses proprietary authentication technology and a concierge service for consignors moving high-value goods.

The recently acquired online retailer Etsy has capitalized on Gen Z consumer culture, relying on a mobile-first interface and influencer-led merchandising, hence making it so popular in vintage and streetwear. While physically it has been brick-and-mortar, it has launched several e-commerce initiatives, such as shopgoodwill.com, and positions itself as a nonprofit to drive mission-aligned consumption.

Everyone involved is now investing in AI across inventory vetting to circular economy branding so that at least some of the environmentally conscious, value-minded shoppers will be grabbed in. Midsized players like Buffalo Exchange, Mercari, and Crossroads Trading also increased by going omnichannel and sustainability-oriented.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| ThredUp Inc. | 18-22% |

| Poshmark | 14-18% |

| The RealReal | 11-15% |

| Depop | 10-13% |

| Goodwill Industries | 9-12% |

| Other Key Players | 23-30% |

| Company Name | Offerings & Activities |

|---|---|

| ThredUp Inc. | Offers consignment services with B2B resale solutions for brands and retailers. |

| Poshmark | Peer-to-peer social marketplace with a strong focus on community, style feeds, and live selling. |

| The RealReal | Specializes in luxury resale with in-house authentication and white-glove consignment service. |

| Depop | Mobile-first, Gen Z-focused resale platform emphasizing vintage and trend-led styles. |

| Goodwill Industries | Operates physical thrift stores with growing online resale via shopgoodwill.com. |

Key Company Insights

ThredUp Inc. (18-22%)

Dominant resale platform with scalable logistics and B2B services, integrating resale into mainstream retail channels.

Poshmark (14-18%)

Leads in social commerce for secondhand fashion; focuses on buyer-seller engagement and influencer growth.

The RealReal (11-15%)

Known for luxury authentication and concierge services; expanding brick-and-mortar presence to support resale value assurance.

Depop (10-13%)

Appeals to younger demographics through trend-aligned resale and creator-centric monetization.

Goodwill Industries (9-12%)

Legacy player expanding digitally while maintaining community-oriented, nonprofit appeal with affordable resale.

By product type, the industry is segmented into dresses & tops, shirts & t-shirts, sweaters, coats & jackets, jeans & pants, and others.

By sector, the industry is divided into resale and traditional thrift stores.

By consumer orientation, the industry is categorized into men, women, and kids.

By sales channel, the industry is analyzed based on various sales channels, including direct sales, hypermarkets/supermarkets, thrift stores/resale stores, online retailers, and other sales channels like independent small stores.

By country, the industry spans across the USA and Canada.

The industry is slated to reach USD 24.8 billion in 2025.

The industry is predicted to reach a size of USD 83.3 billion by 2035.

Key companies include Thredup Inc., Poshmark, The RealReal, Depop, Goodwill Industries, Salvation Army, Tradesy, Vestiaire Collective, Grailed, Mercari, Buffalo Exchange, Crossroads Trading, ASOS Marketplace, and Rebag.

The United States and Canada, with a projected CAGR of 12.9% during the forecast period, are poised for fastest growth.

Jeans and pants are being widely used.

Table 1: Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 2: Market Volume (Million Units) Forecast, By Product Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast, By Sector, 2018 to 2033

Table 4: Market Volume (Million Units) Forecast, By Sector, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 6: Market Volume (Million Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 8: Market Volume (Million Units) Forecast, By Sales Channel, 2018 to 2033

Table 9: Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 10: Market Volume (Million Units) Forecast, By Country, 2018 to 2033

Table 11: USA Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 12: USA Market Volume (Million Units) Forecast, By Product Type, 2018 to 2033

Table 13: USA Market Value (US$ Million) Forecast, By Sector, 2018 to 2033

Table 14: USA Market Volume (Million Units) Forecast, By Sector, 2018 to 2033

Table 15: USA Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 16: USA Market Volume (Million Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 17: USA Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 18: USA Market Volume (Million Units) Forecast, By Sales Channel, 2018 to 2033

Table 19: Canada Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 20: Canada Market Volume (Million Units) Forecast, By Product Type, 2018 to 2033

Table 21: Canada Market Value (US$ Million) Forecast, By Sector, 2018 to 2033

Table 22: Canada Market Volume (Million Units) Forecast, By Sector, 2018 to 2033

Table 23: Canada Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 24: Canada Market Volume (Million Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 25: Canada Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 26: Canada Market Volume (Million Units) Forecast, By Sales Channel, 2018 to 2033

Figure 01: Market Value (US$ Million) and Volume (Million Units) Analysis, 2018 to 2022

Figure 02: Market Value (US$ Million) and Volume (Million Units) Forecast, 2023 to 2033

Figure 03: Market Value (US$ Million) Analysis, 2018 to 2022

Figure 04: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 06: Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 07: Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 08: Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis By Sector, 2018 to 2033

Figure 11: Market Volume (Million Units) Analysis By Sector, 2018 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections, By Sector, 2023 to 2033

Figure 13: Market Attractiveness By Sector, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 15: Market Volume (Million Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 17: Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Figure 19: Market Volume (Million Units) Analysis By Sales Channel, 2018 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 21: Market Attractiveness By Sales Channel, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 23: Market Volume (Million Units) Analysis By Country, 2018 to 2033

Figure 24: Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 25: Market Attractiveness By Country, 2023 to 2033

Figure 26: USA Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 27: USA Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 28: USA Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 29: USA Market Attractiveness By Product Type, 2023 to 2033

Figure 30: USA Market Value (US$ Million) Analysis By Sector, 2018 to 2033

Figure 31: USA Market Volume (Million Units) Analysis By Sector, 2018 to 2033

Figure 32: USA Market Y-o-Y Growth (%) Projections, By Sector, 2023 to 2033

Figure 33: USA Market Attractiveness By Sector, 2023 to 2033

Figure 34: USA Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 35: USA Market Volume (Million Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 36: USA Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 37: USA Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 38: USA Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Figure 39: USA Market Volume (Million Units) Analysis By Sales Channel, 2018 to 2033

Figure 40: USA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 41: USA Market Attractiveness By Sales Channel, 2023 to 2033

Figure 42: Canada Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 43: Canada Market Volume (Million Units) Analysis By Product Type, 2018 to 2033

Figure 44: Canada Market Y-O-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 45: Canada Market Attractiveness By Product Type, 2023 to 2033

Figure 46: Canada Market Value (US$ Million) Analysis By Sector, 2018 to 2033

Figure 47: Canada Market Volume (Million Units) Analysis By Sector, 2018 to 2033

Figure 48: Canada Market Y-O-Y Growth (%) Projections, By Sector, 2023 to 2033

Figure 49: Canada Market Attractiveness By Sector, 2023 to 2033

Figure 50: Canada Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 51: Canada Market Volume (Million Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 52: Canada Market Y-O-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 53: Canada Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 54: Canada Market Value (US$ Million) Analysis By Sales Channel, 2018 to 2033

Figure 55: Canada Market Volume (Million Units) Analysis By Sales Channel, 2018 to 2033

Figure 56: Canada Market Y-O-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 57: Canada Market Attractiveness By Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

United States Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United States Non-Dairy Creamer Market Insights – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA