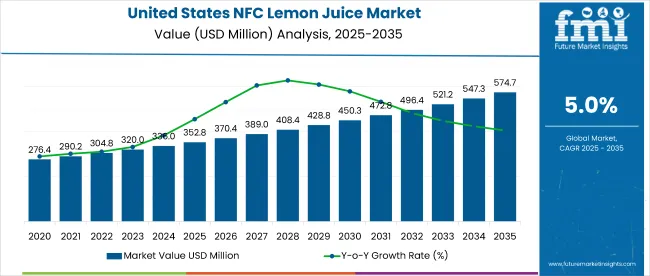

The USA NFC lemon juice market is valued at USD 352.8 million in 2025 and is expected to reach USD 574.7 million by 2035, reflecting a CAGR of 5%. Growth in the market will be driven by increasing consumer preference for minimally processed beverages, rising awareness of health benefits associated with citrus juices, and expanding applications in food and beverage segments.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 352.8 million |

| Projected Value (2035F) | USD 574.7 million |

| CAGR (2025 to 2035) | 5% |

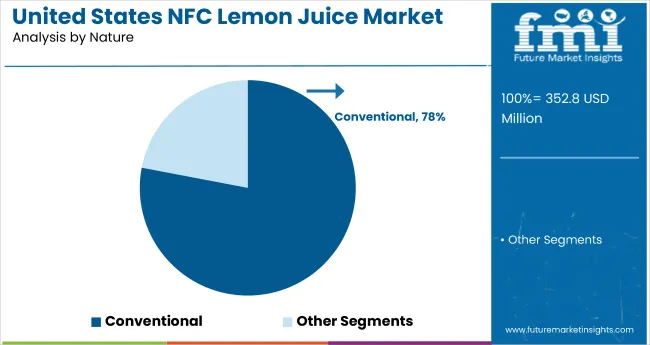

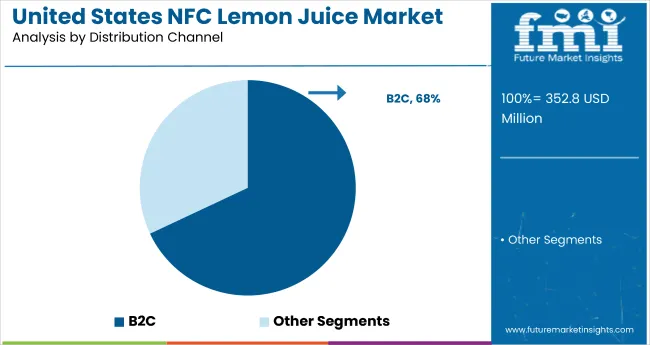

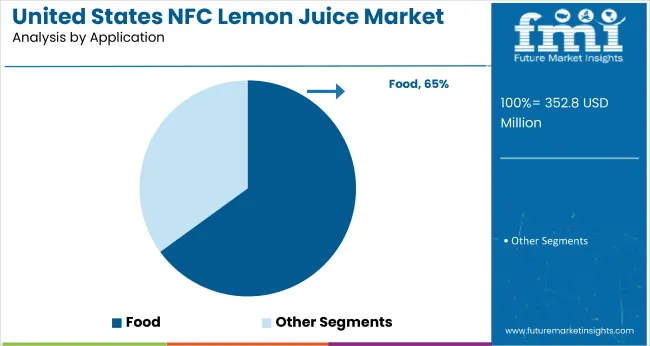

The demand for clean-label, plant-based, and vegan-friendly options is expected to influence sales of NFC lemon juice significantly. Among applications, the food segment will maintain a leading position with 65% market share in 2025. Conventional NFC lemon juice will dominate the nature segment with a 78% share, while online retail, under the B2C channel (accounting for 65% market share), emerges as the fastest-growing distribution channel.

The market holds a niche yet notable share within its parent markets. It accounts for approximately 2.5% of the overall juice market and around 1.1% of the broader beverage market. Within the NFC beverages market, it represents a stronger foothold at nearly 6.8%, owing to rising consumer preference for cold-pressed and minimally processed drinks. In the citrus products market, it holds a share of close to 4.5%, primarily driven by its use in culinary and beverage applications. Within the functional beverages market, its contribution is relatively modest at 0.9%, given the dominance of fortified and enhanced drinks.

Moving forward, innovation in packaging formats and flavor variants will be a key focus. Increased focus will be placed on R&D to enhance nutritional profiles and extend shelf life without compromising freshness. Government initiatives supporting citrus farming and clean-label products are anticipated to create a favorable regulatory landscape.

The shift toward sustainable sourcing and the growing popularity of home-based mixology and cooking will continue to fuel market expansion for NFC lemon juice in the USA Additionally, the popularity of citrus-based flavor profiles in foodservice and home consumption is likely to sustain strong interest across distribution channels.

The market is segmented by nature, distribution channel, and application. By nature, the market includes organic and conventional. In terms of distribution channel, the market is classified into B2B and B2C, with B2C (hypermarkets/supermarkets, convenience stores, specialty stores, groceries, wholesale, and online retail).

By application, the market is divided into food (dairy and frozen products, bakery and confectionery, jams, jellies, and preserves, and others), beverages (juice, soft drinks, squash, cider, and others such as mocktails and syrups), cosmetics, pharmaceuticals, flavours, and others (cleaning solutions & aromatherapy).

Conventional NFC lemon juice is expected to dominate the nature segment through 2035, holding a 78% market share in 2025. Its affordability, widespread availability, and established consumer trust have driven its continued dominance. While organic variants are gaining traction, conventional products remain more accessible to price-sensitive consumers. Established brands have also built robust distribution networks, enhancing visibility in both retail and foodservice channels.

B2C is projected to dominate the distribution channel, accounting for 68% of the total market share. This growth is fueled by rising consumer demand for natural beverages, the proliferation of retail and e-commerce platforms, and increasing product availability in both physical and digital stores. Enhanced packaging, stronger brand visibility, and clean-label preferences are also driving B2C sales forward.

The food is projected to lead in terms of application segment, accounting for a 65% market share in 2025. NFC lemon juice is widely used in salad dressings, marinades, desserts, sauces, and condiments. Its consistent flavor, natural acidity, and clean-label positioning have contributed to growing demand in both commercial and home cooking. As cooking habits evolve toward health-conscious preferences, this segment is expected to expand steadily.

Recent Trends in the United States NFC Lemon Juice Market

Key Challenges in the United States NFC Lemon Juice Market

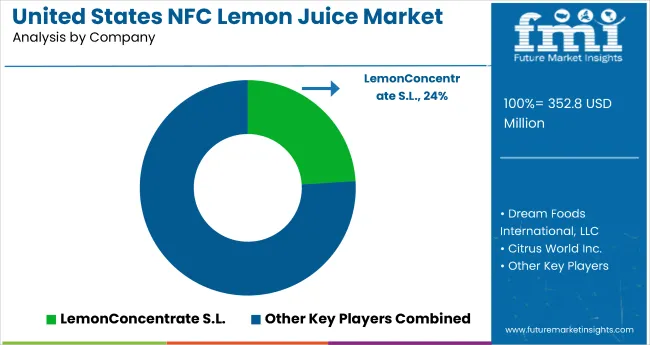

The global market is moderately fragmented, with a mix of producers and specialized citrus processors competing for market share. Leading suppliers such as LemonConcentrate S.L., Dream Foods International, and Citrus World Inc. are leveraging regional lemon availability, long-standing retail partnerships, and robust export capabilities. Market leaders are primarily competing based on product purity, sourcing transparency, pricing efficiency, and packaging innovations tailored to consumer preferences in health and wellness beverages.

Top companies are investing in supply chain optimization, sustainable sourcing, and expanding product portfolios with clean-label and flavored NFC variants. Strategic alliances with foodservice and e-commerce platforms are also on the rise. For instance, Bevolution Group has enhanced its presence across North America by adding ready-to-use NFC beverages to its commercial portfolio.

Companies like Louis Dreyfus and Dohler GmbH are doubling down on reduced sugar and high-fiber juice innovations, while others like Dream Foods are targeting specific flavor blends to gain an edge in consumer segments prioritizing natural and functional beverages.

Recent United States NFC Lemon Juice Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 352.8 million |

| Projected Market Size (2035) | USD 574.7 million |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD millions / Volume in kilotons |

| By Nature | Organic, Conventional |

| By Distribution Channel | B2B, B2C (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Groceries, Wholesale, Online Retail) |

| By Application | Food, Beverages, Cosmetics, Pharmaceuticals, Flavors, Others |

| Countries Covered | United States |

| Key Players | LemonConcentrate S.L., Dream Foods International, LLC, Baor Products S.L., Bevolution Group, Argenti Lemon S.A., Citrus World Inc., Prodalim Group, Citrusvil S.A., Louis Dreyfus Company, and Dohler GmbH |

| Additional Attributes | Dollar sales by value, segment-wise market share analysis, and state-level insights |

The market size is valued at USD 352.8 million in 2025.

The market is projected to reach USD 574.7 million by 2035, expanding at a CAGR of 5%.

B2C is expected to dominate the market with a 68% share in 2025.

Conventional NFC lemon juice is projected to lead with a 78% market share in 2025.

The food sector leads the NFC lemon juice market with a 65% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA